Welcome to the April edition of the Motive Monthly Economic Report. What follows is an analysis of the major trends in the supply chain and economy across the Motive platform during the past month. Motive’s transportation and logistics data is a reflection of consumer demand and therefore, a leading indicator of overall economic stability and trends. Keep reading for a front-seat view into key factors currently influencing the U.S. economy.

Big picture: Market contraction slows significantly as market pain appears to be easing

- March saw the trucking market trend in the right direction, as contraction slowed and new registrations surged to levels not seen since March 2023.

- Motive maintains its prediction that the market will continue to improve heading into Q3.

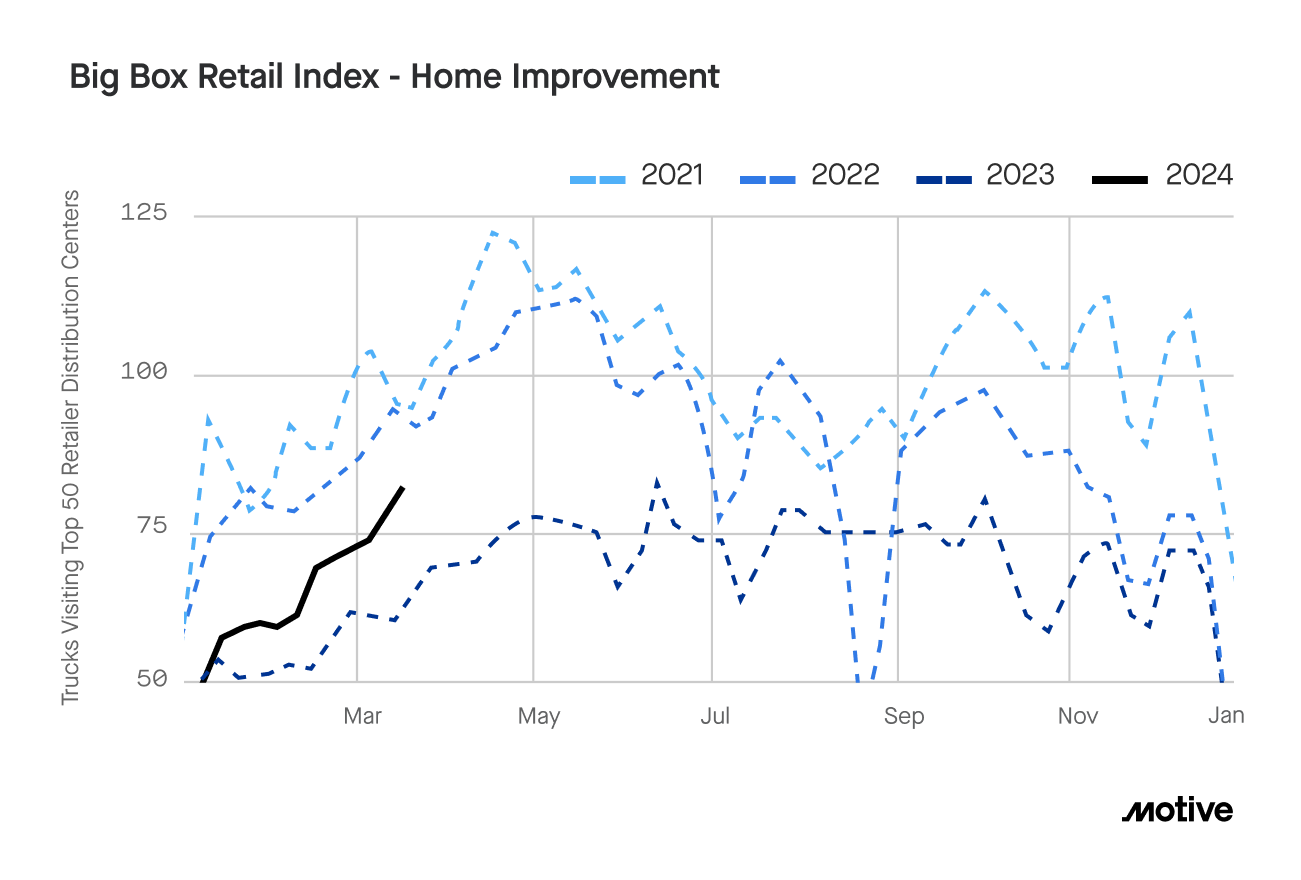

- Motive’s Big Box Retail Index saw gains across all sectors, with visits to home improvement retailer warehouses seeing the most significant jump heading into Spring and Summer.

