Welcome to Motive’s first-ever Holiday Outlook Report! The report looks at the current State of Freight, State of Retail, and State of Safety as we enter peak freight season with predictions for what to expect this holiday season and heading into 2024. Keep reading for a front-seat view into key factors currently influencing the U.S. economy.

Big Picture

In 2023, we’ve experienced continued rebalancing following the economic surge driven by the pandemic and oversupply of capacity. These have shrunk and restrained the market. The trend is expected to continue into Q4 and early 2024, so carriers should adjust their plans accordingly.

- Climbing diesel prices are causing more financial stress for carriers.

- Carrier exits and new carrier starts trended back downward after brief improvement in August, but driver retention since 2022 has improved.

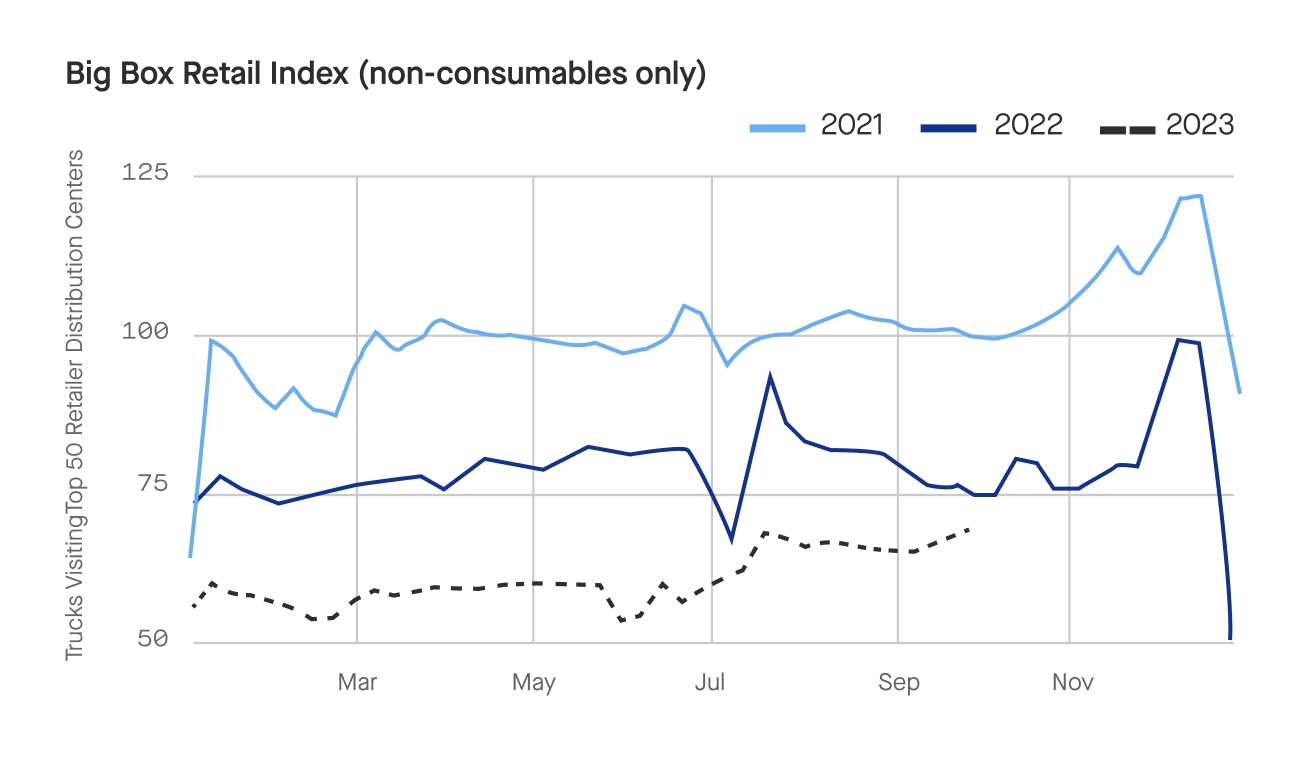

- The Motive Big Box Retail Index improved slightly, as retailers may be slowly ramping up at a higher rate than in 2022.

- Motive still expects overall contraction of the market and relatively delayed restocking to continue through the holiday season and into early 2024.

