How is it possible that in the age of self-driving cars, fleets are still manually tracking their vehicle miles and fuel purchases to complete quarterly IFTA reports?

At Motive, we thought it was time for a change. We started by helping fleets automatically track miles by state or province for every vehicle with a Motive ELD installed in it. The response from our customers has been incredible — 90% use our automatic IFTA fuel purchase reports feature.

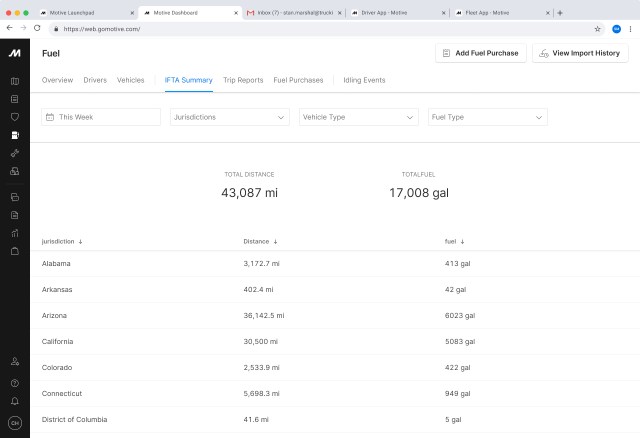

But automatically tracking vehicle miles is only part of the solution. That is why we are excited to announce the launch of automatic IFTA fuel purchase reports. Motive now makes the process of filing your IFTA fuel tax even easier by automatically tracking fuel purchases by jurisdiction for every vehicle in your fleet. Fleets can simply upload fuel receipts and Motive will automatically summarize the total distance and fuel purchased in each state or province for every vehicle in your fleet. You can then simply export the summary and fill out the IFTA form for your state.

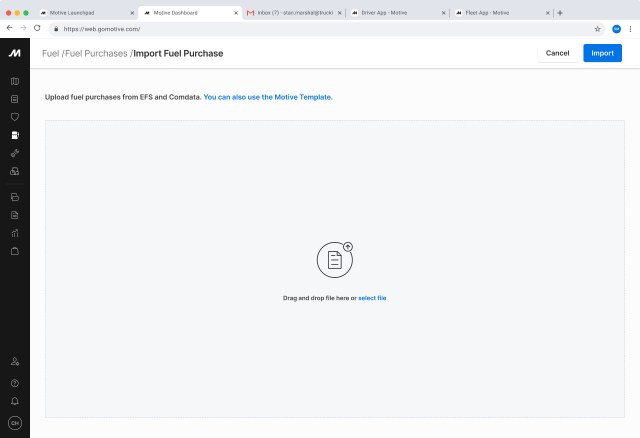

You can upload fuel purchase entries individually, or in bulk by uploading a CSV file with fuel purchase records for your fleet.

You can view and export the total distance and fuel purchased in each state for every vehicle in your fleet.

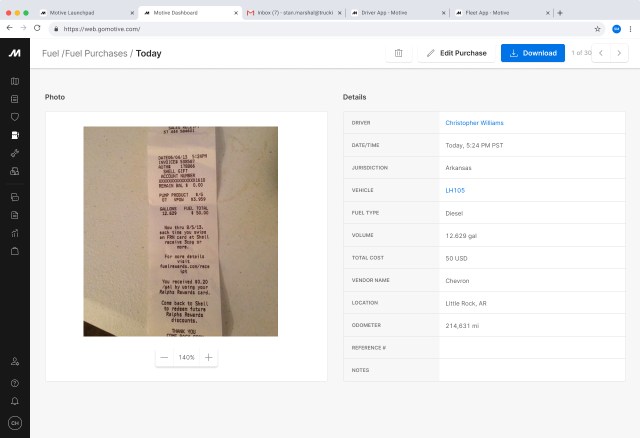

You can also view the details for each fuel purchase along with the receipt.

Simplify IFTA fuel tax reporting with Motive

IFTA trip, and fuel purchase reports are offered as part of the ELD Pro package. Learn about our ELD prices.

As always, feel free to reach out to our support team with any questions or feedback at support@motive.com.