- Motive predicts this sector will close the year 25-30% ahead of 2023

- Truck data shows traffic to the port of Baltimore remains depressed following the collapse of the Francis Scott Key bridge. Still, the accident’s effects on the wider supply chain landscape will likely be moderate.

Plan in the right context to avoid the mistakes of the past

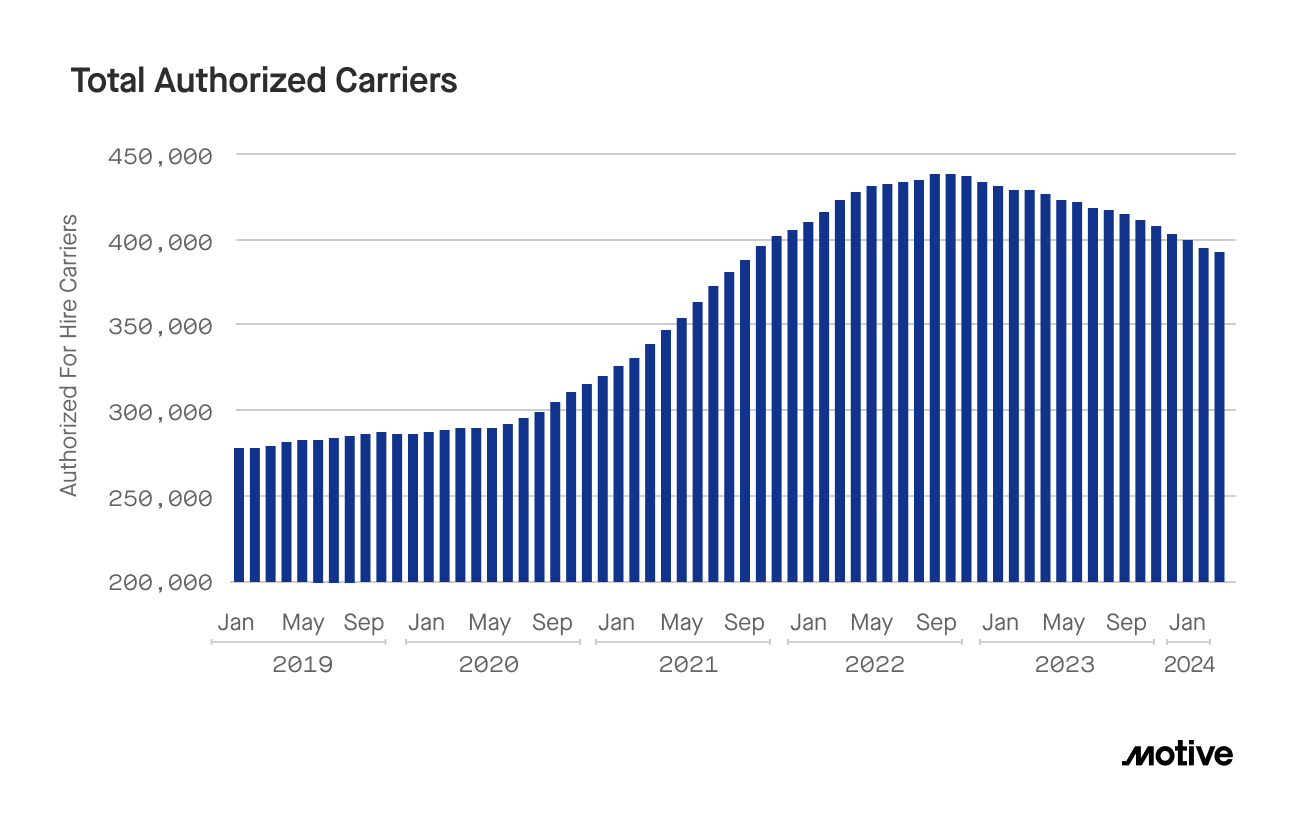

The trucking market continues to move in the right direction as contraction slows and demand remains high. It’s important to clarify that this doesn’t signify a booming market. Rather, it indicates progress in recovering from the longest and deepest downturn the trucking industry has experienced. Business owners must take these positive data points in the right context, and understand a return to the heights of 2022 is unlikely. Stubbornly high inflation and macroeconomic factors will continue to impact the market, and business owners should plan accordingly.