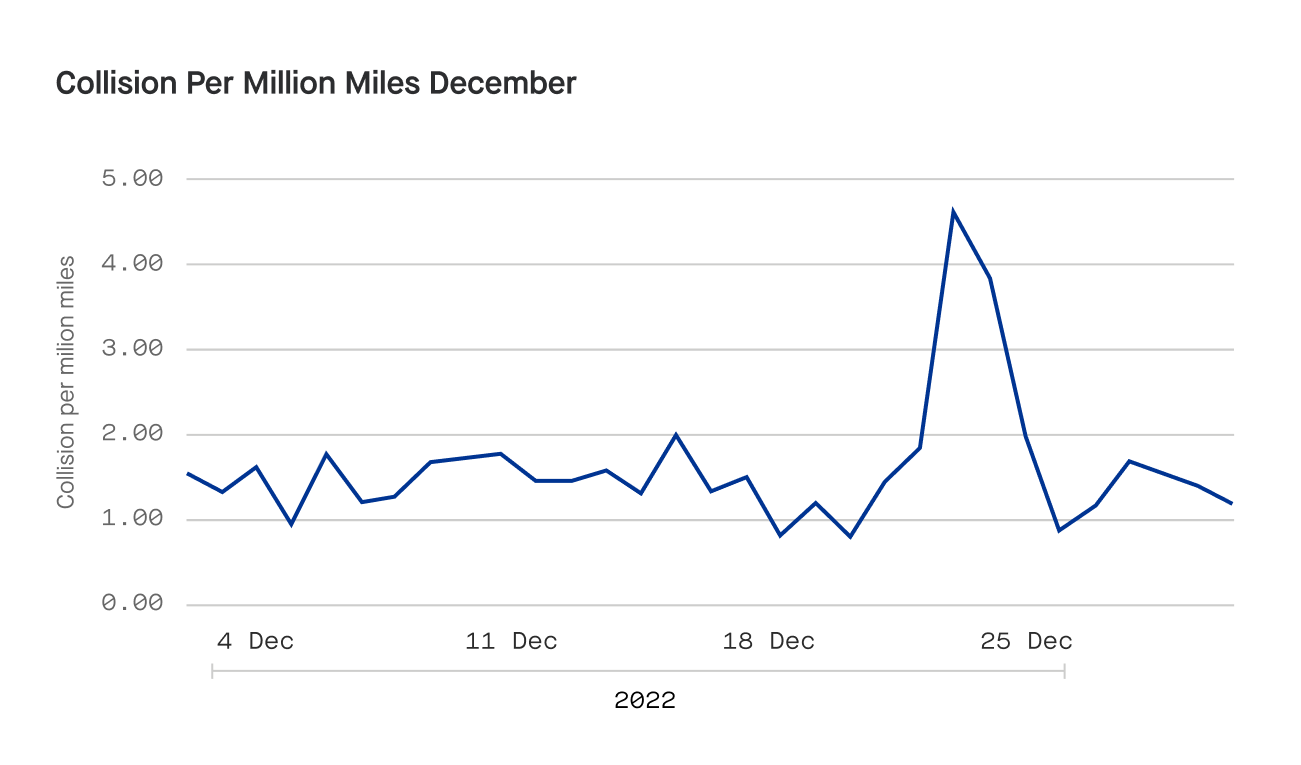

- Safety on the road becomes an increased concern for carriers around the holidays, especially on December 23 when collisions can more than double.

- In this economic climate, operational efficiency is one of the only things within a business’s control. Therefore, it will be the key to carriers having a happy new year.

