spend management | motive card

Maximize savings and eliminate fraud with the Motive Card.

Improve your profitability with the AI-powered fleet card.

Motive is the only platform that combines Fleet Management and Spend Management, giving finance teams complete control of their fleet-related spend.

GUARANTEED CASHBACK

Get 2.5% cashback on every dollar you spend.

Motive’s Cashback Bundle enables you to maximize savings with up to 2.5% cashback in the first year.

- Earn cashback on all Motive Card spend on top of partner rebates.

- Get up to 2.5% on your first year of spend*, with 1.5% in subsequent years.

SAVINGS NETWORK

Earn fuel rebates at 35,000+ locations.

Get significant savings on fuel, maintenance, and more, at over 35,000 partner locations in North America including Love’s, TA, Casey’s, 7-Eleven, Exxon and Mobil service stations, Discount Tire, Speedco, and more.

- Tier 1 savings averaging $0.20+/gallon on diesel.

- Flexibility to bring pre-negotiated direct discounts.

- Savings Finder helps drivers navigate to the best deals.

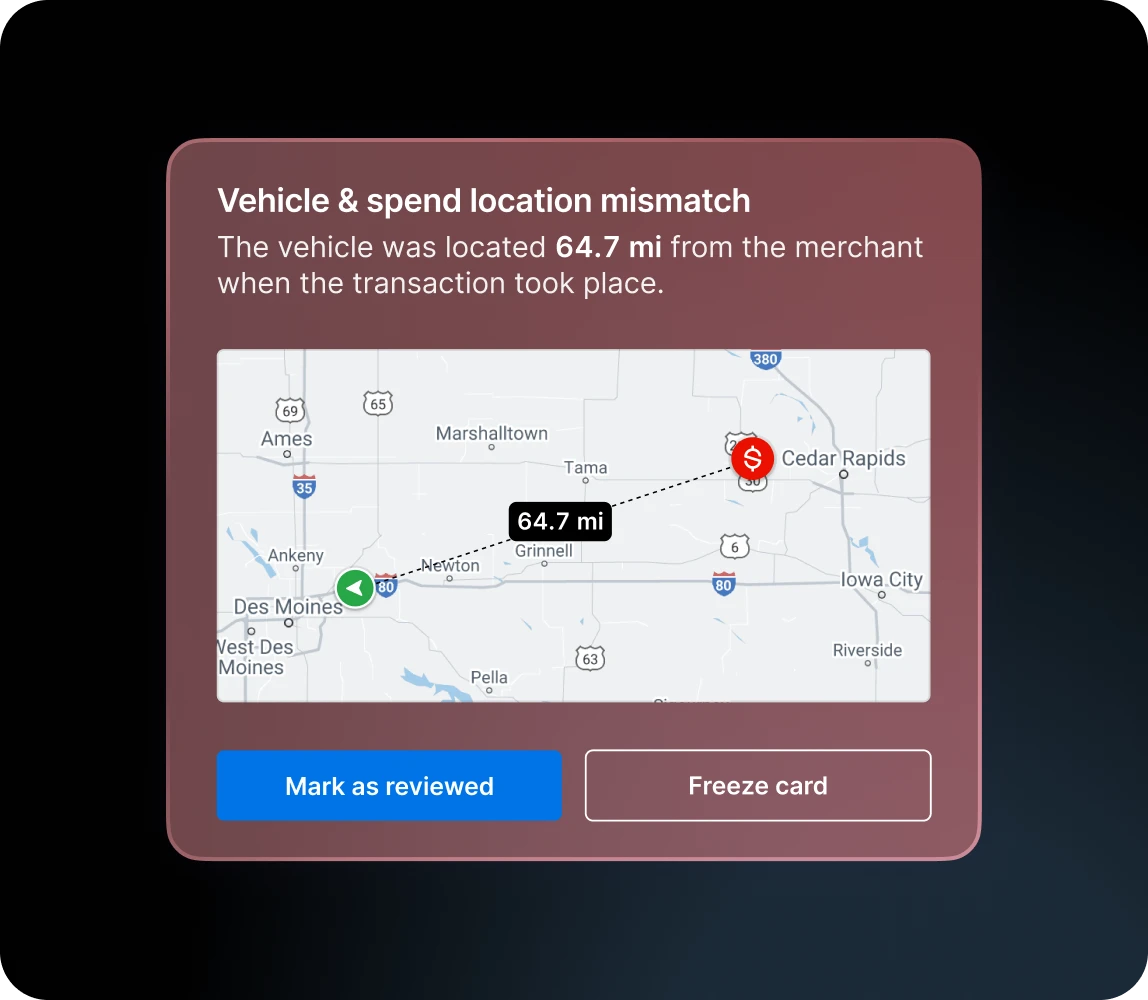

AI FRAUD DETECTION

Eliminate fraud with AI-powered fraud detection.

