Every day, your fleet’s drivers spend money on fuel, lodging, and maintenance. While it’s true that you have to spend money to make money, tracking spend can be complex as your fleet grows. You may feel like you’re constantly behind. You may be trying to reconcile schedules with receipts to approve legitimate spending while monitoring for unauthorized charges and use.

Add in the inevitable lost or stolen fleet cards or employee churn, and card management becomes even more complicated.

If you’re already using a fleet management solution to streamline how your fleet operates, the next logical step is to add spend management. Centralizing fleet operations will further improve productivity while easing your team’s administrative burden.

The Motive Card’s advanced spend control options can help you manage your fleet’s spending. Set and manage limits, activate and deactivate cards, and identify potential fraud — all from your Fleet Dashboard. The no-fee Motive Card also provides discounts on fuel, maintenance, and other expenses.

Three ways spend controls help fleets save money, improve efficiency, and reduce risk.

1. Reduce fraud and unauthorized spending

Unauthorized spending is an area of concern for fleet managers. An estimated 5-10% of a fleet’s annual fuel consumption is lost to theft or misallocation. It’s a small percentage that can quickly add up to big bucks.

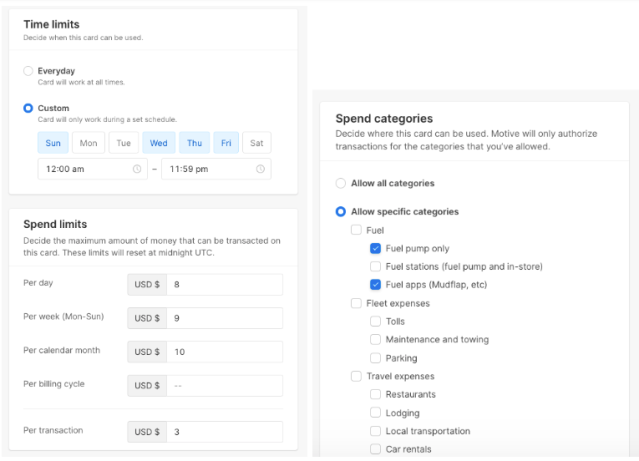

Motive’s spend control capabilities provide limits on how your drivers are spending company dollars on company time. Fleet managers can match charges with vehicle location and time, as well as limit spending to designated categories or hours.

For example:

- Limit fuel purchases to the pump only, rather than in-store.

- Allow fuel expenses while restricting lodging.

- Specify that the card is only authorized during certain days or times.

Adjust these parameters in real time, right in the Fleet Dashboard.

2. Customize spending limits to your fleet’s needs

Spend controls allow you to set spending limits by driver group, spend category, or time period. Spending limits help protect your bottom line by restricting excessive spending, but still allow your drivers to get what they need on the road, whether that’s maintenance, lodging, tolls, or meals.

With spend controls, you can reduce unauthorized spending by:

- Limiting transactions to set days or hours.

- Setting maximum transaction amounts by day, week, month, or billing cycle.

- Restricting spending to designated categories.

And if something happens and you need to authorize new times or categories, or increase a transaction limit, you can do so on the fly with immediate effect. If a driver with a $1,000 limit gets into an accident and requires a $3,000 tow, the fleet manager can instantly update their limit within the available credit limit to pay for the tow, then reinstate the $1,000 cap.

3. Limit risk from lost or stolen fleet cards or employee churn

Even in the smallest fleets, cards get lost or stolen. Employees join and leave. These factors make it harder to keep tabs on which fleet cards should be active and spending. With Motive spend control abilities, you can manage fleet card status from the dashboard whenever you need to:

- Activate a new employee’s card.

- Freeze a card that’s lost.

- Deactivate a stolen or departing employee’s card.

Changes take effect immediately to reduce the financial risk of unauthorized charges.

Read: Fleet card basics and benefits.

Integrate spend management with your fleet operations

With Motive Spend Management, you can streamline your fleet operations even further. Run your fleet’s physical and financial operations out of a single dashboard, and gain full visibility into your drivers, assets, and spending. Detailed reports help you see trends, like who’s spending what and where, without requiring hours of manual work reconciling charges or reimbursing employees’ personal cards.

With end-to-end visibility and detailed reports, you’ll have full insight into where and how your fleet’s dollars are spent. Motive Sustainability can even provide a consolidated view of your fleet’s fuel trends, benchmarked across Motive’s entire network of vehicles. This data can tell you where every gallon of fuel is going while pinpointing opportunities to increase efficiency.

Get another layer of fuel fraud protection with fuel theft alerts that notify you when suspicious purchases are made, based on telematics data combined with transaction data. The Motive Vehicle Gateway provides vehicle/driver location and fuel telematics. Transaction data from the Motive Card lets you know what type of fuel is being purchased and where. For example, if there is a vehicle location/fuel purchase location mismatch, Motive will flag this as a potentially fraudulent purchase for your visibility.

Plus, the Motive Card gives you meaningful discounts on fuel and more. Save an average of over 20 cents per gallon of diesel at partner stations, including Love’s, TA, and Road Ranger. You’ll also save on maintenance and other expenses. The Motive Fleet Card is free to use with no application, membership, or transaction fees. It’s backed by Mastercard, so you can conveniently pay for all business expenses with the Motive Card where Mastercard is accepted – no need to manage multiple cards.

As Stephanie Matos of BB Auto Logistics says, “The Motive Card is great — so easy to use, and with big savings where I already fill up.”

Learn more about Motive Spend Management

Learn how a spend management solution with the spend control capabilities can help you save money and increase profitability. Apply for the Motive Card.

If you ever need support, reach out to Motive’s award-winning support team, available 24/7, for any questions about anything regarding your Fleet Dashboard – from your Motive Card to your Vehicle Gateway.

The Motive Card is issued by Sutton Bank, Member FDIC pursuant to a license from Mastercard International. Subject to the Terms of Service. Mastercard and the circle design are registered trademarks of Mastercard International Incorporated.