Trucking market contraction slowed significantly in March, continues climbing out of record lows of 2022-23

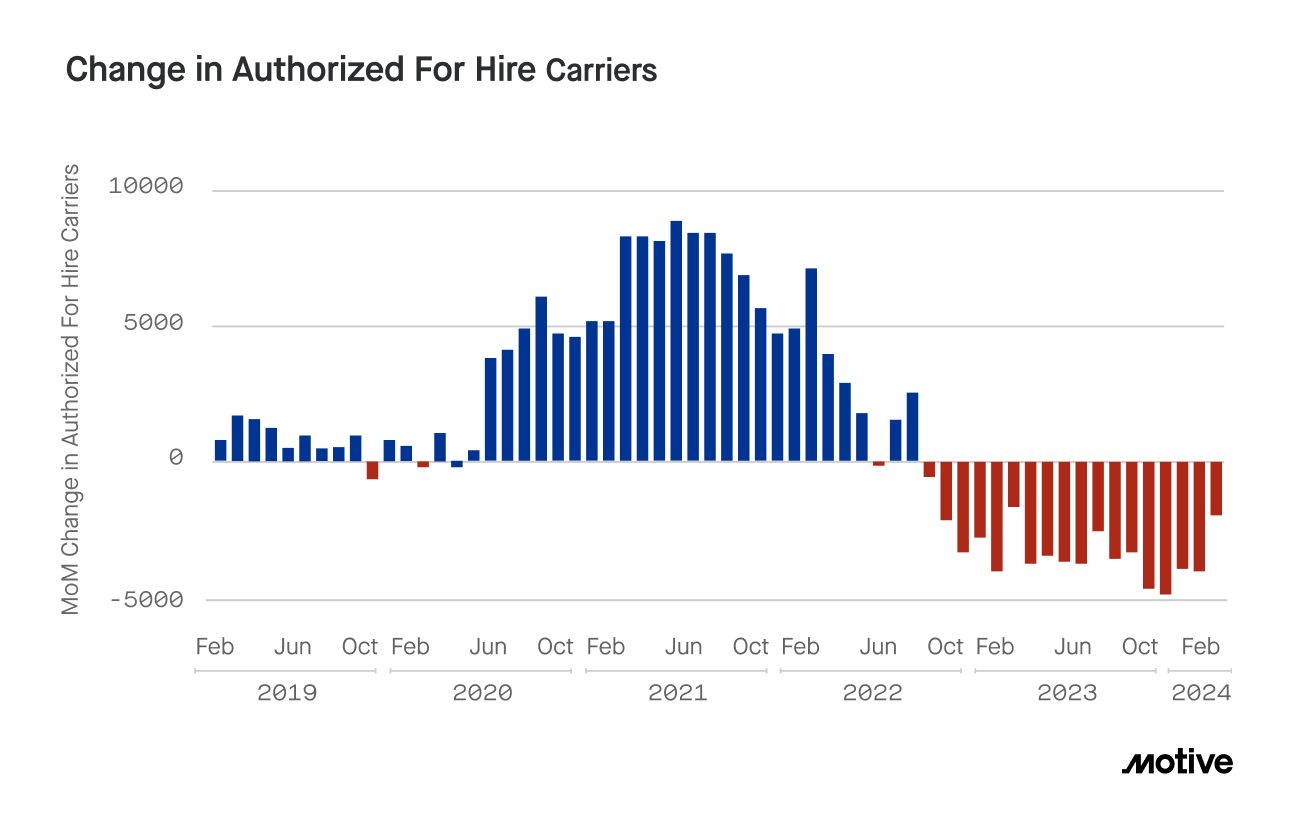

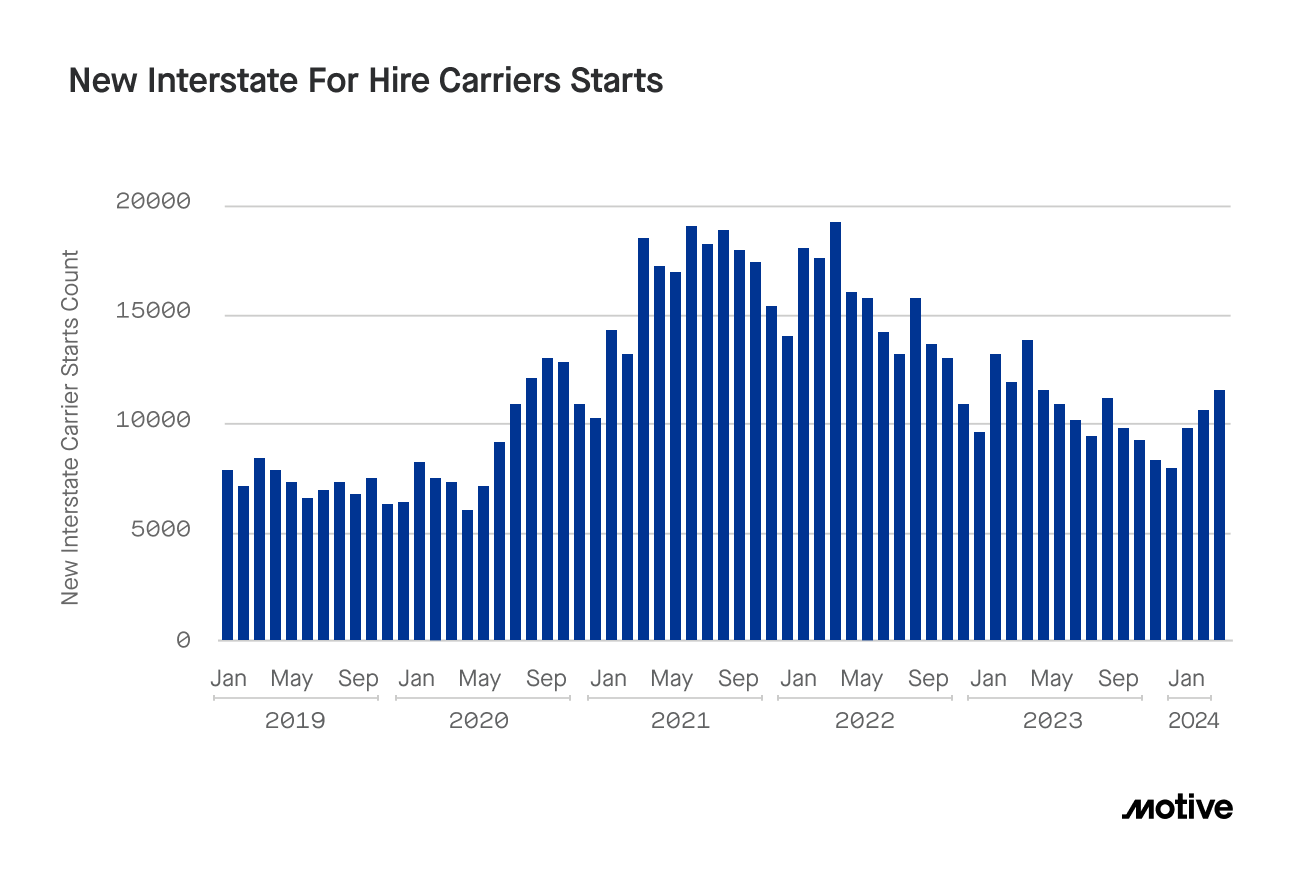

53% fewer trucking firms (totaling 1,827) exited the market in March, bringing the market’s contraction to its lowest level in 12 months. New carrier registration also saw positive gains, as 9.1% more registrations (9,463 in total) hit in March to mark the highest level in 12 months. Bolstered by continued gains in