State of Freight

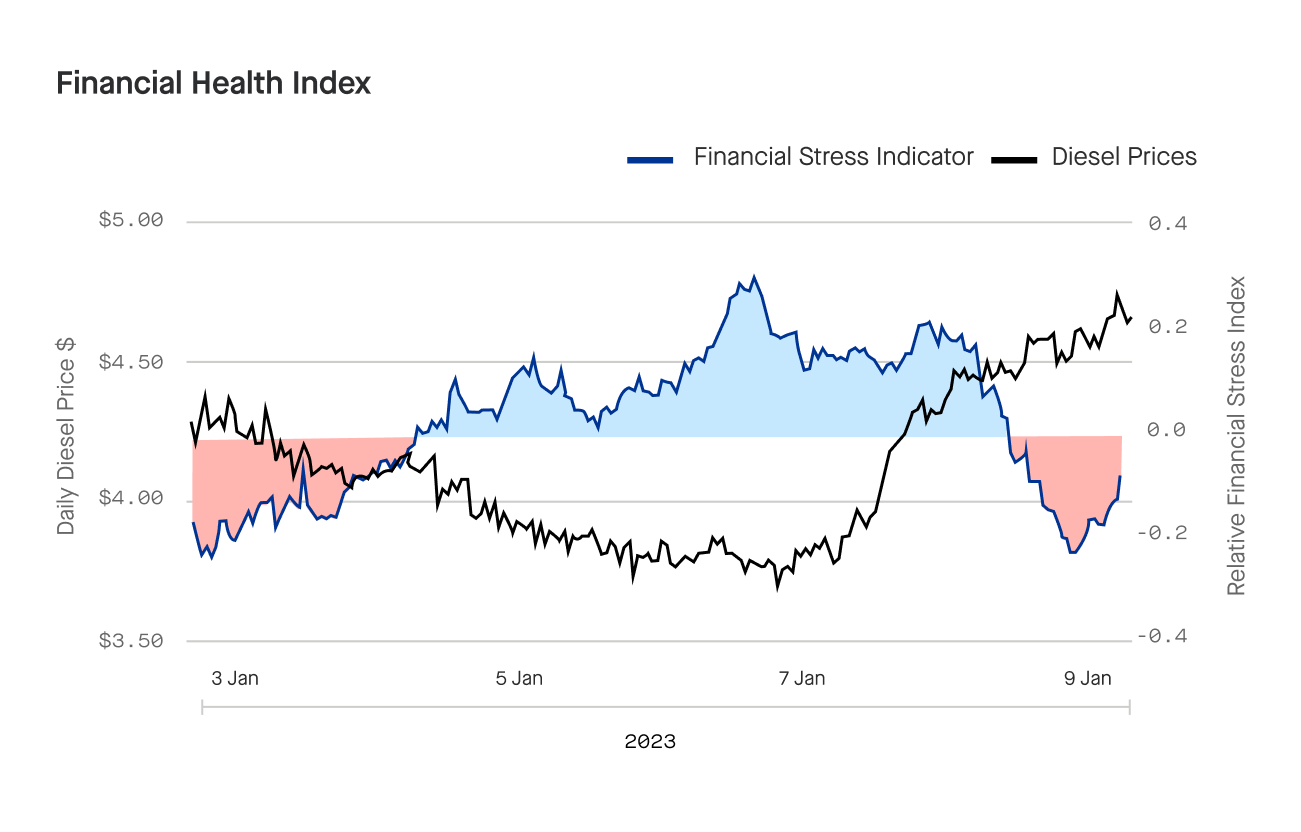

- Motive’s new Financial Health Index tracks financial health among carriers measured by payment delays and its correlation with fluctuations in diesel prices. 2023 has seen a strong correlation of higher fuel costs and increased financial stress.

