IFTA fuel Tax Reporting Software

Easy & automated IFTA fuel tax reporting.

Save hundreds of hours on IFTA fuel tax reporting by combining fleet and spend data in Motive’s integrated operations platform.

No more manual data input or IFTA report creation.

Accurate, automated calculations.

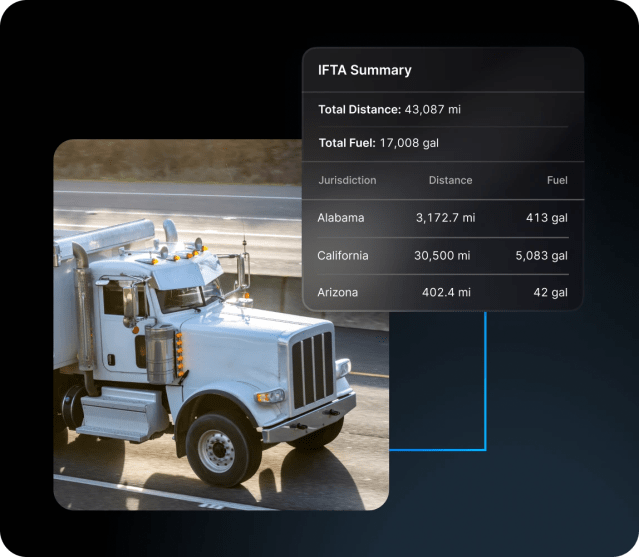

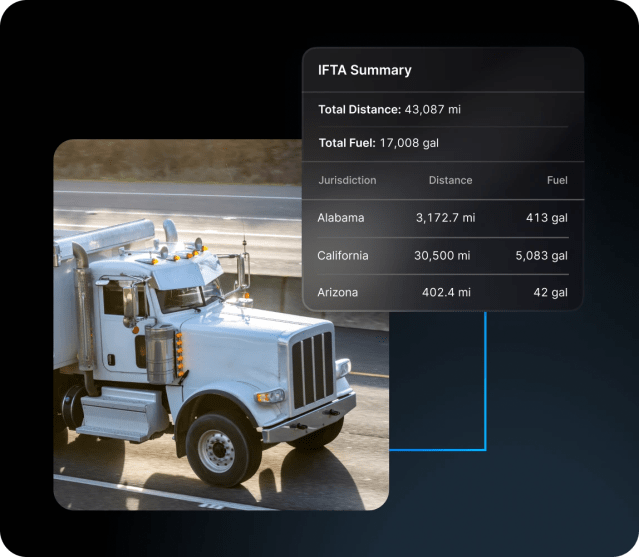

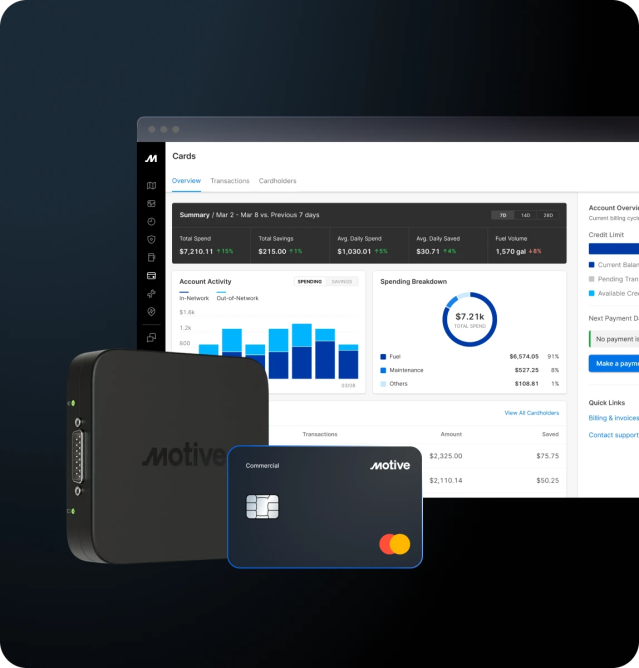

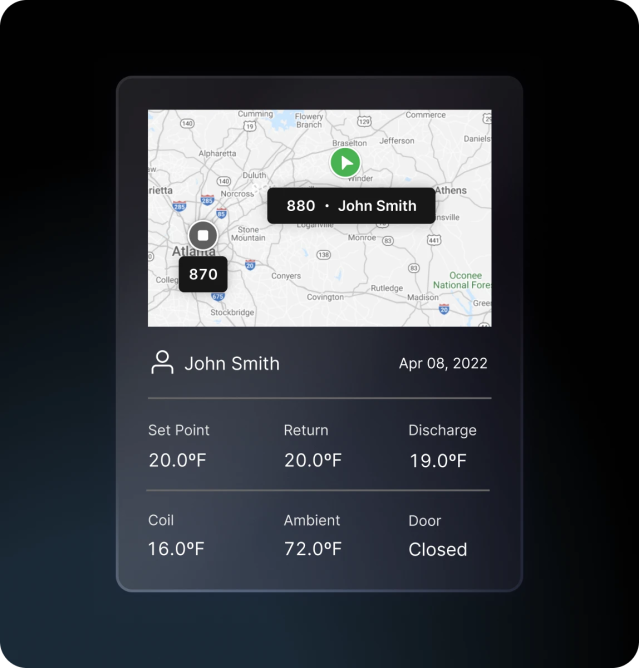

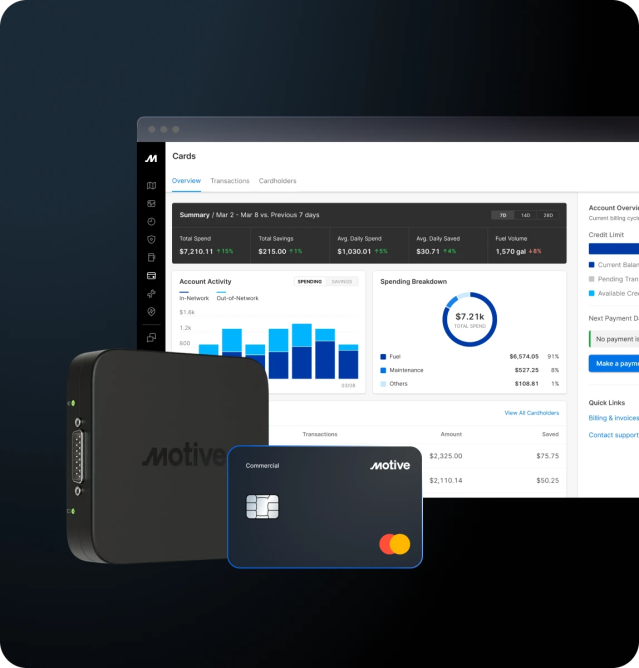