retail demand (more on that below) and stable consumer confidence, this marks a positive shift for carriers, who have experienced a historically long and deep market contraction following the pandemic.

This data is consistent with our prediction that the market will be more carrier-friendly by the second half of 2024.

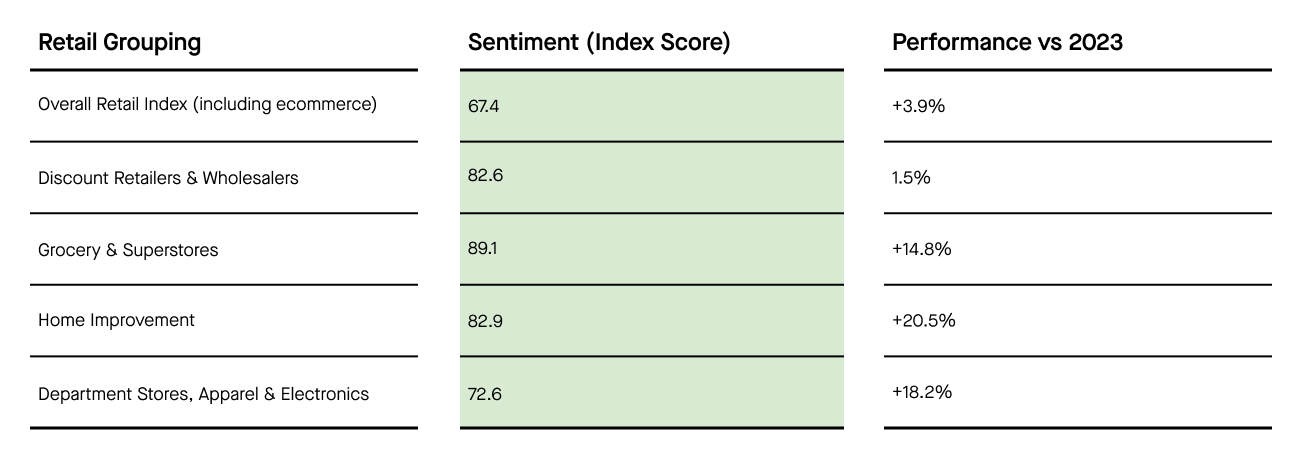

Visits to the top 50 retail warehouses continue to climb, with gains seen across the board as restocking surges heading into Spring and Summer

