Welcome to the May edition of the Motive Monthly Economic Report. What follows is an analysis of the major trends in the supply chain and economy across the Motive platform of 120,000 customers during the past month. Motive’s transportation and logistics data is a reflection of consumer demand and therefore, a leading indicator of overall economic stability and trends. Keep reading for a front-seat view into key factors currently influencing the U.S. economy.

Motive Predictions:

- The U.S. freight recession will end in Q3 2024.

- By September the market will see its first net positive growth since 2022.

- Demand among brick-and-mortar-based retailers will stay strong through Q3.

- Mexican freight market growth shows no signs of slowing down.

Nothing but blue skies ahead, right? Not so fast…

While the freight recession is on its way out, its effects will not leave the market overnight. Yes, the overall lower trucking capacity it caused coupled with higher demand are positive signs for transportation and logistics businesses, but we do not expect a large correction for the overall market. We anticipate price improvements will hit spot rates first, and the overall rebalancing of the market will be gradual. It’s worth noting that improvements will also be dependent on the U.S. economy continuing to grow.

The takeaway: Don’t assume higher trucking rates are imminent. From seasonal pressures to economic considerations to unexpected demand shifts, there are still many factors to consider and we don’t expect the new normal to be anything like the freight boom we saw during the pandemic.

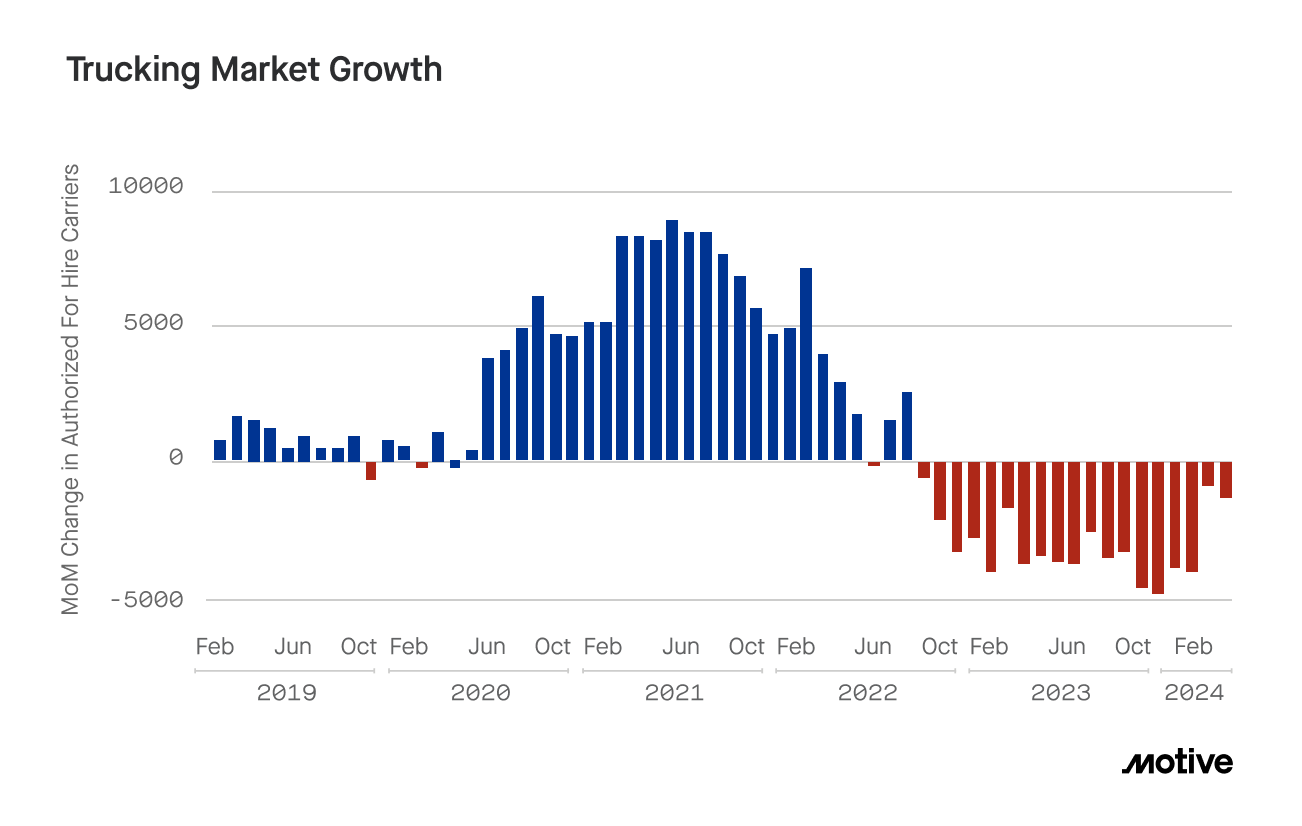

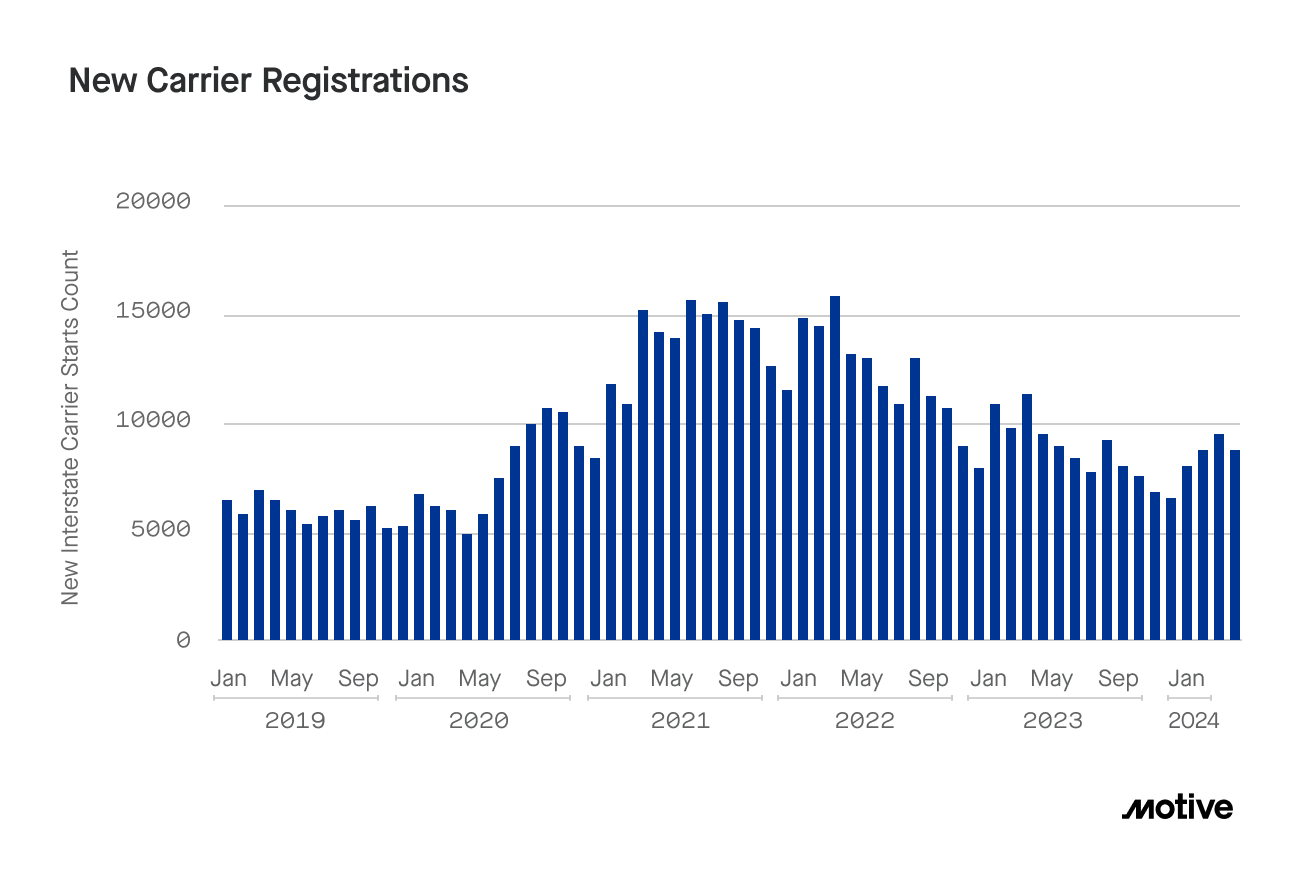

The freight market approaches positive growth as carrier exits decrease and registrations rise

1,149 trucking companies exited the market in April. While this is a slight increase from March, it still marks a 69% decrease compared to January and the second straight month with fewer than 2,000 exits. Similarly, while April’s 8,769 new carrier registrations are a 7% decrease compared to March, it is also the third consecutive month with over 8,000 new entrants.

These two indicators highlight that the market is approaching something not seen in almost 2 years: positive carrier growth. This is further bolstered by retail sales continuing to climb and restocking maintaining its forward momentum (see below for more). Given all of this, Motive is going beyond its previous prediction of a more carrier-friendly market in 2H and believes the most protracted freight recession in history will end by September of this year.

