Fleet insurance provides many benefits for companies that own a fleet of commercial vehicles. It protects businesses from repair costs and medical bills, reduces office admin work, and lowers insurance premiums.

In this guide to fleet and truck insurance, you’ll learn what fleet insurance is, its costs, the types of commercial truck insurance, and how to find the best insurance for your fleet.

What is commercial fleet insurance?

Commercial fleet insurance is a financial protection contract that insures company vehicles. It’s a critical part of fleet management, because it helps companies avoid losses from accidents, theft, or vehicle damage.

The Federal Motor Carrier Safety Administration (FMCSA) requires commercial fleets to get fleet insurance when applying for operating authority.

What information do you need to take out fleet and commercial truck insurance?

Insurance providers typically require various information to underwrite a fleet insurance policy. Here’s a list of frequently requested documentation you’ll need when applying:

- Current commercial insurance policy declarations page.

- If you don’t have a declarations page, use your current personal automobile insurance contract or request a copy of the declarations page directly from your prior insurer.

- Your commercial driver’s license numbers and their relevant driving histories, plus any violations, infractions, or citations.

- Vehicle identification numbers (VINs) of every commercial vehicle to be insured, including a summary of each vehicle’s safety features.

- If you don’t have the VINs at the time of application, give as much relevant vehicle detail as you can, such as the model classification, weight, manufacturer, and the manufacturing year.

- Specified years of documented loss runs from previous insurance providers for all requested coverage.

- Audited or reviewed financial statements from a given period, including income through brokerage or trip lease operations.

- Copies of International Fuel Tax Administration (IFTA) reports (schedule to be specified) indicating vehicle mileage by state and total mileage for a given period.

- Safety ratings from federal compliance reviews, and copies of fleet safety and maintenance programs.

- Copies of permanent lease and trip lease agreements.

What types of commercial truck insurance can you get?

Individuals and companies who own fleets of commercial trucks can apply for any of these motor fleet insurance types:

General liability insurance

Also called public liability insurance, general liability insurance in trucking covers property damage and third-party bodily injuries resulting from business activities unrelated to driving commercial vehicles.

The FMCSA mandates freight forwarders, owner-operators with authority, and motor carriers to carry general liability insurance.

Motor carriers also typically insure their commercial drivers with this policy type.

Primary liability insurance

Also known as trucking liability insurance, primary liability insurance is the minimum level of insurance required for operating trucking and transport enterprises.

Primary liability insurance doesn’t cover damages to commercial vehicles or cargo. This policy type requires motor carriers and owner-operators with authority to list or schedule each vehicle on the policy. Otherwise, the insurance provider won’t release claims.

Non-trucking liability insurance

Non-trucking liability is insurance for using vehicles for non-business purposes. Non-trucking liability insurance covers personal use of your vehicle between your return and the next dispatch schedule.

Owner-operators under lease agreements with motor carriers can benefit from this truck fleet insurance type. Although owner-operators have general liability insurance coverage, that policy only covers business operations. Non-trucking liability insurance protects owner-operators from losses during non-business-related incidents.

Bobtail (owner-operator) insurance

This owner-operator insurance protects policyholders after they deliver cargo and when using their vehicle for purposes other than trucking.

Owner-operators under lease agreements can get bobtail insurance when operating for mobility and not while transporting property for the motor carrier under whose operating authority they deliver, and whose liability policy they depend on while trucking.

Bobtail insurance sounds like non-trucking liability insurance. However, there’s one crucial difference.

Bobtail insurance covers owner-operators when using the trucks without trailers whether for personal or commercial purposes. Non-trucking liability protects the owner-operator when using the truck for personal intentions, whether or not they carry the trailer.

Bobtail insurance doesn’t cover damages to the owner-operator’s truck, but only the liabilities arising from an accident.

These liabilities include:

- Expenses for a lawsuit if one occurs.

- Hospital bills and treatments for any injuries inflicted on a person.

- Payment for all property damages.

Motor truck cargo insurance

Motor truck cargo insurance offers protection on the freight or commodity hauled by a for-hire owner-operator. This policy type covers liability for lost or damaged cargo resulting from vehicle crashes, fire, or the striking of a load.

Physical damage insurance

Physical damage protection is a general term for insurance policies covering your commercial vehicles. Physical damage coverage includes collision insurance and a full, comprehensive policy.

Owner-operators can also opt for fire and theft protection with combined additional coverage (CAC), a limited insurance for specific heavy-duty commercial vehicle types.

