Welcome to the December edition of the Motive Monthly Economic Report, where we analyze the major trends in the supply chain and economy across the Motive platform during the past month. Keep reading for a front-seat view into key factors currently influencing the U.S. economy.

Big picture: In November, retailers increased their inventories in anticipation of the holiday shopping season, while diesel prices continued to decline. Despite this, the trucking market contracted further, potentially influenced by seasonal factors.

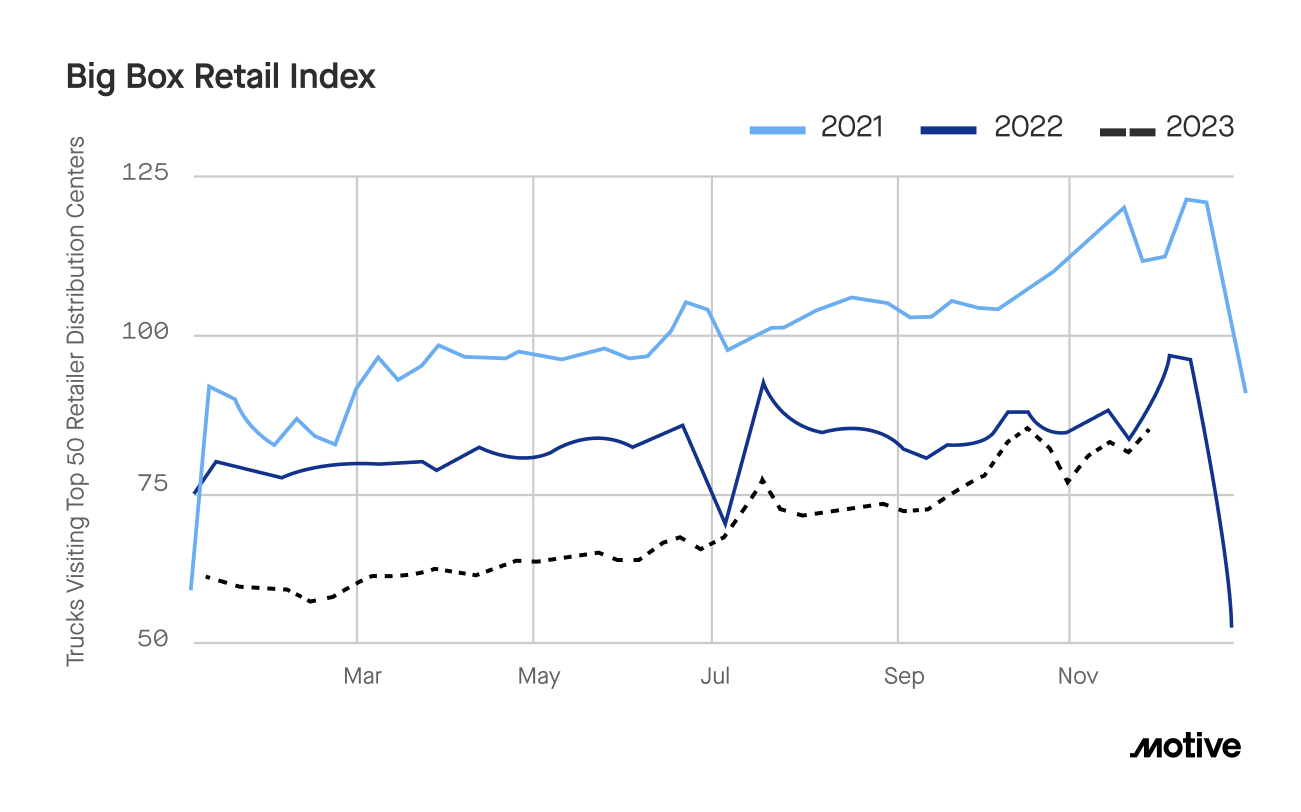

- Though November had a slow start compared to last year, Motive’s Big Box Retail Index saw trucking visits rise closer to 2022 levels. November’s weekly average visits showed that the trend of delaying restocking has continued.

