Spend Management | Motive Card

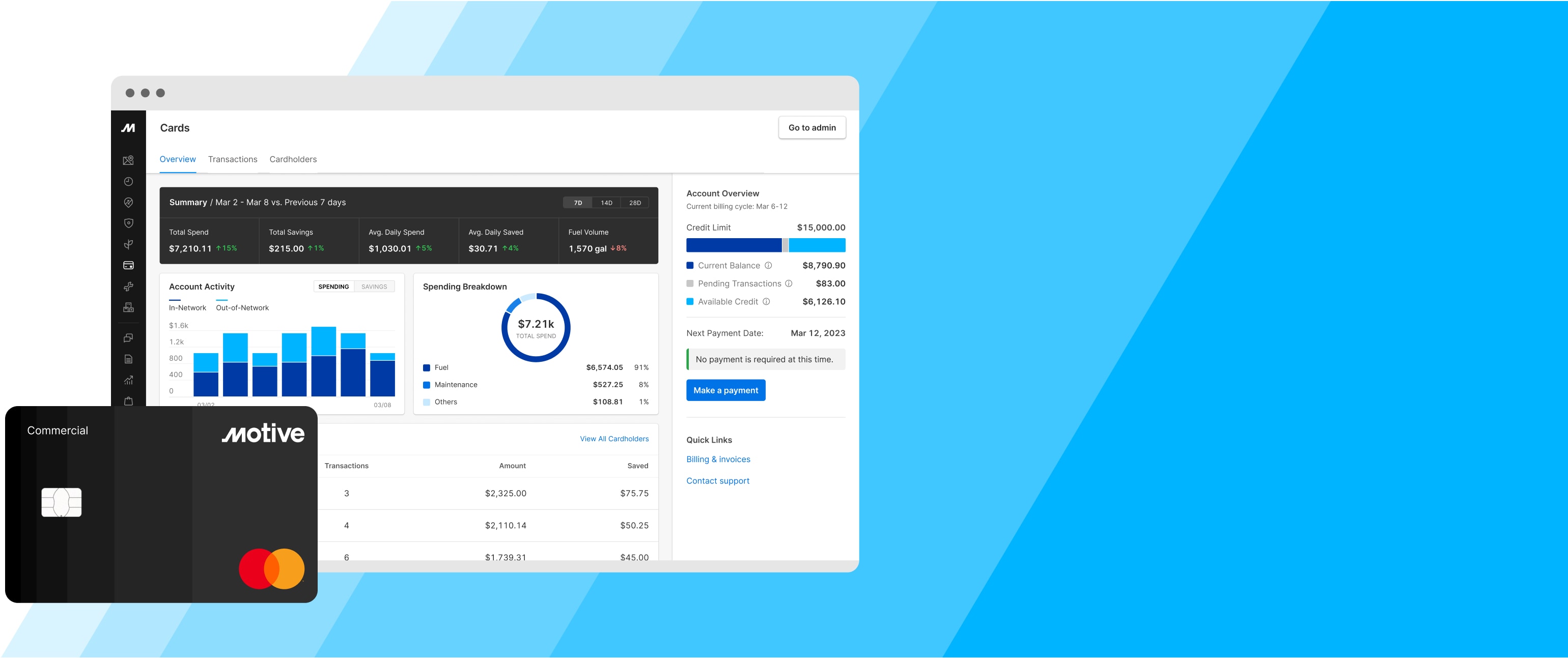

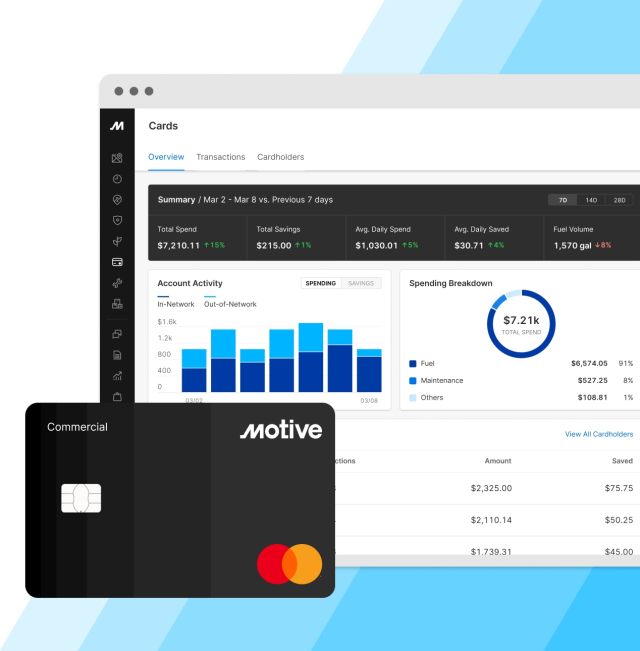

The only fleet card that connects with your business.

