FRAUD PREVENTION

Stop fraud

on the spot.

Motive combines vehicle telematics data with Motive Card payments data to create the fastest, most accurate way to stop fleet-related fraud.

Protection up to $250,000 per year.

Trust that your business is protected when using Motive’s fraud controls. Our Fraud Protection Guarantee provides the most comprehensive coverage in the market with assurance of up to $250,000 annually ($15,000 per card)*.

Prevent loss with fast, accurate, and proactive fraud detection.

Secure your bottom line.

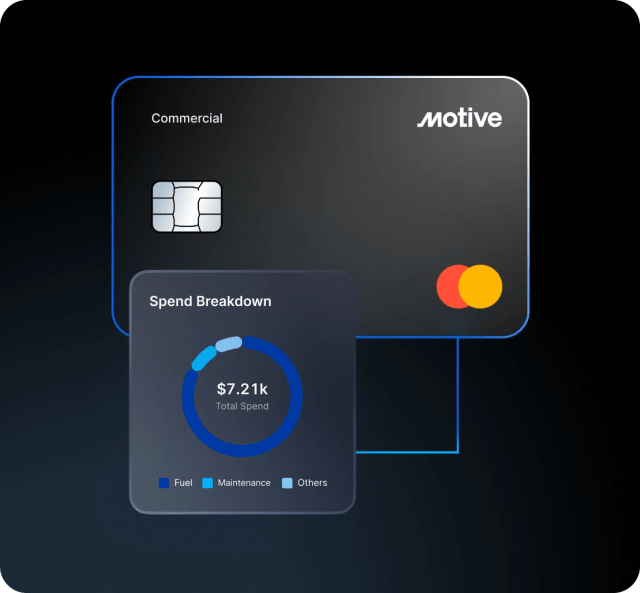

With fleet telematics and spend management in one platform, you can protect your business from fuel siphoning, fuel theft, card skimming, and more.

Automate fraud prevention.

Stop spending hours disputing charges or manually identifying fraudulent transactions. AI-enabled auto-decline transactions and alerts stop suspicious transactions on the spot.

Uncover hidden fraud.

See how fraud is impacting your business with fast, accurate data that helps you make decisions and protect your bottom line.

Empower your managers and drivers with fast and accurate fraud detection.

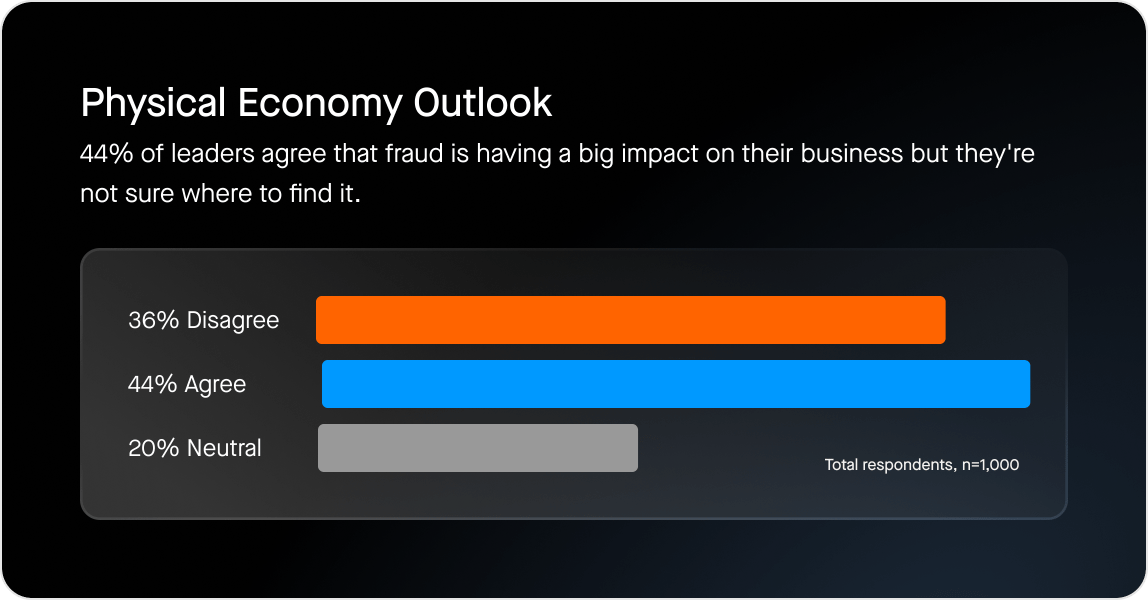

Unsure how fraud affects your business? You’re not alone.