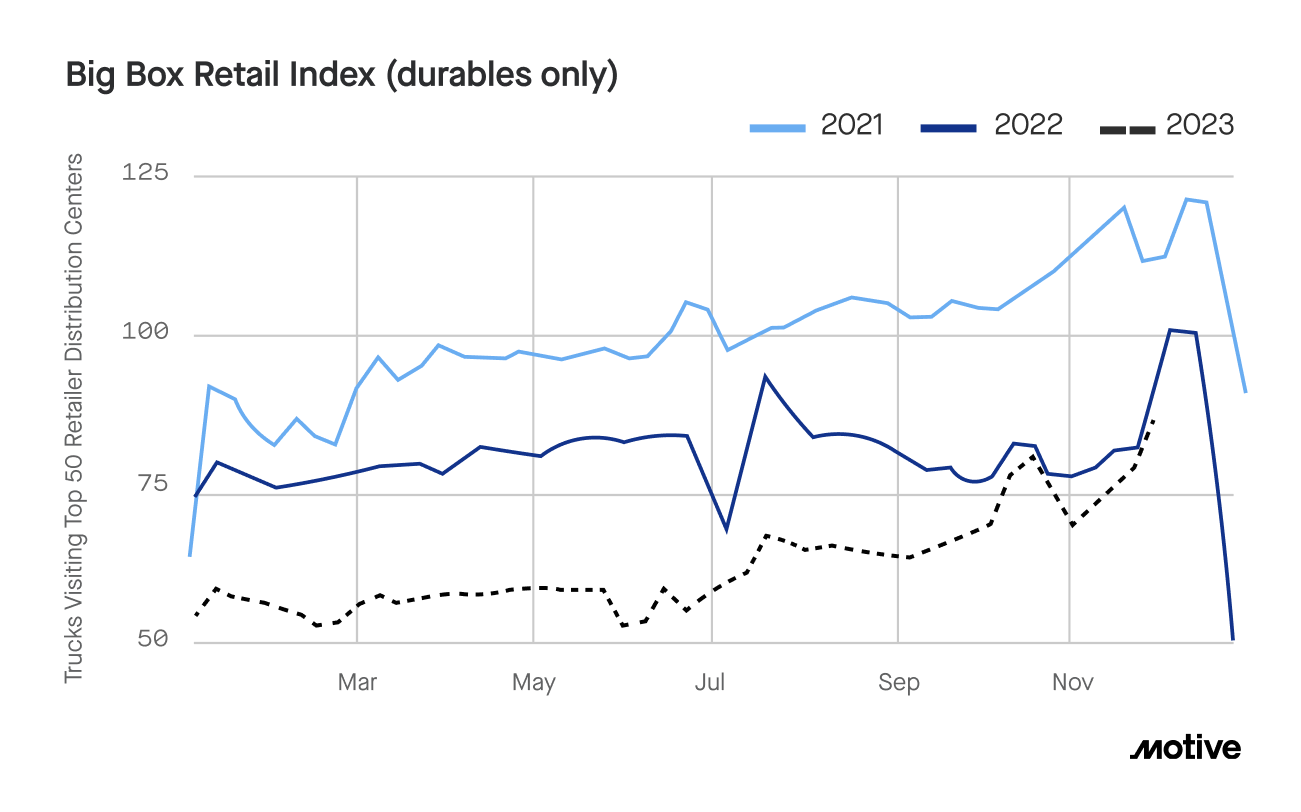

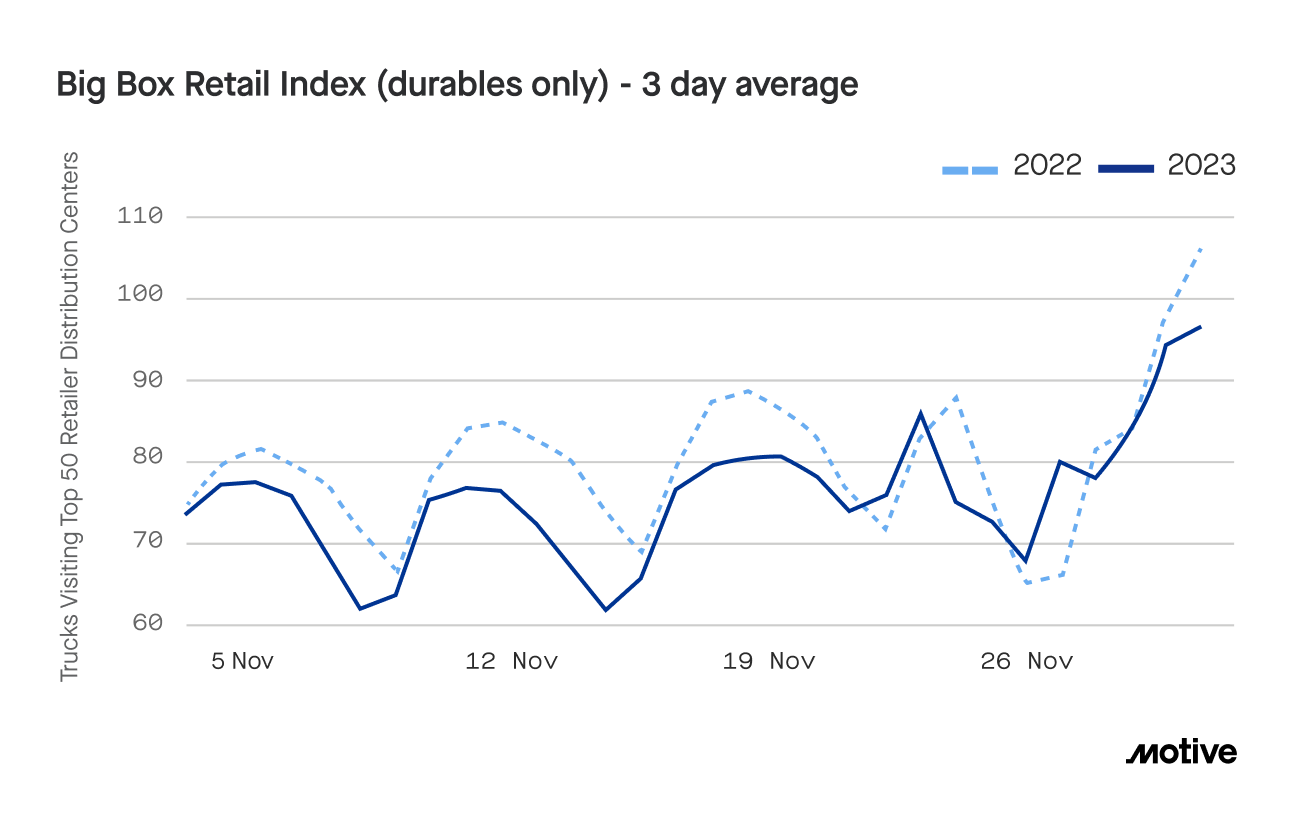

- Encouragingly, there’s a positive trend in restocking for durable goods, with a notable 16-point increase from the beginning of October through November. Diesel prices dropped another 5% in the same period.