Maximize savings and profitability with a 360° view of fleet and spend.

Embedded into Motive’s integrated operations platform, the Motive Card enables you to reduce costs and uncover hidden savings by dismantling data silos, curbing fraud, and automating tasks.

FRAUD DETECTION

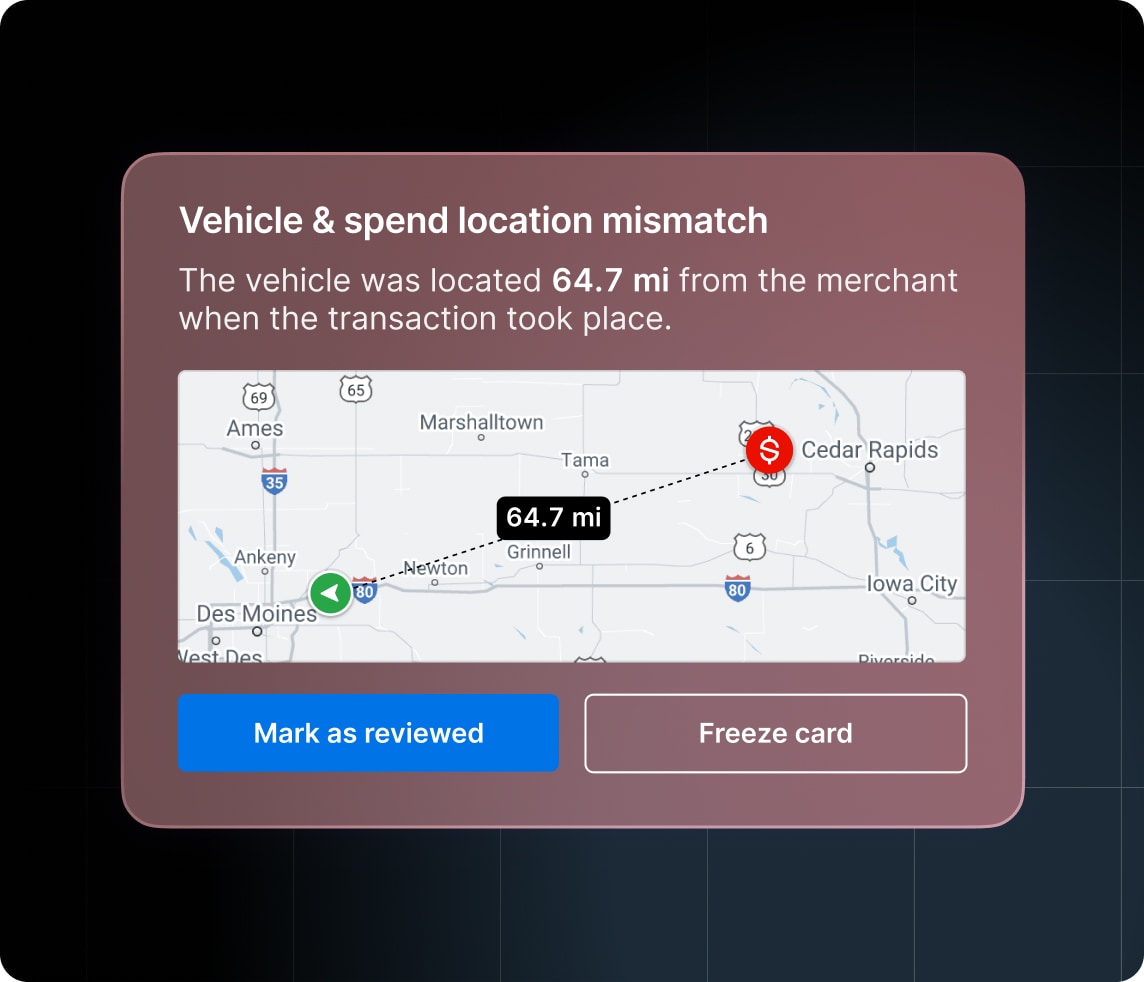

Detect suspicious transactions through AI-enabled fraud alerts.

Shared data between fleet telematics and Motive Card spend enables automatic detection of fraudulent transactions in near real-time, allowing for prompt action to safeguard your business.

- Receive alerts when vehicle and spend locations don’t match.

- Get notified if tank level differs from purchased fuel volume.

- Freeze cards, or auto-decline transactions on the spot.

