IFTA reporting is a significant headache for many carriers. Often, carriers have to spend countless hours and allocate several people just to put their records together for their IFTA reports (e.g., fuel purchases and individual vehicle mileage reports). With all the clerical work that comes with completing the task, a carrier’s productivity can easily get hampered.

It wouldn’t be wrong to say that IFTA calculation is a tiresome and time-consuming task for fleets. This blog post will explain how you can simplify IFTA. We’ll cover:

- How does IFTA work?

- A few tips for avoiding IFTA audits

- How you can easily prepare IFTA reports with the Motive ELD solution

Let’s begin.

How does IFTA work?

From a 30,000-foot perspective, the International Fuel Tax Agreement (or IFTA) is the agreement made between the Canadian provinces and some states in the U.S. to simplify the way trucking companies would report their fuel use. The agreement affects carriers who travel in more than one jurisdiction.

The International Fuel Tax Agreement does make life easier for trucking companies. With IFTA in place, carriers won’t have to hassle themselves with having to go to the point of entry of each IFTA member jurisdiction that they travel to. They simply have to get their license from one IFTA member jurisdiction (their base jurisdiction) and be able to travel across different member states or provinces.

Also, carriers will no longer be audited by multiple IFTA auditors, only the base jurisdiction where the carriers obtained their license will do the auditing.

It’s just that the manual calculation process takes a lot of time and efforts. We will get to it later in the post.

Also, as a reminder, here are the IFTA filing deadlines:

- 1st quarter (January to March) — April 30

- 2nd quarter (April to June) — July 31

- 3rd quarter (July to September) — October 31

- 4th quarter (October to December) — January 31

4 tips for avoiding IFTA audits

While IFTA jurisdictions are only required to audit 3% of their accounts on an annual basis (excluding new accounts), your chances of getting audited aren’t as slim as you might think.

While most of the accounts which are meant to be audited are selected randomly, some of them aren’t quite chosen that way. The chances of your audit increase the more IFTA knows that you are prone to error or whenever they see something about your IFTA reports that doesn’t match up.

Following are some tips that you can consider to lower your chances of getting selected for an audit.

- Review your trip sheets to make sure that it shows continuity. If your record shows your truck suddenly reaching Ohio when your truck came from Wisconsin (without showing any records of the states between), it would raise red flags for the people reviewing your records.

- Don’t forget to record your non-taxable or personal mileage. You’ll end up having mileage gaps if you forget to include these in your records.

- Don’t be late in filing your IFTA reports. Delaying increases the chances of your company getting audited. Additionally, it also leads to hefty fines.

- Don’t ever miss recording your mileage and fuel use, so you can be 100% accurate when calculating your quarterly MPGs.

Following these tips can be quite frustrating if you’re keeping track of your records manually. If you want to keep the crosshairs of IFTA auditors as far away from your company as possible, then you have no choice but to follow them.

How to generate IFTA reports with Motive?

There is no hiding the fact that calculating IFTA reports is a hassle for most fleets. It takes time, efforts, resources, and is just an administrative burden that every fleet could do without.

The frustrating and time-consuming process can be made simple with a powerful fleet management system.

Fleets that are using the Motive ELD solution can calculate their IFTA reports in just a few minutes. It only takes a couple of clicks to quickly generate IFTA reports by using the Motive Dashboard for Fleets.

Over 90% of Motive customers use our automatic IFTA reports features for reducing administrative burden, increasing efficiency, and saving money.

Here is how it works.

Using the Motive Dashboard for Fleets, click the IFTA tab from the left sidebar menu.

It takes users to the ‘IFTA Summary’ tab, which looks like this.

On the Summary page, you can view the total distance covered by your vehicles and the total amount of fuel purchased per jurisdiction.

You can add a date range or a vehicle type filter on your reports, too. If you are preparing for an upcoming deadline, you should select the previous quarter.

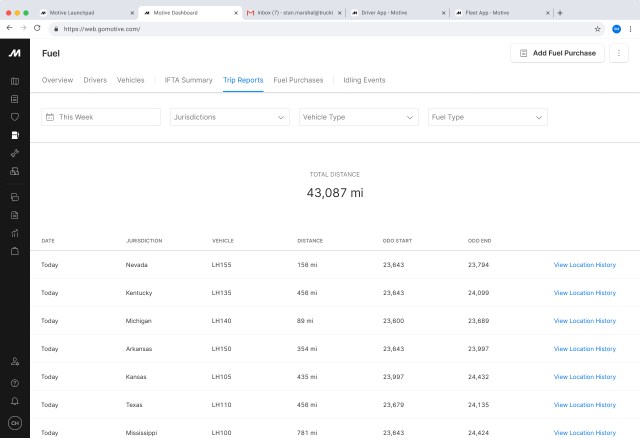

For a more detailed report, you can click the “Trip Reports” tab.

The screen will show all the vehicles in your fleet and an overview of their daily trips.

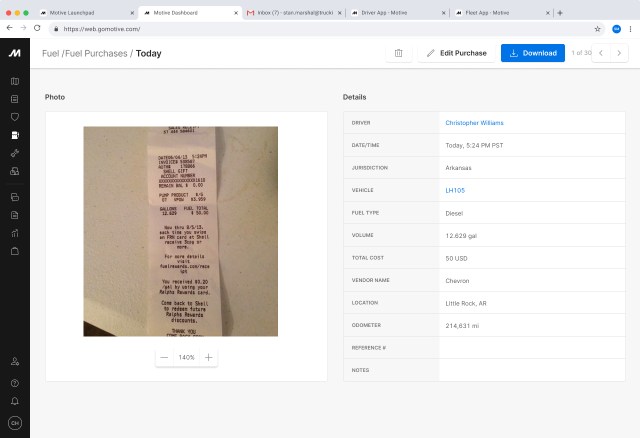

We’ve also released a new feature that helps our users track their fuel purchase reports automatically. Through this new feature, our users only have to upload their fuel receipts. Our system then automatically summarizes the total distance each vehicle covers and the amount of fuel purchased per state or province.

You can upload fuel purchase entries individually or in bulk by uploading a CSV file.

Details of each fuel purchase, along with the receipt and all the other details, are available for easy viewing in the Dashboard.

With all the details made available to the fleet managers in the Motive Dashboard for Fleets, fleet managers can export the summary, fill out the IFTA forms for their states, and they’re pretty much good to go.

What happens when you don’t send IFTA reports?

It’s worth emphasizing how trucking companies who do not send their IFTA reports can be in serious trouble. Not only would not sending their reports be considered as a form of tax evasion, but carriers can be penalized or even be shut down.

When carriers are late in submitting their reports, they also get fined $50 or 10% of their total net tax due with their return, whichever is greater.

Simplify IFTA reporting with Motive

Contact a sales rep to learn the Motive ELD solution can help ease your administrative burden of dealing with tedious paperwork.

You can also request a free demo and have a hands-on experience of how the Motive ELD solution can help you calculate IFTA reports with utmost ease.