Fleet management is a critical aspect of running a business that relies on transportation. It involves coordinating and organizing a range of activities, from vehicle maintenance to fuel management. One of the most important tools in a fleet manager’s arsenal is the fleet card. In this article, we’ll take a closer look at cards for commercial fleets, including the basics and the benefits of using a dedicated fleet card.

What are fleet cards?

Fleet cards are payment cards that are designed specifically for commercial fleets. They are issued to fleet managers and their drivers and are used to pay for fuel, maintenance, and other expenses associated with operating a fleet of vehicles. Fleet cards are accepted at a network of service stations, repair shops, and other authorized vendors, but are often closed loop, meaning the card can only be used at a specific vendor for a specific use, e.g., fuel purchases. Some cards are more widely accepted and can be used anywhere a regular credit card is accepted.

Benefits of using a dedicated fleet card

1. Improved cost control

One of the most significant benefits of using a fleet card is that it enables fleet managers to gain greater control over fuel and maintenance costs. These cards typically offer detailed reporting that enables managers to track expenses in real time, allowing them to identify areas of overspending or inefficiencies. This, in turn, allows them to make data-driven decisions to reduce costs.

2. Streamlined spend management

Certain fleet cards can streamline spend management by eliminating the need for drivers to carry cash or personal credit cards. This reduces the administrative burden on fleet managers, who can easily reconcile expenses and monitor activity on the card. However, if a card can only be used for fuel, managers must either rely on a second card or rely on a reimbursement process for non-fuel expenses like maintenance, tires, or incidentals.