Contingent cargo insurance

Contingent cargo insurance is coverage for freight brokers involved in complicated claims between a shipper and a motor carrier. This commercial truck insurance covers typical causes of losses, such as cargo theft and damage during transit, for any carrier.

Freight brokers should always carry this type of haulage fleet insurance to be prepared for the following incidents:

- One or more parties fail to fulfill their duties.

- The insurance provider declines a cargo insurance claim.

- The responsible carrier unwillingly or can’t pay for losses incurred to the shipper’s cargo.

Workers’ compensation insurance

Workers’ compensation insurance covers costs associated with an employee’s work-related injury or illness. This insurance even covers legal fees should the employee choose to sue the company.

State laws mandate most companies to obtain this type of motor fleet insurance in case their staff gets hurt on the job.

Refer to your state laws for trucking-related injuries covered by workers’ compensation insurance. Regulations usually cover:

- Work-related illnesses from exposure to hazardous chemicals.

- Traumatic injuries after a vehicle accident.

- Stress injuries from repetitive cargo loading and unloading.

How much does truck and fleet insurance cost per month?

There isn’t a single answer to “how much is truck insurance a month?” because the cost depends on several factors, including insurance type and carrier. Cheap truck insurance doesn’t always mean best, and fleet managers looking for cheap truck insurance should find the pricing option that works best for them.

The estimated monthly insurance cost for owner-operators with their own authority can run from $667 to $1,250.

If you’re an owner-operator leasing to a motor carrier, the average monthly truck or semi-truck insurance cost can range from $167 to $333.

The monthly semi-truck insurance cost also varies according to factors such as insurance type and carrier. Here are some average price ranges by insurance type:

- Primary liability coverage: $416 to $1,000.

- General liability: $42 to $66.

- Umbrella policy: $50 to $58.

- Bobtail insurance: $29 to $50.

- Cargo insurance: $33 to $100.

- Physical damage: $83 to $250.

- Occupational or workers’ compensation insurance: $133 to $183.

Check with your insurance provider for the monthly insurance cost applicable specifically to your fleet.

What factors affect the cost of commercial truck insurance?

In addition to carrier and insurance type, the cost of getting truck insurance depends largely on your commercial fleet’s size, purpose, classification, and more.

For instance, service fleets usually pay cheaper insurance premiums than delivery fleets, since the latter also needs to protect its cargo.

Here are some other factors that can impact how much truck insurance costs:

1. USDOT operating and driving history

If you’re an owner-operator with several violations of U.S. transport laws, your premiums will likely be more expensive. Even offenses as minor as a speeding ticket can raise insurance costs.

If your USDOT operating history shows that you demonstrate unsafe driving behaviors, your portfolio will appear risky.

Your policy might even be costlier if your driving history shows your involvement in several accidents. That’s because large heavy vehicles with massive truckloads can harm people and properties more than lighter vehicles.

2. Policy requirements

There are a few policy requirements to be aware of when looking at the factors that affect commercial truck insurance costs.

FMCSA requirements

The FMCSA mandates different financial responsibility limits for commercial vehicles and motor carriers:

- For-hire interstate general freight carriers: $750,000.

- For-hire and private carriers of oil and specific hazardous waste types: $1 million.

- For-hire and private carriers of other hazardous substances: $5 million.

These numbers are the minimum mandatory liability amounts and are typically higher than most state limits, which means drivers and carriers can expect to pay higher premiums.

Insurance policy requirements

Some insurance contracts require carrying additional coverage according to your protection needs and policy type. This extra coverage can include trailer interchanges such as physical damage from theft, vandalism, fire, and explosion. Motor truck cargo protection is also an additional inclusion.

Getting contract additions to protect your assets increases your fleet insurance rates.

3. Cargo type

Some products pose a greater risk to transport than other cargo. For example, if you carry heavy farm equipment and get in an accident, you can cause more severe injuries than a truck delivering fruits and vegetables.

This type of risk can also mean higher insurance rates but be sure to disclose the type of cargo you plan to transport when getting a quote from your insurance firm. Being precise and transparent with this information can lessen the risk of a denied claim later.

4. Industry risk

Similar to cargo type, if your business type generally has greater operational risk, your insurance premiums will likely get more expensive.

For instance, a food truck that’s always on the road has a higher chance of getting into an accident. Construction vehicles frequenting unsafe job sites are also high risk.

5. Location

Some states have cheaper insurance rates than others because of their varying required minimum liability amounts.