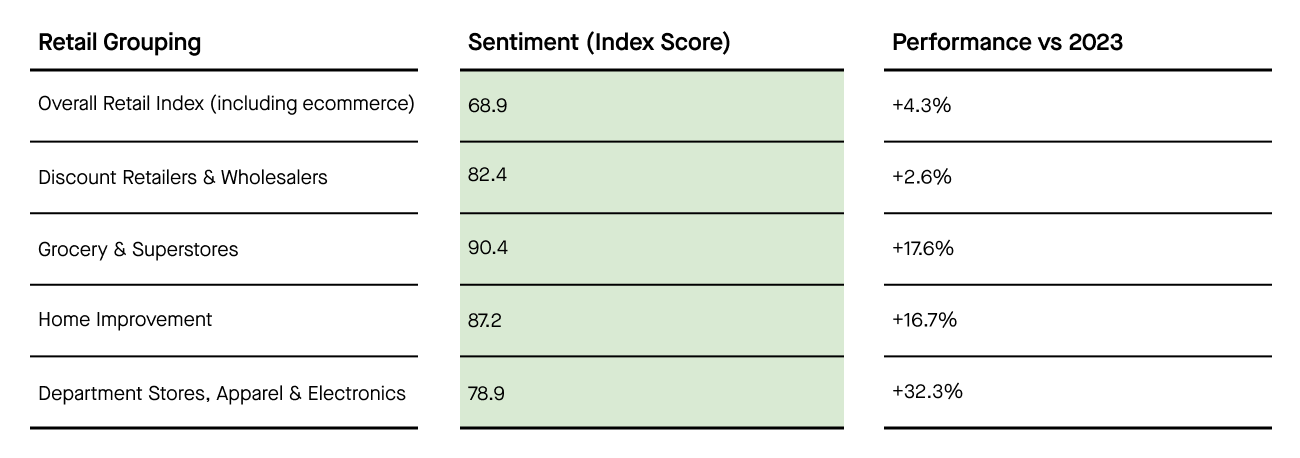

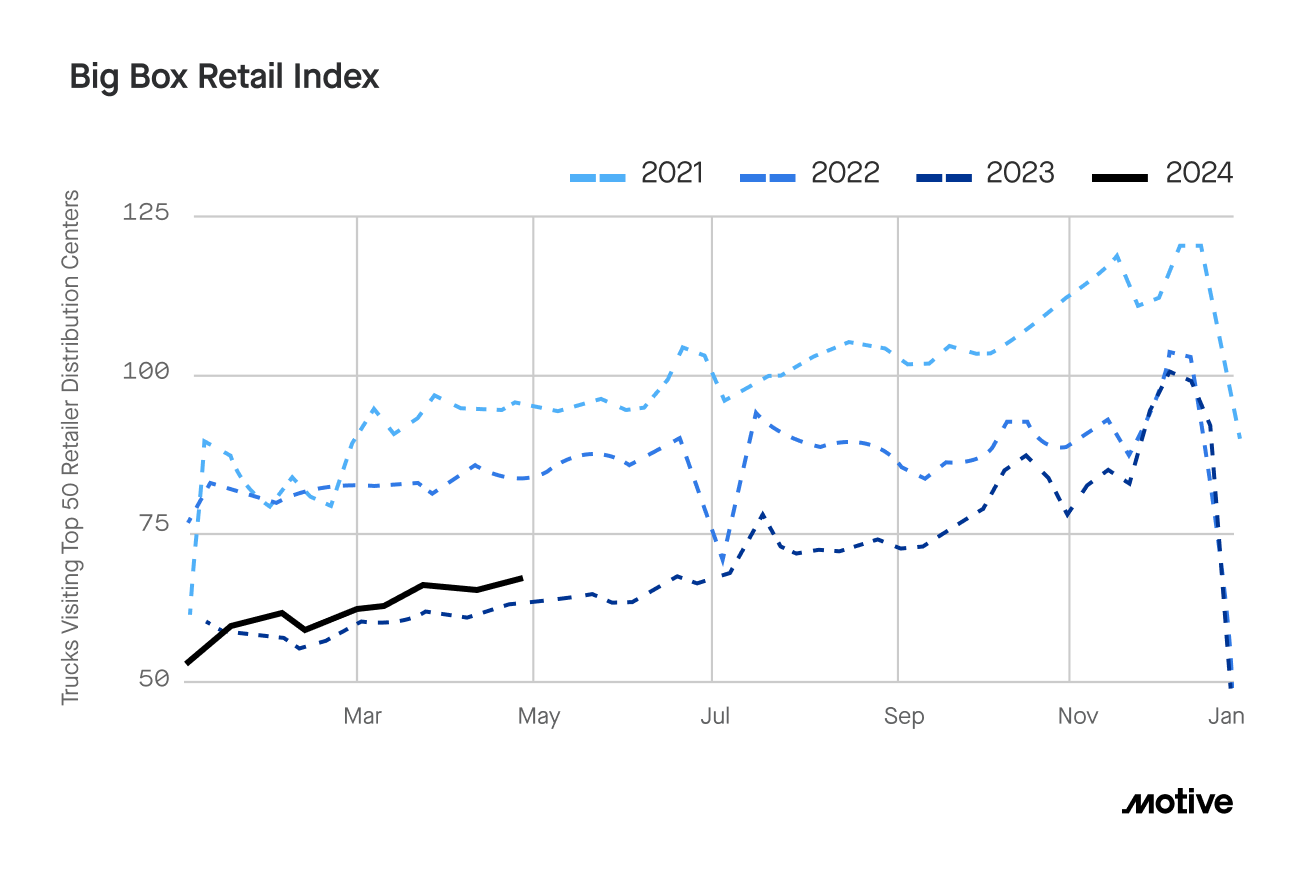

Trucking visits to brick-and-mortar-based retail sectors pop in April

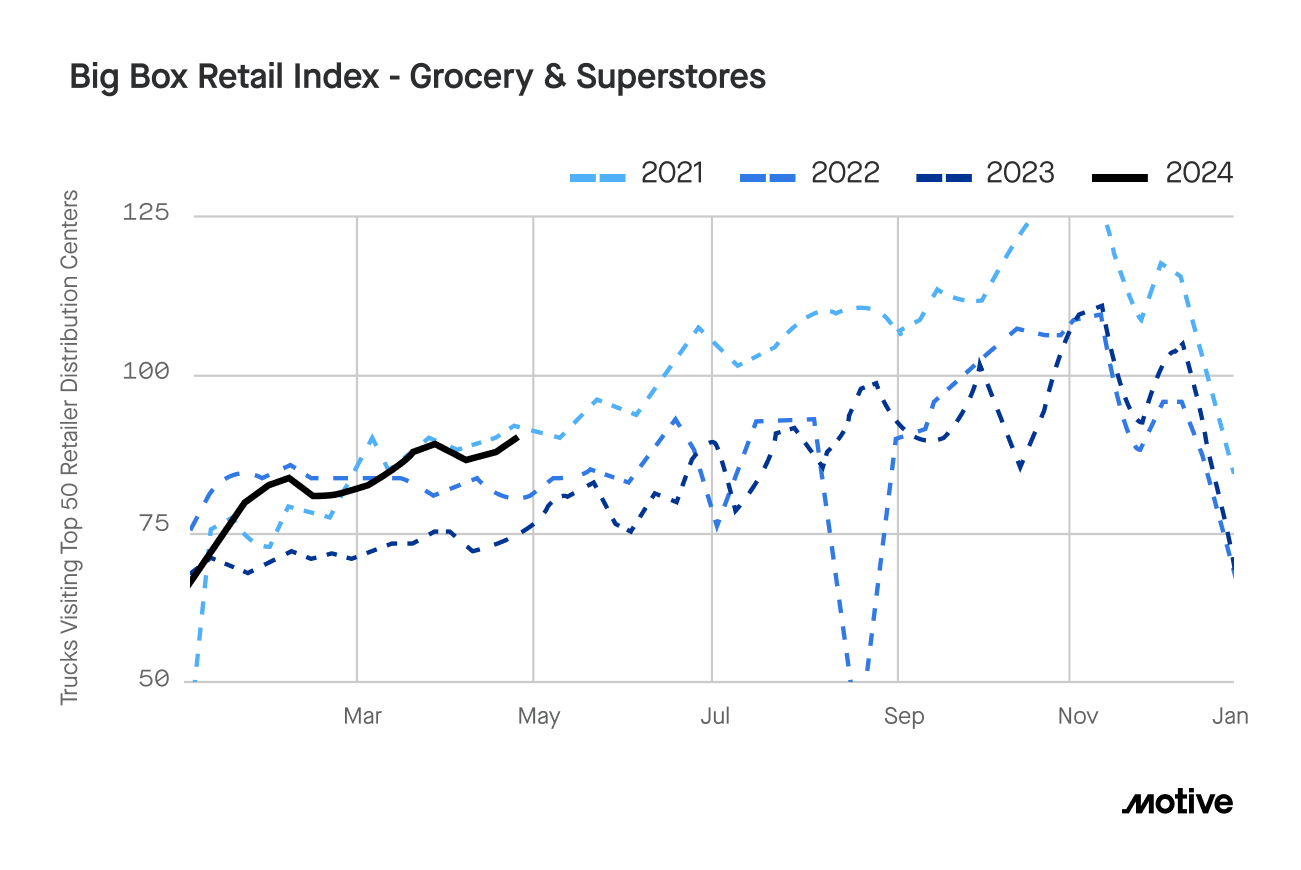

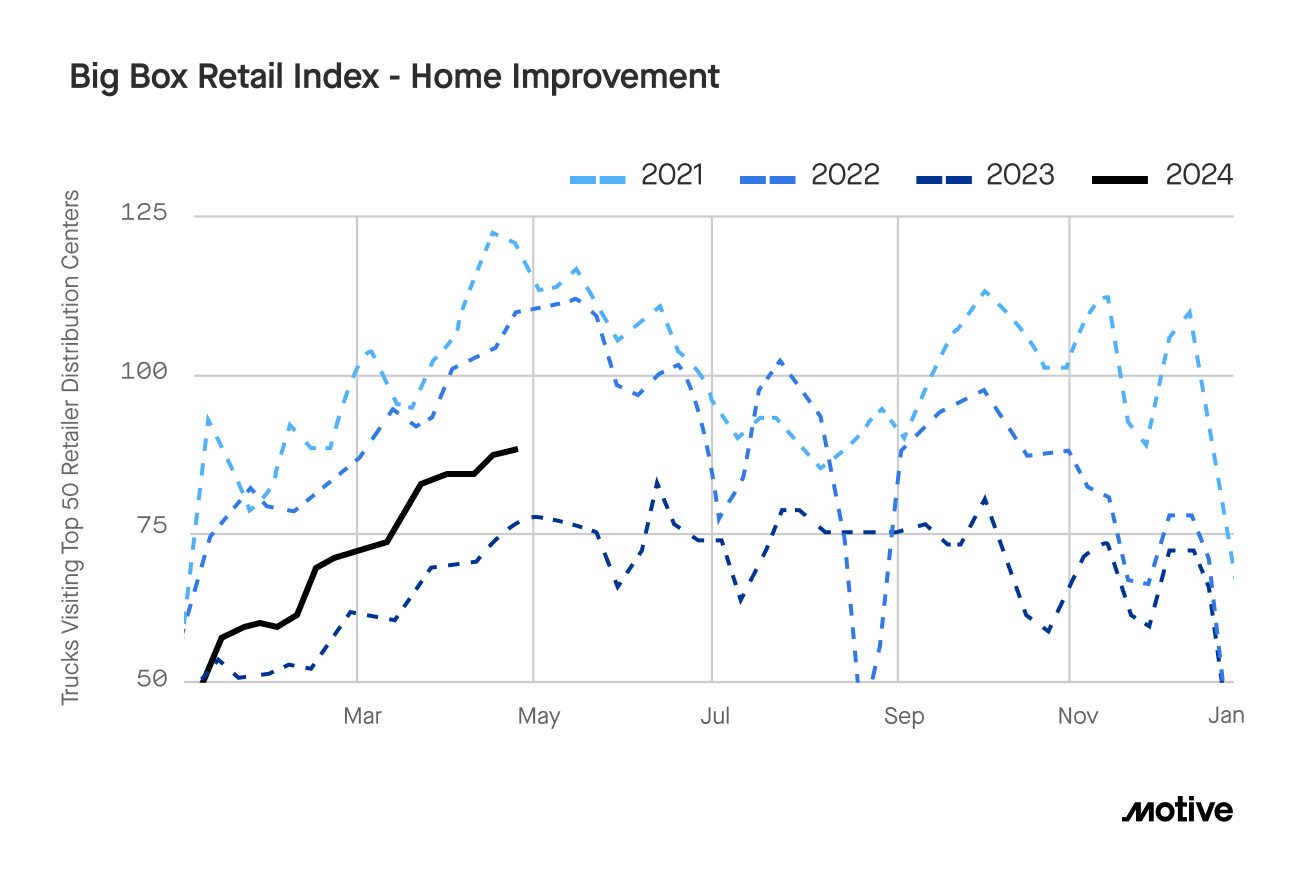

