- Introduction

- The State of Safety

- The State of Retail

- The State of Freight

- The State of Theft and Fraud

- Looking ahead

Introduction

As we approach the busy holiday season and look ahead to 2025, businesses across the physical economy face significant challenges and opportunities. From heightened safety risks on the road to shifting retail trends and ongoing freight market disruptions, the Motive Holiday Outlook Report provides critical insights into the State of Safety, Retail, Freight, Theft, and Fraud. This report delivers data-driven predictions to help safety leaders, transportation leaders, fleet managers, and business owners navigate the complexities of peak holiday demand while preparing for the evolving landscape in 2025. Let’s dive in.

State of Safety: Managing risk during the holidays

As the holidays draw near, the spirit of the season promises joy and excitement for friends and family gathering in celebration. But the season brings more than revelry and holiday cheer. For people taking to the road, it also brings increased risk.

For transportation and logistics businesses, the holiday season brings unique challenges. In addition to tighter delivery deadlines and longer hours behind the wheel, drivers must contend with heavy traffic and deteriorating weather conditions. Field service businesses, such as plumbers, HVAC businesses, and plow services, face urgent customer demands. Combined with unsafe roads, this pressure can lead to more accidents, especially with the rise in holiday speeding and crashes.

Roads are more dangerous during the holiday season

Collision and weather risks are particularly high during the holidays. Motive’s 2023 Holiday Outlook Report revealed a 10% increase in speeding events before Christmas, culminating in a 32% spike in crashes on Christmas Day when compared to the rest of December.

Hazardous weather played a significant role, with 65.5% of Christmas Day crashes occurring on wet, snowy, or icy roads. Factors like these raise the risk level — not just for commercial drivers, but for motorists and pedestrians sharing the road.

The uptick in speeding events in the week leading up to Christmas is likely due to increased shipping activity and the push to ensure on-time delivery.

Motive data shows that nearly half (47%) of all collisions happen after dark, even though more vehicles are on the road during the day. Hours-of-service violations peak during the holidays as well, as drivers push themselves to meet delivery deadlines. In the two weeks following the rush, violations drop, highlighting the intensity of the season.

If navigating a “normal” holiday season wasn’t already challenging enough, an active hurricane season has ravaged communities and disrupted supply chains, especially in the Southeast. Hurricanes like Helene and Milton have caused widespread damage, leaving behind damaged roads, crippled infrastructure, and overwhelming clean-up efforts. Drivers have been rerouted, shipments have been delayed, and operating costs are spiking. All of this spells trouble for safety and logistics.

To navigate these disruptions, fleets must take a proactive approach through the use of technology. The most effective tools provide real-time visibility and timely data feedback, allowing fleets to stay agile during severe weather. An Integrated Operations Platform is essential for maintaining safety and continuity, enabling fleets to respond quickly and keep drivers safe in the face of natural disasters.

Our Take

For businesses with fleets, the 2024 holiday season will be especially challenging. With higher crash risk and the lingering effects of hurricanes, implementing proactive tools like AI-powered dash cams, 360° cameras, and real-time tracking is critical. This will help fleets protect their drivers, secure their cargo, and maintain the highest level of operational efficiency.

State of Retail: Adapting to constant disruption

The retail landscape has transformed significantly, and supply chain disruption has become a constant challenge. In 2024, retailers have embraced new strategies to tackle hurdles such as long-term bottlenecks and extreme weather that can destabilize critical shopping periods like the holiday season.

A shift toward stability

By prioritizing stability over cost savings, retailers are moving away from the traditional low-inventory, just-in-time restocking model. Instead, they’re restocking earlier and building extra inventory to shield themselves from unpredictable disruptions. This shift was underscored by a 19.7% year-over-year increase in Chinese imports by mid-summer, showing that businesses are willing to invest more to meet consumer demand and avoid stockouts.

The rise in Chinese imports isn’t just about keeping up with demand — it’s a sign of a broader trend in supply chain management. By sourcing earlier and maintaining higher inventory levels, retailers are preparing for the unexpected, from geopolitical tensions to weather-related delays. This proactive approach helps businesses ensure they can meet consumer expectations even under pressure, especially during high-stakes seasons like the holidays.

The growing role of Mexico in supply chains

As retailers diversify their supply chains, Mexico has emerged as a critical player. According to Motive’s September Economic Report, Mexican imports through the Port of Laredo surged 30% year-over-year. This trend shows how retailers are increasingly turning to Mexico, not just for its shorter lead times and lower tariffs, but also to reduce the risks associated with other global supply chains.

Mexico’s proximity to the U.S. offers more than convenience — it enables faster response times and better adaptability to unexpected disruptions, such as labor strikes or geopolitical conflicts that may affect imports from other regions. By strategically balancing imports from both China and Mexico, retailers are minimizing risks while creating more resilient supply chains. Chinese imports help maintain inventory stability during high demand, while Mexican imports provide a quicker, more flexible option to avoid potential disruption.