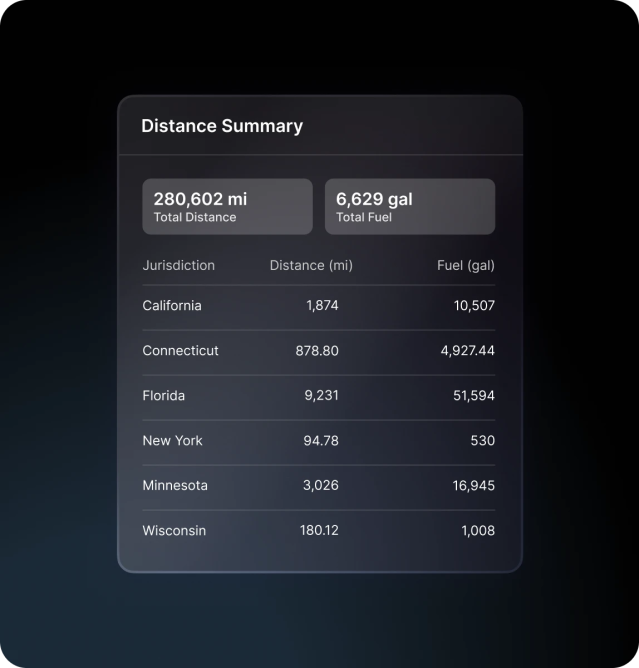

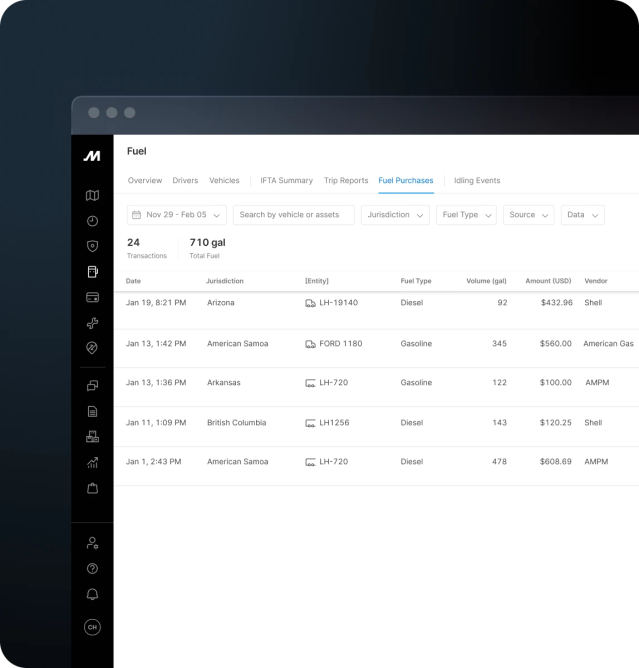

Motive tracks everything from fuel purchases to distance traveled by jurisdiction by combining data from Motive Card and our Vehicle Gateway.

More efficient IFTA reporting.