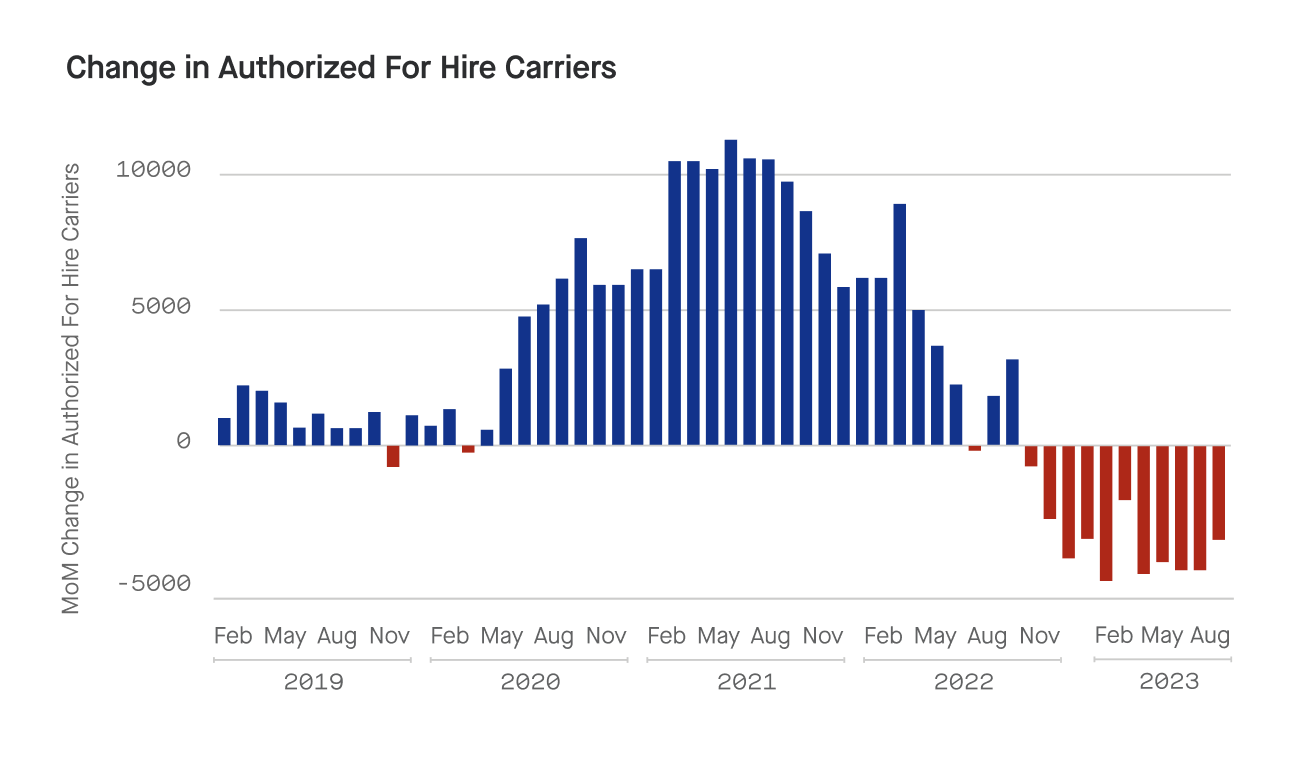

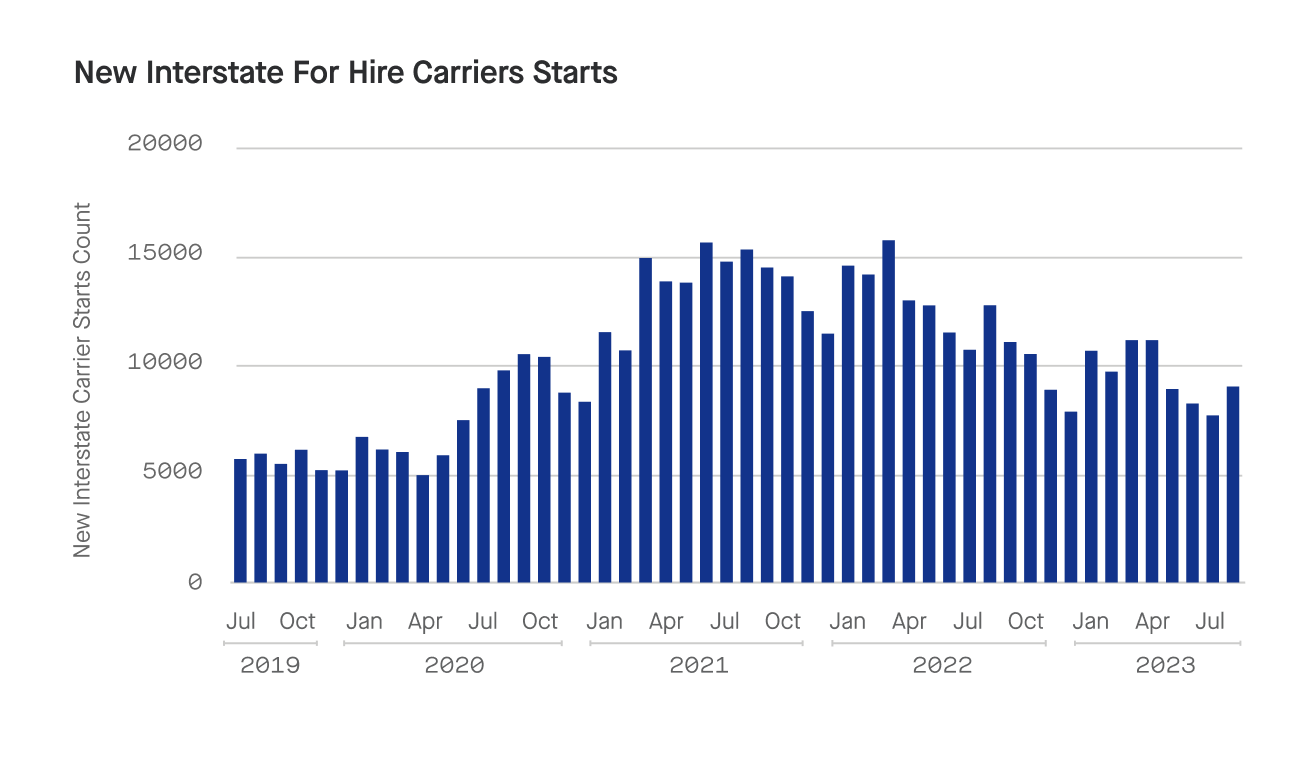

- Though the summer brought some reprieve, net carrier exits from the market have continued to increase through 2023. New carrier starts, which saw a pop during the pandemic and for a short time afterward, have also steadily decreased in 2023.