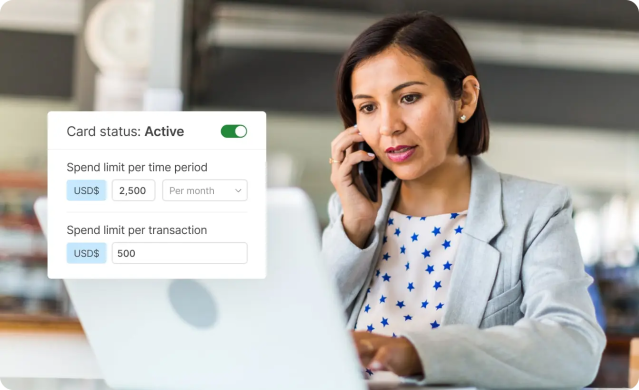

SPEND CONTROLS

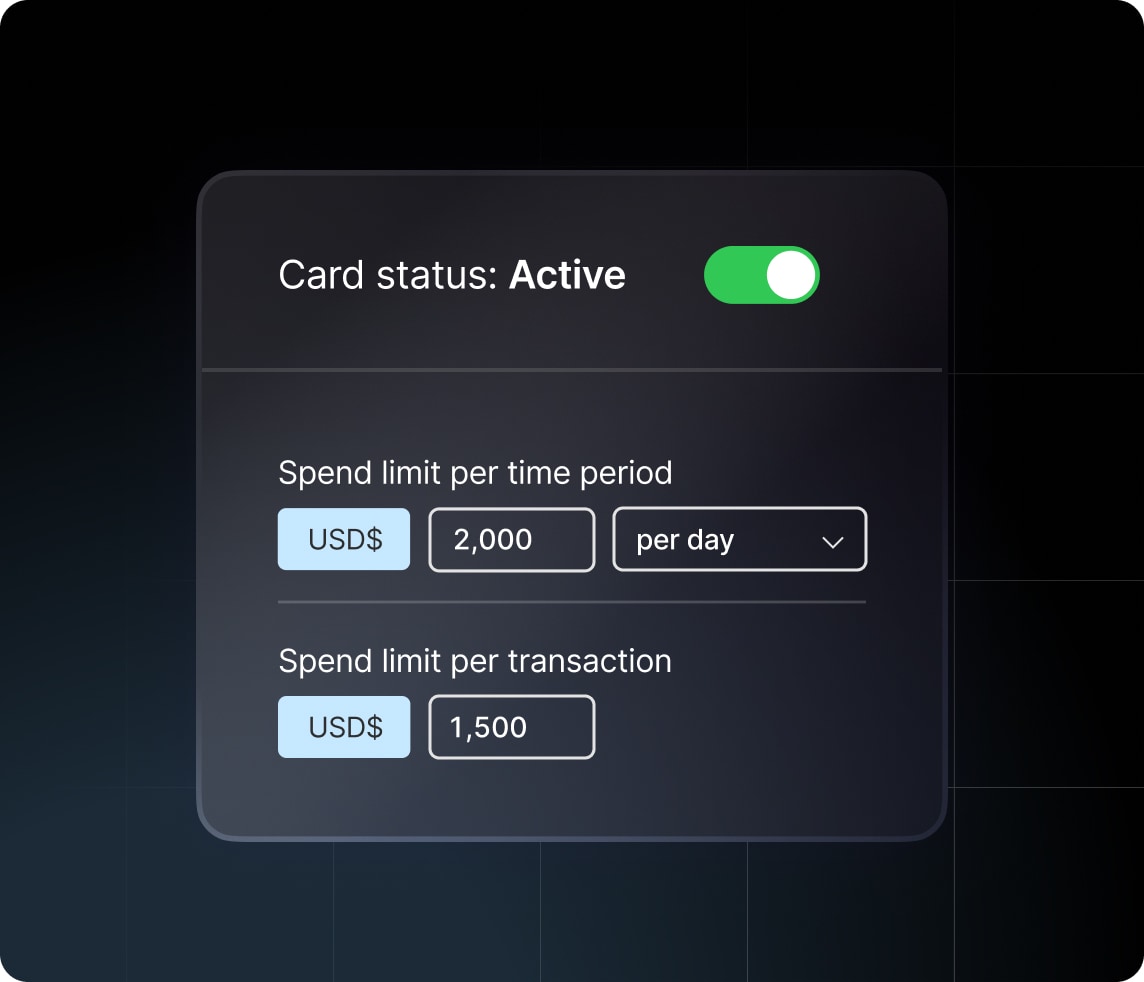

Prevent unauthorized spend with fully customizable controls.

Stop unauthorized Motive Card spending before it happens with customizable controls. Set limits for individuals or groups of cardholders, exactly how you want.

- Control cardholder spend by amount, day, time, and more.