Fraud is often a pervasive and invisible problem, but Motive’s AI-powered platform makes it possible to detect fraud and prevent it.

19%

Of fleet spend is lost due to fraud or theft

22%

Of construction fleet payments are lost to fraud or theft

44%

Of leaders believe fraud has a significant financial impact on their business

Dive deeper into fraud detection and prevention.

Webinar

Fleet Card Fraud: Is your fleet leaking profits?

Fuel is 30-60% of your total operating costs. And 5% of your fuel spend may actually be fraudulent. Learn how to spot the problem in a sea of transactions and tell fraudsters to hit the road.

guide

Friendly fraud: How to spot it — and stop it.

Physical economy leaders estimate that fraud accounts for 19% of fleet spending, on average. Learn how to minimize the effects of friendly fraud and keep bad actors out.

report

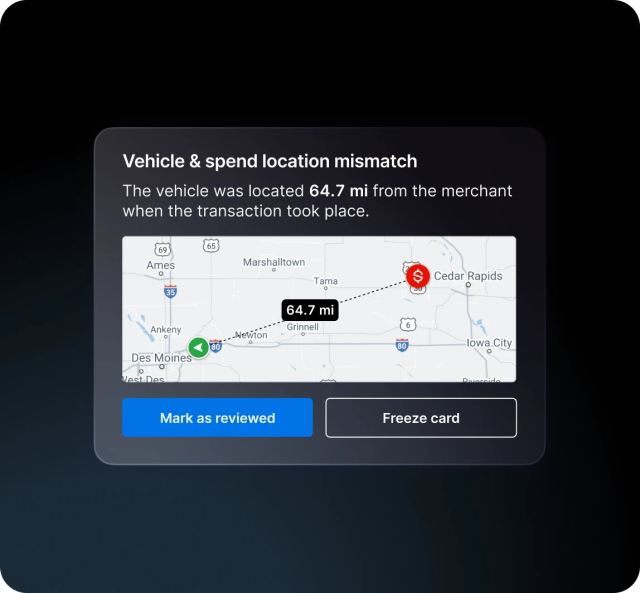

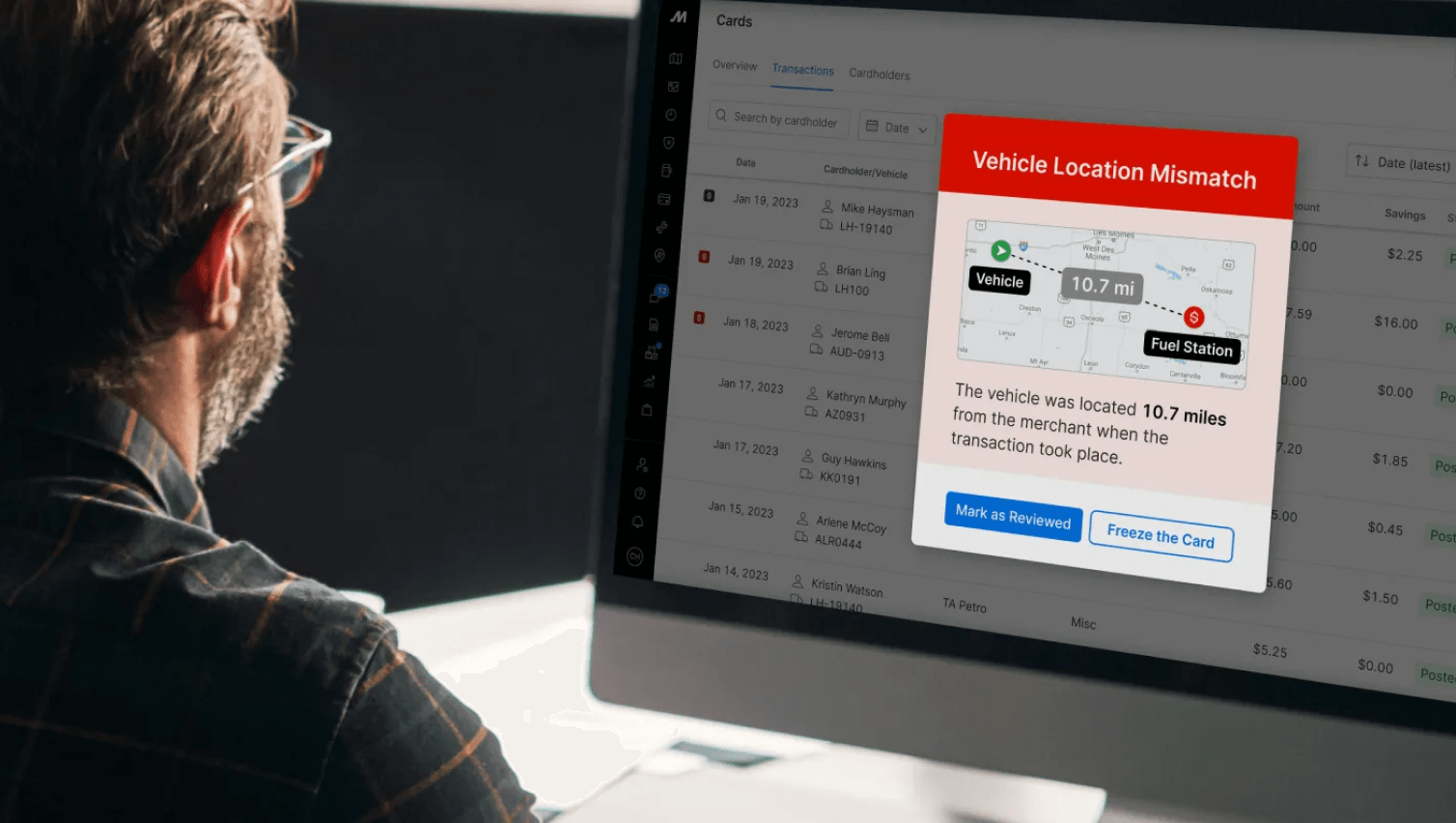

How our new Motive Card feature helps fleets identify and reduce fuel theft.