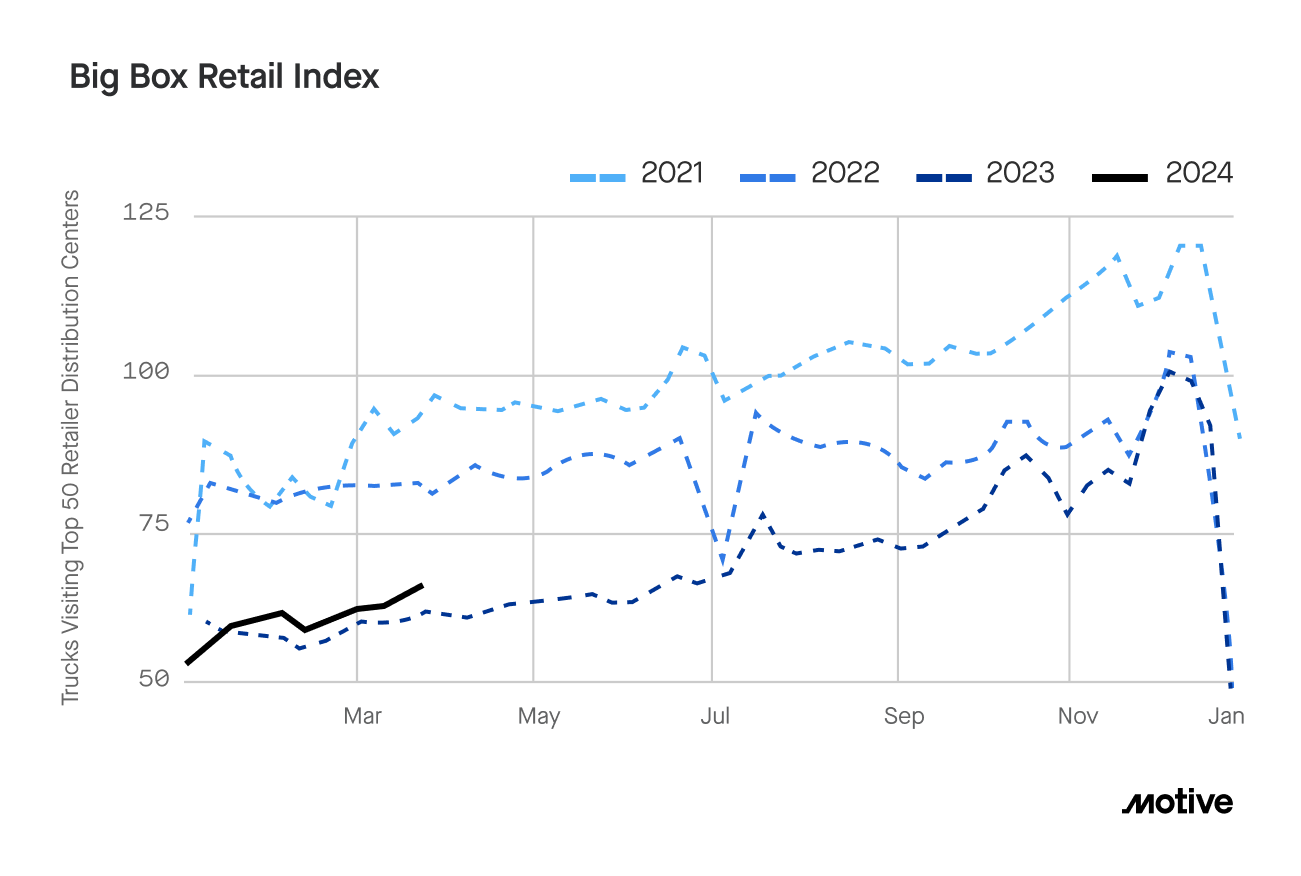

The trend of retailers restocking inventories showed no signs of slowing down in March. Motive’s Big Box Retail Index saw truck visits to the warehouses of the top 50 US retailers jump 6.9% since February and 3.9% year-over-year.