As supply chain disruptions become more frequent, proactive planning and diversification are essential. Retailers that adapt will safeguard their holiday sales — often accounting for 30% to 50% of annual revenue — and build more resilient supply chains capable of thriving in an unpredictable global environment.

Our Take

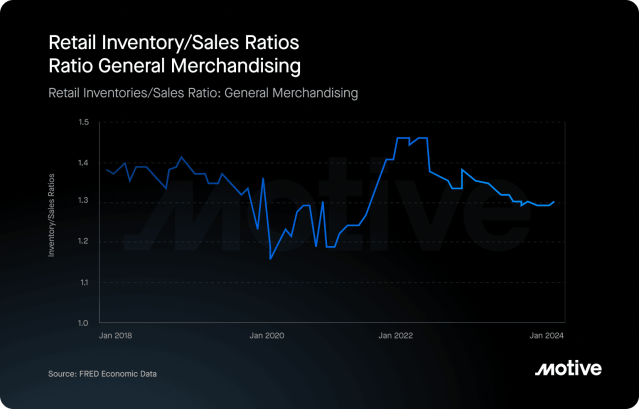

In 2025, we expect significant shifts in both inventory management and cross-border trade. Retailers will move away from just-in-time inventory strategies, opting for higher inventory-to-sales ratios, which are predicted to rise above 1.3 by December 2024 and remain elevated throughout 2025. This shift reflects a need for greater inventory buffers to meet demand. Meanwhile, the demand for Mexican imports will continue to grow, with cross-border trucking traffic peaking in October 2024. Expect a rise again in early 2025, driven by nearshoring and increased trade at the Laredo border crossing. Together, these trends highlight the evolving dynamics in supply chains and trade as businesses adapt to new challenges and opportunities.

Early restocking and strong consumer demand drive growth

With the holidays approaching, retailers are bracing for a surge in demand that they expect to meet successfully. Their optimism is driven by record-breaking sales and early restocking efforts that began in June. It was the first time since 2021 that the pre-holiday restocking blitz started so early, indicating that retailers are prepared for a robust season.

With a strong labor market and interest rates falling, consumers have reason to feel positive. Consumer spending is showing resilience, and with inflation cooling, buyers are eager to spend.

Our Take

Motive predicts consumers will do more in-person shopping this holiday season, with brick-and-mortar stores seeing the biggest jump in sales.

| Retail Grouping | Sentiment (index score) | Performance vs 2023 |

|---|---|---|

| Overall Retail Index (including e-commerce) | (81.6) | +6.4% |

| Discount Retailers & Wholesalers | (101.1) | +9.5% |

| Grocery & Superstores | (116.0) | +22.6% |

| Home Improvement | (106.2) | +47.6% |

| Department Stores, Apparel & Electronics | (100.9) | +27.1% |

With the International Longshoremen’s Association strikes lasting just two days, holiday sales are on the path to growth. Fueled by a flood of imports into the Port of L.A. in July and August, sales are projected to be 5% to 8% higher this year.

If summer signals hold up, grocery, superstores, department stores, and home improvement will drive the most growth. Restocking trends in grocery and superstores hit an all-time high in August, up 22.6% year-over-year. Department stores and apparel saw an even higher spike in restocking, at 27.1%.

Month-over-month, home improvement retailers saw the biggest change, with an 11.2% surge in September over August. Since 2023, home improvement restocking is up 29.3%. With Big Box chains like Home Depot and Lowe’s now stocked with holiday decor, Halloween preparations have kicked off the first seasonal spike in restocking. Subsequent waves will hit at Thanksgiving and Christmas.

Our Take

In 2025, retail prices will increase. Higher freight and transportation costs will compel retailers to hold onto inventory and pass these costs to consumers early in the year, even as inflation cools. Facing increased pressure and narrow margins, retailers will be less inclined to absorb rising costs themselves.

State of Freight: Trucking is on the path to recovery, albeit slower than expected

The trucking market has had a turbulent year, but 2024 is poised to end on a cautiously optimistic note. While we expected to see growth in the trucking sector by November 2024, stagnant freight prices and carrier exits have slowed the rebound slightly.

We expect moderate growth to return in the first quarter and long-term growth trends of 5.7%, year over year, to be restored by the end of 2025. With the oversupply of carriers now gone, the market looks more like it did before 2020, drawing closer to more traditional, cyclical trends.

Global economic uncertainty could present some headwinds, so keep an eye on fluctuating interest rates and diesel prices worldwide.