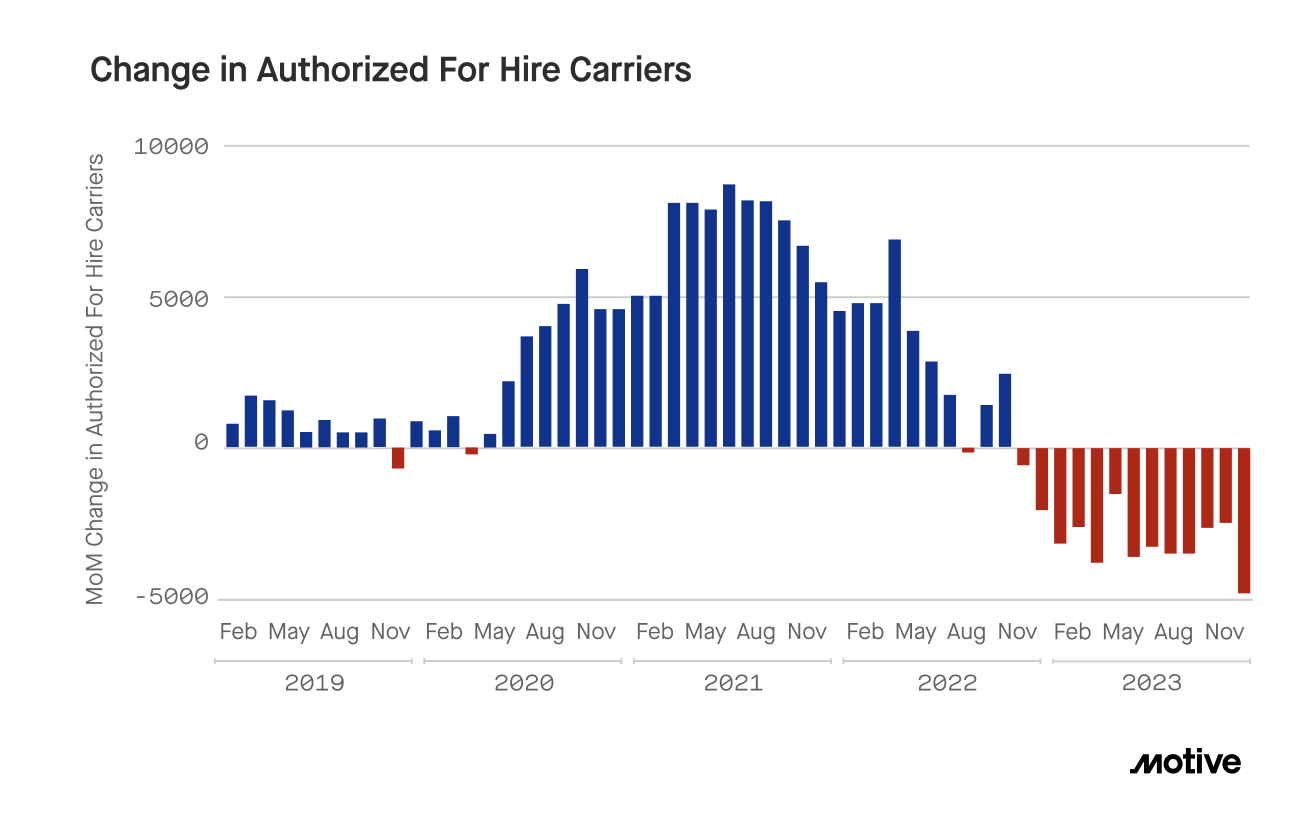

- Nevertheless, the market sustained its overall contraction observed throughout 2023, with seasonal pressures appearing to hinder new carrier starts and contribute to a rise in company closures.

- Every dollar saved is a dollar earned for these low-margin, capital-intensive businesses underscoring the significance of exercising control over controllable factors.

Consider seasonal fluctuations in the right context

Predicting the effects of holidays and seasonality in consumer and transportation demand can be deceptively complex. While we know the dates of demand-heavy holidays like Christmas, Chinese New Year, or Independence Day, the disruptions of the pandemic followed by the current freight recession have altered traditional patterns of ramping up inventories.

As businesses finalize plans and projections for the coming year, they should reflect on how seasonality has changed and what might cause further change moving forward. For example, will businesses continue stocking inventories closer to these high-demand holidays? How will the current capacity in the trucking market affect rates around these high-demand times? While these can’t be fully predicted, they should be included in a business’s contingency plan to inform how businesses approach projections and operational flexibility.

After a slow start to November, retail restocking moves closer to 2022 levels

Motive’s Big Box Retail Index, which observes trucking visits to warehouses for the top 50 retailers in the US, ended November down 3% compared to the same time last year. After a sharp dip from mid-October through the first week of November, warehouse visits rebounded heading into Thanksgiving.

