Welcome to the November edition of the Motive Monthly Economic Report, where we analyze the major trends in the supply chain and economy across the Motive platform during the past month. Keep reading for a front-seat view into key factors currently influencing the U.S. economy.

Big picture: Despite a surge in visits from the top 50 retailers, the trucking market is still contracting amid the ongoing uncertainty of 2023. Expect increased turbulence in Q1 2024 with a shrinking freight market and rising consumer prices.

- Consumer prices have remained relatively stable, even with the overall increase in diesel prices in 2023 due to excess capacity. But that may change soon.

- Carrier starts and exits continue to show a market contraction that will likely persist into 2024 until demand and capacity are more balanced.

- Retail trucking visits saw significant jumps in October, closing much of the gap compared to 2022 as top retailers start to normalize their restocking efforts leading up to the holidays.

- Leaders must plan for uncertainties by assessing cost structures and creating realistic contingency plans for their company’s best-, mid-, and worst-case scenarios.

Carriers must prioritize efficiency and reduce wasteful efforts as market rebalancing continues

2023 has been a year of uncertainty, but there were not many major shifts in the trucking market. That may change as early as Q1 2024, as the supply of trucking capacity goes down and becomes more balanced with demand for goods. This means businesses need to start thinking now about what their operational priorities are, where efficiency can be improved, and how wasteful efforts or spending can be eliminated. Visibility into fleet operations, spend management, equipment health, and safety will be critical to making these determinations, which will allow business owners to be prepared for these shifts in the trucking market and wider economy.

Will diesel price increases affect consumers?

Diesel is one of the biggest expenses for carriers, but right now it isn’t a cost carriers can pass to retailers or consumers to maintain their thinning profit margins. Excess trucking capacity compared to demand for goods means freight prices haven’t been able to rise to make up the difference.

However, as carriers exit the market and trucking capacity falls to a level that’s more balanced with demand, these costs will be easier to include in freight prices. That will likely mean higher prices for consumers.

