Welcome to the April edition of the Motive Monthly Economic Report, where we analyze the major trends in the supply chain and economy across the Motive platform during the past month. Keep reading for a front-seat view into the key factors influencing the U.S. economy.

Big Picture: Q1 brought mixed signals; Q2 is the quarter to watch

- Freight recession persists. New company formations are up due to lower operating costs but total capacity is contracting as small carriers exit the market.

- Retail isn’t rebounding. Decline in retail warehouse visits indicates weakness in consumer demand, but surprisingly may also be a sign of recovery in the supply chain.

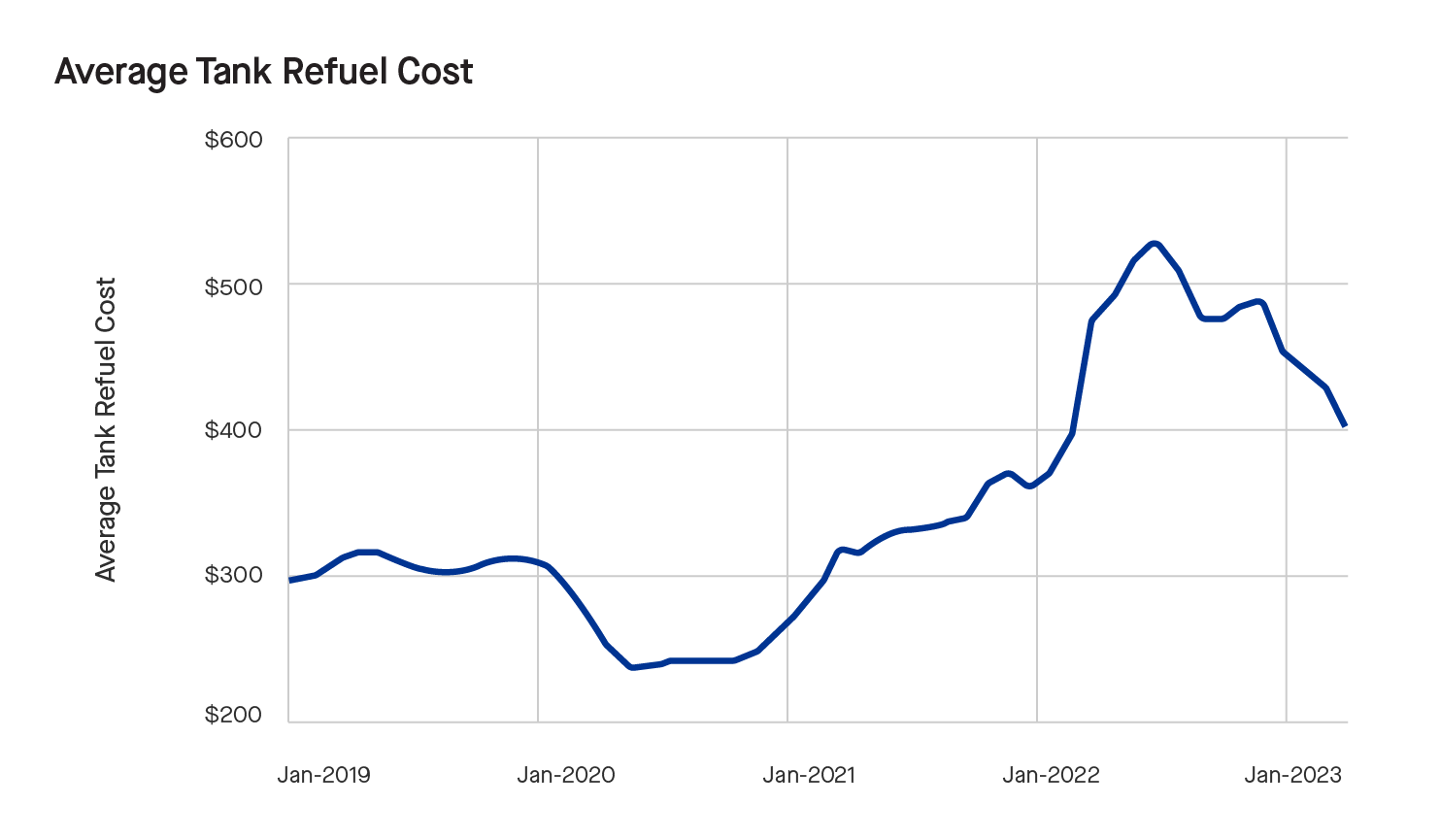

Lower operating costs are contributing to an increase in new trucking company formation

The average cost to fill a heavy-duty Class 8 truck tank has decreased by 22% from its 2021 peak of $521 to $403. With operating costs (namely fuel) still on the decline, companies were motivated to enter the market. However, the second quarter will be critical to observe as rates are gradually rising and inflation is still a concern.