The rally in visits through November is more prominent when looking at durable goods such as appliances, electronics, furniture and other “hard goods”. The transportation of these items to retailer warehouses saw a 16-point increase from early October to the end of November. When comparing average activity for October and November, visits for companies focusing on durable goods were down 5.9% year-over-year, while those for focused on non-durable goods fell by 10.9%.

Motive predicts that visits to the top 50 retailers will hit their peak this week and that the gap in visits between 2022 and 2023 will likely decrease further but remain marginally below 2022 levels.

The market’s contraction gets exacerbated by seasonal fluctuations, though diesel prices drop slightly

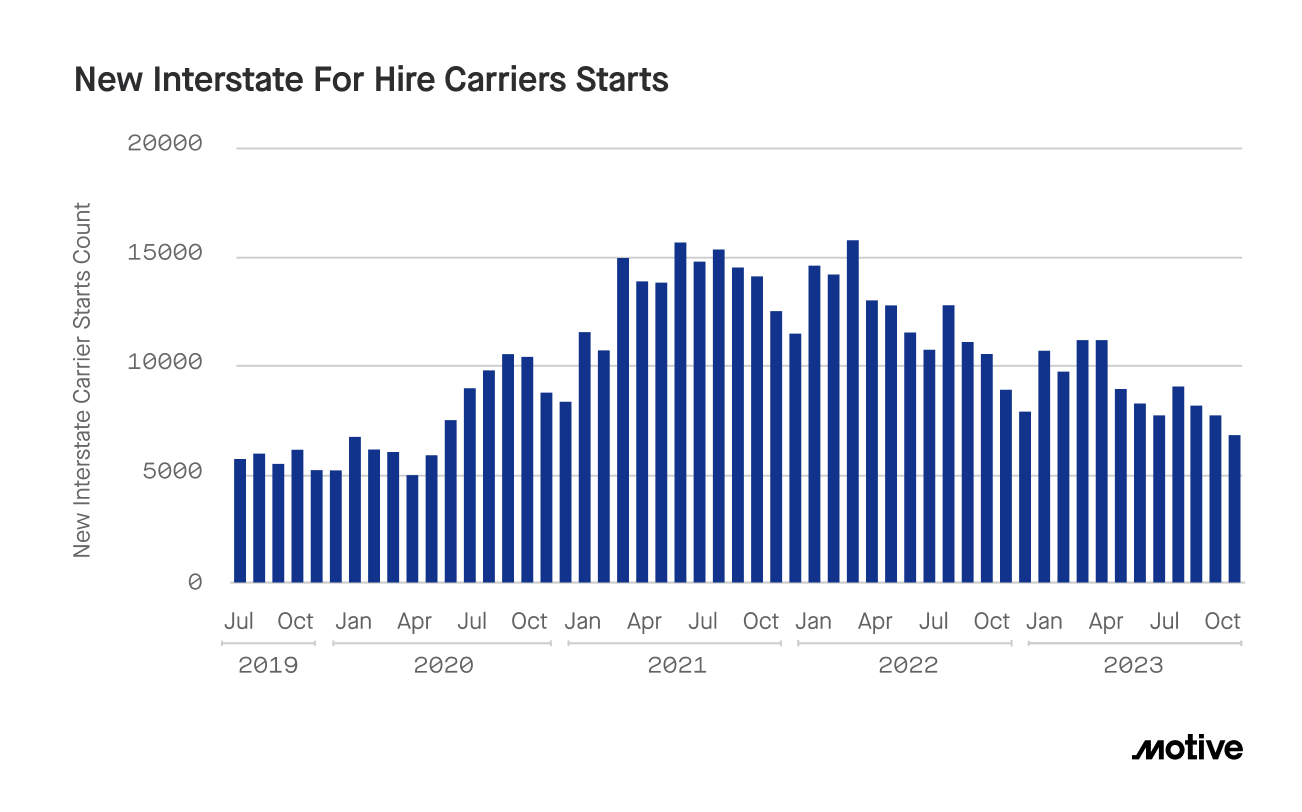

The number of carriers exiting the trucking market jumped to 4,931 in November, a 55% increase compared to October. Simultaneously, new carrier registrations also declined, with 6,792 registrants representing a 9% drop since October and a 16% drop since the end of Q3. Both of these numbers represent the continued market contraction being compounded by typical seasonal changes. For example, Q4 has fewer working days and typically sees struggling carriers decide to exit by the end of the year, while many potential new entrants to the market decide to start up after the holidays.