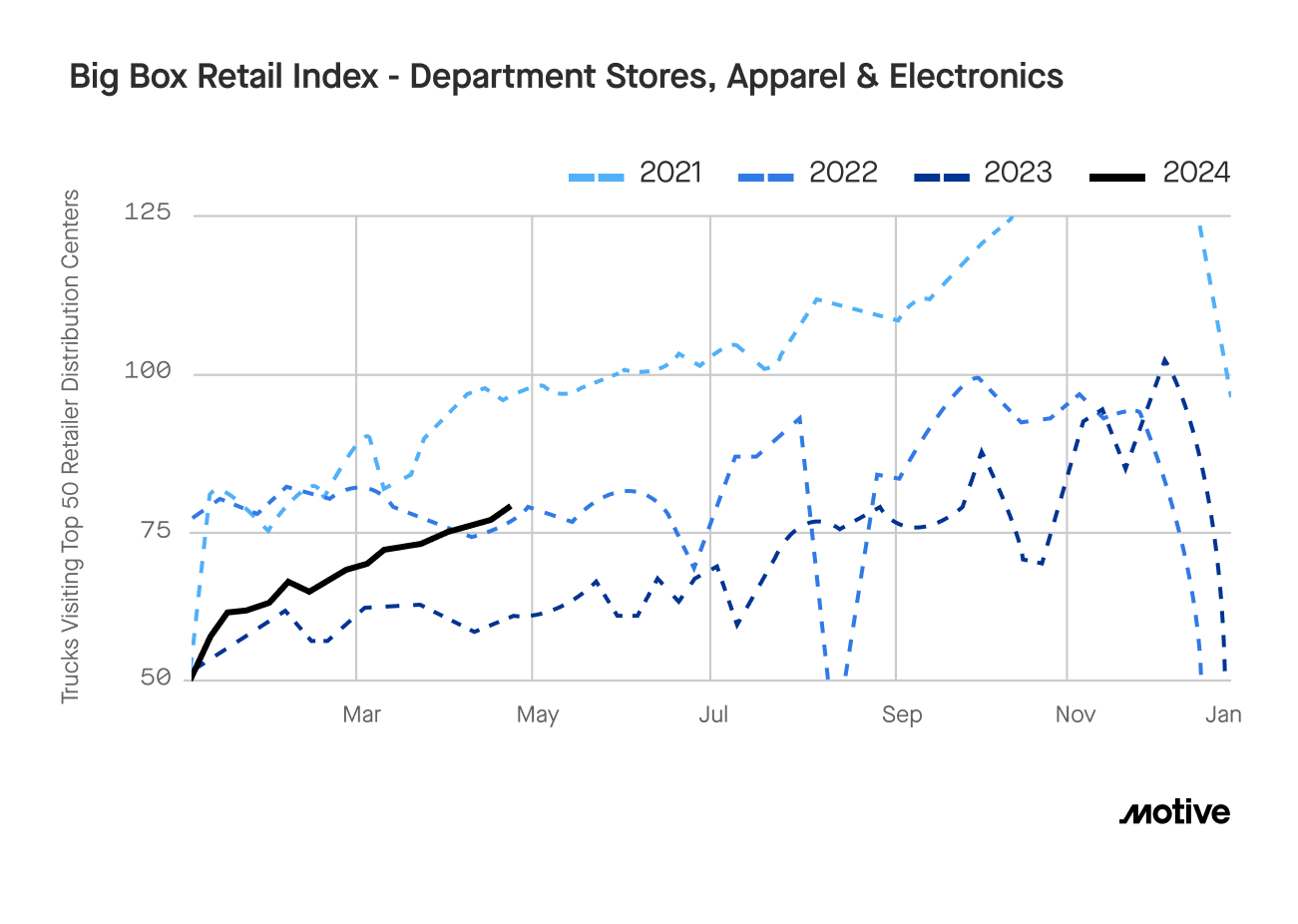

Motive’s Big Box Retail Index saw truck visits to the warehouses of the top 50 US retailers jump 1.3% since March and 4.3% year-over-year. The April measure’s defining trend was a surge in demand from retailers largely operating brick-and-mortar stores. While dipping e-commerce sales have led to slower growth for that sector, department stores, apparel, and electronics saw a 32.2% jump year over year in visits in April. Home improvement, which Motive has predicted will close 2024 25-30% higher year-over-year, also continued to perform well with a 16.7% gain in April.

Motive predicts that demand will remain strong for most brick-and-mortar-focused sectors like home improvement, and these will continue to outperform through Q3.