- Block specific merchants and spend types.

- Get flexibility to add and remove categories instantly.

SAVINGS NETWORK

Reduce costs using the Motive Card savings partner network.

Get significant savings on fuel, maintenance, and more, at over 25,000 partner locations in North America including Love’s, TA, Casey’s, 7-Eleven, Exxon, Discount Tire, Speedco, and more.

- Tier 1 savings averaging $0.20+/gallon on diesel.

- Flexibility to bring pre-negotiated direct discounts.

- Savings Finder helps drivers navigate to the best deals.

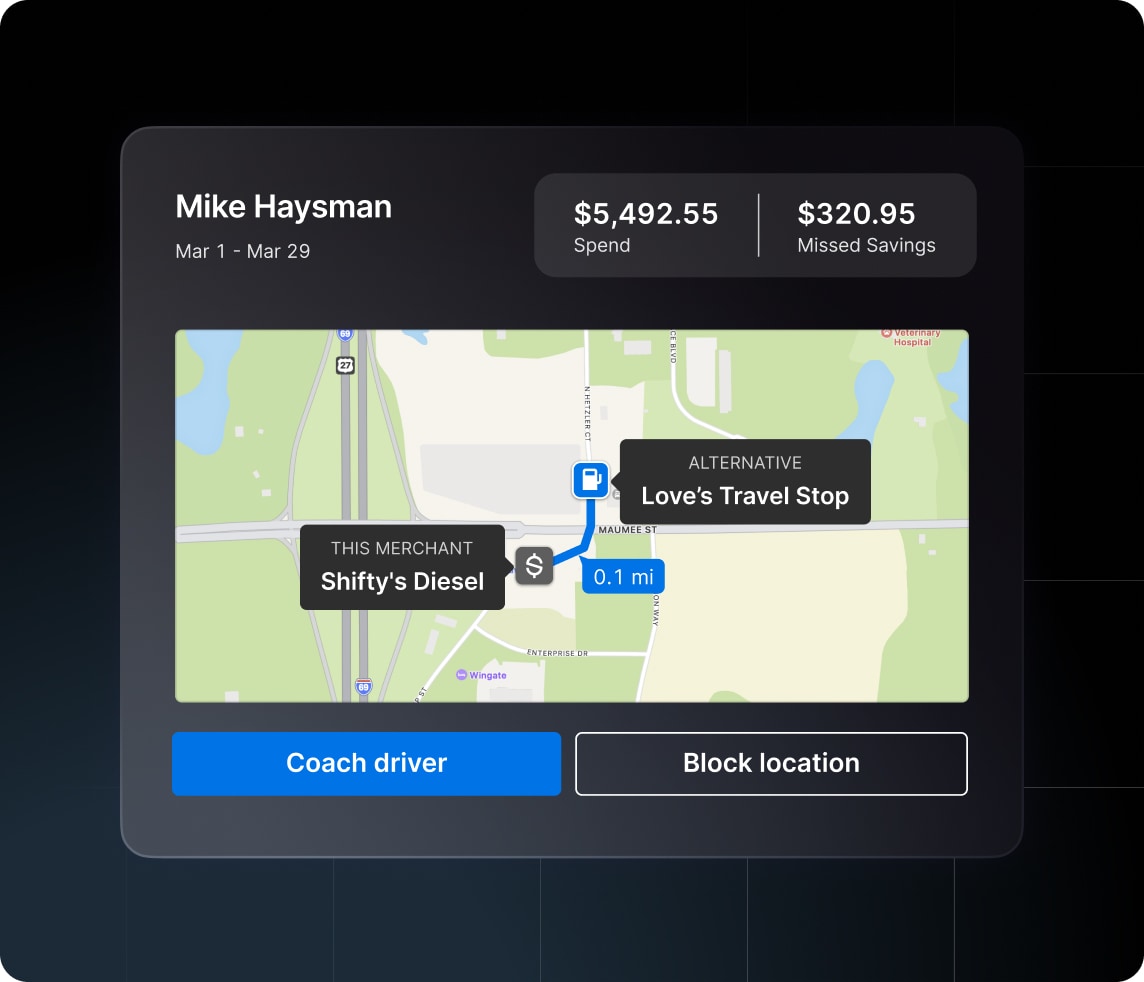

MISSED SAVINGS

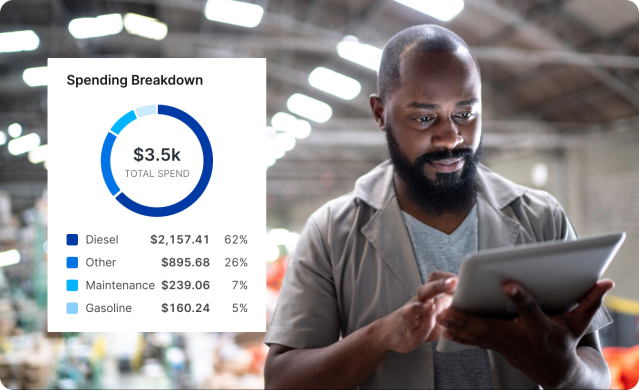

Discover opportunities to reduce wasteful spend.