Motive combines vehicle telematics data with Motive Card payments data to detect and prevent fraud in real-time. AI-powered fraud alerts automatically identify and auto-decline suspicious transactions.

- Receive alerts when vehicle and spend locations don’t match.

- Get notified if tank level differs from purchased fuel volume.

- Freeze cards, or auto-decline transactions on the spot.

- Rest easy with our Fraud Protection Guarantee which provides coverage up to $250,000 per year* in the event of fraud.

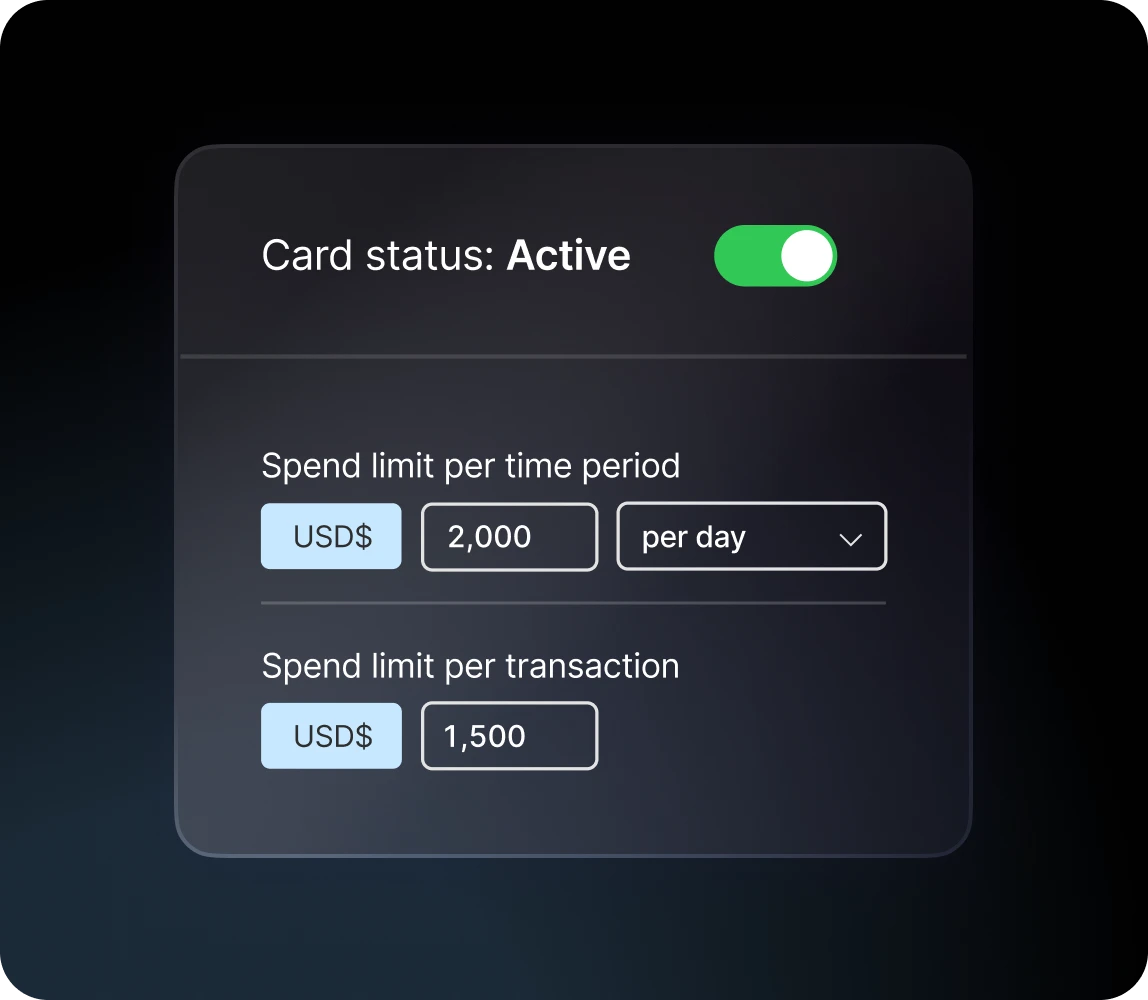

SPEND CONTROLS

Prevent unauthorized spend with fully customizable controls.