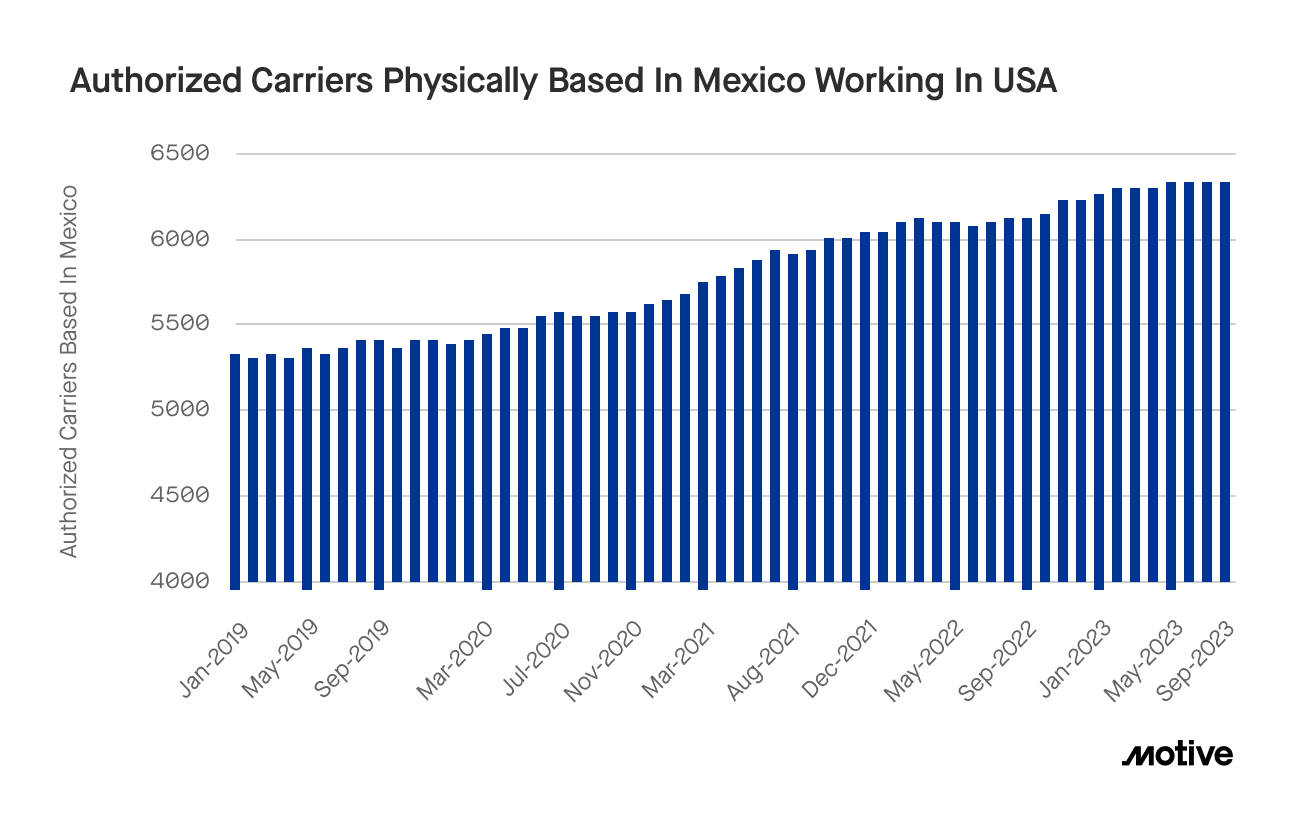

Mexico’s carrier market, bolstered by U.S. and China nearshoring, shows no signs of slowing

