Deeply integrated spend management product offers a comprehensive view across physical and financial operations.

It has recently become more expensive than ever to manage fleet operations.

Historically, fuel represented the second-largest operating cost in the physical economy, preceded by payroll. But with gas prices skyrocketing across the globe, businesses will likely see fuel costs surpass payroll. This means it’s more important than ever for businesses to save wherever possible.

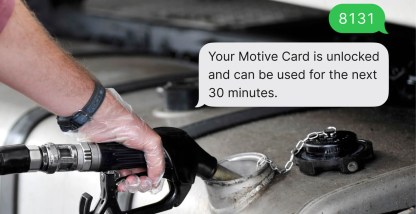

Today, we’re thrilled to announce the launch of the Motive Fleet Card, the first corporate card that natively integrates with a fleet management platform, giving businesses an all-in-one solution to automate their financial and physical operations.“We’re excited to bring fintech innovation to businesses that power the physical economy,” says Hemant Banavar, Director of Product for Spend Management at Motive. “By combining telematics data and transaction data in one place, we can help our customers spend less and save more, while also preventing some of their biggest financial headaches, such as fraud or spending misuse.”

Swipe and save

Fuel discounts are more important than ever for driving profitability. The Motive Card offers businesses significant fuel discounts at leading fuel providers, including Love’s, TA, Petro Stopping Centers, TA Express, and Road Ranger, along with industry-leading discounts on tires, maintenance, and more. The Motive Card has zero activation or annual membership fees and can be used for any business expense.

Read: Fleet card basics and benefits.

Manage your fleet and your spend in one place

“Motive is unifying the management of financial and physical operations in one integrated platform,” says Shoaib Makani, co-founder and CEO of Motive. “Our customers can now manage their spend from the same place they manage their drivers, vehicles, and assets. We are helping our customers streamline their operations and run more productive and profitable businesses.”

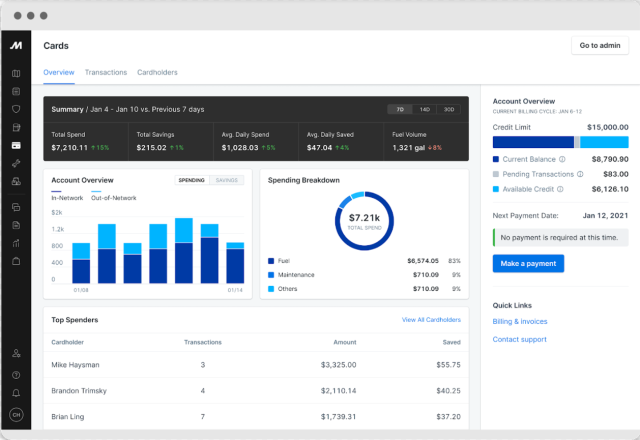

Motive’s integrated Spend Management application provides businesses with powerful controls to limit when, where, what, and how much their employees can spend. Managers can easily adjust spend controls by cardholder, amount, time, and category directly from the Fleet Dashboard.

An integrated dashboard also provides deep insights backed by both transaction data and telematics data. Motive uniquely offers insights such as spend by vehicle, category, and more, combined with telematics data like fuel and location data to understand where to optimize.

Save time with automated IFTA reporting – Motive Card fuel purchases are automatically included in IFTA reports. Comprehensive details needed for filings like vehicle, fuel type, and jurisdiction are assigned to each purchase.

Also, combat fraud and fuel theft — fuel theft alerts from the Sustainability application notify you when a fuel purchase is made for a vehicle with mismatched fuel type, or vehicle location/fuel purchase location mismatch.

“The Motive Card has been a game-changer for our business,” says Stephanie Matos of BB Auto Logistics, LLC. “Now we can easily keep track of expenses in the same dashboard where we manage our fleet operations, and get fuel savings at the same time. Having one place to go for everything saves me time and money for my business.”

Get started

The approval process for the Motive Card is quick and easy, with a team of dedicated product experts available 24/7 to ensure a seamless onboarding experience. Apply today.

The Motive Card is issued by Sutton Bank, Member FDIC pursuant to a license from Mastercard International.

The Motive Card is issued by Sutton Bank, Member FDIC pursuant to a license from Mastercard International. Subject to the Terms of Service. Mastercard and the circle design are registered trademarks of Mastercard International Incorporated.