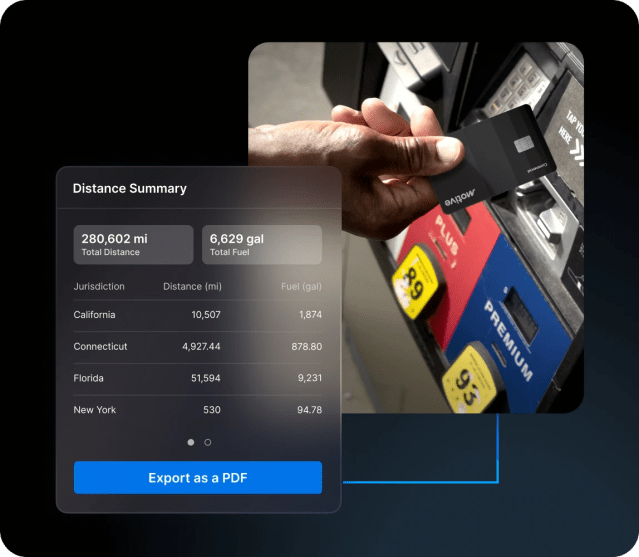

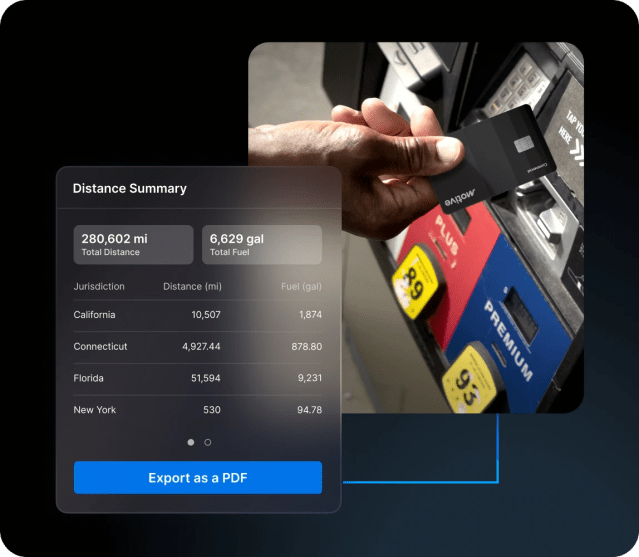

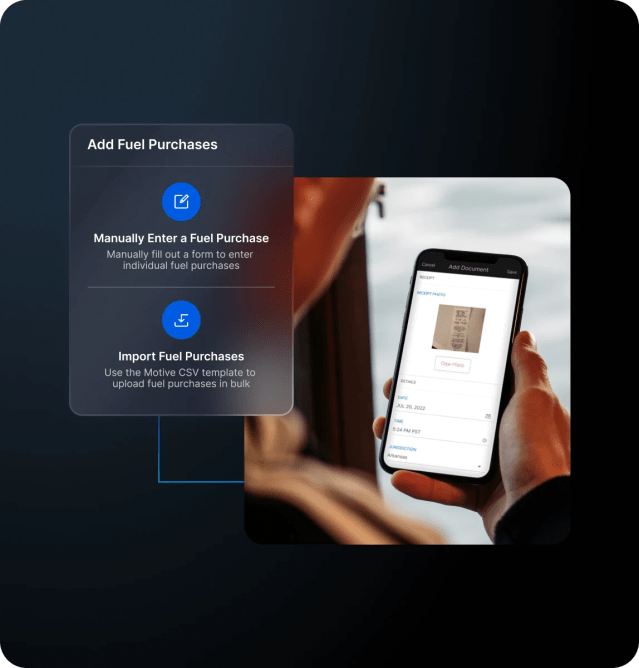

Transactions made with the Motive Card sync automatically, and you can easily upload fuel purchase receipts in the Motive Driver App and Fleet Dashboard.

One-click IFTA exports with Motive Card.

Lower your audit risk by exporting error-free, read-to-file IFTA reports in one click.

Save hundreds of hours.

Save time with an integrated platform.

Motive Card’s IFTA reporting solution streamlines complicated and time-consuming work with powerful features and an easy-to-use interface.

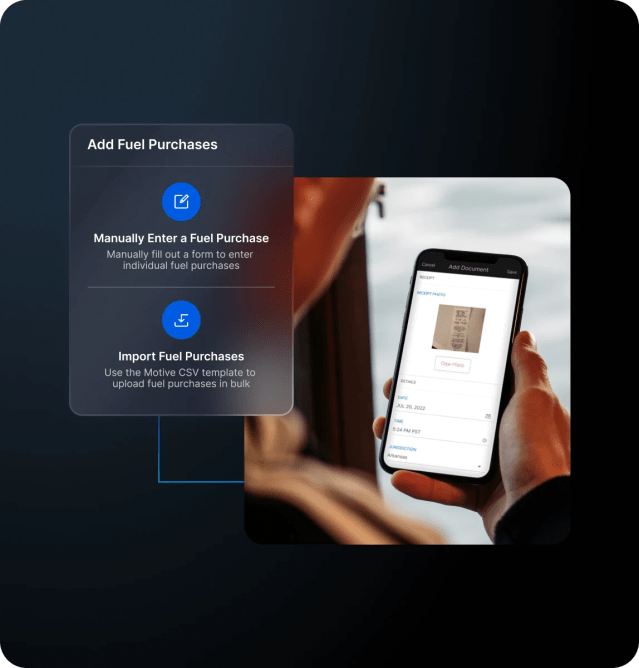

Import individually or in bulk.

Easily add fuel purchases via CSV files from your fuel vendor. With Motive Card, drivers can also upload their own receipts via the Driver App.