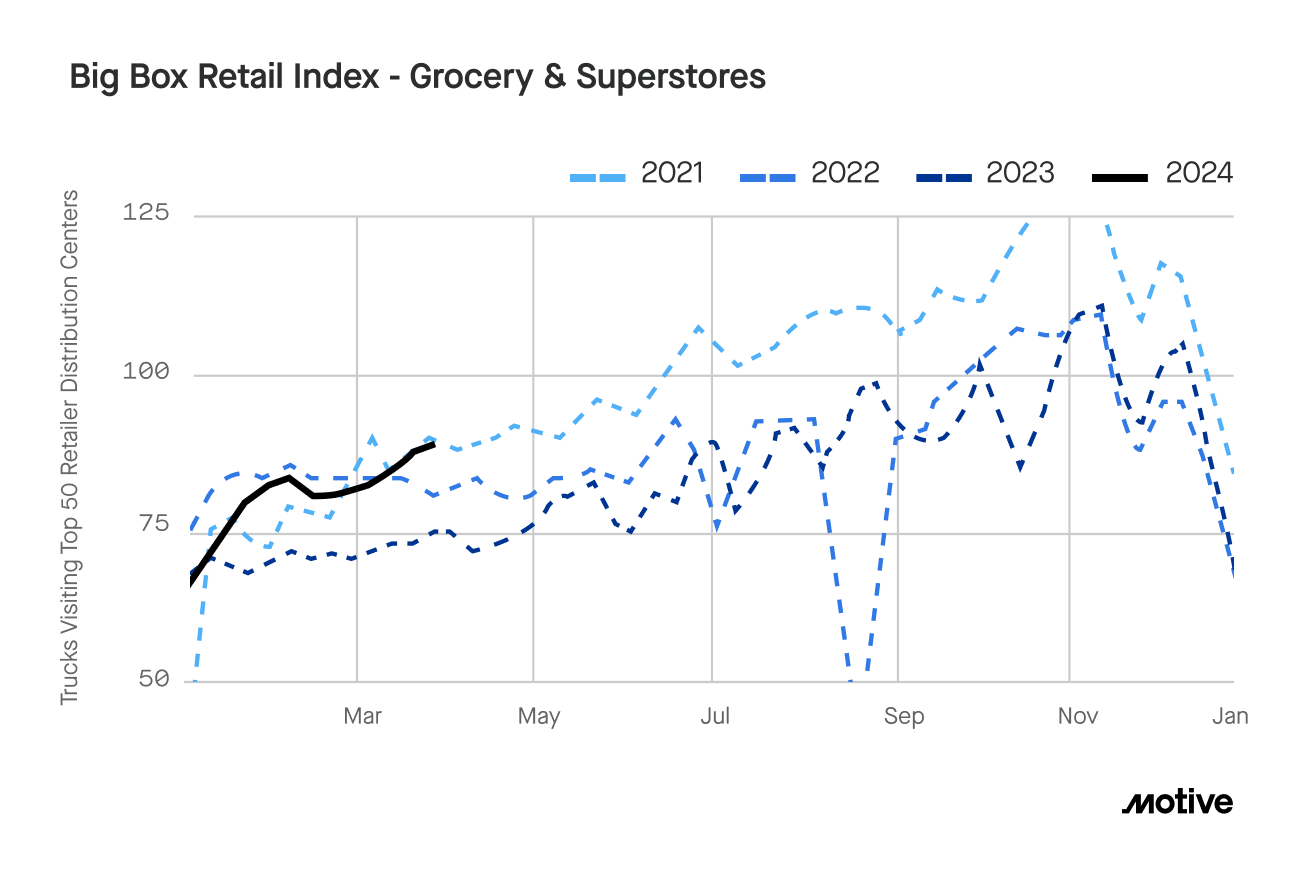

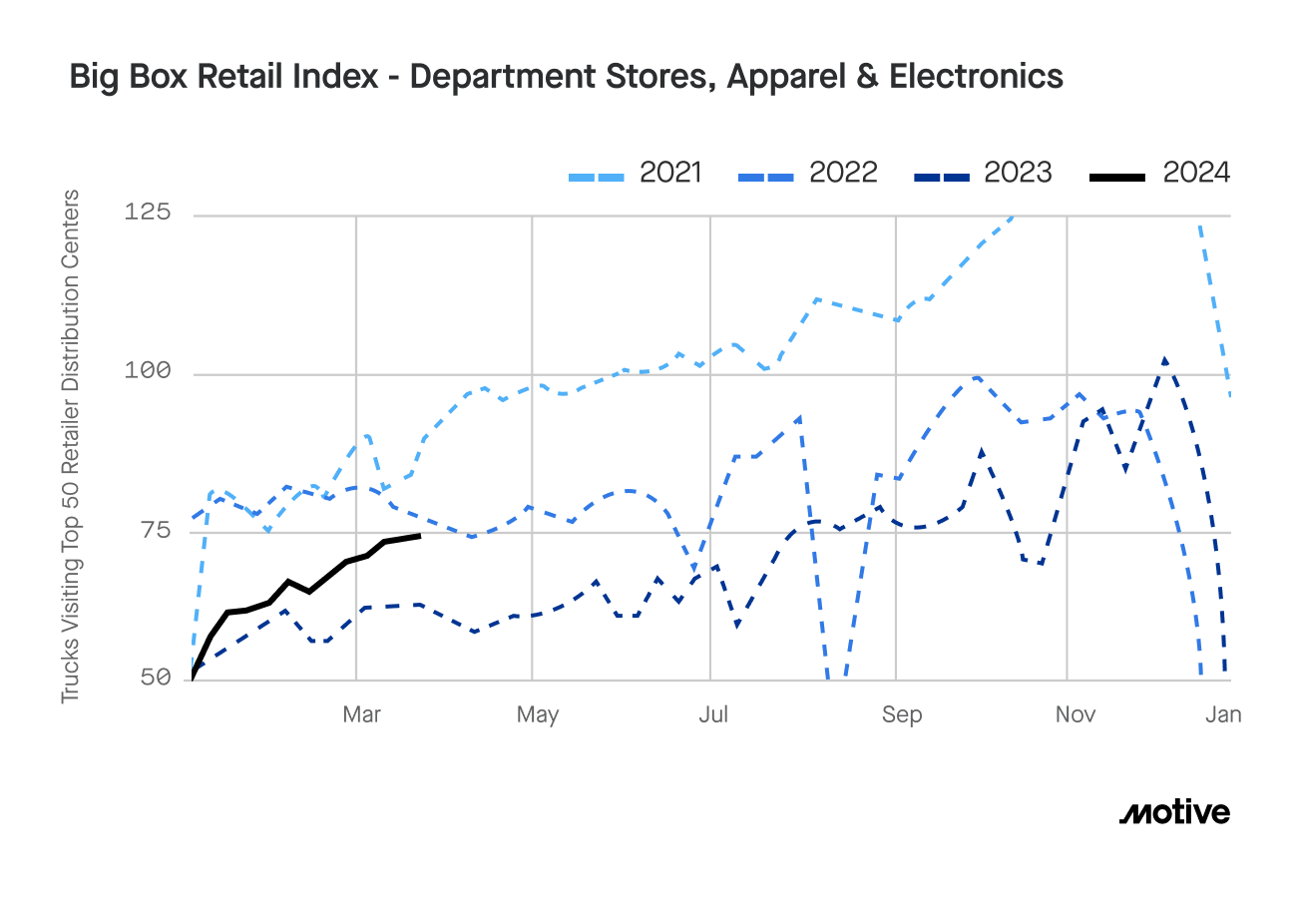

Looking at sectors across retail shows the first month of gains for everyone this year. Discount retailers and wholesalers saw their first increase of 2024 (1.5% YoY), while department stores, electronics, and apparel saw another big surge (18.2% YoY). Grocery and superstores also saw a significant jump of 14.8% YoY, but it was home improvement that saw the biggest jump (20.5%). While some data suggested the home improvement market would contract in 2024, warehouse visits have steadily increased since the year began. We predict that this trend will continue, hitting its peak in early to mid-May and close out the year 25-30% higher than 2023.

