Physical economy leaders estimate that fraud accounts for 19% of fleet spending, on average. Learn how to minimize the effects of friendly fraud and keep bad actors out.

It may have a catchy name, but there’s nothing friendly about friendly fraud. It is fraud after all.

Friendly fraud is committed by customers, employees, and others you think you can trust. And it could be costing your business a lot of money. More than 60% of merchants have reported an increase in friendly fraud since 2022, making it the second most common type of fraud today. And though the number of fraud reports recorded through the Federal Trade Commission’s database has declined from 2.9 million to 2.4 million, the aggregate amount lost to scams has skyrocketed 44% to $8.8 billion.

What can fleets do about this rising threat? We turned to fraud prevention expert Jeff Sakasegawa to find out. Having worked as a fraud analyst for Google, Facebook, Square, and now Persona, Sakasegawa shares how to recognize and stop friendly fraud before it ravages your fleet.

What is friendly fraud?

Friendly fraud is the abuse of corporate policies and procedures for personal financial gain. It often happens when an employee takes advantage of a lack of visibility at the company and makes a few purchases on the company card, for example. Other times, a customer might deny receiving a product or service, even though they did receive it. The customer’s money is then refunded as a credit back to their account.

“People who engage in this type of fraud are usually in dire financial straits,” Sakasegawa says. “They’re looking to get money back from a large corporation, based on the assumption that the business can afford to share the wealth.”

In the U.S., where providers want to protect their relationship with customers, they’re hesitant to investigate these transactions. “The money has to come from somewhere, and it usually comes from the merchant who processed the transaction,” Sakasegawa says.

Why friendly fraud is growing

In 2023, Merchant Fraud Journal projected that chargebacks would cost merchants over $100 billion, with the average value of a chargeback $192. What’s driving the rise in friendly fraud? A few factors.

- Workers believe they have no alternative. As inflationary pressure persists, friendly fraud is increasing. With less buying power, workers are looking for any form of financial relief. “If it costs you twice as much to buy gas as it did last month, people will do whatever they can to make ends meet,” Sakasegawa says.

- Some people feel that they’re owed a treat, especially if they work long hours or don’t feel valued. “Their philosophy is ‘I’m so underpaid you wouldn’t believe it,’” he says. “They feel the least their employer could do is splurge on a treat here and there. It’s this attitude of ‘They can afford to give me $200 a month in gas.’ For some people, that makes a lot of sense.”

- Businesses have done a great job of reducing the most hostile types of fraud. What remains is a larger percentage of friendly fraud. A surge in online activity in the last few years has caused a spike in fraud committed by customers. “The more online transactions there are, the more opportunity there is for these kinds of disputes to occur,” Sakasegawa says.

Friendly fraud in transportation

As friendly fraud grows, it’s found a foothold in the transportation industry, where it often manifests as fuel fraud. Fuel stands among the top three fleet expenses, making it an easy target for operators looking to save a few bucks. To detect fuel fraud, physical operations leaders should beware of the following tactics.

Fuel deceit

With deception like this, employees may fill up their personal vehicles on the company card; submit a fuel purchase that exceeds a vehicle’s fuel tank capacity; or pump fuel into a container for personal use, conveniently charging the business.

“In theory you should be purchasing only fuel, but who’s to say you don’t purchase a couple extra things for you and yours?” Sakasegawa asks. “Everyone’s got a tool drawer in the garage, and your driver may want an extra wrench or screwdriver to add to the collection. Small purchases like this add up over time. As line items they’re all too easy to miss.”

Sharing fuel cards

Employees may share fuel cards with friends, colleagues, and family members, authorizing multiple pump purchases on a single account. Managers may presume that the fuel is going into a fleet vehicle, but it isn’t always.

Fuel type fraud

This kind of fraud involves purchasing the wrong kind of fuel for the assigned vehicle — regular unleaded, for example, instead of diesel. When this happens, it could indicate that a purchase has been made for an unauthorized vehicle.