Stop unauthorized Motive Card spending before it happens with customizable controls. Set limits for individuals or groups of cardholders, exactly how you want.

- Control cardholder spend by amount, day, time, and more.

- Block specific merchants and spend types.

- Get flexibility to add and remove spend categories instantly.

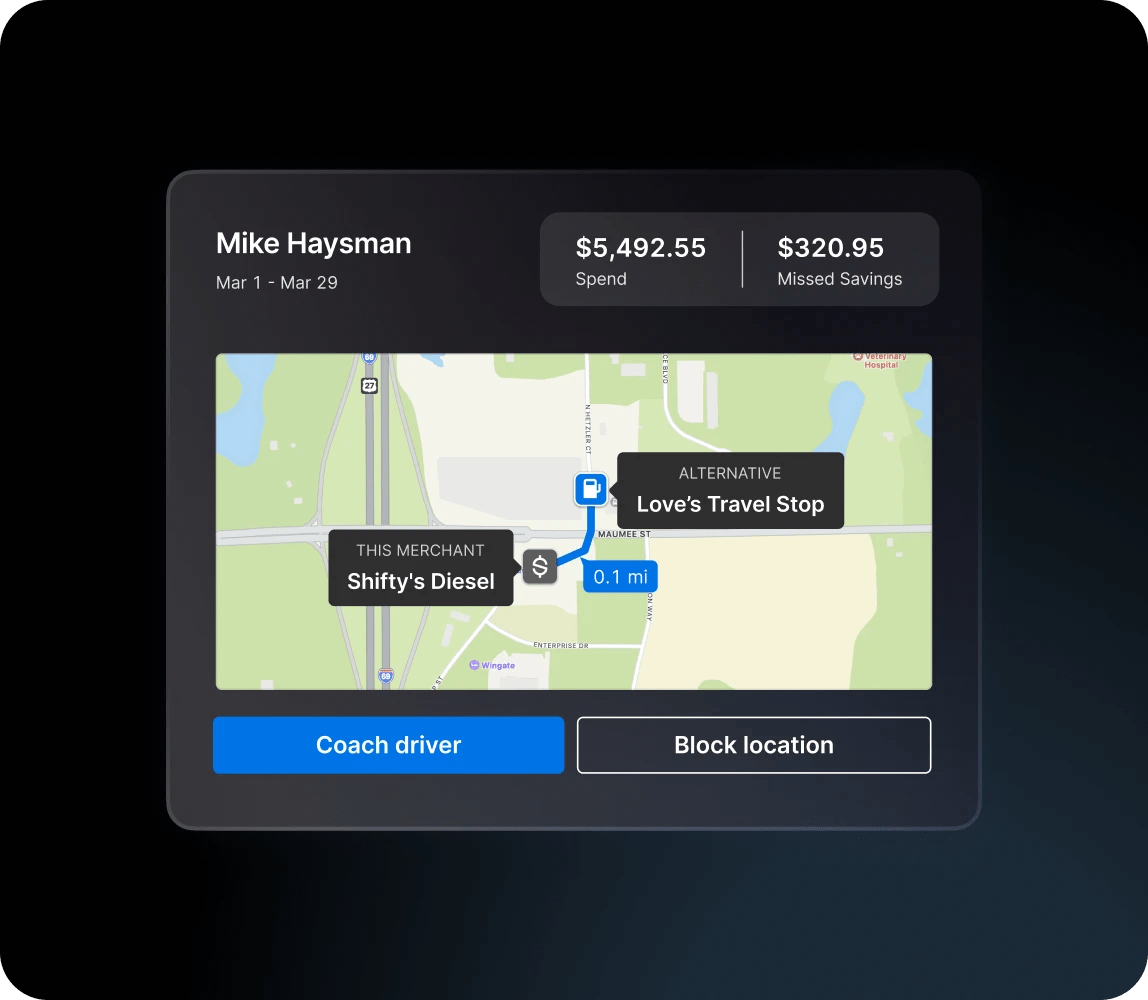

MISSED SAVINGS

Discover opportunities to reduce wasteful spend.

Find out when and where drivers are choosing more expensive fueling stations, missing potential savings.

- Gain automated insights into missed saving opportunities.

- Utilize data to coach drivers on cheaper locations.

- Block locations where drivers regularly pay more for fuel.

IFTA AUTOMATION

File IFTA in seconds.

Motive automatically captures vehicle mileage and combines it with Motive Card fuel purchase data to automate IFTA fuel tax reporting.