For example, you’ll find expensive premiums when operating in Louisiana, Florida, Delaware, New Jersey, and Rhode Island.

6. Operating radius

If your commercial vehicles operate in several areas (or have a large operating radius), you expose your business to more risks because you have longer driving periods between stops and more route options, including potentially less familiar roads.

If you’re a semi-truck driver traveling regionally, your semi-truck insurance cost can go higher than drivers with local routes.

7. Vehicle classification

Heavy semi-trucks will have a higher semi-truck insurance cost than lighter pickup trucks transporting the same commodities.

This is because the semi-truck has greater potential to cause severe damage in accidents than the pickup truck.

Additionally, newer vehicles have higher insurance rates since they’re costlier to replace or repair than older vehicles.

Top tips for reducing truck and fleet insurance

Follow these tips to lower your fleet insurance costs:

1. Align your insurance limits with the level of risk involved

Underinsurance puts your company’s profitability at risk because you end up paying hefty amounts of money if you experience accidents. On the other hand, you could be wasting money if you pay for excessive coverage.

Find the appropriate limits for your commercial truck insurance, compare policies from different providers, and get one that best matches your protection needs.

2. Attain excellent SAFER scores

Safety and Fitness Electronic Records (SAFER) refers to FMCSA’s system with records of motor carriers’ safety-related profiles and data.

You can get SAFER scores that reflect your compliance with road safety and transport regulations. These ratings and other system data are publicly available online. Insurance firms can refer to this information to assess your risk portfolio and policy premiums.

If you have low SAFER scores and several noted violations, you might be paying for more expensive insurance contracts.

Aim to get excellent SAFER ratings by adhering to the requirements of transport laws. Some examples of mandated activities include keeping updated Hours of Service (HOS) records and maintaining your vehicles.

3. Pay your insurance premiums in lump sum

Avoid paying in installments as much as possible. Opt to pay in full with the annual rate significantly lower your premiums.

4. Increase your deductible

Raise your “voluntary excess” or deductibles. This refers to the amount you pay for losses out of your company’s money when making a claim. The deductible can be a specific figure or a percentage of your truck insurance policy.

For instance, if you have a coverage of $10,000 and your deductible is $1,500, the insurance firm covers you for $8,500 (or up to your coverage limit).

Deductibles are a means of sharing the risk between you and the insurance provider. The larger your voluntary excess is, the cheaper your policy can be.

Indicate only the deductible amount that you can afford to disburse in the event of an incident. Avoid inputting exaggerated figures simply to lower your premiums.

8. Insure all or several vehicles with one insurance firm

Many insurance providers offer discounts or incentives when you insure your entire fleet with them. Ask your insurance firm the size or number of commercial vehicles you can apply for coverage to get lower premiums.

9. Improve your drivers’ operating behaviors

Insurance providers factor in current and historical driving behaviors to determine your commercial vehicles’ risk levels and premium rates.

Regularly demonstrating unsafe driving habits can increase the potential of getting into accidents and causing injuries and fatalities. That translates to more expensive insurance policies.

Train and re-mentor your drivers to enhance their behaviors when operating on the road. Below is a list of safe driving practices:

- Switch off idle engines.

- Anticipate road conditions.

- Reduce driving speed.

- Use air conditioning minimally.

- Avoid activities that can lead to drowsy driving.

- Maintain tire pressure.

- Eliminate unnecessary vehicle weight.

10. Execute an effective fleet safety program

Developing a world-class safety program requires a two-pronged approach.

Start by recognizing that drivers are a fleet’s most important asset. Build a strong safety culture to improve safety outcomes.

Next, adopt an integrated fleet management solution. Of course, these outcomes must be measured and tracked over time.

All fleets can do this using traditional measures such as roadside violations and crash rates, which can provide valuable insight into the success of the safety program. Unfortunately, these are trailing metrics that measure outcomes that have already happened and impacted a fleet’s public safety metrics.

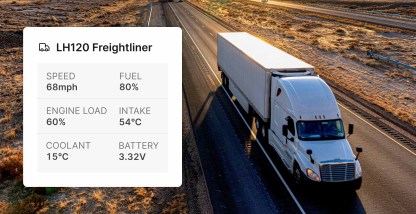

More sophisticated fleets can use data from onboard monitoring systems to get real-time feedback on driver behavior and actions, allowing them to address poor behaviors before they result in a violation or, even worse, a tragic accident.