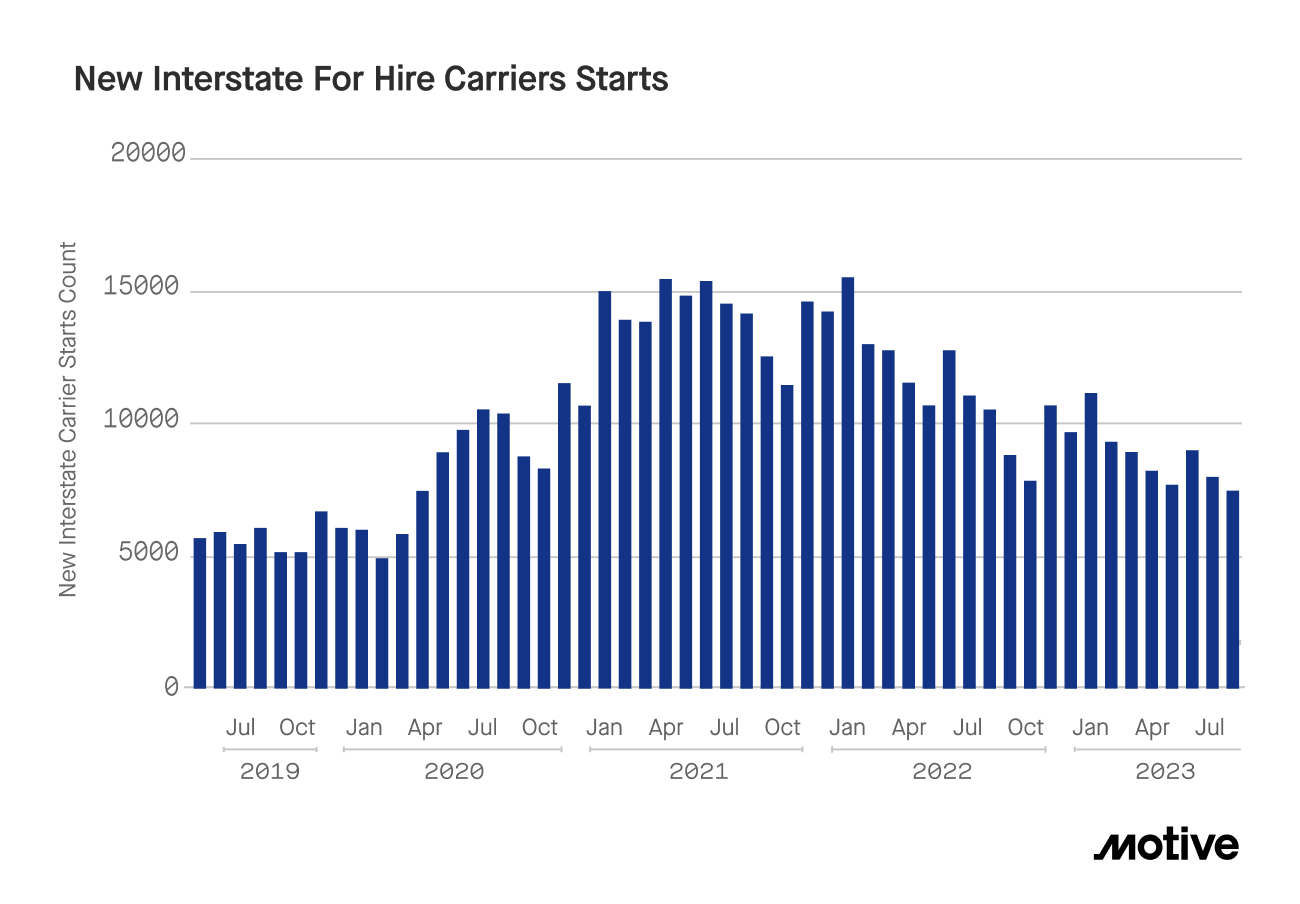

Carriers keep exiting the market, while new registrations hit lowest level since June 2020

3,168 carriers left the trucking market in October, keeping pace with the average for 2023. Simultaneously, registrations for new carriers dropped 7.5% month over month, hitting their lowest levels of 2023 — and since the peak of the pandemic in June 2020.

We anticipate these trends to continue through December and into Q1. December and January will likely see more carriers closing as smaller businesses decide not to continue into the new year under the current market conditions. While carrier registrations might see a slight bump, which is typical for the start of the year, the lack of consumer demand is likely to make this continue trending downward as well. Trucking capacity needs to be more balanced with demand for freight prices to rise and market conditions to change.

