Fuel is an ongoing expense that fluctuates depending on the market. The market appears to be on an upswing, with the average gasoline price peaking at over five dollars a gallon in summer 2022. If the current fuel trends are any indication, demand for fossil fuels will continue to increase in the rest of 2022 and beyond.

With the predictions of rising fuel prices, using a fleet fuel card is an excellent way to maximize your fuel savings, as many fleet fuel cards offer rewards that can impact your bottom line.

Fleet fuel cards (also known as fleet gas cards) allow you to track purchases and employee spending, view detailed reports, manage maintenance expenses, and take full control of spending for your business vehicles.

What is a fuel card?

The idea behind a fuel card is simple. They provide a way for your business to manage fuel and maintenance expenses effectively and efficiently while offering added security and tracking features to help with fleet management. Fleet fuel cards are much safer than cash and provide one online account where you can easily review all transactions, access miles-per-gallon tracking information, and halt unauthorized spending.

How to get a fuel card for your fleet

If you’re wondering how to get a fleet fuel card to use, it isn’t as difficult as you’d think. In fact, it can all be done online.

The process is fairly straightforward. Once you’ve decided on the right gas card provider, the next step is to start contacting the fuel card companies that you think will work best for your fleet.

The majority of companies require filling out some basic information, like details about yourself, your business, your fleet’s vehicles, your business’s requirements, and some contact information. Most fleet card companies operate quickly and thoroughly and help you throughout the sales process.

How do fleet fuel cards work?

Fleet fuel cards are a huge benefit for companies and individual drivers who want to track their fuel expenses closely. Fleet fuel cards are designed to record specific information about fuel usage, like driver ID information and mileage. The information that fleet fuel cards give you helps you track who’s making fuel purchases and how many miles per gallon of fuel you’re getting.

Some carriers use generic business cards for fuel usage, but traditional business cards have some downsides and will only provide information like date, location, and dollar amount of fuel transactions.

What are the benefits of fleet fuel cards?

Better fuel efficiency

Among fleet fuel card benefits are better fuel efficiency. While there are many tips drivers can try to save money on fuel, fleet cards help you take a data-focused approach. Fuel cards capture more robust data at most brand-name fuel stations, including information like price per gallon, location, driver ID, and odometer readings.

Access to this data gives drivers and companies a more accurate picture of fuel purchases they are making, allowing them to analyze fuel spend and find areas to optimize.

Fraud protection

Fuel cards are configured for drivers to enter a unique ID for their transactions, and this prevents unauthorized users from using a particular fuel card. There are also fuel cards that allow companies to set purchase limits as well as alerts for when those limits are exceeded by users. When searching for a fuel card, it’s a good idea to make sure that it comes with security features, like the ability to limit access or get reimbursement for lost or stolen cards and unauthorized use.

Streamlined operations

A huge fleet fuel card benefit for companies is the ability to streamline some of their operations. Fleet fuel cards come with many controls and parameters companies can set for card usage.

Some controls and parameters companies can set with fleet fuel cards are:

- Allow at-pump purchases only

- Allow both at-pump and in-store purchases

- Limit purchases to only certain locations

- Set different purchasing profiles for different types of vehicles with different fuel capacities

- Allow the ability to override purchase limits if there is an emergency

Help with IFTA Reporting

Unless you are exempt from IFTA fuel tax, your business operations also include International Fuel Tax Agreement (IFTA) reporting. Per the IFTA, a comprehensive fuel tax report is required four times a year.

The IFTA agreement states that commercial carriers must keep precise records of fuel purchases, mileage, and fuel taxes accrued in each state or province traveled in. The records that fleet fuel cards provide help in compiling this necessary information for IFTA reports.

Cost savings

Most fleet fuel cards have an online platform that allows users access to detailed purchase information. Having access to purchase information in a single, centralized location allows users to optimize spending for the most savings. In most cases, companies can set maximum purchase thresholds by day or amount, as well as get reports showing which drivers hit or exceed the purchase thresholds.

Tip: See if your fuel card gives you the ability to do exception reporting, which allows you to track fuel purchase behaviors you deem unusual.

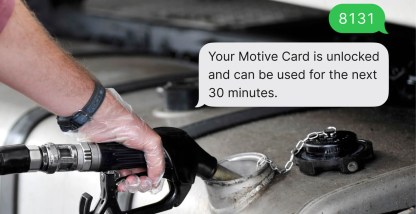

Manage your spend and fleet in one place

An innovative solution for fleets, the Motive Spend Management application is natively integrated with a fleet management platform to allow users to manage their spend and fleet in one place. Boost efficiency by consolidating your software and easily control your spend from one dashboard. Users can limit when, where, what, and how much their cardholders can spend by setting up spend controls directly from the Fleet Dashboard. In addition, having an all-in-one integrated suite with transaction reporting combined with telematics can help save time on things like IFTA filing with Motive’s automated IFTA reporting. Every fuel purchase made with the Motive Card automatically includes details needed for filing, like vehicle, fuel type, and jurisdiction.

The Motive Card is a zero-fee fleet fuel card for businesses that manage fleets of vehicles or equipment. Get discounts at every gas station, with greater discounts at partner providers, including Love’s, TA, Petro Stopping Centers, and TA Express, and Road Ranger, along with industry-leading discounts on tires, maintenance, and more. The Motive Card has zero activation or annual membership fees and is backed by Mastercard, so can be used for any business expense.

Apply for the Motive Card. Get a response in under 3 days.

Other fuel operations solutions from Motive

Motive offers comprehensive fleet workflow solutions that help fleets simplify tasks and streamline operations. Here are some of the ways Motive’s solutions help fleets manage fuel operations:

- Motive Sustainability is a powerful way for fleets to save money on fuel and operate more efficiently. Get a consolidated view of your fleet’s fuel consumption, benchmarked across our expansive network of vehicles. Additionally, combat fuel theft and fraud with alerts when suspicious purchases are made when you use the Motive Card; for example, when a fuel purchase is made for a vehicle with mismatched fuel type, or vehicle location/fuel purchase location mismatch.

- Motive integrates with WEX/EFS Fuel Tax Services. With this integration, you can feed your Motive GPS data directly into WEX/EFS’s Fuel Tax system. Your fuel data is merged with the GPS information to create fuel tax reports by month or by quarter.

- Our AI-driven fuel efficiency program helps fleets save up to 13% on annual fuel costs with powerful AI-driven insights, increased visibility into fuel operations, and a proactive approach to maintenance.

- Through our vehicle tracking and telematics software, you can take control of your fuel costs and save money by reducing idle time, planning more efficient routes, preventing vehicle misuse, and coaching poor driving habits.

Motive offers total visibility into every aspect of your fleet management. Join over 120,000 businesses that trust Motive to improve the sustainability, safety, and profitability of their fleets. Request a demo today.

The Motive Card is issued by Sutton Bank, Member FDIC pursuant to a license from Mastercard International. Subject to the Terms of Service. Mastercard and the circle design are registered trademarks of Mastercard International Incorporated.