Get actionable insights that help you reduce fuel costs. Find out when and where drivers are choosing more expensive fueling stations, missing potential savings.

- Gain detailed insights into missed savings opportunities.

- Utilize data to coach drivers on cheaper locations.

- Block locations where drivers regularly pay more for fuel.

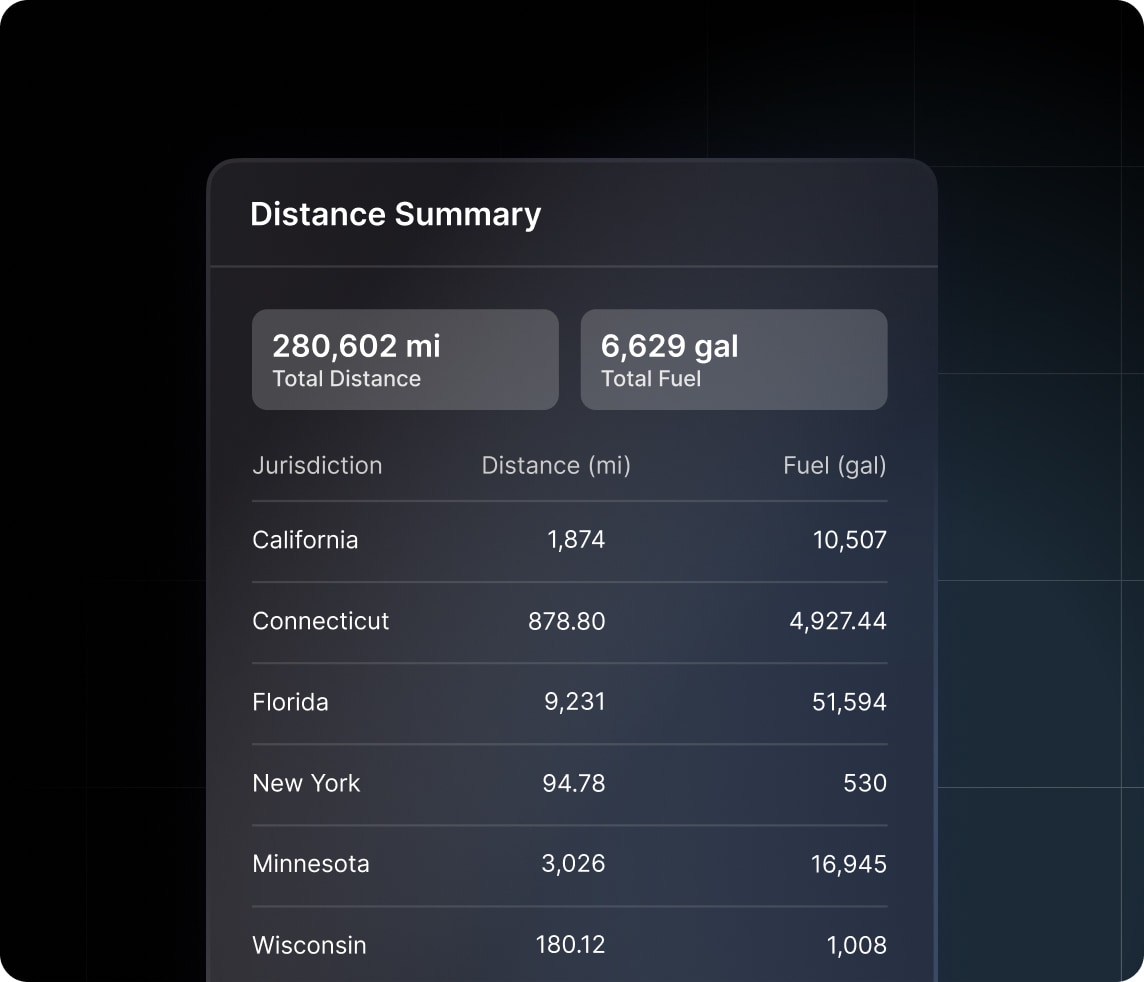

IFTA AUTOMATION

File IFTA in seconds.

Motive’s 360° view of fleet and spend data allows for automated filing of IFTA reports.

- Save hours of time spent on manual reconciliations.

