When IFTA came about, it simplified state and province fuel tax reporting for interstate commercial carriers. Now it’s a practical requirement. Carriers crossing two or more state or provincial lines need to be licensed by IFTA and display current IFTA decals, or IFTA stickers.

Before we go too far, let’s look at some IFTA facts:

- An IFTA license and decals streamline the payment of fuel taxes to multiple jurisdictions.

- If you operate across two or more states, you might be subject to the IFTA license requirement.

- You can automate IFTA reporting with a comprehensive fleet management solution.

Obtaining IFTA licensing is a simple procedure, a must if you meet the qualifications. In this article, we’ll discuss:

What is IFTA?

IFTA is an acronym for International Fuel Tax Agreement. Adopted in 1996, the agreement allows for the collection and redistribution of fuel taxes paid by interstate commercial carriers.

Commercial drivers have always been required to pay fuel taxes in the states where they traveled. No matter where the fuel was purchased. Each state has its own IFTA requirements and charges its own fuel tax rate. Prior to IFTA, carriers had to register in each state they entered. They had to affix decals to their vehicles as proof they had registered. The trucking company had to ensure that the proper fuel taxes were paid to the proper states or provinces, and that any refunds were collected. In other words, an administrative nightmare..

IFTA simplified this process. Forty-eight American states and 10 Canadian provinces participate in the agreement. A carrier obtains a single IFTA license for their vehicle or vehicles. They are then allowed to travel through all IFTA jurisdictions and are only required to submit one quarterly fuel tax return to their base jurisdiction.

Who needs an IFTA license and decals?

An IFTA-qualified motor vehicle is one built and used to transport property or people. It also

- Has two axles and a gross vehicle weight of over 11,797 kilograms or 26,000 pounds, or

- Consists of any weight, with 3 or more axles, or

- Is used in combination and has a weight that exceeds 11,797 kilograms or 26,000 pounds.

Any carrier that operates vehicles like those described above probably requires an IFTA license. Especially if they are based in an IFTA member state or province. And operate across two or more member states or provinces.

IFTA application: how to apply for IFTA license and decals online

Obtaining an IFTA license and decals are important steps in becoming a successful owner-operator. If your company requires an IFTA license, you need to apply in the state where your company is based. IFTA application forms can be found online. They are administered by your state Department of Transportation or tax collection agency.

Search online for “IFTA application [name of your state]” to find the correct IFTA application form.

Sometimes application forms serve a dual purpose, allowing you to apply for additional decals or make account changes.

What do you need for an IFTA license application?

Basic information required by the application includes:

- USDOT number

- Registered business name

- Mailing address

- Federal business number

Once your IFTA license application is processed, your state or provincial IFTA authority will issue official IFTA decals for the current year. You can receive a temporary license by fax while your decals are being sent.

How long does the IFTA license last?

An IFTA license and decals expire on Dec. 31 of each year. You have until March 1 of the following year to obtain a current IFTA license and display current decals on your vehicles.

How many IFTA stickers do you need?

You will be provided two IFTA decals for each licensed vehicle. You need to display one on each side of your truck cab.

Calculating IFTA reporting

Once you are licensed, you must file a quarterly IFTA fuel tax return with your base state. Return deadlines are:

- 1st quarter (Jan. to March)—April 30

- 2nd quarter (April to June)—July 31

- 3rd quarter (July to Sept.)—Oct. 31

- 4th quarter (Oct. to Dec.)—Jan. 31

You will be required to track your miles for each state. Fleet managers and drivers must work together to make sure the amount of fuel consumed for each state or province is accurately recorded. Whenever drivers cross state or province lines, they should record odometer readings.

Fuel purchases must be accurately recorded as well. These consist of the total gallons of fuel purchased in each state or province. It is up to the carrier to retain original receipts or invoices to prove that fuel tax was paid.

Once total miles per state or province and fuel purchases have been calculated, the fuel miles for each jurisdiction must be calculated. A fuel miles calculation can be done with an easy formula:

Total miles driven / total gallons = overall fuel mileage

To calculate gallons of fuel consumed in each jurisdiction, you can input your overall fuel mileage into this formula:

Total miles driven in (specific state or province) / overall fuel mileage = fuel consumed in (specific state or province)

The fuel purchases per state or province are the metrics you need to calculate the fuel tax that your company owes each jurisdiction. This calculation depends on the applicable rates during the IFTA quarter. Fuel tax rates for each fuel type and state or province can be viewed on the IFTA website. Note that you shouldn’t perform the calculation until then, as the rates are subject to change.

The formula, finally, for calculating the actual amount owed each state or province is:

Fuel tax required in (specific state or province) – fuel tax paid in (specific state or province) = fuel tax owed to (specific state or province)

How does Motive simplify IFTA reporting?

Traditionally, vehicle miles and fuel purchases had to be reconciled manually. Everything, from fuel purchase receipts to miles driven in each state or province must be accounted for. Drivers can use the tax reporting worksheet from the Owner-Operator Independent Drivers Association (OOIDA) to track fuel purchases, miles driven, states or provinces, and routes traveled.

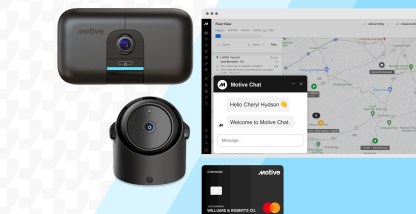

For each state or province, Motive offers automatic IFTA reporting that allows for automatic monitoring and sorting of fuel purchases and costs.

Fuel purchase data can be uploaded in one of two ways. A CSV file from fuel card providers such as EFS or Comdata can be directly uploaded through Motive’s integration. Alternatively, drivers can manually submit their fuel purchases as well as upload pictures of fuel purchase receipts from the Motive app. Good news is, you won’t dread IFTA reporting anymore.

Obtain your IFTA licenses and decals

If you own and/or operate a commercial truck or fleet that meets IFTA qualifications, you will need an IFTA license and IFTA stickers/decals to display on each vehicle. They can be obtained through your state or provincial agency. You must then track your mileage in each state or province, and keep track of your fuel usage in each. Tracking and reporting are made considerably more accurate and easy through the use of software such as the Motive Fuel Tax Reporting software solution.

For more information on IFTA, read our guide on everything you need to know about IFTA.

Request a free demo of the Motive fleet management solution to learn how it can help commercial fleets simplify the IFTA fuel tax reporting process.