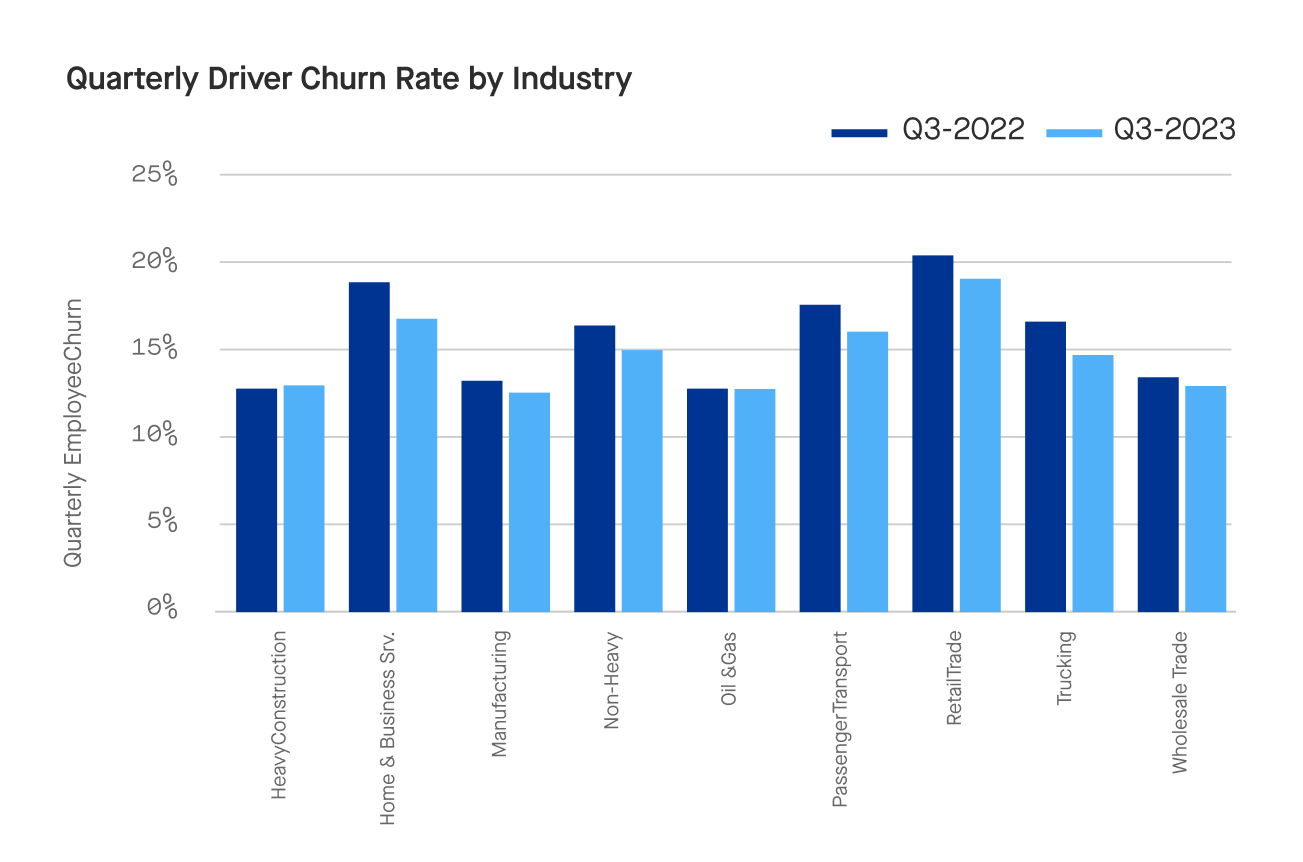

- One metric that has seen improvement has been driver retention, where we have seen a 5% improvement from 2022 to 2023. Though overall churn remains a challenge, more drivers are staying put, particularly in industries like passenger transport, retail, and warehousing.