- Distances and fuel transactions are automatically allocated.

- Export to your preferred file type.

We help customers achieve measurable results.

Related resources

REPORT

Are you losing up to 5% of fuel

spend to fraud?

Fleet card fraud can be a costly blind spot, cutting into your profits. New report highlights hidden fraud epidemic and how to spot it, boosting profits.

Fleet card basics

Unlock savings

Fraud prevention

Frequently asked questions

Why do I need a spend management solution?

An integrated spend management solution can help you save time through automation of administrative tasks such as consolidating receipts, tracking expenses, and simplifying reporting like IFTA filing, so your team can be more productive. Motive’s spend management solution is part of our all-in-one platform meaning you can manage fleet and spend in one dashboard. This provides full visibility into your entire business so you can identify areas to save and operate more efficiently.

How can an integrated spend management solution and fleet operations application benefit my business?

Getting an holistic view of your fleet, including expenditures, helps you run a more efficient business:

- Gain visibility into your entire business operations and spending areas so you can easily identify opportunities to save.

- Easily sort and filter your transactions by cardholder and other data that already exists in your Fleet Dashboard without having to manually compare separate applications.

- Simplify administrative tasks with automatic fuel purchase reports generated from the Motive Card, combined with vehicle location data to make things like IFTA filing easier.

Detect and reduce fraud with Motive’s Vehicle and Spend Location mismatch functionality which ensures that it’s really your vehicle getting filled up. GPS location matching compares Motive Card and Vehicle Gateway data. Receive alerts for differing vehicle and spend locations and use card spend controls to reduce out-of-policy transactions.

What discounts can I get with the Motive Card?

You can use the Motive Card to get premium fuel discounts at participating partner stations including Love’s Travel Stops, TA, 7-Eleven, Petro Stopping Centers, TA Express, Road Ranger, Casey’s, Yesway, Allsup’s, and a number of independent truck stops. We also have partnerships to help you save on maintenance, tires, labor, and more at locations including Boss Shop, FlowBelow, and more.

Does the Motive Card require a membership fee?

No. The Motive Card is free to use. There are zero activation, transaction, or membership fees.

Does the Motive Card have late fees?

Yes. If the invoice is not paid in full by the due date, a late fee will be assessed and applied to your account. The late fee is 5% of the invoice balance, with a minimum fee of $40.

What’s the process of applying for a Motive Card?

Does Motive report to credit bureaus?

Motive does report your payment history to business credit bureaus, allowing you to build and improve your company’s credit score when you pay on time. A strong business credit score can help provide opportunities to secure additional financing with better interest rates and loan terms.

Can I use my fleet card to purchase items rather than fuel?

The Motive Card is more than a fuel card for fleets. Yes, you can use it to purchase and get discounts on fuel, but you can also use it for fleet maintenance & repair, lodging, gas station store purchases and any other business expenses. Motive Fleet Card can be used anywhere Mastercard is accepted.

What is the difference between a fleet card and a credit card?

Traditional credit cards and cash provide minimal control over the amount spent, the location of spending, and the specific items purchased. In contrast, fleet cards empower you to manage employee expenditures directly. For instance, you can use spend controls to establish daily or per-use dollar limits, block unauthorized merchants, and only enable certain spend categories.

How can Motive Card help reduce fraud?

Motive Fleet Card uses data-driven, proactive defenses — fraud detection and controls — to detect and reduce fuel theft GPS location data matching that compares fleet and spend data allow you to ensure it’s really your vehicle getting filled up. Receive alerts for differing vehicle and spend locations and use card controls to reduce out-of-policy or suspicious transactions. The mobile-based unlock feature provides added security by requiring cardholders to verify their identity via their assigned phone, reducing fraudulent purchases. Integration of spend management and fleet telematics data allows for tighter controls and optimized operations.

CONNECT WITH US

Unlock the potential of your operations with Motive.

- Comply with industry rules and regulations.

- Improve visibility and automate operations.

- Identify risks and automate driver coaching.

Products | Motive Card

The only fleet card that connects to your business.

Connect fleet and spend management. Uncover new ways to unlock savings and productivity.

New report: We surveyed 1,000 physical operations leaders. 59% say rising costs are their biggest threat. Will AI save the day? Explore the findings.

How it works

More than a fleet card.

Enhance productivity.

Save up to 7% per vehicle by managing everything on one dashboard.

Competitive discounts.

Save up to 5% per vehicle through discounts at over 25,000 partner locations.

Reduce fraud.

Save up to 5% per vehicle through real-time insights and alerts to help identify fraud.

Maximize fuel efficiency.

Save up to 10% per vehicle through opportunities identified by AI-powered reporting.

Enhance productivity.