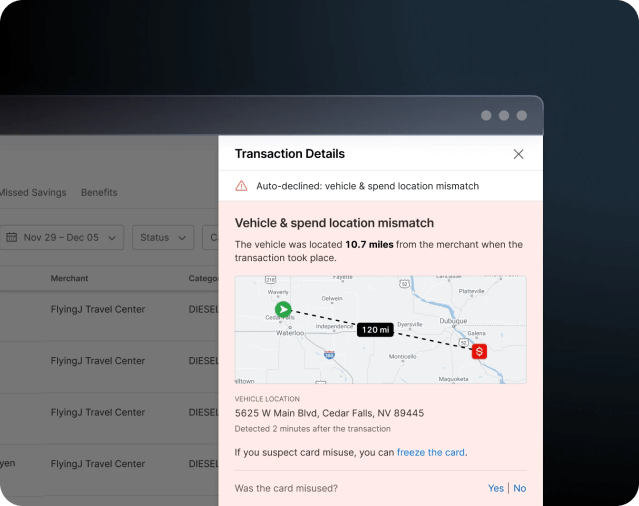

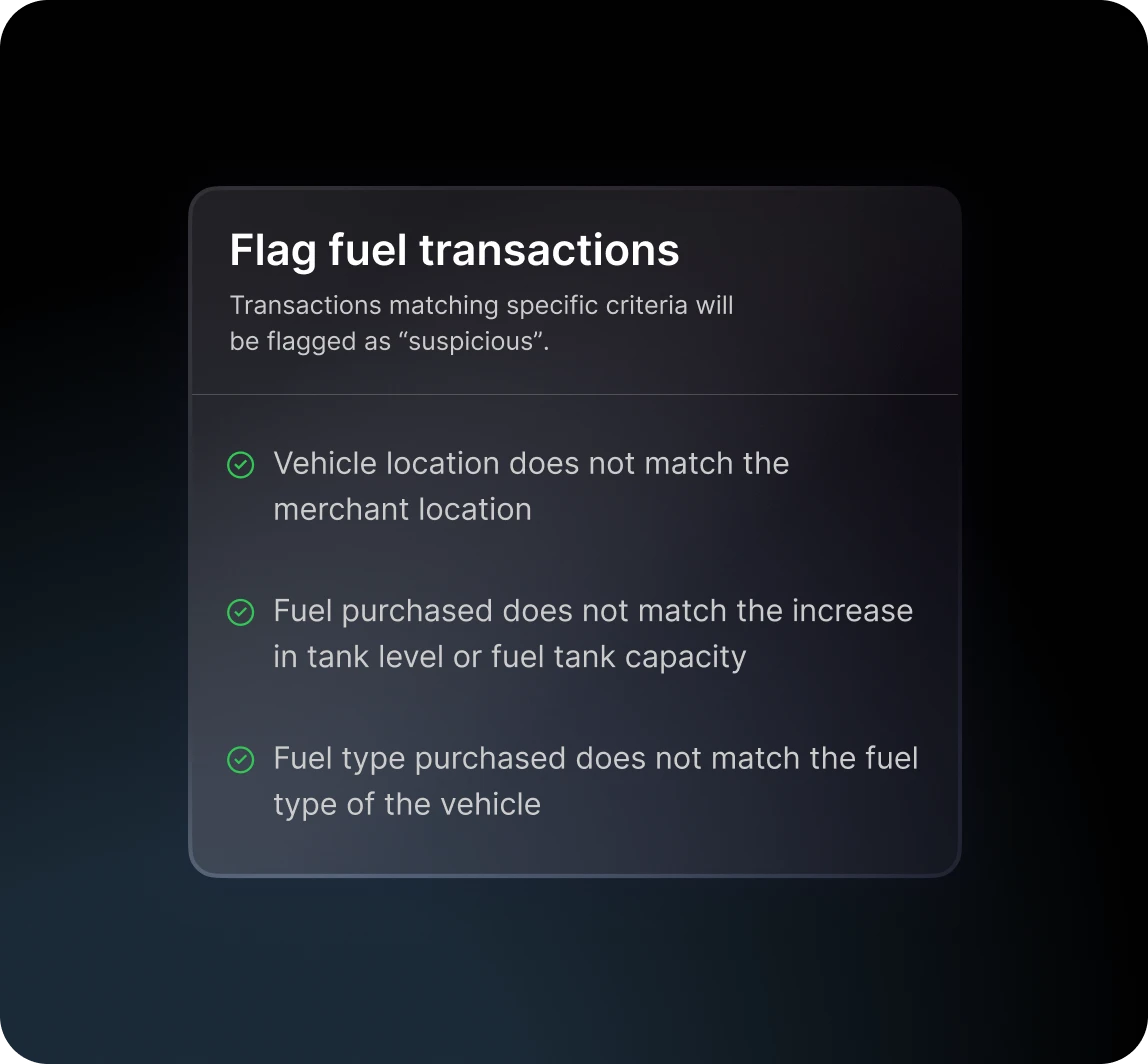

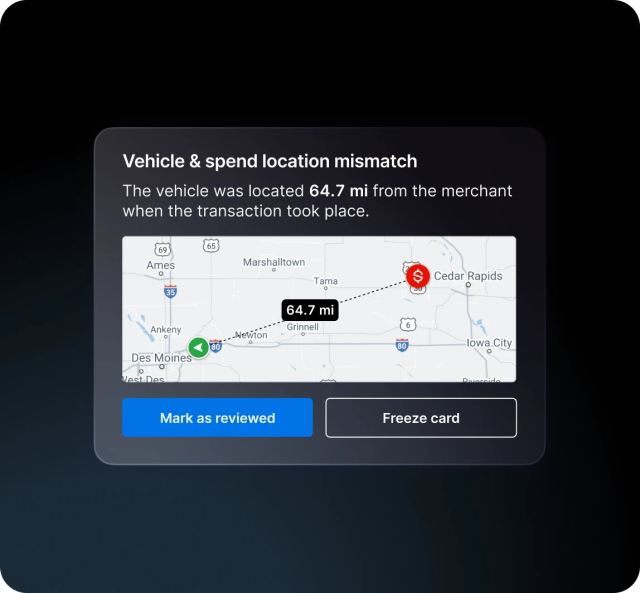

Fleets need efficient and savings-minded service providers. Motive Card flags suspicious activity and alerts fleets of potential fuel theft or fraud when the vehicle location doesn’t match the spend location.

Frequently asked questions

What’s covered as part of Motive’s Fraud Protection Guarantee

Our advanced fraud protection program safeguards your profitability through mobile-based card unlock, AI-powered fraud detection with instant auto-declines, and highly customizable spend controls. Motive’s fraud controls are so accurate that we back them with an up to $250,000* annual guarantee.