The market (and workers) are craving stability

With carriers consistently exiting the market, new carrier starts trending downward, and diesel price fluctuations driving financial stress, 2023 showed how impactful volatility can be for carriers. More drivers staying put indicates what they and the wider market desire: more stability, both in their operations and the overall marketplace. As carriers have continued to struggle with post-pandemic market shifts, it will be crucial that they stabilize operations as much as possible. This includes prioritizing operational efficiency and appropriate spend management for the busy holiday season and heading into 2024.

Diesel price swings are creating more financial stress

Diesel prices, one of the biggest input costs for carriers, saw major fluctuations in 2023. Prices gradually declined from March to June but then surged 18% from July to September. Financial stress, which is measured as the change in payment delays for carriers, saw tight correlation with these swings. For every 50 cents diesel prices increased in 2023, Motive saw a 30% increase in companies’ financial stress. As credit delinquencies overall continue to increase, this financial stress particularly impacts smaller carriers. They have not seen spot rates increase at the same rate as diesel prices and are seeing their revenues squeezed at a time when debt options are more limited. Since September, financial stress has improved somewhat in correlation with diesel prices falling, but this simply shows that businesses that can cope with the price fluctuations are able to stay afloat, while smaller businesses that can’t are more likely to be adversely affected

Carrier exits and starts shift back toward record highs

The number of carriers exiting the market increased in September, moving back toward the record highs seen in Q2. This indicates that the decreases last month were likely an anomaly versus signs of a changing trend. At the same time, new carrier starts saw a 10% drop, which also brought it back in line with Q2 and the overall decreases we’ve seen in 2023. When the market will return to a level aligned with demand relies on external factors like diesel price fluctuations and interest rates.

Driver churn drops amid economic uncertainty

Companies that transport goods and people, like trucking and passenger transit, have struggled for a long time to retain drivers, but driver retention saw some improvement between 2022 and 2023. The number of drivers leaving their jobs each quarter went down by 5%, bringing it to 14.9%. Industries seeing the largest improvement include passenger transport, retail, and warehousing. However, this improvement might be due to carriers leaving the market, and hiring slowing down, limiting drivers’ job choices and making them more likely to stay where they are.

State of Retail

- The Motive Big Box Retail Index improved in September, indicating that retailers are slowly replenishing warehouse inventories in preparation for the upcoming holiday shopping season.

- In addition, retailers that don’t sell consumables like groceries may already be matching inventories to demand more closely, which would be a step toward stabilization of the market.

- We foresee retailers staying cautious, waiting until the last minute to match inventory with demand due to the prevailing risk-averse climate, even though the holiday season may pick up speed compared to 2022.

Anticipate delayed inventory ramp-ups, and adjust accordingly

With capacity running higher and supply chains operating leaner, carriers should anticipate that retailers are likely to ramp up their inventories closer to when they’re needed for the foreseeable future. Doing so will help to account for potentially slower periods ahead of holiday ramp-ups, particularly due to recent decreases in consumer demand.

Retailers start increasing volumes again

Motive’s Big Box Retail Index, which observes carrier trips to warehouses of the top 50 retailers in the US, saw slight improvement in September (up 1.2 points to 74.7). This continues a gradual upward trend following record lows in Q1 2023. After spending the first half of 2023 depleting excess stock, this data suggests retailers have slowly begun building inventories back up ahead of the 2023 holiday shopping season.

Notably, when we exclude retailers that sell consumables such as groceries from our analysis, we see that the first half of 2023 saw relatively low inventories, but the second half has been significantly stronger. This may indicate that the biggest retailers are moving towards better alignment of inventories with demand, which would be a step toward stabilization of the market.

Though the gap between where the Big Box Retail Index stood in 2021 and now is still wide, September’s numbers bring us closer to where retail visits were in 2022. On a related note, we anticipate that, similar to 2022, the ramp up in holiday restocking will still be delayed by roughly 3 weeks compared to previous years. Throughout 2023, retailers continued the trend of stocking up closer to peak demand periods rather than holding excess inventory for extended periods before holiday surges.

State of Safety

Safety can’t be overlooked during the holidays

Safety is more important than ever around the peak retail and, thus, peak freight holiday season when events like severe weather and busy roads are stacked against operators. It’s critical to implement tools and protocols to protect drivers, ensure productivity, and keep the roads safer for everyone at this time of year.

Increased violations, severe weather correlate with uptick in collisions

Over the holidays, the businesses driving the physical economy make sure our gifts are delivered, our grocery shelves are stocked, and our homes are warm. Trucking plays a significant role, moving roughly 72% of the nation’s freight by weight annually. But statistics show that more trucks on the road means higher risk of accidents, and the holidays often amplify this risk.