How to minimize friendly fraud

We recently surveyed 1,000 physical economy leaders in construction, oil and gas, and other industries. According to the results, respondents estimate that fraud accounts for 19% of fleet spending, and 40% of C-suite leaders expect fraud to be a major threat to their business in 2024. Nonetheless, a lack of visibility is making it tough for leaders to detect and prevent fraud.

To gain visibility and control, it’s best to invest in technologies designed specifically to protect against fraud. To reduce your exposure, Sakasegawa recommends the following.

1. Let employees know their purchases are being tracked.

Whether it’s a corporate credit card for managers or a fleet card for drivers, let your team know they’ll have to account for their spending.

- When issuing a fleet card to a driver, give them a heads-up that they’ll be responsible for every charge that goes to the card.

- Tell them the statement will be reviewed at the end of the month, and require receipts and invoices.

- “When you create hoops that workers have to jump through to create fraud, it can be a strong deterrent,” Sakasegawa says.

2. Use fleet cards with built-in spend controls.

“In the high-cost environment that we’re in, limiting fleet spending is crucial,” Sakasegawa says. “Fraud scales quickly. It doesn’t happen once and then stop. People will generally commit fraud until they are stopped. Having controls that automatically limit spending will curb fraudulent activity and protect the business.”

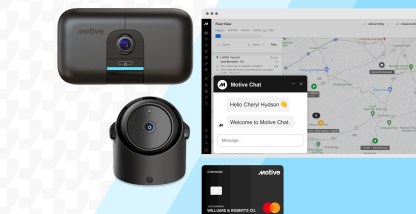

Tools like the Motive Fleet Card make it easy to reduce unauthorized spending. Fleet managers can:

- Instantly control who uses the Motive Card and how they use it.

- Add spending limits.

- Improve security.

- Restrict card use to certain times and locations.

- And reduce unauthorized fuel spend.

To proactively reduce misuse, the Motive Fleet Card requires drivers to unlock permissions using their smartphones instead of through a PIN number that can be shared. The Motive Card’s Fraud Reduction feature instantly flags suspicious fueling activity based on vehicle location and spend data. Whenever vehicle location and spend data don’t match, Motive instantly alerts managers to potential misuse.

3. Invest in AI-powered functionality that provides real-time visibility into fleet spend.

A new Motive study conducted in partnership with Freightwaves shows that physical economy leaders still rely on outdated methods, such as manual tracking, to detect fraud. Many of them plan to leverage more advanced methods in the future. However, they’d be wise to leverage these methods now.

With real-time visibility into fleet spending, fraud becomes easier to see, measure, and stop. AI-powered functionality that alerts businesses to fraudulent spending in real time is invaluable today, when concerns about fraud keep leaders up at night.

Motive’s Physical Economy Outlook 2024 shows that:

- 76% of physical economy leaders want to use AI to gain critical visibility across their operations.

- 38% of them value the potential of artificial intelligence (AI) to detect and prevent fraud.

- More than one-third plan to invest in physical operations software in the next 12 months.

- And 27% list theft or fraud as the biggest threat to their business over the last year.

To address these concerns, Motive boosts fleet card security and reduces unauthorized spend by integrating spend management and fleet telematics data in a unified Integrated Operations Platform. As a result, managers can set up spend controls and detect fuel theft as it happens. The value of real-time protection like this cannot be overstated.

“Fraudsters tend to talk to each other and share what they learned, causing scams and financial losses to spread,” Sakasegawa says. “Having real-time visibility into illicit spending can prevent the spread of fraud and reduce its impacts.”

Protect your business from friendly fraud

Learn how the Motive Fleet Card can deter theft, increase profitability, and maintain visibility into fuel spend, all while giving you discounts on fuel and maintenance at thousands of partner locations.

About Persona

Persona understands how important accurate detection and quick deterrence are in protecting your business from friendly fraud. That’s why the tools in their identity suite are designed to proactively fight fraud. To learn more, visit their website.