Turn on these fraud prevention features and rest easy knowing Motive has you covered:

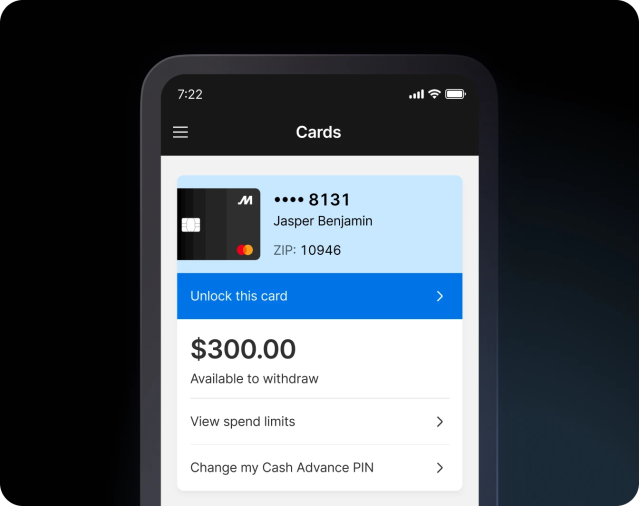

- Mobile-based unlock. Prevent card skimming by requiring cardholders to unlock their cards using their Motive Driver App or via SMS.

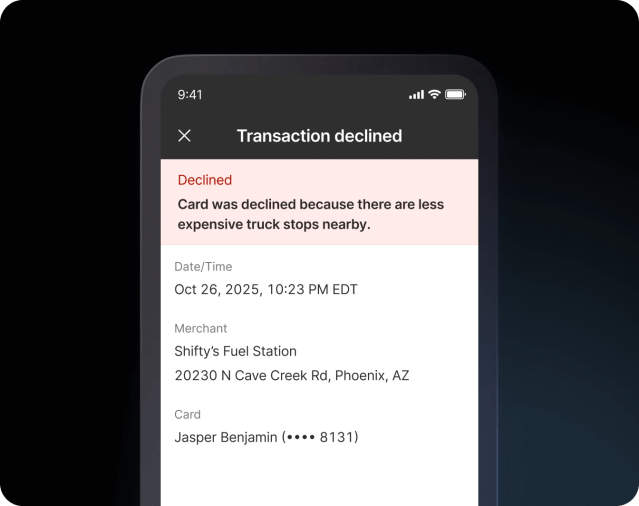

- AI-powered fraud detection and auto-declines. Integrated fleet telematics and spend management create the fastest, most accurate way to stop fuel fraud and auto-decline out of policy and suspicious transactions.

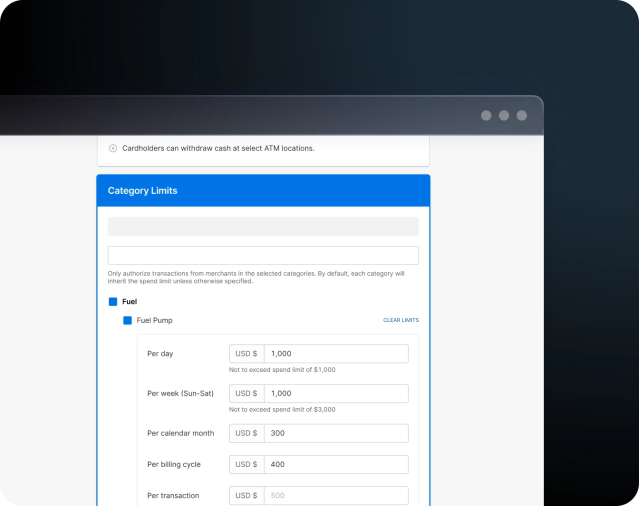

- Customizable spend and merchant controls. Prevent unauthorized spend with highly customizable controls that suit your business needs

Why is Motive’s fraud detection faster and more accurate than other solutions?

Motive integrates spend management (Motive Card) and fleet telematics (Vehicle Gateway) into one platform. This gives businesses an unmatched, 360º view of fleet and spend, which eliminates manual processes and makes identifying fraud easier.

Shared data enables automatic detection of fraud in near real-time, allowing businesses to take prompt action to safeguard their spend.

