In a panel discussion recently held at the 2017 McLeod Software’s User Conference, fleet executives talked about some of the biggest challenges the trucking industry is expected to face once the ELD mandate takes effect. In this article, we discuss the impact to load planning and freight sales.

According to the panelists, these challenges involve an industry-wide “culture change” in how hauling runs are scheduled and how shipments are being priced.

Once the ELD rule is implemented on the 18th of December 2017, carriers are bound to experience the said challenges. This is mainly due to the 2013 hours of service (HOS) rules being digitally monitored and strictly enforced.

Carriers which were previously lenient in keeping with their HOS compliance would no longer be able to do so because of the automatic data tracking and tamper-resistant features of electronic logging devices.

Because of the strict enforcement of the Hours-of-Service regulations (which aim to ensure that exhausted drivers are kept off the road), the FMCSA estimates that the ELD mandate would help save approximately 26 lives and prevent about 562 injuries each year.

Aside from this, the ELD mandate is also expected to cut on operational costs in the trucking industry by reducing an estimated $1 billion worth of paperwork-related costs per year.

With the coming operational changes that motor carriers across the country are bound to face, industry experts now emphasize the need to educate trucking company employees of all levels about the ELD mandate.

Transition to ELD mandate compliance

According to Jerry Harris, Gypsum Express’ Vice President of Vans and Dedicated Operations, education about the ELD mandate should be given to all employees of the company — including human resource and payroll officers.

Gypsum Express is one of the country’s largest privately-owned flatbed carriers with a fleet size of 700 trucks in its headquarters in Baldwinsville, NY.

The company switched to ELDs about five years ago, losing only two out of their 500 drivers who “wouldn’t even give it a chance.”

Paul Davis, the IT manager of Best Logistics Group, mentioned that his company also took a hit due to their transition to the ELD mandate and lost two of their 300 truck drivers.

Davis explained that one of the two drivers who decided to leave the company chose to do so because of how ELDs gave him the “Big Brother” feel in terms of how these devices apparently monitored his daily operations.

On the other hand, Davis said the other driver chose to leave because of how he wasn’t able to get a hang of the technology being used.

The fact that out of 800 drivers these two companies only lost four drivers is a testament that the upcoming ELD mandate is not going to cause a “mass exodus” of drivers. Despite the rumors, data suggests that the trucking industry is adapting well to the ELD rule.

Moreover, Harris said Gypsum Express easily recovered from these slight difficulties and integrated the use of ELDs into their daily operations:

“Leadership proved huge; our owner got up and said we’re going to see this through and to bear with us. [That] push from the top got us over the top.”

For those who are still uncertain about transitioning their fleets to ELDs, Harris said:

“The rules haven’t changed. It’s just a different manner of recording it. How you approach the change with your people is one of the biggest things. You can’t do it halfway. It’s got to be everyone in the organization pulling in the same direction.”

In addition, Lamar Quinn, a General Manager from R.E. Garrison Trucking, also believes in the importance of educating all trucking company employees about the ELD mandate, especially those who handle sales.

The Vinemont, Alabama-based company switched to using ELDs back in 2015.

Although the company experienced a drop in driver productivity in the early stages of their transition, Quinn said the circumstances that resulted because of their use of ELDs led to their sales team focusing more on their efforts in acquiring the “right freight.”

He further stated that their use of ELDs eventually led to an increase in their driver productivity by 17%.

Their improved productivity translated into a 30% increase in their weekly revenue per truck, which went to as high as $4,400 each week from $3,600 a week per truck.

Quinn likewise said that R.E. Garrison now offers their drivers better home time schedules because of the improved freight quality resulting from the use of ELDs.

According to Quinn:

“The ability for drivers to have quality home time now truly exists, thanks to ELDs. It’s part of the plan; we couldn’t do it before.”

Changes to load planning

Harris noted that the biggest challenge the company had to face with their switch to using electronic logs was making sure that load planners always had tasks ready and available for drivers to perform.

He pointed out that there have been cases in their transition where drivers who arrived at distribution centers after a long hauling run had to wait until their load planners have decided which delivery to take next, rather than immediately sending him or her off.

“Too often, my planners were reactors. It really forces you to plan. If they get up, start their clock, drive into our office and stand there for three hours while we figure out today’s game plan, we just wasted a third of their day. Really be cognizant of the clock running and not running.”

Quinn also shared the same sentiments on how the ELD mandate changed the way their load planners are now scheduling their company’s hauling orders.

According to Quinn:

“This is not baseball; you don’t get three strikes. ELDs tell you where the ‘bad freight’ is. Planning is huge; we need to select the right freight, and we needed our sales team to educate our customers on proper lengths of haul. This changed our entire culture.”

With the ELD mandate, load planners from R.E. Garrison are now looking for either one-day freight moves that haul for a maximum length of 500 miles or two-day freight moves that reach up to 1,000 miles.

As what Quinn explained:

“We needed to get out of that 600 to 700-mile length or haul or price it very differently.”

In addition to this, Davis also noted how the use of ELDs affected the role of driver managers in his company — they are now aware of what “real time” is available for their drivers.

Davis further elaborated on this by saying:

“It’s been a rude awakening to logistics people who never cared about hours. Drivers now know when their day starts and when it ends; there is no ambiguity. It’s really changed what they are supposed to do and has put them in more control.”

Changes to freight transactions

Another challenge that Gypsum Express faced ever since its transition is striking a balance between the demands of customers who require shorter hauling time, but do not allow their trucks to be temporarily parked at the delivery site.

Harris said:

“We had to tell customers when loads could not be legally hauled. We also had to work with customers that demanded firm delivery times but would not provide parking at their site.”

Because of the current nationwide shortage of parking locations for trucks (as reported by the American Transportation Research Institute), Harris compares these occasions to throwing a dart and expecting to hit a target that is 500 miles away.

According to Harris:

“Things have to fall so specifically in line to make that happen. I tell them we’ll be as close as we can, but if we can’t park there, we do have to take our break, and we have hours-of-service laws to contend with. Those places become a real challenge. We’re not there yet.”

In addition to this, Quinn believes that charging shippers with additional fees for detention time now play a critical role in the industry’s operations because the ELD mandate strictly monitors the observance of a driver’s maximum on-duty time.

Quinn said:

“If a shipper wants us to go to an unfavorable consignee with excessive dwell time, we’ll give them that truck for a $650 fee – whether we then get out early or not.”

Harris believes that one of the common struggles carriers are currently facing is educating and changing the perception of customers to understand how the strict observance of the HOS rules legally affect a driver’s freight delivery schedule.

Harris stated that:

“All of our in-house people who need to be educated, we’ve accomplished that. The outside world still doesn’t get it. That’s a constant battle, and I believe it will be for years.”

What’s next?

There are less than three months left before the ELD mandate takes effect.

Carriers caught unprepared during its implementation deadline could have their fleets charged with hefty fines that might cost more than $100 per compliance violation cited.

Because of how these ELD violations could hamper your business operations, we recommend that you equip your fleets with an FMCSA-registered ELD solution as early as today.

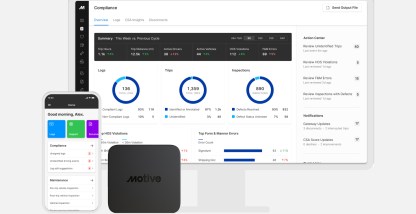

The Motive ELD is FMCSA-registered, affordable, and has many useful fleet management features for fleets of all sizes. Call 844-325-9230 if you have any questions.