Baltimore bridge collapse response highlights new normal for supply chains

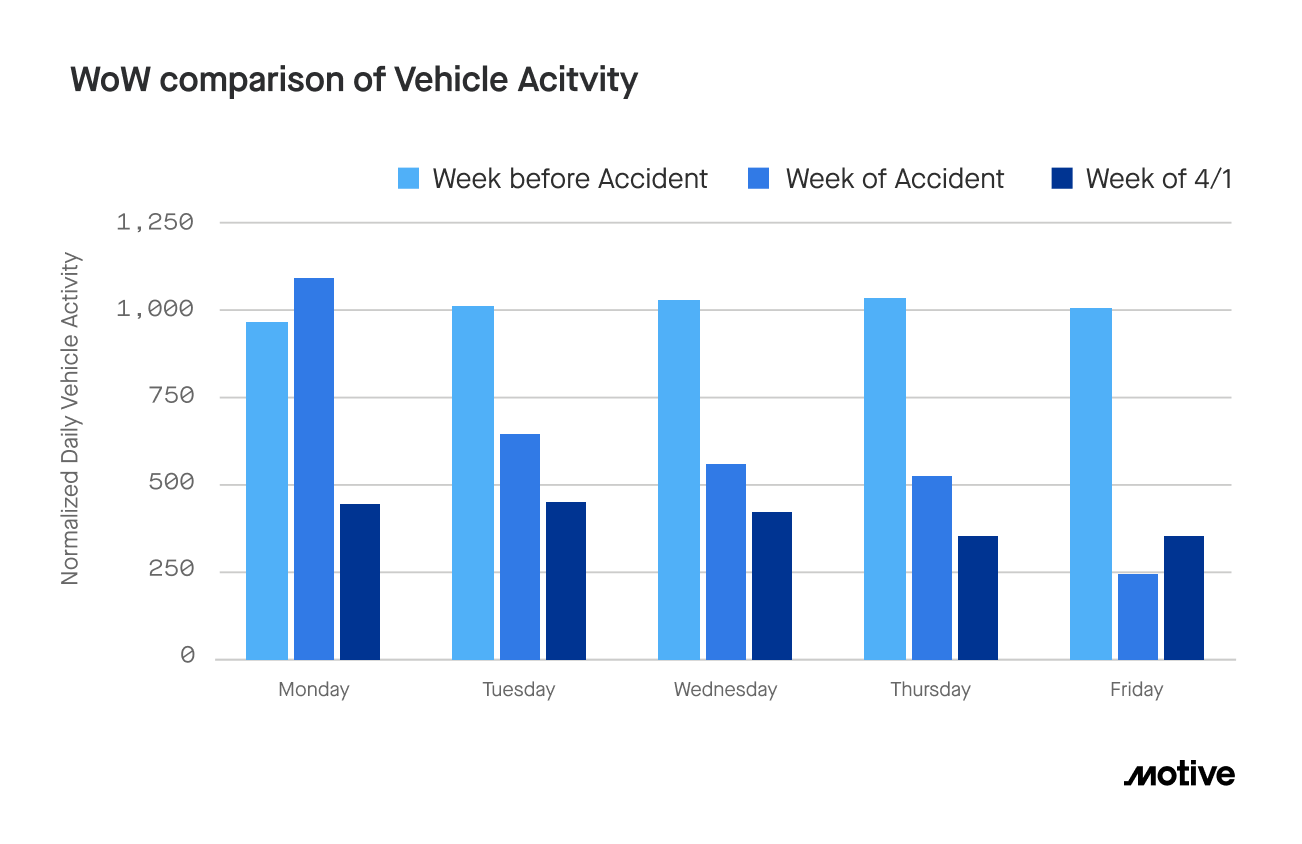

Over the last few years, the transportation sector has dealt with major disruptions due to “black swan events” like the Suez Canal blockage, the pileup at the Port of Long Beach during the Covid surge, and the drying up of the Panama Canal last year. The Francis Scott Key bridge collapse in Baltimore marks the latest example, with a nearly 60% drop in trucks going to the port since the accident occurred. Much of this drop occurred in the three days following the accident, with traffic to the port remaining depressed as a result.

The situation in Baltimore also shows that supply chains have had to become better at handling unexpected events like these out of necessity. The overall impact to wider US and global supply chains is likely to be moderate, as rail mitigation and other responses have been enacted to redirect shipping traffic to other ports. We expect most of the disruption will occur over Q2 before the impact is largely mitigated.

Motive’s prediction: Consumer demand and improvement in rates will create a more carrier-friendly market in 2H24

Motive predicts a more carrier-friendly environment by the second half of 2024. February data supported last month’s prediction that 2024 carrier registrations would outpace pre-pandemic levels by 10-20%. Meanwhile, sustained consumer demand, normalized restocking patterns, and potential improvement in spot rates show further positive signals for the trucking market. We anticipate rates will have moved upward and consumer demand will keep its current pace in the second half of 2024, leading to fewer carrier exits in addition to the previously mentioned gains in net-new registrations.

Data Methodology

The Motive Monthly Economic Report uses aggregated and anonymized insights from the Motive network, as well as publicly available government data from the Federal Motor Carrier Safety Administration, U.S. Census, and U.S. Department of Transportation.