Welcome to the August edition of the Motive Monthly Economic Report, where we analyze the major trends in the supply chain and economy across the Motive platform during the past month. Keep reading for a front-seat view into key factors currently influencing the U.S. economy.

Big Picture: The freight recession is moving upmarket, trucking jobs decline, and after a stronger than expected July 4th, retail demand has corrected.

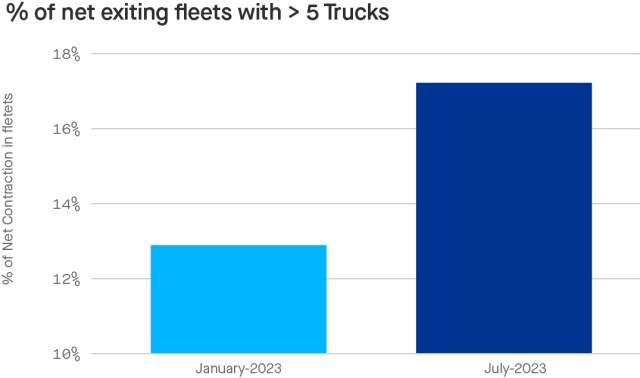

- July data showed continued declines in US carriers, but with a key difference: fleets of 5 vehicles or less that are exiting fell by 5%, meaning more exits were mid-sized to larger fleets than we’ve seen in 2023.

- Motive expects the current rate of contraction to continue, and more truck drivers could be unemployed as a result.

- Retail demand trended back downward post-July 4th, showing a 15% year-over-year decline.

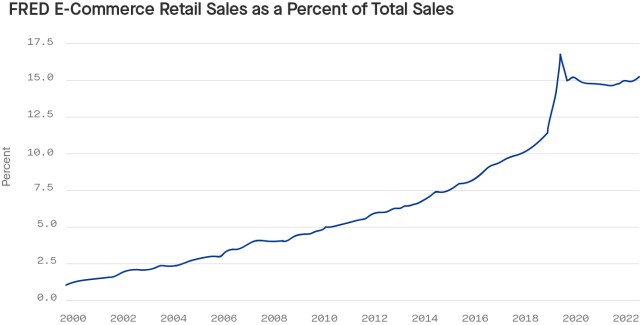

- The freight recession may be a “detox” from the pandemic’s artificial demand highs, as ecommerce growth is now back in line with pre-pandemic 10 year averages.

Freight recession moves upmarket

July brought another month of contraction in the number of authorized carriers, and a larger portion of them were fleets of 5 vehicles or more (from 12% to 17%). Early in the freight recession smaller carriers got hit hardest by changing retail diesel and freight spot market prices, but as the conditions have continued, the larger fleets are feeling the effects more significantly. Evidence of this can be found in the recent news about Yellow filing for bankruptcy.

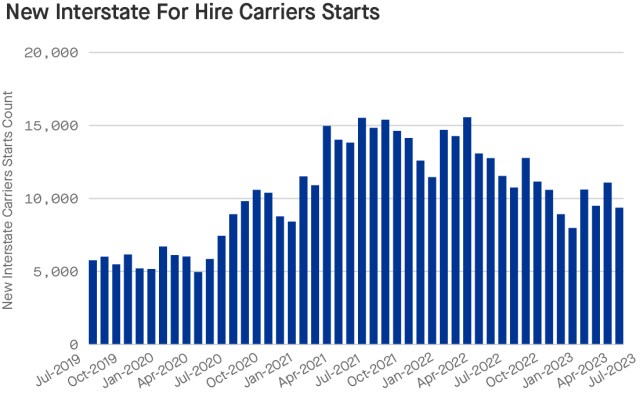

New carrier starts continue reversion to pre-pandemic levels

Not only have trucking jobs decreased in consecutive months (June and July) for the first time since early in the pandemic, but there are also fewer opportunities for displaced drivers. As more companies are leaving the market (see above for Change in Authorized for Hire Carriers Index), new carrier starts declined over 7% in July, continuing the trend of reverting to 2019 levels and marking a 29% decline since the beginning of the year. Motive’s data suggests the current rate of contraction to continue, meaning that more and more truck drivers could continue to hit the job market as these conditions persist.

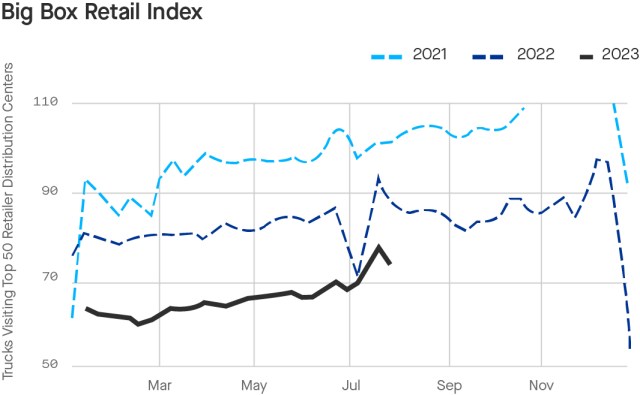

After a 4th of July surge, retail demand shifts downward again

Motive’s Big Box Retail Index that observes trucking visits to warehouses for the top 50 retailers in the US dropped in the last two weeks of July, showing a year-over-year decline of 15%. The first two weeks of July (which included July 4th and Amazon’s Prime Day) seem to have marked the peak of demand for 2023 given this downshift. This further supports the idea that the freight recession will remain through the rest of 2023.

Plummeting toward…normal?

According to recent data from the St. Louis Federal Reserve, the downturn in e-commerce retail sales growth has actually brought it back in line with pre-pandemic 10-year averages. While the downturn in consumer demand and the resulting freight recession have been challenging for many carriers, it may also represent a “detox” from the artificial highs of consumer demand (and gross margins) during the pandemic. Similar to mortgage interest rates now being at more historically common levels, it may be that trucking’s lack of growth is less a catastrophe and more a reversion to normal levels.

U.S. Census Bureau, E-Commerce Retail Sales as a Percent of Total Sales [ECOMPCTSA], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/ECOMPCTSA, August 4, 2023.

Key takeaway: In this challenging market, efficiency is king

The pandemic created highly favorable economics for trucking companies with unprecedented demand as people spent more on goods than services. This created high rates for moving goods. Diesel prices were low, so these companies saw increased revenue growth.

At the same time, interest rates were low and consumers and businesses received government stimulus. Some companies preserved cash while others spent it. But as consumer demand trends lower, retailers bring in inventory closer to demand, and rates continue to increase, businesses focused on operational efficiency and preserving cash are better prepared to weather the storm. In short, the focus for freight businesses right now and going forward has to be efficiency.

Data Methodology

The Motive Monthly Economic Report uses aggregated and anonymized insights from the Motive network, as well as publicly available government data from the Federal Motor Carrier Safety Administration, U.S. Census, Federal Reserve Bank of St. Louis, and U.S. Department of Transportation.