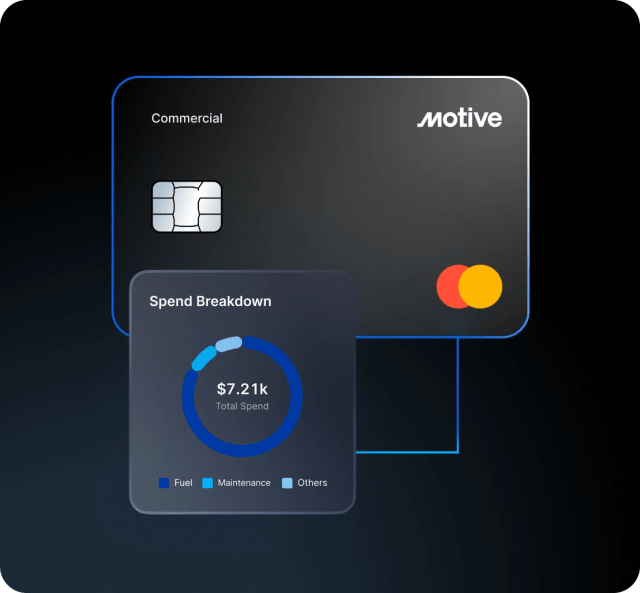

Besides fraud detection, what else can the Motive Card do for my business?

In addition to fraud detection, the Motive Card offers:

- Customizable spend controls. Set limits for individuals or groups of cardholders. Block specific merchants, establish spend categories, and control cardholder spend by amount, day, time, and more.

- Partner savings network. Get significant savings on fuel, maintenance, and more at over 25,000 partner locations in North America, including Love’s, TA, Casey’s, 7-Eleven, Exxon, Discount Tire, and more.

- Wasteful spend identification. Get actionable insights that help you reduce fuel costs and discover missed savings opportunities. You can even block locations where drivers regularly pay more for fuel.

- Easy IFTA filing. Motive’s fleet and spend data help you file IFTA reports. Save time spent on manual reconciliations, automatically allocate distances and fuel transactions, and export your preferred file type.

At what level and categories can I control spend for Motive Cards?

Motive Card spending levels and categories are fully customizable. Fleet admins can set limits on:

- When, how much, and where the cardholders can spend.

- Specific days and times when the card can be used.

- The amount that can be spent every day, week, month, and billing cycle.

- Where the card can be used, including enabling or disabling transactions in specific categories like fuel, maintenance, supplies, food, and travel.

Fleet admins can also block specific merchants, ensuring drivers can’t use their Motive Card at those locations.

How do you alert fleet managers of potential fraud events?

Fleet managers can receive email and app notifications. Suspicious transactions are also flagged and viewable in the Motive dashboard, providing additional details.

How do you manage fuel types when the cardholder vehicle changes? Will there be false alerts?

You can reassign Motive Card to the new vehicle or driver. The product will then reassess any fuel type mismatch.

How accurate are fraud alerts? What happens when there is a false alert?

We’ve measure our accuracy to be more than 90% when flagging fraudulent transactions. This is only possible because of our AI-powered platform that integrates fleet telematics and spend management, combining vehicle location with transactions.

If a fleet admin determines a transaction is not suspicious, they can review the transaction and share feedback on why the flagging was inaccurate. All feedback helps improve our models.

How is this different from other fuel cards that offer discounts and perks?

While many cards provide discounts, Motive Card uniquely integrates with our all-in-one fleet management platform. The result is real-time fraud detection tied directly to vehicle data like GPS and fuel tank levels. This added layer of protection ensures you get the most out of every gallon while safeguarding your assets.

Motive card also operates on Mastercard rails, allowing the cardholder to use it for all their fleet expenses, not just fuel.

Are savings guaranteed?

Motive can conduct a personalized review of your current transactions and discounts to see if you would benefit by switching to Motive Card. Our finance team often offers additional rebates on top of our per-gallon discounts to help maximize your savings.

Are there annual or transaction fees with Motive Card?

Motive Card has zero application, membership, transaction, or hidden fees. You’ll enjoy complete transparency, only pay for what you use, and have no surprises on your bill.

CONNECT WITH US

Unlock the potential of your operations with Motive.

- Comply with industry rules and regulations.

- Improve visibility and automate operations.

- Identify risks and automate driver coaching.