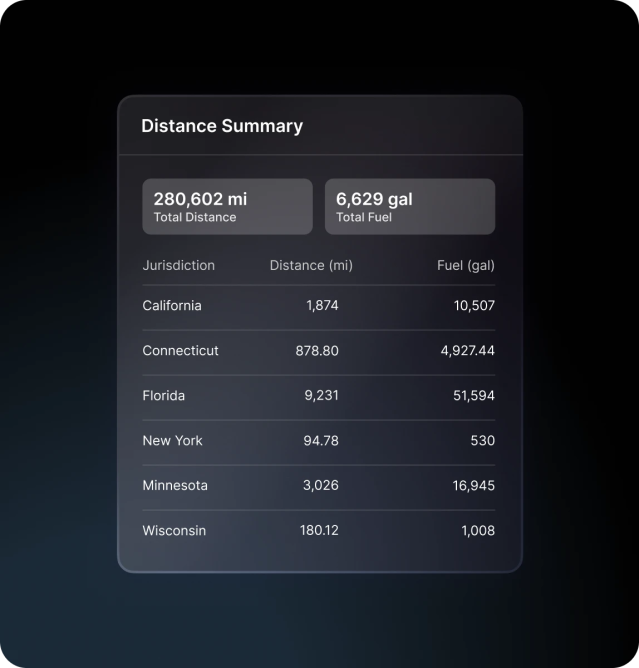

Accurately track mileage & fuel.

View detailed mileage and fuel spend to improve fuel efficiency and simplify IFTA filings.

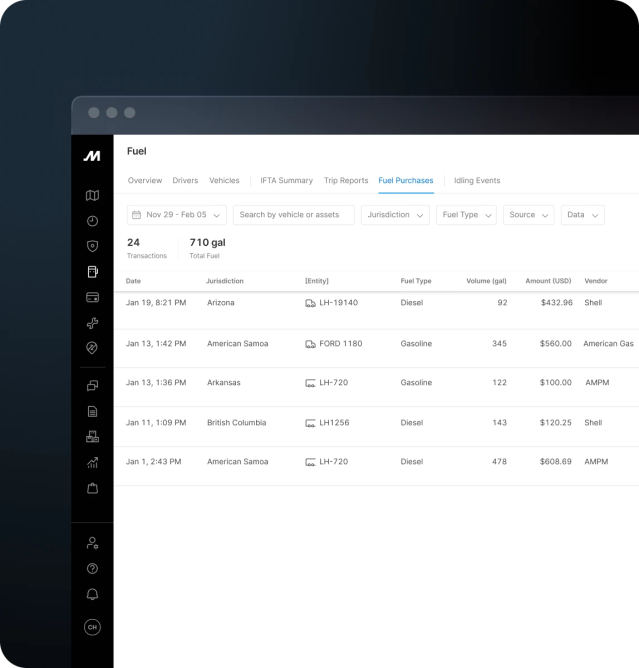

See Motive Card transactions.

All purchases made with Motive Card are automatically included in IFTA reports, saving significant time on collation and reporting.

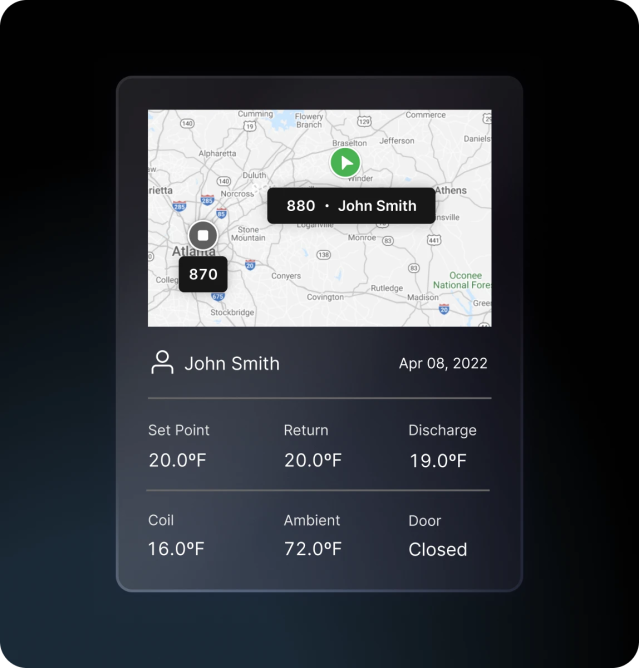

Classify reefer and DEF.