Get more done in less time. Connect spend data with fleet data to automate tasks and be more efficient.

Integrated spend reporting

Scalability

Universal acceptance

IFTA automation

Integrated spend reporting

See spending and savings trends, and quickly identify areas to optimize. Monitor transactions by cardholder, amount, and category. Filter and report on information such as purchase and posted date, product description, per unit cost, quantity, and category.

Scalability

Motive Card spend management is flexible and scalable to accommodate businesses of all sizes and industries. Easy group controls, reporting, and automation make Motive Card suitable for large and small businesses. Flexibility to assign fleet cards by driver or by vehicle.

Universal acceptance

Use one card for fuel, maintenance, lodging, and more. Use it anywhere Mastercard is accepted and for any type of purchase you approve. No more reimbursements or multi-card hassle.

IFTA automation

The Motive Fleet Card automatically captures all transaction data needed for IFTA reporting to make filing a breeze. Comprehensive details such as vehicle, fuel type, and jurisdiction are assigned to each purchase. Eliminate receipt tracking, state matching, manual calculations, or shipping data to pricey third parties.

Get competitive discounts, no hidden fees.

Save on fuel, maintenance, and more.

Pay $0 in hidden fees and protect your bottom-line savings. Our in-app Savings Finder tool makes it easy for drivers to navigate to the best discounts.

Large fuel discounts

Maintenance discounts

No hidden fees

Large fuel discounts

Maximize your purchasing power with Tier 1 savings averaging 20+ cents per gallon. Get discounts at 25,000 partner locations and growing, including Love’s, TA, and 7-Eleven. No gallon minimums required.

Maintenance discounts

Save on maintenance expenses, including tires, preventive maintenance, and labor costs.

No hidden fees

Increase profits with no application, membership, or transaction fees eroding your savings rebates.

Reduce fraud and unauthorized spend.

Protect your business and cut fraud losses with telematics-backed fraud detection. Boost security and stop unauthorized spending.

Vehicle & spend location mismatch

Spend controls

Fraud controls

Location mismatch

Motive’s robust telematics detect and flag fuel transactions that occur at a different location from the assigned vehicle.

Spend controls

Stop unauthorized spending before it happens. Simplify spend control management with spend profiles to limit transactions by day and time, category, location, and amount for different sets of cardholders. Update limits in real time to temporarily authorize emergency purchases.

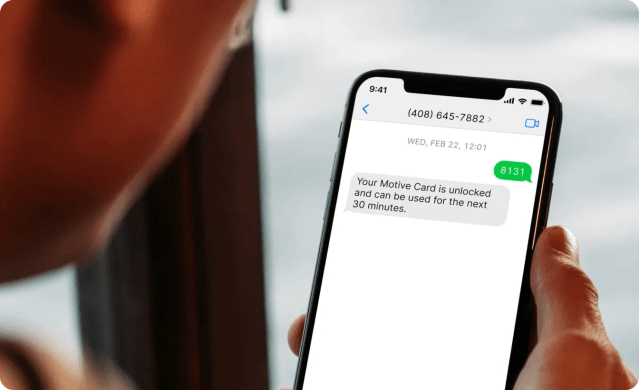

Fraud controls

Enable phone-based card security, which requires the cardholder to unlock the card with their assigned phone before allowing transactions. This helps prevent cards and PINs from being compromised by skimming.

Maximize fuel efficiency.

Pair with Motive fleet products to reduce fuel usage and lower costs.

Reduce fuel consumption

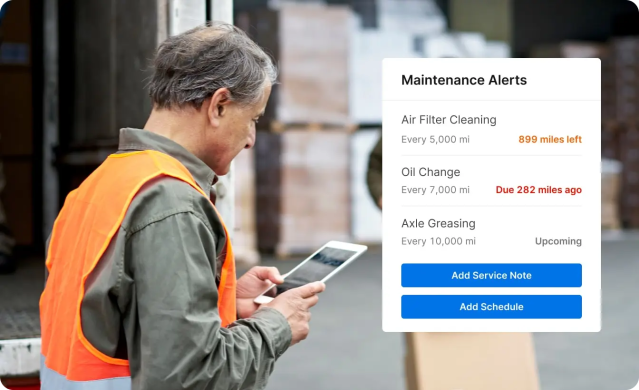

Maintain your fleet

Full view of fuel operations

Reduce fuel consumption

Identify and reduce fuel-wasting behaviors like idling, speeding, and hard acceleration.

Maintain your fleet

Proactively maintain vehicles and assets with automated service records and electronic inspections to reduce efficiency losses, boosting MPG and vehicle uptime.

Full view of fuel operations

Understand every aspect of fuel from planning, to purchase, to consumption and waste, all with savings in mind.