Carrier exits remained stable in September, with about 1,300 operators closing for the third straight month. Low trucking rates continue to put pressure on small businesses, making it difficult for many to stay afloat. At the same time, new carrier entries have declined by 5.1% since August, even as 7,800 new carriers entered the market. Although new entries are down 10% year-over-year, they’re still 38% higher than the pre-pandemic levels of 2019.

By August, the median age of carriers leaving the market had risen to 3 years, up from 1.5 years at the start of the freight recession. This shift signals a return to more typical business cycles as the recession eases. Nonetheless, companies older than 3 are struggling. In 2024, 50% of carrier exits involved these businesses, compared to 37% in 2023.

The primary reason for this exodus is cash burn, as falling trucking rates during the recession drained reserves. Southern states have been hit hardest, with Georgia seeing a 7.2% drop in operations and Texas a 4.3% decrease. Meanwhile, Indiana stands out as the only top-10 trucking market to experience growth, having been less affected by the trucking boom and the freight recession.

Our Take

While strong consumer demand during the holiday season will drive positive freight growth, we expect a short-term dip in new carrier entries as many wait for the new year to begin operations. In 2025, rising freight rates will likely stabilize the market, with older trucking companies better positioned to stay afloat. Newer operators, particularly in large states like California and Texas, may face higher turnover as rising costs challenge their resilience.

State of Theft and Fraud: Spikes around the holidays

As we approach the holiday season, the risk of theft and fraud is higher than ever, especially for businesses operating within the physical economy. The rise in cargo theft and credit card fraud presents a significant challenge for companies during the holidays, as financial exploitation and the threat of stolen equipment, vehicles, and cargo rise.

Surge in cargo theft

Cargo theft surged 49% in the first half of 2024, and the holiday season will likely exacerbate it even more. Cargo thieves are particularly opportunistic during the holidays when both consumer goods and valuable equipment are in higher circulation and businesses may be stretched thin on security resources. Many of these crimes occur at unsecured or poorly monitored facilities or when trucks are left unattended during deliveries. A review of holiday theft trends from the past five years indicates an average loss of $121,473 per theft, making these crimes a significant financial burden for companies.

Companies are increasingly using real-time tracking technology and AI-powered security systems to combat this trend. Tools like these provide instant alerts that allow businesses to track vehicles and goods in real time and recover stolen items quickly.

Our Take

In the construction industry, GPS tracking helped recover $5 million in stolen equipment, proving that investing in technology pays for itself in theft prevention alone.

Rise in credit card fraud for commercial vehicles

The holiday season also brings heightened financial risk, particularly in the form of credit card fraud and fuel card skimming. According to Motive’s Physical Economy Outlook, 44% of business leaders report that fraud is having a significant financial impact on their operations, and many remain uncertain about how to detect it effectively.

Fraud, especially in the form of fuel card theft, is a growing issue for companies operating fleets. Industry leaders estimate that 19% of current fleet spend is lost to fraud or theft. That figure rises to 22% in industries like construction. For businesses operating on thin margins due to fluctuating costs like fuel, maintenance, and insurance, these losses are especially painful.

To mitigate these growing risks, businesses must adopt a proactive and technology-driven approach to physical and financial security.

Our Take

Businesses with physical operations are gradually becoming more aware of fraud and theft, and their impact on operations. However, there is still a significant gap in effectively addressing these issues. Within the large transaction volumes generated by enterprise fleets, fraud often goes undetected. Furthermore, theft is often exacerbated by insufficient monitoring of trailers, depots, and warehouses. Without the support of AI and 24/7 monitoring, businesses remain vulnerable to these costly threats.

Looking ahead: Outlook for the holiday season and 2025

Looking ahead to the 2024 holiday season and into 2025, the outlook for businesses operating fleets and managing logistics is defined by both risk and opportunity. Heightened safety concerns, rising freight demands, and shifts in retail and theft trends will require proactive strategies to address. Implementing advanced technologies like AI-powered dash cams, 360° cameras, real-time tracking tools, and robust security systems will be crucial for maintaining operational efficiency and protecting assets. As businesses adapt to these emerging trends, those that invest in technology and innovation will be better positioned to thrive this holiday season and beyond.

Is your business ready for the holiday rush and beyond?

Understanding the macroeconomic landscape can help you prepare for the holiday rush and 2025 planning. Having a strategic partner and investing in the right technologies can take your business to the next level. Motive offers insights, strategies, and AI-powered solutions to help you address safety risks, freight trends, and rising costs head-on. Use our ROI calculator or take a tour of the Motive Integrated Operations Platform to get started.

Data methodology

The Motive Holiday Outlook Report uses aggregated and anonymized insights from the 1.3 million drivers using the Motive platform, as well as publicly available government data from the Federal Motor Carrier Safety Administration, U.S. Census, and U.S. Department of Transportation.