Quickly identify tax-exempt fuel purchases. Motive classifies reefer and Diesel Exhaust Fluid transactions for you.

Cascade Environmental saved 800 hours per month on IFTA reporting.

When combined with Motive’s AI-powered platform, Motive Card improves safety, productivity, and profitability.

800 hrs

Saved on IFTA reporting.

50%

CSA score improvement.

50%

Improvement on safety and compliance.

IFTA reporting software that makes your job easier.

Frequently asked questions

What does IFTA stand for?

IFTA stands for International Fuel Tax Agreement. Adopted in 1996, it allows for the collection and redistribution of fuel taxes paid by interstate commercial carriers through a reporting process.

Learn how IFTA fuel tax works.

What is IFTA?

IFTA is the cooperative agreement between 48 states in the U.S. and 10 provinces in Canada. It allows inter-jurisdictional carriers to report and pay taxes for the fuel their vehicles consume across state lines—using a single fuel tax license.

Learn more here.

How do Motive Card and the Vehicle Gateway help with IFTA reporting?

The Motive platform’s 360° view of fleet operations and spend transaction data allows for automated compilation of everything you need to file IFTA reports. The Motive Vehicle Gateway uses its GPS sensor and the vehicle’s odometer to track the exact distance a vehicle travels in each IFTA jurisdiction—every day. Fuel transactions are tracked by Motive Card and automatically allocated to the respective jurisdictions. Fleet managers can generate reports covering everything that is needed to file IFTA.

Learn how to view and export IFTA reports in our Help Center.

Does Motive account for special mileage exemptions, such as toll roads?

The Motive Vehicle Gateway records the vehicle’s location each minute the vehicle is in motion. A report detailing the vehicle’s location history, combined with distance by jurisdiction, is available in the Motive Fleet Management Dashboard. This report can be used to identify and claim mileage exemptions.

Does Motive automate the filing of IFTA reporting paperwork?

Motive doesn’t automate IFTA fuel tax filing, but it does automate the creation of IFTA reports. In addition, Motive helps fleet managers track the distance fleet vehicles travel in each jurisdiction. And when drivers use the Motive Card, fuel purchases are automatically added, simplifying IFTA reporting even more.

Do I need an IFTA license and IFTA stickers?

If you operate a motor vehicle that’s built and used to transport property or people, you need an IFTA license and stickers.

An IFTA-qualified vehicle also has two axles and a gross vehicle weight of over 26,000 pounds or 11,797 kilograms; or consists of any weight with three or more axles; or is used in combination and has a weight that exceeds 26,000 pounds or 11,797 kilograms.

How does IFTA automation help with overall fleet compliance?

IFTA automation simplifies key aspects of fleet compliance by automating fuel tax calculations and report creation. Combined with Motive’s compliance tools like HOS tracking and DVIR management, IFTA automation ensures your fleet stays compliant across all regulations. Read more about IFTA requirements here.

Can Motive integrate IFTA automation with GPS tracking?

Yes, Motive’s GPS tracking system works seamlessly with IFTA automation. The system tracks travel distances accurately by jurisdiction, ensuring precise IFTA reporting while providing real-time visibility into your assets.

CONNECT WITH US

Unlock the potential of your operations with Motive.

- Comply with industry rules and regulations.

- Improve visibility and automate operations.

- Identify risks and automate driver coaching.