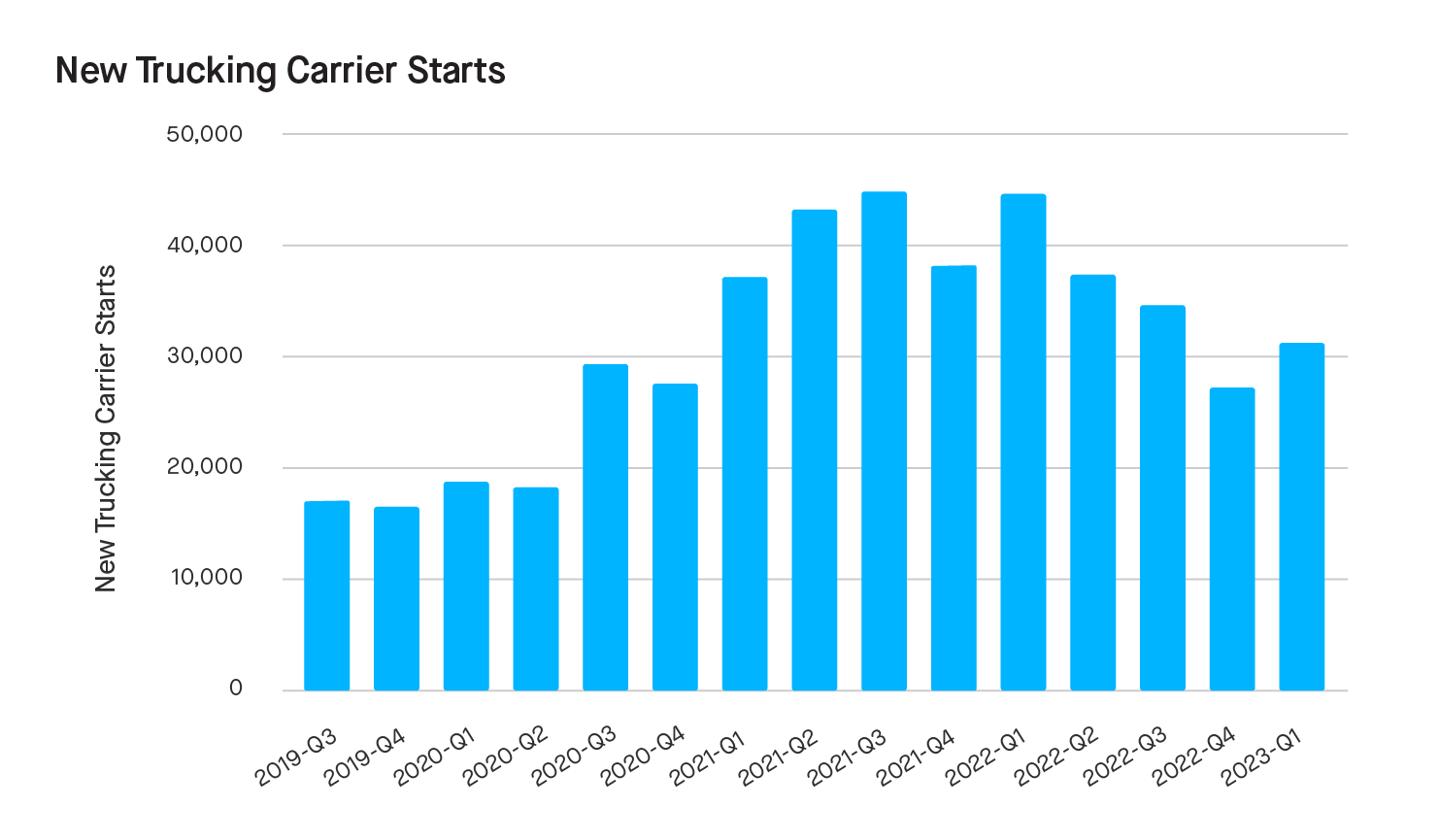

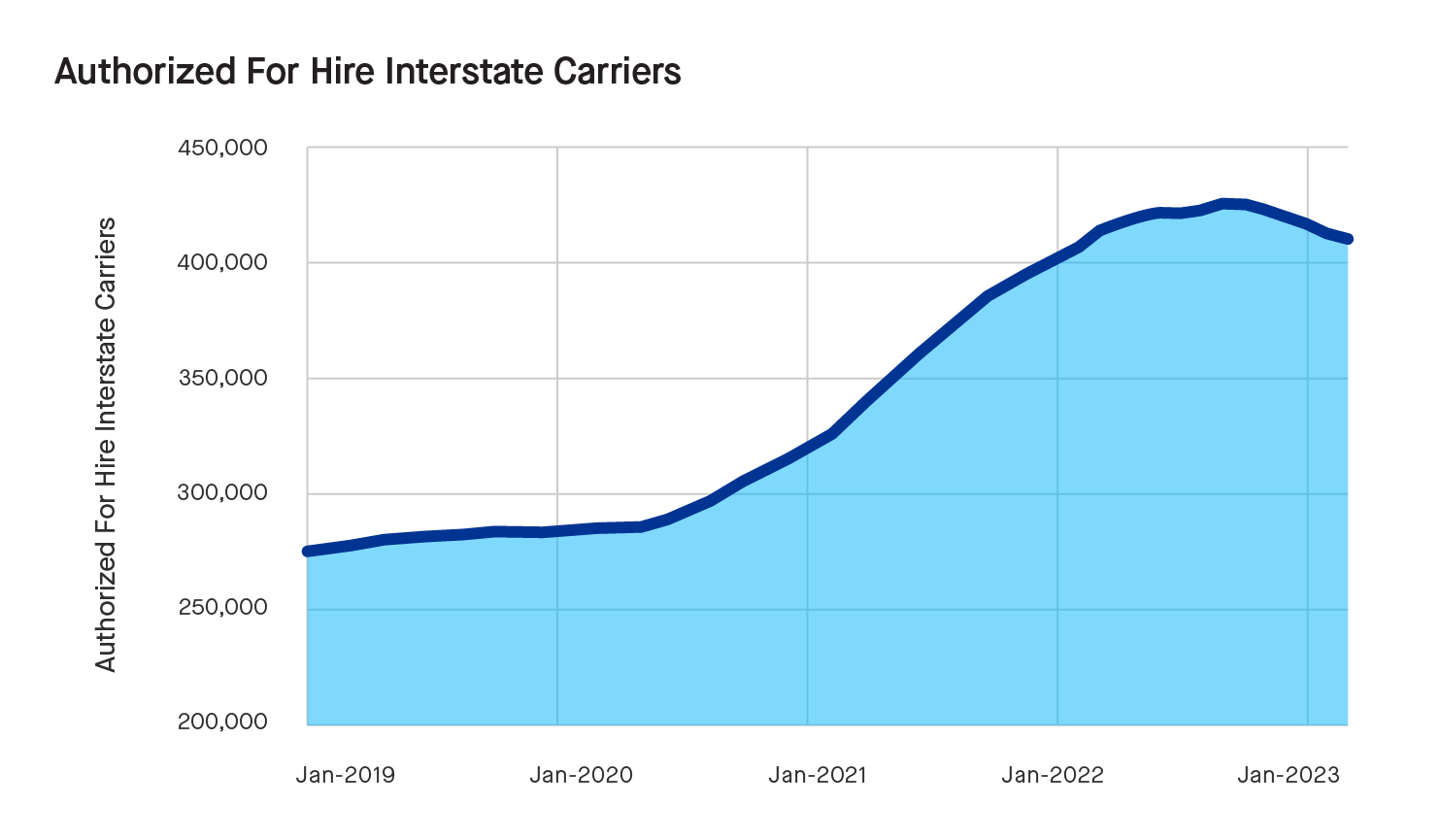

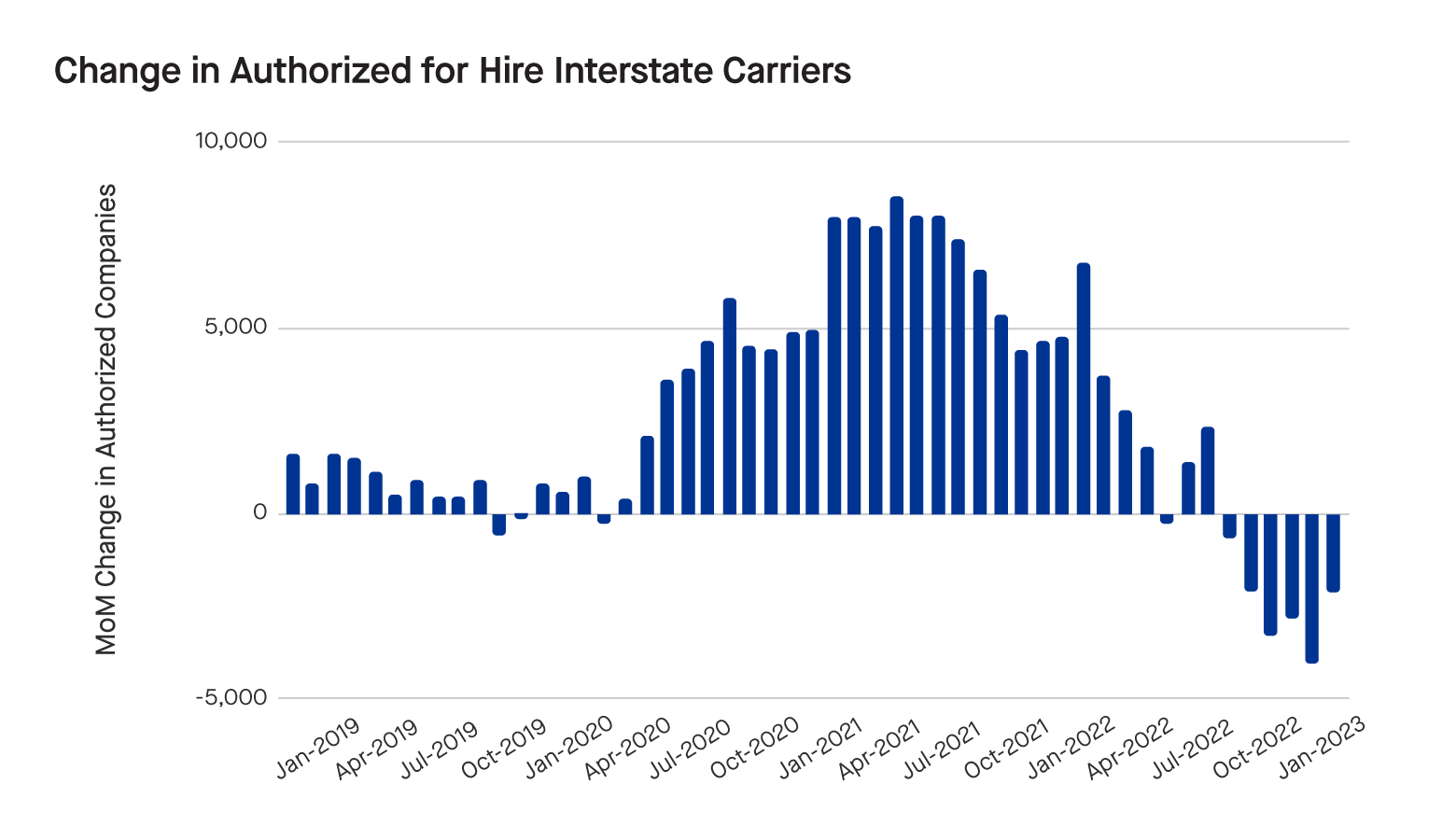

New trucking company formation bounced back after Q4 decline but more firms left the market than were created

I

In March, 11,000 new trucking companies were formed, contributing to a total of 31,200 in the first quarter, indicating a rebound from the declines seen in Q4. However, despite the increase in new formations, the number of companies leaving the market exceeded the number of new companies created, resulting in a net decrease of approximately 2,000 authorized carriers. This trend suggests the freight recession is getting worse.

