IFTA fuel tax reports are an essential part of the job for interstate commercial drivers. Drivers must file quarterly IFTA fuel tax reports to stay compliant. If you’ve found yourself wondering how IFTA reports work or whether or not you’re required to file, wonder no more! Here is more information on IFTA, what it is, how it works, the deadlines for submitting fuel tax reports, and most importantly, whether or not it applies to you.

What is IFTA?

IFTA or the International Fuel Tax Agreement is an agreement between different US states and Canadian provinces. This agreement simplifies the process of redistribution of fuel taxes that intrastate carriers pay in different states.

Before the fuel tax agreement, interstate drivers were required to acquire fuel permits from every state that they drove in. Now, carriers only need to report jurisdictional fuel use to their base state, which then collects taxes on net fuel use and reimburses other states.

The IFTA agreement is among the following US states and Canadian provinces:

U.S. states that are members of the IFTA agreements

- Alabama

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- West Virginia

- Wisconsin

- Wyoming

In short, if you drive in any of these 48 states (all, except for Hawaii, Alaska, and the District of Columbia), the IFTA agreement will apply, subject to other conditions.

Canadian provinces that are members of the IFTA agreements

- Alberta

- British Columbia

- Manitoba

- New Brunswick

- Newfoundland

- Nova Scotia

- Ontario

- Prince Edward Island

- Quebec

- Saskatchewan

Who needs IFTA?

Here are the criteria that define whether or not you need an IFTA license:

- Are you based in a member jurisdiction? (The above-mentioned list of US states or Canadian provinces)

- Do you operate across two or more member jurisdictions?

- Do you operate a qualified motor vehicle?

If your answer is yes, then you need an IFTA license.

What is a qualified motor vehicle?

The International Fuel Tax Agreement defines “qualified motor vehicle” as a motor vehicle used, designed, or maintained for the transportation of persons or property.

A qualified motor vehicle:

- Has two axles and a gross vehicle weight or registered gross vehicle weight exceeding 26,000 pounds or 11,797 kilograms

- Has three or more axles regardless of its weight

- Is used in combination, when the weight of that combination exceeds 26,000 pounds or 11,797 kilograms gross vehicle or registered gross vehicle weight

- Is not a recreational vehicle

To summarize, if you are based in a member jurisdiction and operate a qualified motor vehicle across two or more member jurisdictions, you need to have IFTA license and decals issued by your base jurisdiction.

When do you need to file IFTA fuel tax reports?

You need to file an IFTA fuel tax report every quarter — four times a year.

Here are the deadlines for each quarter:

- First quarter: April 30

- Second quarter: July 31

- Third quarter: Oct. 31

- Fourth quarter: Jan. 31

10 frequently asked questions (FAQs) regarding IFTA

Here are 10 frequently asked questions that many drivers and carriers have regarding IFTA and filing fuel tax reports.

- Which states should I register with?

You only need to register with your base jurisdiction state or province.

- Where can I travel using my IFTA license?

As a commercial motor vehicle driver, you can travel in all the member jurisdictions that were mentioned earlier.

- Does IFTA also cover road taxes?

No, IFTA only covers fuel taxes. It does not cover additional taxes, such as New York’s Highway Use Tax, that some states may have.

- What credentials will I receive after registration?

You will receive your IFTA license. The master copy should be kept safe in the office, while each qualified motor vehicle should keep a copy of the license.

In addition, you will also receive two decals for each qualified motor vehicle that should be placed on the exterior portion of the driver’s side and the cab’s passenger side.

- Do I file the fuel tax report if no taxable fuel was used during the reporting period?

Yes, you still need to file the IFTA fuel tax report, even if no taxable fuel was used during the quarter.

- Will I need to file IFTA taxes if I was inactive during a quarter?

Yes, you still need to file IFTA taxes even if you did not move any freight during the reporting period.

- Will I need to file the IFTA fuel tax report if I did not operate outside my jurisdiction?

Yes, even if you did not operate outside your jurisdiction, you still need to file your quarterly IFTA report.

- When do I renew my IFTA license?

You must renew your IFTA license every year.

- What is the penalty if I don’t file my quarterly IFTA return?

The penalty is $50 or 10 percent of the total tax due, whichever is higher. Your license may also be suspended if you do not file a quarterly IFTA return within 30 days after the deadline.

- What should I do to document fuel purchases for IFTA reports?

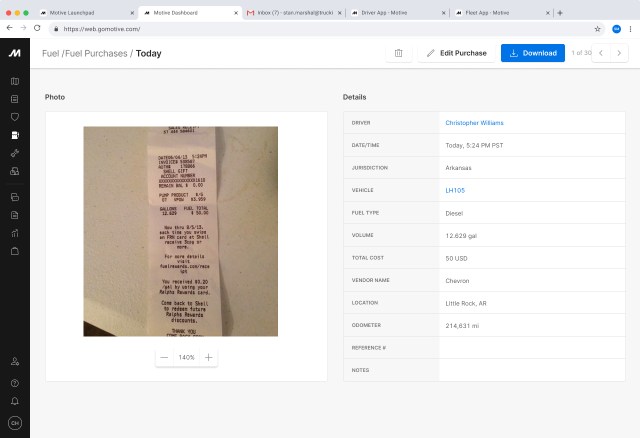

Each driver must collect detailed fuel receipts and retain them. The fuel receipts or invoices must contain the following information:

- Purchaser’s name

- Seller’s name and address

- Date of the purchase

- Number of fuel gallons purchased

- Type of fuel purchased

- Price per gallon

- Unit numbers of vehicle

The easiest way to collect, retain, and upload these fuel receipts is via Motive.

With Motive, fuel receipts can be imported in bulk if you use Comdata or EPS as your fuel card providers.

Additionally, drivers can also easily upload fuel purchases at the point of purchase by taking a photo of the fuel receipt and filling the required information, such as location, cost, and fuel type.

With all the required information in the Motive Dashboard, IFTA fuel tax reports can be easily calculated with just a few clicks. This can save dozens of hours in administrative work and hundreds of dollars in wasted resources.

Learn more about IFTA in our guide.