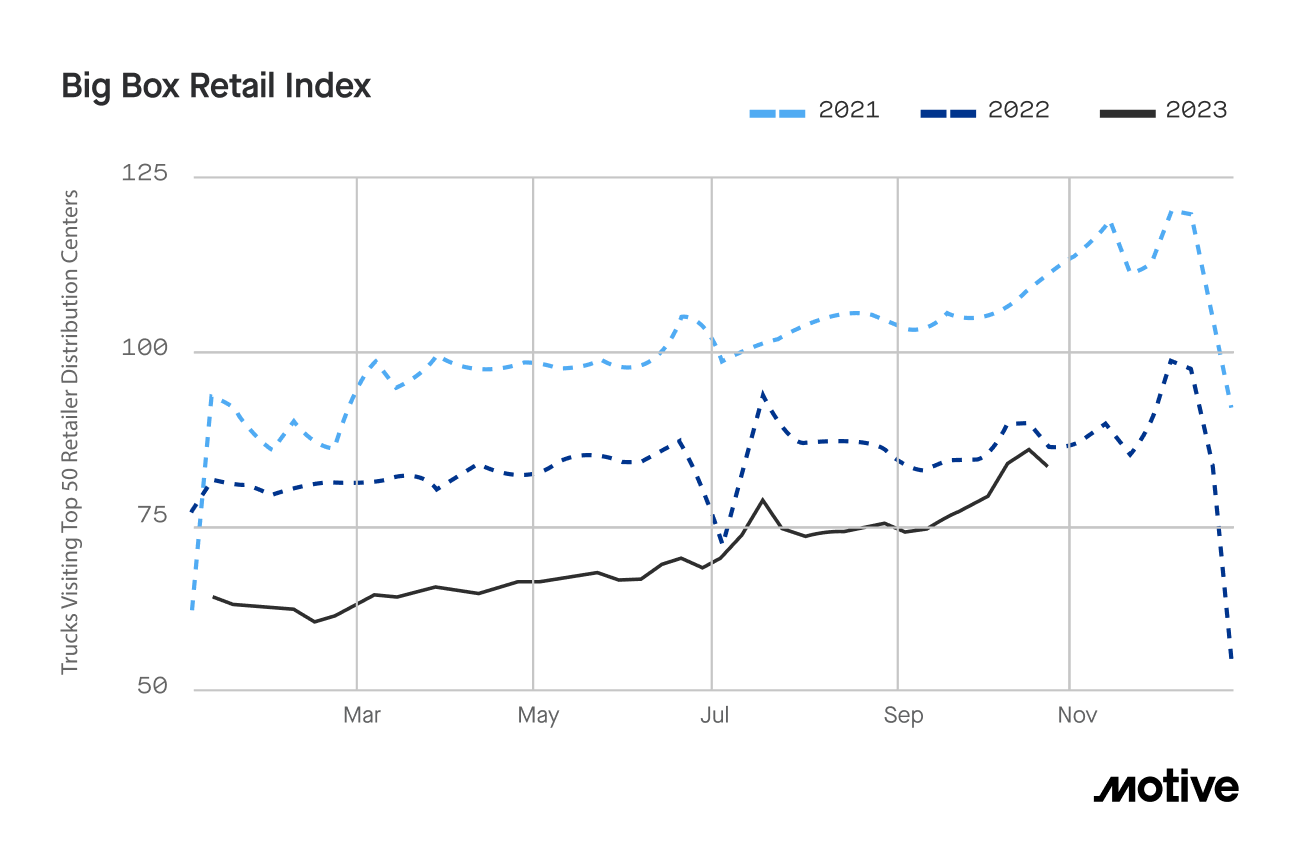

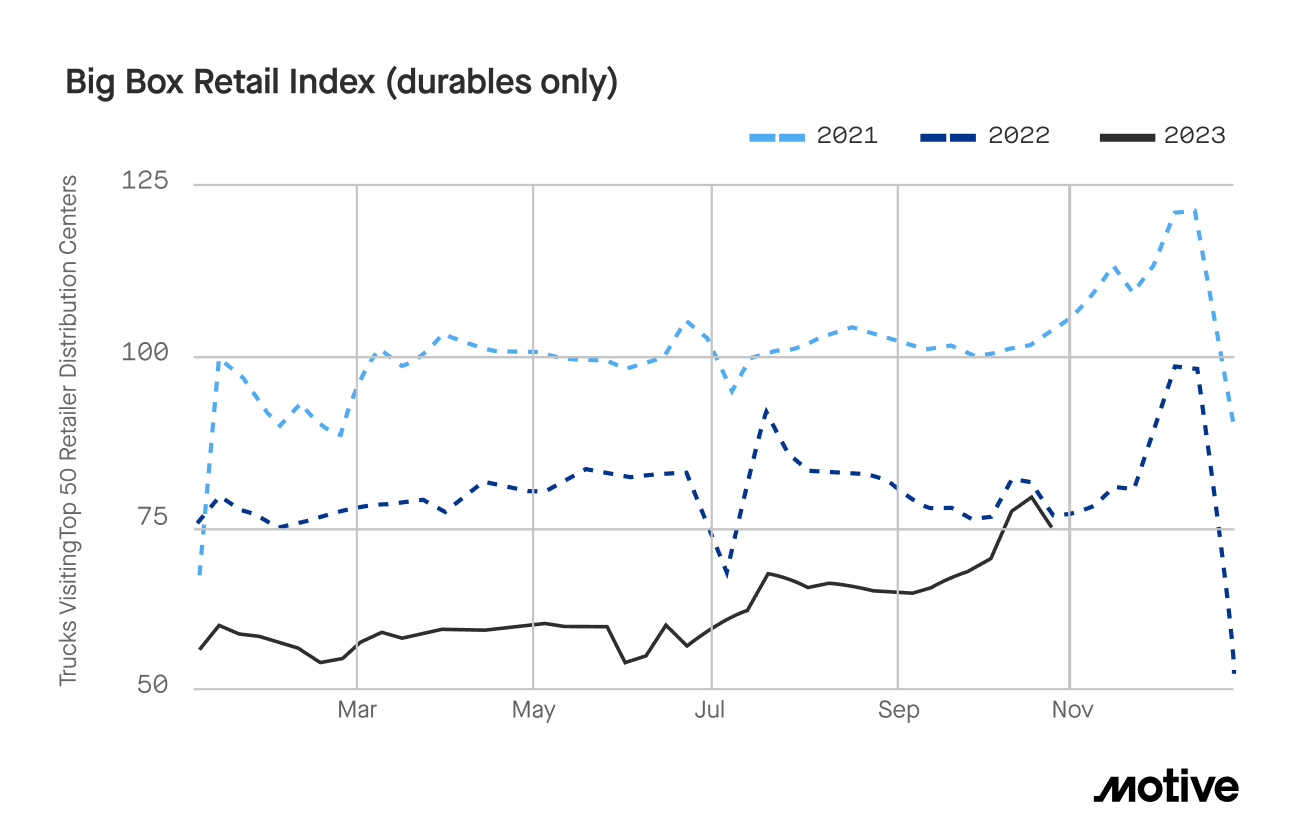

Big Box Retail Index jumps as larger retailer inventory management normalizes

Motive’s Big Box Retail Index, which observes trucking visits to warehouses for the top 50 retailers in the US, jumped by 7.6 points in October. Retailers that sell durable goods such as larger appliances or furniture saw an even bigger rise of 8.6 points compared to September. The top 50 retailers are now down just 4% from 2022 levels of activity, a significant improvement from the 15% year-over-year decline seen in June. Notably, this spike occurred in the second and third weeks of October, as a result of Amazon Prime Day and competing discounting efforts from other retailers.

What does this represent? It’s likely that instead of indicating overall higher demand, large retailers are returning to more normal inventory management. They’re bringing in more stock as the holidays approach compared to the tighter stocking windows we’ve seen this year. Overall, we maintain our prediction that November will see retail visits exceed those from 2022.

How to secure your business and plan for uncertainties

Transportation, retail, and logistics leaders can focus on enhancing operational efficiency by gaining visibility into major cost areas, such as fuel spend and fleet operations. This is true for every business, but especially for the freight market as it heads into another uncertain year and continues working through the complexities brought on by the COVID-19 pandemic. Plan for uncertainties by assessing cost structures and creating realistic contingency plans for your company’s best, most likely, and worst-case scenarios. A key element of this is proactively identifying areas to improve efficiency. This can include leveraging cost visibility platforms and conducting software audits to eliminate wasteful spend that is not serving your customers.

Data Methodology

The Motive Monthly Economic Report uses aggregated and anonymized insights from the Motive network, as well as publicly available government data from the Federal Motor Carrier Safety Administration, U.S. Census, and U.S. Department of Transportation.