These fleets should work with their vendors to unlock these technologies’ true potential and analytic power.

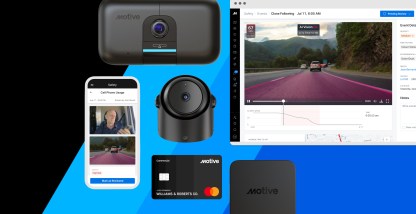

11. Install safety-related, risk management technologies

Set up robust technologies to minimize safety risks, optimize your fleet protection program, and improve your chances of getting low-cost truck insurance.

These technologies include GPS trackers, dashboard cameras, electronic logging devices (ELDs), and vehicle maintenance solutions.

GPS tracking tools give real-time vehicle location updates and telematics data, such as direction, speed, and fault codes. If your vehicles are stolen, you can track their whereabouts and enhance your chances of catching the culprit and retrieving your assets.

Dash cams integrated with GPS trackers can give you additional visibility into your drivers’ risky behaviors.

Use the footage to exonerate your drivers from unfair blame, enhance your coaching sessions, keep vehicles in optimal conditions, and improve your fleet’s safety profile.

Dash cams can also increase ROI, especially those with artificial intelligence (AI). AI dash cams can help prevent accidents by reducing distracted driving and other high-risk road behaviors. They use AI to detect unsafe driving behaviors and notify drivers in real time.

With these alerts, you and your drivers can act promptly to avert potential, profit-draining collisions or minimize the incident’s impact and possible losses.

ELDs also help lower insurance premiums. These devices record your drivers’ HOS and help them avoid overtimes leading to exhaustion, drowsy driving, and accidents.

Pair your ELD solutions with GPS trackers to demonstrate your fleet’s HOS compliance during the insurance firm’s evaluation of your primary ratings.

Lastly, use vehicle maintenance solutions alongside your developed maintenance plans to get cheaper premiums.

These devices and plans show that you carefully look into your vehicles’ conditions and ensure their safe, optimal operation.

In particular, vehicle maintenance solutions can remind you of any scheduled upcoming upkeep and inspection activities. Maintenance solutions can also detect and notify you of fault codes, enabling you to respond immediately and maintain vehicle safety.

Is cheap insurance worth the risk?

Getting low-cost truck insurance isn’t wrong. Rather, it’s reasonable.

However, if you only consider low prices when looking for commercial truck insurance, you can miss out on securing your fleet’s full protection needs.

You can also encounter unrealistically low quotes that are often cheap for the following reasons:

- The policy fails to give critical coverage. Insurance firms usually sell fleet insurance in packages with multiple coverages, such as physical damage, liability, bobtail, cargo, and non-trucking liability. General liability or umbrella coverages are sometimes essential but insurance providers can exclude them from your quote.

- The policy has lower coverage limits. Insurance policies don’t provide equal dollar amounts to cover the same fleet needs. For instance, some policies offer up to $15,000 for cleanups after a cargo spill. Others can insure you for that same incident for $7,000 only. Ensure your policy has limits that satisfy your preferences and business requirements.

- Industry misclassification. Unethical agents can miscategorize your company to manipulate your premium rates and make them look like a bargain. Make sure to double-check that this isn’t one of the reasons your quote is inexpensive.

How to find the best insurance for your truck or fleet

Consider these tips when selecting the most suitable truck insurance for your commercial fleet:

1. Inquire about the kind and amount of coverage your fleet will get

Ask your insurance firm what its specific coverage will be for your fleet since providers vary in their policy offers. Make sure the insurance firm knows your company inside and out to get proper advice on your coverage.

Be open about your company’s overall nature, the location of your operations, and your future plans for your fleet. Then, compare the insurance costs and specific coverage details offered by the insurance firms you’re considering.

2. Know your general liability limits

Know your policy’s occurrence and aggregate limits. The occurrence limit is the amount you’ll pay to make one claim, while the aggregate limit is the full price your policy pays for all claims filed in one year.

This information lets you identify whether to file a claim for an incident, pay for the damages voluntarily, or find feasible alternatives without compromising your coverage.

3. Learn how the claims processes will go

Knowing how to file a claim after an incident enables you to get back to your business operations as soon as possible.

Ask these questions:

- Can you make a claim online, through a mobile app, or in-person only?

- How long will the claims process take?

- What are the requirements for filing?

Additionally, find out how to check truck insurance status conveniently after making a series of claims to stay updated with your remaining coverage.

Learn how to save on fleet insurance costs in this post.