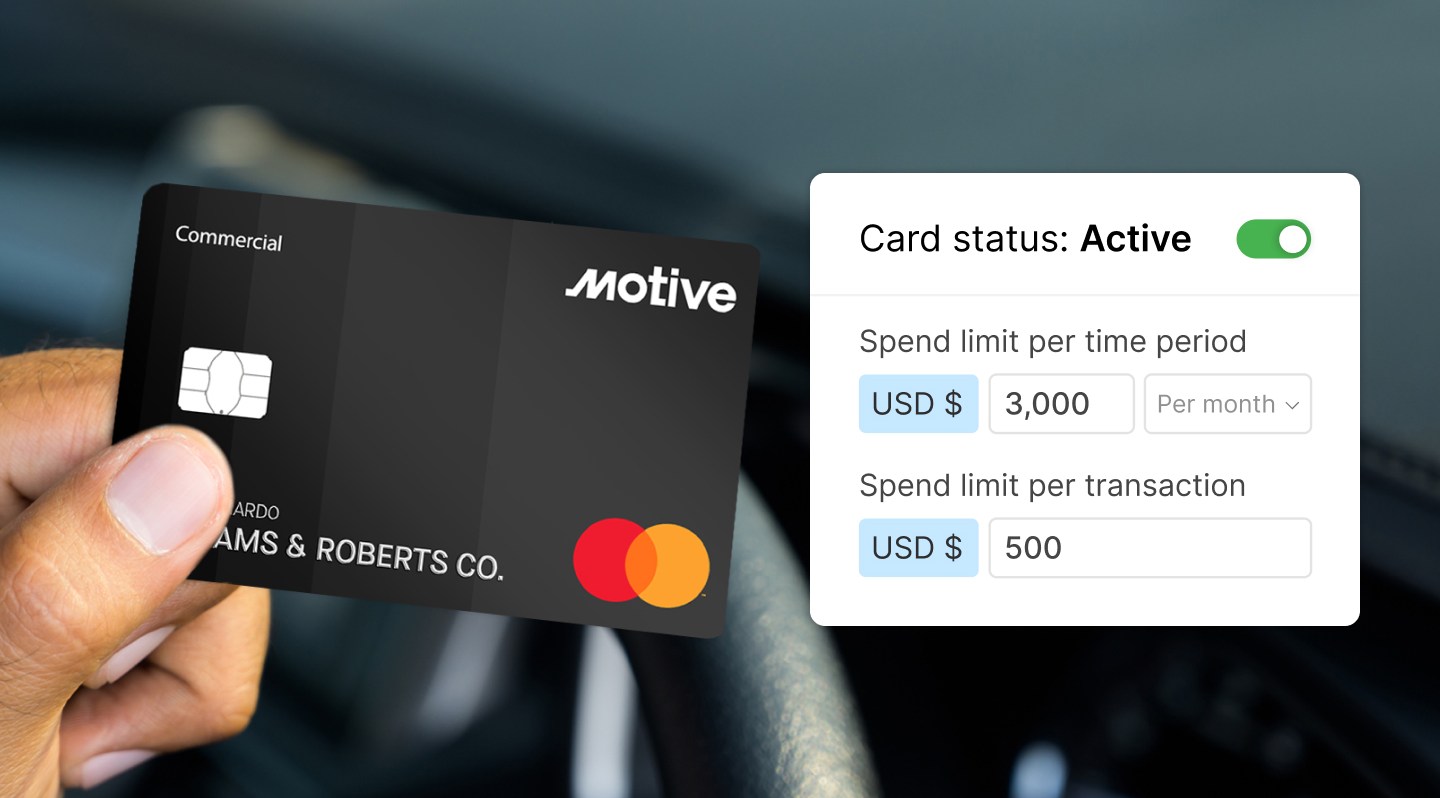

With most fleet cards, managers can also set up spending limits, purchase restrictions, and other controls to prevent unauthorized spending.

3. Enhanced security and fraud prevention

Fleet cards also offer enhanced security features that are not available with traditional credit cards. They can be restricted to specific vendors or fuel types, and they often require driver identification and PIN codes to complete transactions. This makes them less susceptible to fraud and misuse (although it doesn’t stop fraud entirely). Card fraud is a growing problem for fleets. Modern fleet card issuers recognize the impact fraud can have on a business and have incorporated telematics and mobile capabilities to enhance security and help prevent instances of friendly fraud and third-party fraud.

4. Access to discounts and rebates

Many fleet card programs offer discounts and rebates on fuel purchases, which can help to offset the cost of operating a fleet. These can add up to significant savings over time, particularly for larger fleets. Unfortunately, they are also commonly offset by hidden fees that can quickly erase or even outweigh discount savings. It’s important to understand what, if any, fees a program charges. It may require a fleet manager to sift through the fine print of their card agreement, as these fees, and how they’re triggered, are often hidden. Some fleet cards offer no hidden fees and a vast network of locations that offer significant discounts.

5. Improved cash flow

Fleet cards can also help to improve cash flow by offering flexible payment terms and eliminating the need for drivers to pay out of pocket for expenses. This can be particularly beneficial for smaller fleets or businesses that are just starting out.

6. Cash advances

Some fleet cards offer drivers cash advances to drivers, so they can make personal purchases while on the road. Those expenses are usually deducted from the driver’s pay but this benefit is convenient for drivers who don’t want to carry a personal card or cash. This increases driver flexibility and helps with worker retention.

7. Productivity improvements

Modern fleet cards integrate with other business systems to increase productivity by automating activities like tax calculation and filing, bookkeeping, fuel route optimization, and other manual processes, all resulting in time and cash savings.

Are fleet cards right for my business?

Fleet cards are an essential tool for any business that operates a fleet of vehicles, and can help businesses save thousands of dollars per vehicle per year through fuel discounts and productivity enhancements. They offer a range of benefits, from improved cost control and streamlined spend management, to enhanced security and access to discounts and rebates. If you’re looking to improve your fleet management practices, consider investing in a dedicated fleet card program.

Ready to learn how Motive can help you save on fuel and maintenance, prevent fraud losses, and reduce the amount of time spent on administrative tasks? Apply now to unlock savings with the Motive Card!