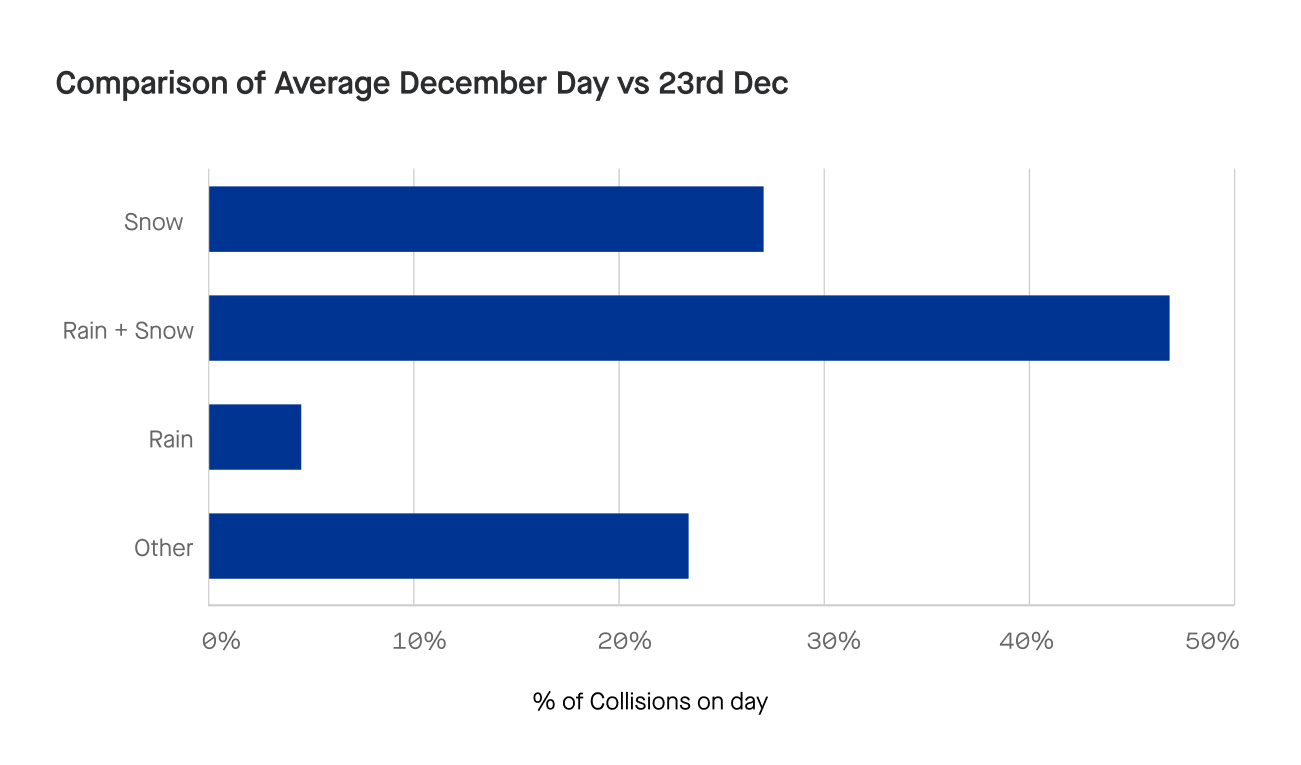

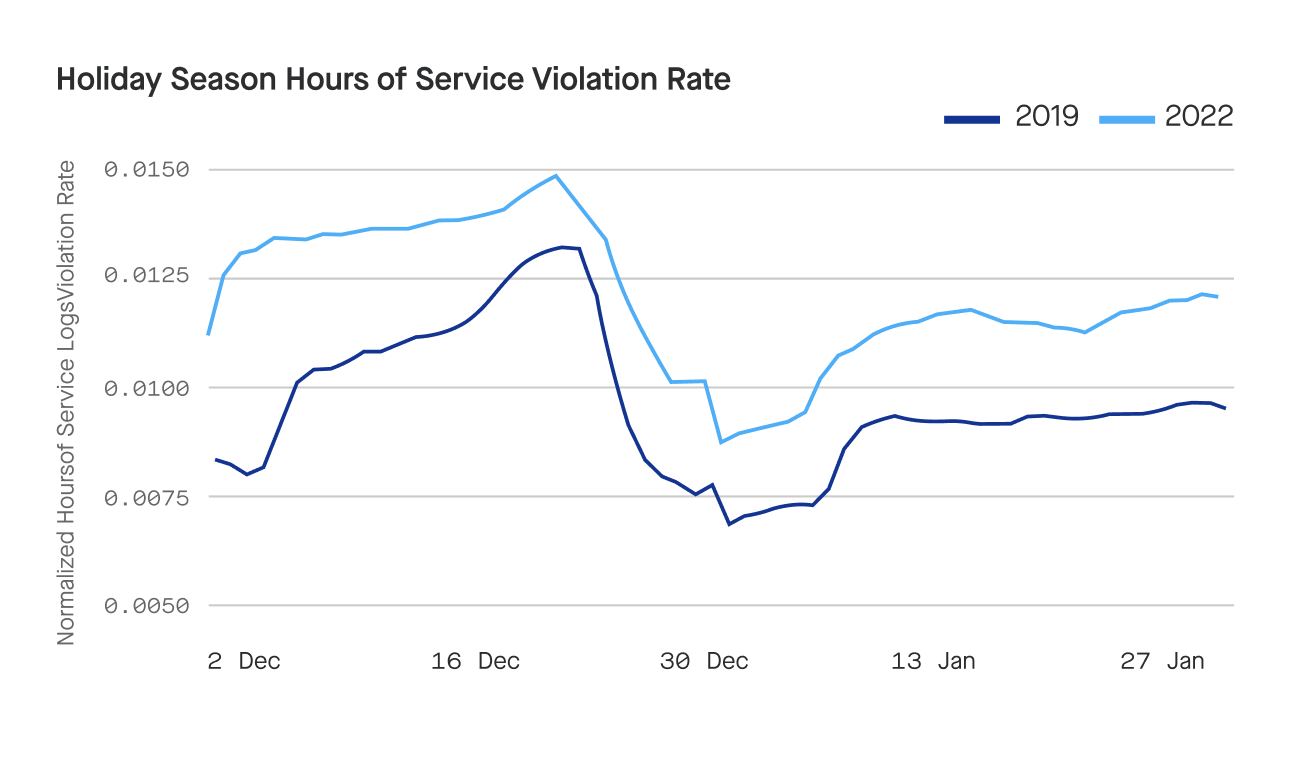

Last year, we saw a 14% increase in critical speeding events around the holidays, likely due to the rush and demand associated with this time of year. In fact truck collisions more than doubled on December 23 in particular. Severe weather was another factor, as December 23 of last year also saw 73% of accidents happen at locations impacted by snowy, icy, and wet conditions. Finally, hours of service violations also tick up during the holidays, with December 2022 seeing a 10% increase, and December 2019 seeing a 28% jump.

Looking ahead: Predictions for the holiday season and 2024

The trucking market’s contraction will continue

We at Motive don’t anticipate the contraction of the overall trucking market to abate going into the holiday season and early 2024. The capacity glut created in the aftermath of the pandemic’s spending boom is still here, and current economic conditions aren’t showing signs of that changing.

Cost and demand volatility will carry into 2024

Diesel and insurance prices will continue to be volatile through the first half of 2024. Excess capacity will need to decrease and prices will need to go up in order for the freight market to be more stable. Consumer demand will also need to at least maintain (or even grow) to match capacity, which we don’t see happening in early 2024.

Fewer drivers will seek to change jobs

Driver retention statistics in 2023 may indicate carriers will be part of a trend seen in the wider job market: fewer people will seek to change jobs overall. This doesn’t mean driver retention will be any less important for carriers in the coming year, but drivers may not have as many options to move to in the current economic and industry landscapes.

Retailers will continue to operate leaner, bringing in less inventory (and later)

Retailers will keep their inventory levels low and bring in goods closer to the holiday season. This trend is expected to continue because the holiday demand is not expected to be very strong. Even when demand increases in early 2024, retailers are likely to stick to this strategy, and carriers need to plan for it.

Efficiency will be the key to carriers having a happy new year

If the holidays and early 2024 will bring continued lack of demand, cost volatility and market contractions, then operational efficiency will continue to be critical moving forward. Using technology and solutions that optimize fleet management, spend management, and safety will help carriers maximize their bottom lines, making them as profitable and productive as possible in the current environment.

Data methodology

The Motive Holiday Outlook Report uses aggregated and anonymized insights from the Motive network, as well as publicly available government data from the Federal Motor Carrier Safety Administration, U.S. Census, and U.S. Department of Transportation.