In today’s fast-paced fleet environment, effective spend management is crucial for optimizing operations and controlling costs. One tool that has become indispensable for any business that operates vehicles is the fleet card, which streamlines fuel and maintenance expenses while providing valuable insights into fleet spending. However, not all fleet cards are created equal. And some should be avoided like roadwork during rush hour. This article covers 10 essential attributes that fleet managers, CFOs, and business owners should consider when choosing a fleet card.

10 essential fleet-card attributes

1. Low fees and fee transparency

A fleet card with low fees and transparent pricing is essential for responsible fleet managers. Look for a provider that offers low or no transaction or account management fees, and no hidden charges. This may require you to ask some tough questions or take a deep dive into the fine print of card agreements, but it’ll be worth it in the long run. Clear fee structures allow you to accurately forecast expenses and avoid unpleasant surprises. Many cards charge hidden fees that can rapidly multiply in the event of a payment failure or credit change, resulting in big unexpected expenses when they are least welcome.

2. Discounts and rebates

Find a card that offers a discount or rebate program for your biggest fleet spending categories. These programs can help offset costs by providing cashback, discounts on fuel and maintenance purchases, and special deals with partner merchants. Look for discounts at quality vendors to ensure you’re saving where drivers want to fill up. This increases driver retention and ensures that you’ll take advantage of discounts, as drivers will be happy to fuel where you save. These discounts can make a huge difference for fleets, especially now, during times of compressed margins.

3. Advanced fraud prevention

Fraudulent transactions can be a significant concern for fleet managers. Industry experts believe that 3% to 5% or more of fleet card spend can be attributed to fraud or unauthorized spending. A robust fleet card must offer advanced fraud prevention features. These include:

- Real-time fraud monitoring

- Cards that are locked by default

- Telematics integration for GPS and fuel detection

- Card-level purchase restrictions

- The ability to immediately suspend or deactivate cards in case of suspected misuse

These fraud mitigation features ensure that your fleet’s finances are safeguarded against third-party scammers or “friendly fraud” from cardholders.

4. Detailed and customizable spend controls

Every fleet has unique requirements when it comes to spending controls. A fleet card should offer granular controls that enable fleet managers to:

- Set specific purchase limits by amount, day, and time

- Restrict purchases to certain merchant categories

- Automatically enforce spending policies

The ability to customize these controls easily ensures that the card aligns with your fleet’s unique needs. These controls should be changeable by the fleet manager in real time in case a driver has a legitimate out-of-policy spending need like a rental car or tow.

5. Integration with fleet management systems

If your fleet already utilizes a fleet management system, consider a fleet card that integrates seamlessly with it. This lets you manage your fleet and spending in a single window. Integration enables automatic data transfer between systems, reducing manual data entry and improving accuracy. It strengthens features like automated fraud detection, fuel efficiency tracking, and IFTA automation. It also provides a holistic view of fleet operations, making it easy to track expenses and optimize efficiency.

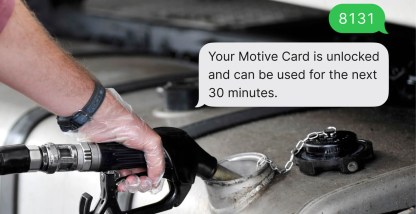

6. Cardholder decline messaging

If a cardholder finds themselves stranded with a declined card, it’s annoying at best and potentially dangerous. No fleet manager wants to be woken up in the middle of the night by a cardholder calling to ask why they can’t make a purchase. This situation often results in a call to the card company and time spent waiting for support. Look for cards that send managers and cardholders detailed alerts about declines, allowing cardholders to solve decline issues on their own, get moving faster, and save the back-office hassle.

7. Universal acceptance network

Ensure that your card is widely accepted across a vast network of fuel stations, maintenance providers, and other merchants. A broad acceptance network eliminates the need for drivers to deviate from their routes in search of specific locations, making fueling more convenient and efficient. It also allows your fleet to take advantage of the cheapest providers available. Furthermore, drivers won’t have to pay out of pocket and collect receipts to execute reimbursements. Finally, it ensures that you can use your card on maintenance, parts, and other business expenses that other cards don’t support.

8. Online and app-based account management

Look for a fleet card that provides a user-friendly online account management platform. This allows fleet managers to monitor transactions in real time, review invoices, easily report on spending, manage cards, and update account settings conveniently from anywhere. Seamless online account management simplifies administrative tasks and saves valuable time.

9. Driver-friendly features

Fleet cards shouldn’t only benefit fleet managers. They should make life easier for drivers too. Look for features like mobile apps that provide real-time transaction information, easy-to-use expense tracking, and convenient access to account details. Driver-friendly features improve transparency and empower drivers to better manage their fueling and maintenance needs. In a tight labor market, and in an industry with cherished driver relationships, employee happiness and retention are critical to success.

10. Excellent customer support

Reliable customer support is crucial when dealing with any service provider. Choose a fleet card provider that offers responsive customer support channels, including phone, email, and live chat. A dedicated support team can quickly address issues or questions, ensuring smooth operations and minimal disruptions in the event of a stoppage or card decline.

The right fleet card

Selecting the right fleet card is a critical decision for managers and fleet owners. Businesses with fleets can choose a fleet card that optimizes operations, controls costs, and provides valuable spending insights by considering these essential attributes:

- Low fees and fee transparency

- Advanced fraud prevention

- Decline messaging

- Detailed and easily customizable spend controls

- A wide acceptance network

- Online account management,

- Integration with fleet management systems

- Driver-friendly features

- Excellent customer support

- Discounts

Each fleet has unique requirements, so it’s essential to assess your specific needs and prioritize attributes that align with your goals. By doing so, you’ll be equipped with a fleet card that not only meets your fleet’s needs but also empowers you to make informed decisions. Along the way, you’ll improve efficiency and streamline your fleet management processes.

Save with the Motive Card

Ready to learn how Motive can help you save on fuel and maintenance, detect fraud, and reduce the amount of time spent on administrative tasks? Apply now to unlock savings with the Motive Card!