Personalized savings expertise.

If you have 25 or more vehicles, our savings experts can help build a custom Motive Card program for your fleet to maximize discounts.

Get complete data visibility.

Bring fleet management and spend management under one roof. Only Motive links fleet and spend data visibility to unlock savings and improve productivity.

Automate operations.

Augment spend data with fleet data to create automation opportunities for IFTA reporting, compliance, fraud detection, and more.

Effectively manage your business.

Eliminate data silos and the need to update data across multiple platforms.

Customers love us

Related resources

Report

Are you losing up to 5% of fuel spend to fraud?

Fleet card fraud can be a costly blind spot, cutting into your profits. New report highlights hidden fraud epidemic and how to spot it, boosting profits.

Fleet Card basics

Unlock savings

Fraud prevention

Frequently asked questions

Why do I need a spend management solution?

An integrated spend management solution can help you save time through automation of administrative tasks such as consolidating receipts, tracking expenses, and simplifying reporting like IFTA filing, so your team can be more productive. Motive’s spend management solution is part of our all-in-one platform meaning you can manage fleet and spend in one dashboard This provides full visibility into your entire business so you can identify areas to save and operate more efficiently.

How can an integrated spend management solution and fleet operations application benefit my business?

Getting an holistic view of your fleet, including expenditures, helps you run a more efficient business:

- Gain visibility into your entire business operations and spending areas so you can easily identify opportunities to save.

- Easily sort and filter your transactions by cardholder and other data that already exists in your Fleet Dashboard without having to manually compare separate applications.

- Simplify administrative tasks with automatic fuel purchase reports generated from the Motive Card, combined with vehicle location data to make things like IFTA filing easier.

- Detect and reduce fraud with Motive’s Vehicle and Spend Location mismatch functionality which ensures that it’s really your vehicle getting filled up. GPS location matching compares Motive Card and Vehicle Gateway data. Receive alerts for differing vehicle and spend locations and use card spend controls to reduce out-of-policy transactions.

What discounts can I get with the Motive Card?

You can use the Motive Card to get premium fuel discounts at participating partner stations including Love’s Travel Stops, TA, 7-Eleven, Petro Stopping Centers, TA Express, Road Ranger, Casey’s, Yesway, Allsup’s, and a number of independent truck stops. We also have partnerships to help you save on maintenance, tires, labor, and more at locations including Boss Shop, FlowBelow, and more.

Does the Motive Card require a membership fee?

No. The Motive Card is free to use. There are zero activation, transaction, or membership fees.

Does the Motive Card have late fees?

Yes. If the invoice is not paid in full by the due date, a late fee will be assessed and applied to your account. The late fee is 5% of the invoice balance, with a minimum fee of $40.

What’s the process of applying for a Motive Card?

Does Motive report to credit bureaus?

Motive does report your payment history to business credit bureaus, allowing you to build and improve your company’s credit score when you pay on time. A strong business credit score can help provide opportunities to secure additional financing with better interest rates and loan terms.

Can I use my fleet card to purchase items rather than fuel?

The Motive Card is more than a fuel card for fleets. Yes, you can use it to purchase and get discounts on fuel, but you can also use it for fleet maintenance & repair, lodging, gas station store purchases, and any other business expenses. Motive Fleet Card can be used anywhere Mastercard is accepted.

What is the difference between a fleet card and a credit card?

Traditional credit cards and cash provide minimal control over the amount spent, the location of spending, and the specific items purchased. In contrast, fleet cards empower you to manage employee expenditures directly. For instance, you can use spend controls to establish daily or per-use dollar limits, block unauthorized merchants, and only enable certain spend categories.

How can Motive Card help reduce fraud?

Motive Fleet Card uses data-driven, proactive defenses — fraud detection and controls — to detect and reduce fuel theft GPS location data matching that compares fleet and spend data allow you to ensure it’s really your vehicle getting filled up. Receive alerts for differing vehicle and spend locations and use card controls to reduce out-of-policy or suspicious transactions. The mobile-based unlock feature provides added security by requiring cardholders to verify their identity via their assigned phone, reducing fraudulent purchases. Integration of spend management and fleet telematics data allows for tighter controls and optimized operations.

The Motive Card is issued by Sutton Bank, Member FDIC pursuant to a license from Mastercard International. Subject to terms of Spend Management Services Agreement. Mastercard and the circles design are registered trademarks of Mastercard International Incorporated.

The Motive Card is issued by Sutton Bank, Member FDIC pursuant to a license from Mastercard International. Subject to terms of Spend Management Services Agreement. Mastercard and the circles design are registered trademarks of Mastercard International Incorporated.