The trucking industry is rebounding while softness in consumer demand continues to put pressure on retail

Welcome to the March Motive Monthly Economic Report, where we break down the biggest supply chain and economic trends across the Motive platform over the last month. Motive serves over 120,000 customers who operate in the physical economy, from small businesses to Fortune 500 enterprises.

Our customers power the North American supply chain — in construction, oil and gas, transportation and logistics, agriculture, distribution, and beyond. They’re the people who grow our food, transport our materials, stock our stores, and pipe energy to our homes. Read on for your front-seat view into the factors that are moving the U.S. economy.

The trucking industry is rebounding

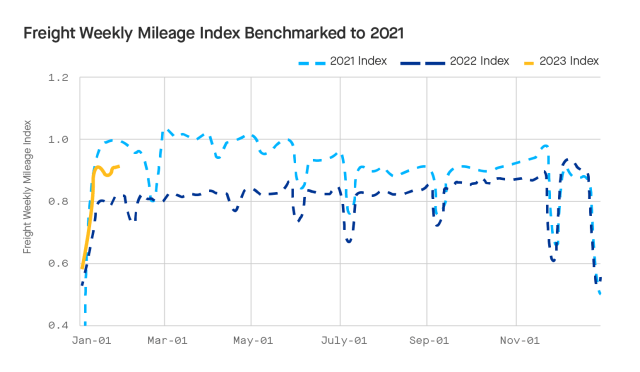

What’s new: Through February, trucking mileage maintained the strong start we saw in January, with a 10% increase in miles year-over-year. The supply chain is getting healthier amid steady reductions in transportation costs (e.g., diesel prices) and shorter lead times due to greater capacity in ocean and over-the-road freight. That said, we are still down 15% compared to the levels of activity seen in 2021.

Why this matters: A healthier supply chain is helping to ease inflation, however the January Jobs Report put unemployment at a generational low. January’s Consumer Price Index (CPI) came in well above the Federal Reserve’s 2% target, which will likely result in more short-term interest rate hikes later this month.

New trucking registrations are up – a positive sign for freight job growth

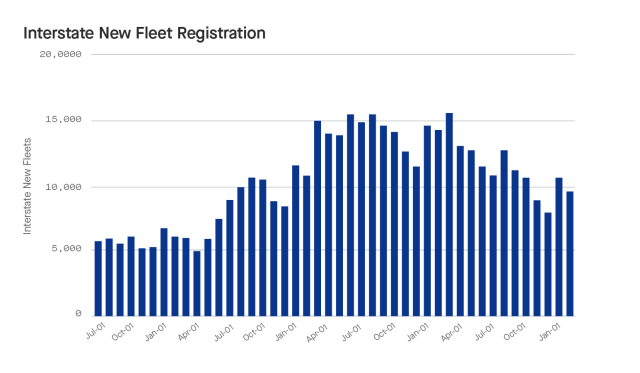

What’s new: A key indicator of freight market sentiment is new trucking company registrations. After almost 12 months of consecutive declines in registrations in 2022, we saw a reversal in February, with an over 30% increase in new company starts. This follows a more than 34% jump in January 2023 since the lows of December 2022. February added 9.5K new companies on a pro-rata basis, given that February has fewer working days.

- Pandemic highs: Coming out of Covid, the demand for physical goods and services skyrocketed, leading to an unprecedented surge in new business formation and expansion of existing firms operating in the physical economy. April 2021-April 2022 saw new fleet creations climbing to historic highs, hitting a peak in July 2021 with over 15K new fleets registered (+172%) versus a 5.5K fleet average during Q4 of 2019.

- Economic lows: This was followed by a stark reversal due to the changing economic environment in early 2022, with climbing inflation and transportation costs (e.g., diesel prices) driving new trucking company registrations down 47% in 2022.

Why this matters: The trucking industry has borne the brunt of changing economic tides in 2022, getting punished with high diesel prices, rapidly decreasing volumes, and drastic declines in operating margins. We ended Q4 2022 with historically high out of business rates exceeding what was seen during the 2008-2009 financial crisis and a net contraction in the number of freight companies. But a reversal in the trend shows early signs of optimism for small business job creation as 97% of registrations are from companies with 5 vehicles or fewer.

Softness in consumer demand continues to put pressure on retail

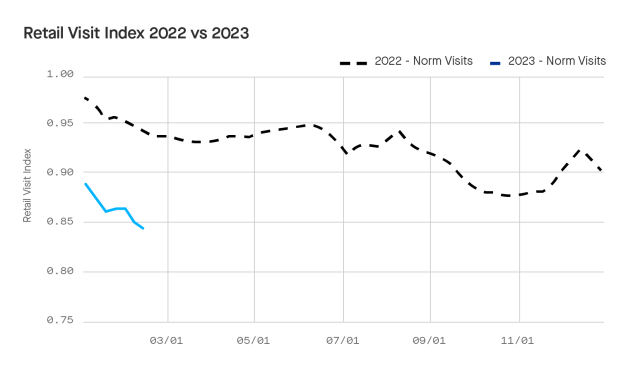

What’s new: We’re still seeing a disconnect between supply chain health, increases in freight activity, and retail recovery. February has tracked January’s trend of lower retail activity when compared to 2022, maintaining 10% lower activity in retail visits year-over-year and 15% less than in February 2021. Consistent hikes in interest rates from the Federal Reserve are having a real impact on consumer demand, as we saw with the cautious retail earnings and outlook last week.

Why this matters: Retailers aren’t investing in inventory due to softness in consumer demand, and they’re offering steep discounts to unload existing stock. Top retailers are being cautious as consumers cut spending; therefore, we shouldn’t expect substantial investments in retail inventory in the near-term.

Data Methodology

Motive data represents over 120,000 customers, half a million vehicles, and millions of drivers, from small businesses to enterprise fleets. Our customers work in every sector of the physical economy, including trucking and logistics, delivery, construction, food and beverage, oil and gas, and more. Motive’s technology is embedded into more than 20% of for-hire trucks in North America, giving Motive a representative view of the over-the-road supply chain.

Indexes Breakdown

- Motive’s Freight Weekly Mileage Index is calculated by the distance traveled for trucks with Motive technology embedded.

- Motive’s Retail Visits Index is measured by truck visits to top retailers’ warehouse with Motive technology embedded.

- Motive’s Interstate New Fleet Registrations reflect new companies registering for interstate activity. This typically covers the market of long-distance trucking that is dominant in the transportation of most goods in North America.