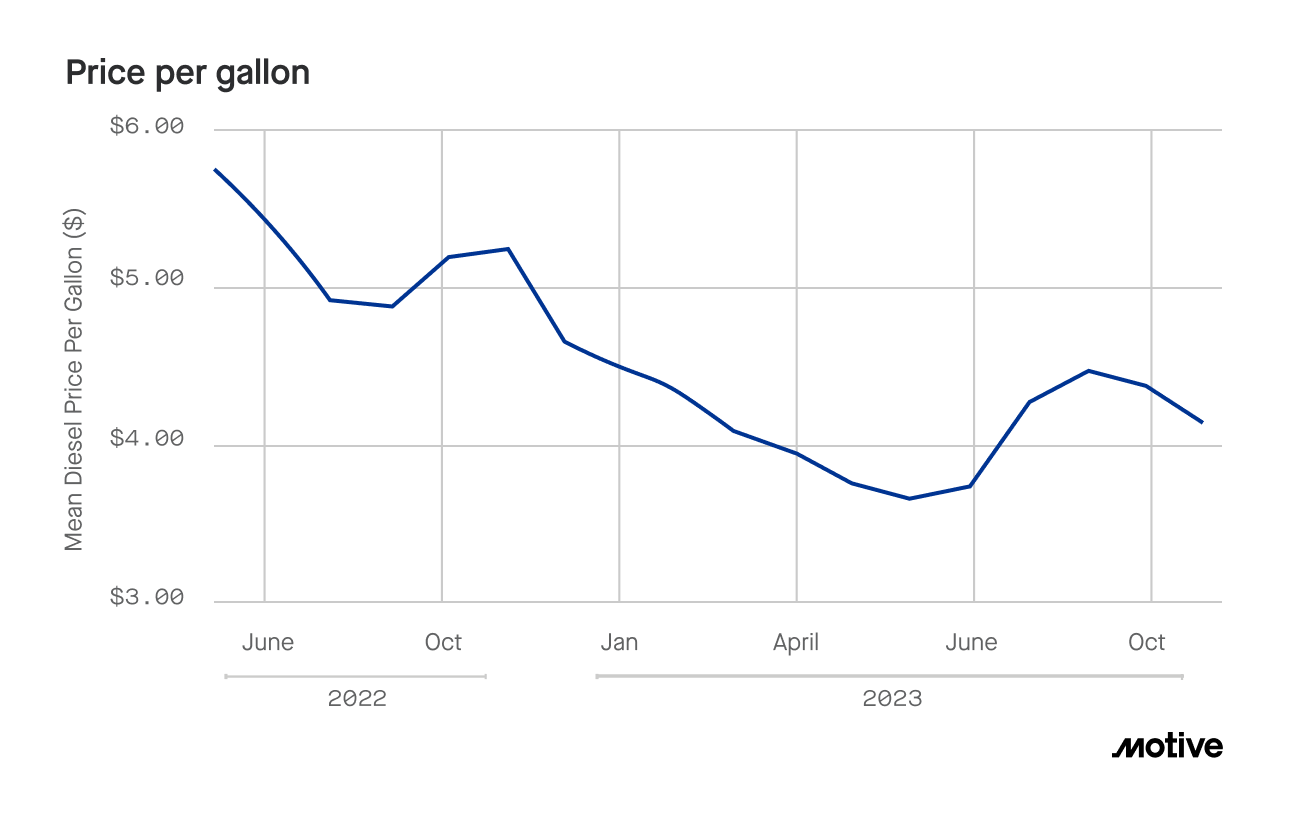

However, one market pressure that did ease for carriers in November was diesel prices, which saw a 5% drop from $4.40 to $4,18. While not as steep as the drop seen at the same time in 2022, prices are down nearly 50 cents year over year.