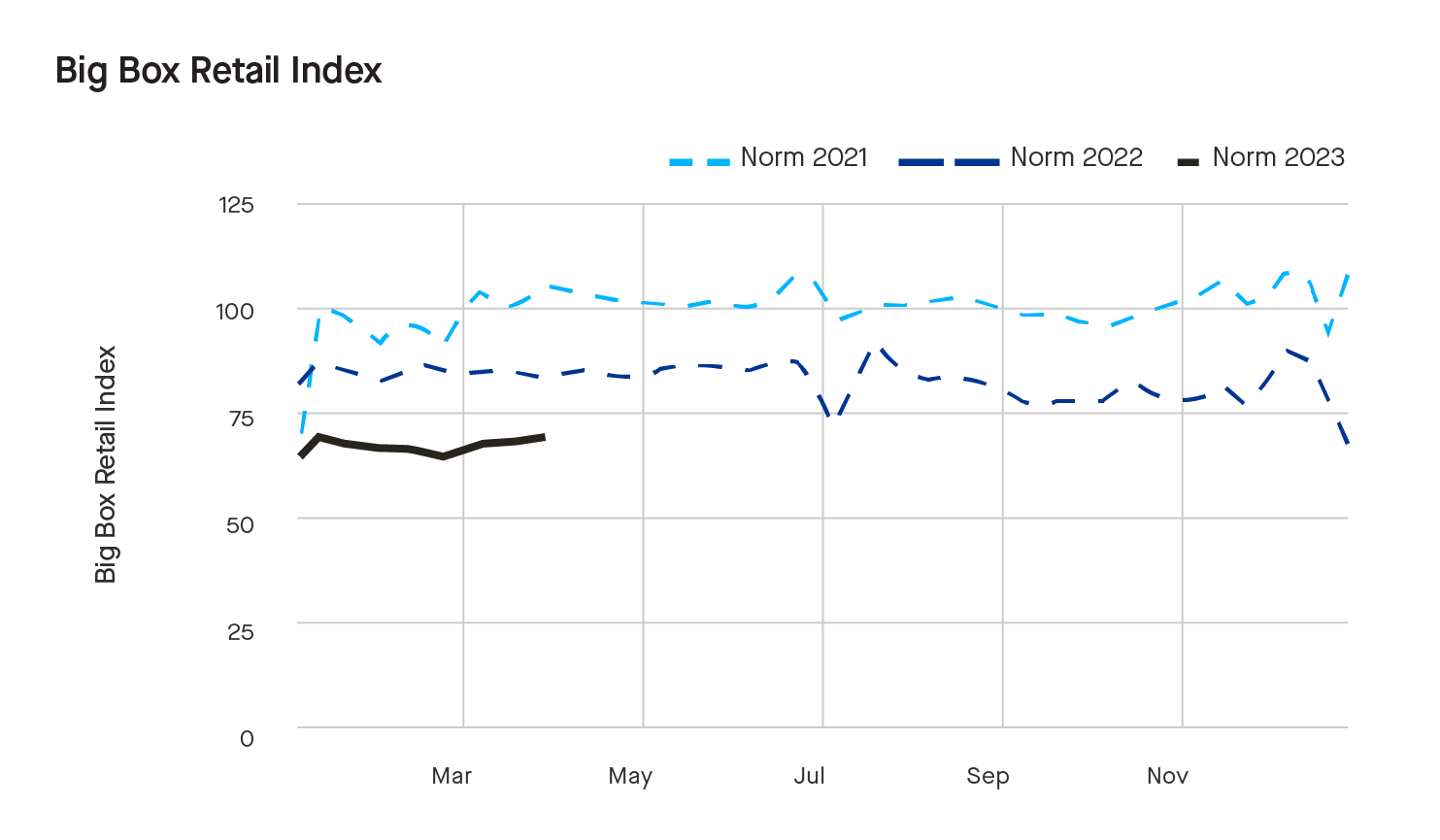

Retail warehouse visits are still down indicating softness in consumer demand

In March, there was an 18% year-over-year decline in the number of big box retail warehouse visits, which follows a 22% year-over-year decrease in February. The decrease in visits to retail warehouses suggests a weakness in consumer demand, but it could also indicate a positive development in the supply chain’s recovery. Retailers now have reduced lead times to restock inventory, after experiencing highs in 2021 and 2022. This has given them the confidence to deplete their existing inventories, knowing they can replenish them quickly.

Data Methodology

The Motive Monthly Economic Report uses aggregated and anonymized insights from the Motive network, as well as publicly available government data from the Federal Motor Carrier Safety Administration and the U.S. Department of Transportation.