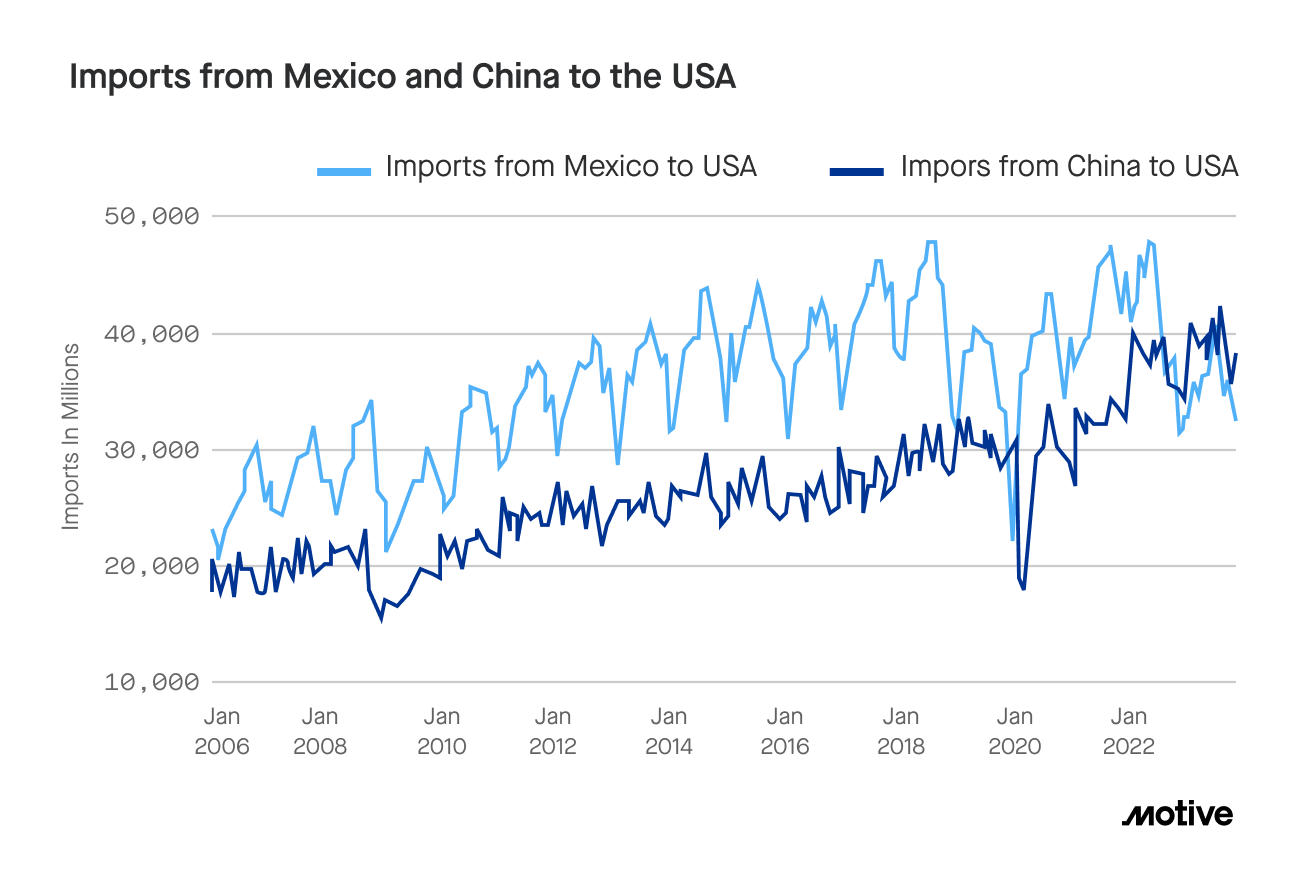

While the U.S. is now slowly coming out of the freight recession, the Mexican carrier market seems to have missed its impacts altogether. Nearshoring has been a critical factor here, as the U.S. has increasingly shifted from relying on Chinese imports to those closer to home in Mexico. Imports from Mexico to the U.S have consistently risen from 2019-2023, culminating in a 33.1% rise in total import freight to the U.S. as of February 2024.

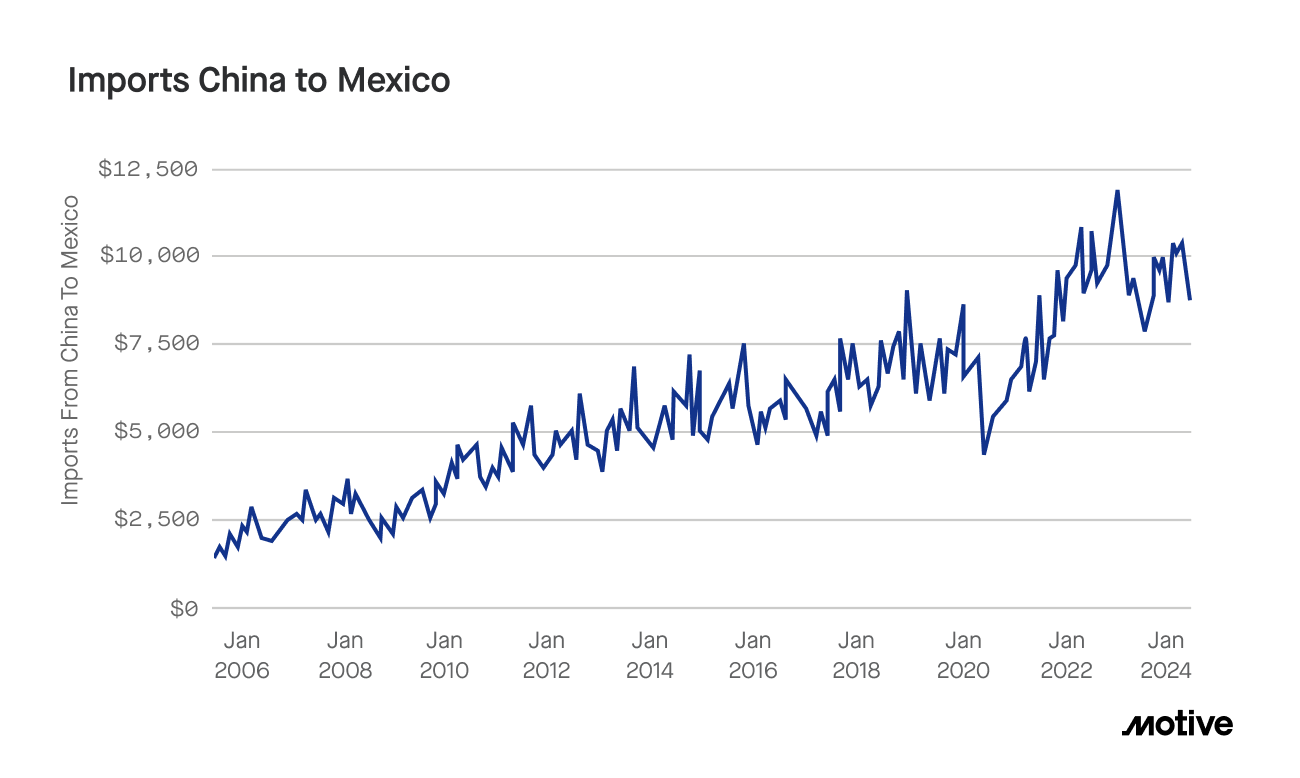

However, China has also directly played a critical part in Mexico’s growth in the freight market. While imports from China to the U.S. decreased by 5% from 2019-2023, imports to Mexico rose 37%. Furthermore, Chinese investment in Mexican facilities and infrastructure grew from roughly $83 million in 2012 to $600 million in 2022. As Mexico becomes a stronger gateway for getting products to North American consumers, expect its logistics and transportation sectors to continue, and even accelerate, in their growth.

Data Methodology

The Motive Monthly Economic Report uses aggregated and anonymized insights from the Motive network, as well as publicly available government data from the Federal Motor Carrier Safety Administration, U.S. Census, and U.S. Department of Transportation.