How to learn from 2023 and take the reins in 2024

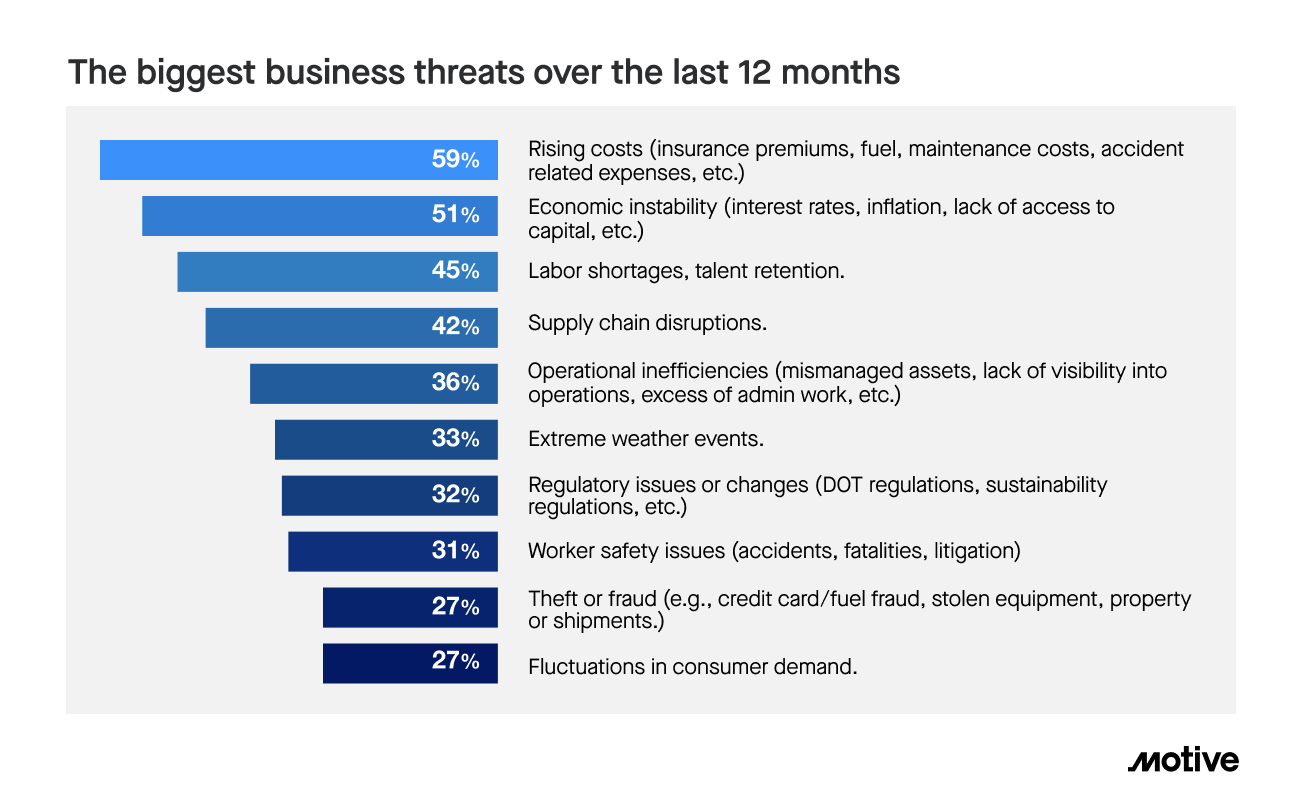

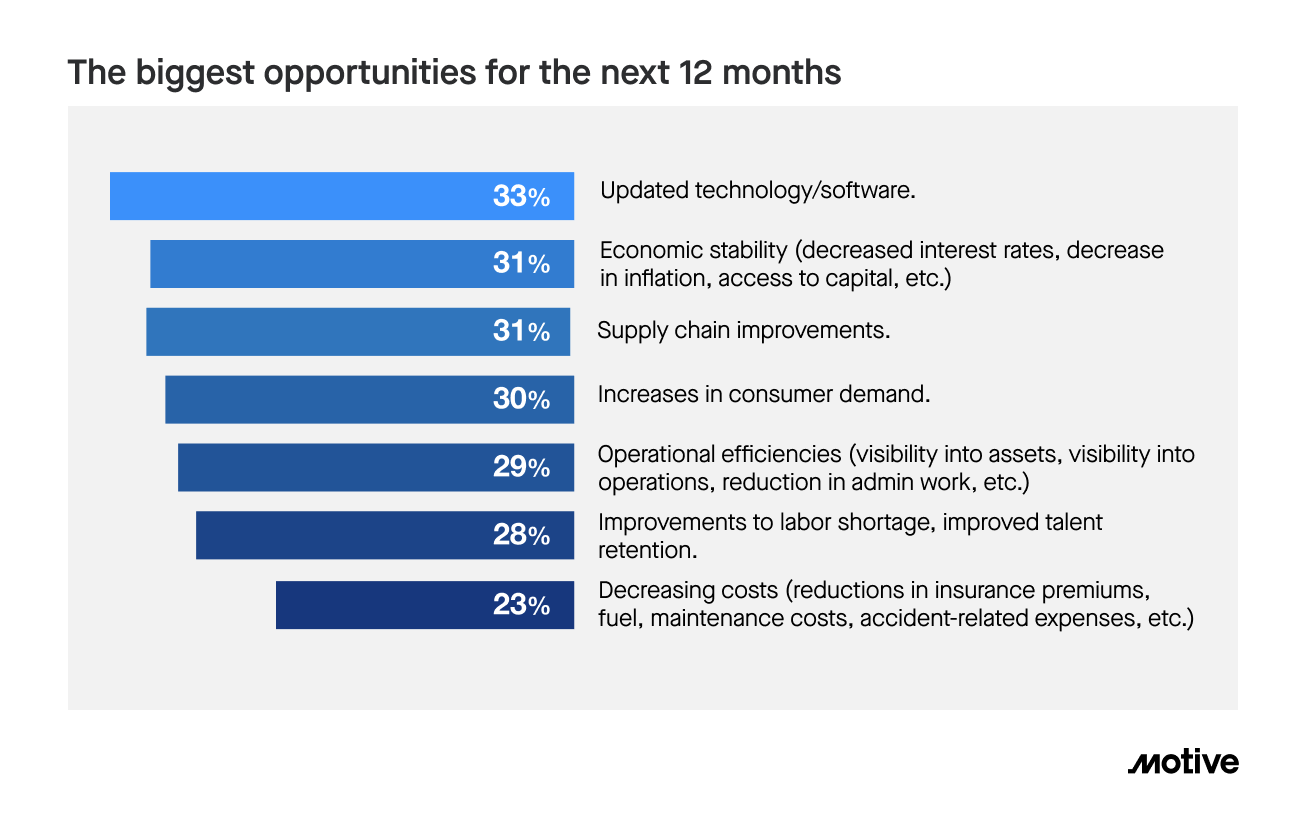

Motive’s Physical Economy Outlook 2024 highlights that the biggest challenges leaders in the physical economy faced over the last 12 months were ones outside their control: rising costs, economic instability, and labor shortages, to name some of the top examples. However, when discussing future opportunities, updating technology solutions and enhancing operational efficiency emerged as key priorities within leaders’ control.

As we enter the new year, prioritizing practices such as enhancing driver safety, managing fleet expenses, preventing fraud, and ensuring the optimal functionality of vehicles, assets, and equipment becomes crucial. Recognizing that every dollar saved is a dollar earned for these low-margin, capital-intensive businesses underscores the significance of exercising control over controllable factors.

Data Methodology

The Motive Monthly Economic Report uses aggregated and anonymized insights from the Motive network, as well as publicly available government data from the Federal Motor Carrier Safety Administration, U.S. Census, and U.S. Department of Transportation.