- Save hours of time spent on manual reconciliations.

- Distances and fuel transactions are automatically allocated.

- Export to your preferred file type.

We help customers achieve measurable results.

Related resources

Featured Resource

Are you losing up to 5% of fuel spend to fraud?

Fleet card fraud can be a costly blind spot, cutting into your profits. New report highlights hidden fraud epidemic and how to spot it, boosting profits.

Fleet card basics

Unlock savings

Fraud prevention

Frequently asked questions

Why do I need a spend management solution?

An integrated spend management solution can help you save time through automation of administrative tasks such as consolidating receipts, tracking expenses, and simplifying reporting like IFTA filing, so your team can be more productive. Motive’s spend management solution is part of our all-in-one platform meaning you can manage fleet and spend in one dashboard. This provides full visibility into your entire business so you can identify areas to save and operate more efficiently.

How can an integrated spend management solution and fleet operations application benefit my business?

Getting an holistic view of your fleet, including expenditures, helps you run a more efficient business:

- Gain visibility into your entire business operations and spending areas so you can easily identify opportunities to save.

- Easily sort and filter your transactions by cardholder and other data that already exists in your Fleet Dashboard without having to manually compare separate applications.

- Simplify administrative tasks with automatic fuel purchase reports generated from the Motive Card, combined with vehicle location data to make things like IFTA filing easier.

Detect and reduce fraud with Motive’s Vehicle and Spend Location mismatch functionality which ensures that it’s really your vehicle getting filled up. GPS location matching compares Motive Card and Vehicle Gateway data. Receive alerts for differing vehicle and spend locations and use card spend controls to reduce out-of-policy transactions.

What discounts can I get with the Motive Card?

You can use the Motive Card to get premium fuel discounts at participating partner stations including Love’s Travel Stops, TA, 7-Eleven, Petro Stopping Centers, TA Express, Road Ranger, Casey’s, Yesway, Allsup’s, and a number of independent truck stops. We also have partnerships to help you save on maintenance, tires, labor, and more at locations including Boss Shop, FlowBelow, and more.

Does the Motive Card have a monthly or membership fee?

Yes. Motive Card charges a monthly fee per active card.

Does the Motive Card have late fees?

Yes. If the invoice is not paid in full by the due date, a late fee will be assessed and applied to your account. The late fee is 5% of the invoice balance, with a minimum fee of $40.

What’s the process of applying for a Motive Card?

Does Motive report to credit bureaus?

Motive does report your payment history to business credit bureaus, allowing you to build and improve your company’s credit score when you pay on time. A strong business credit score can help provide opportunities to secure additional financing with better interest rates and loan terms.

Can I use my fleet card to purchase items rather than fuel?

The Motive Card is more than a fuel card for fleets. Yes, you can use it to purchase and get discounts on fuel, but you can also use it for fleet maintenance & repair, lodging, gas station store purchases and any other business expenses. Motive Fleet Card can be used anywhere Mastercard is accepted.

What is the difference between a fleet card and a credit card?

Traditional credit cards and cash provide minimal control over the amount spent, the location of spending, and the specific items purchased. In contrast, fleet cards empower you to manage employee expenditures directly. For instance, you can use spend controls to establish daily or per-use dollar limits, block unauthorized merchants, and only enable certain spend categories.

How can Motive Card help reduce fraud?

Motive Fleet Card uses data-driven, proactive defenses — fraud detection and controls — to detect and reduce fuel theft GPS location data matching that compares fleet and spend data allow you to ensure it’s really your vehicle getting filled up. Receive alerts for differing vehicle and spend locations and use card controls to reduce out-of-policy or suspicious transactions. The mobile-based unlock feature provides added security by requiring cardholders to verify their identity via their assigned phone, reducing fraudulent purchases. Integration of spend management and fleet telematics data allows for tighter controls and optimized operations.

CONNECT WITH US

Unlock the potential of your operations with Motive.

- Comply with industry rules and regulations.

- Improve visibility and automate operations.

- Identify risks and automate driver coaching.

*New customers must have active Fleet Management and Motive Card within 90 days of one another. Existing Motive customers will get up to 1.5% cashback ongoing. The Motive Card Fraud Protection Guarantee is subject to the following Fraud Protection Guarantee Terms and Conditions. The Motive Card is issued by Sutton Bank, Member FDIC pursuant to a license from Mastercard International. Subject to terms of Spend Management Services Agreement. Mastercard and the circles design are registered trademarks of Mastercard International Incorporated.