Since 2019 the U.S. trucking industry has seen massive swings, from a boom in trucking firms and cargo volumes during the demand boom of the pandemic, followed by the historic freight recession that seems to only recently have improved. The U.S.’s neighbor to the south, however, has not experienced the same turmoil. In fact, Mexico’s trucking industry has seen only growth in spite of the many forces plaguing trucking markets in the U.S. and around the world. How is this possible, and what can be learned from it? Let’s take a look.

Shifting Imports

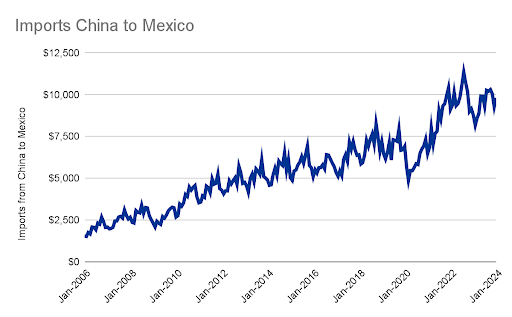

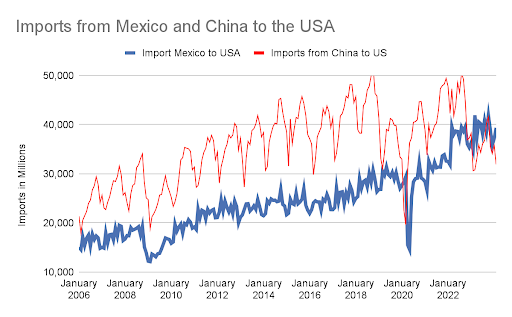

One critical element to observe in these contrasting stories is the shift in imports from China to each country. Since 2019, there has been a notable decrease of nearly 5% in U.S. imports from China, while Mexico has Chinese imports surge by 37% in the same period. January of 2024 alone saw container volumes from China to Mexico rise 59.7% compared to 2023.

While before 2019 there was steady growth of imports into the U.S. from China, it isn’t likely that the level of growth seen previously will return any time soon. Factors like higher Chinese imports to other regions like South Asia and the EU and more protectionist trade policies in the U.S. are factors in this. But there is one commonality between China and the U.S. that may be contributing to Mexico’s carrier market growth: nearshoring.

The Impact of Nearshoring

Moving production facilities closer to the end market (the U.S.), is significantly influencing this trend. Mexico has significant foreign direct investment especially directed to the border states like Nuevo Leon and Coahuila, the top 2 regions seeing investment in 2023. These trends are not only bolstering the country’s economic stature but also its role in North American supply chains. We expect the trend of Chinese investment which grew from $83M in 2012 to $600M in 2022 to accelerate.

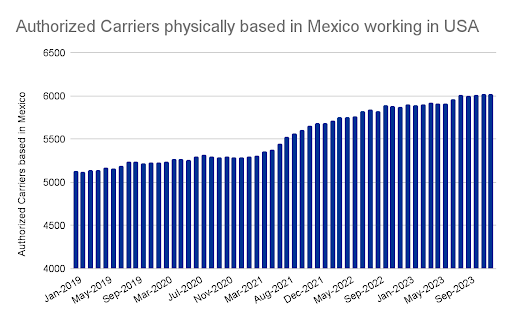

Further to that point, from 2019 to 2023 U.S. imports from Mexico by both ground and ocean transit have consistently risen, culminating in a 33.1% rise in total import freight to the U.S. as of February 2024. In 2023 alone the number of Mexican trucking companies moving goods to the U.S. grew by 2.5%, and the fleet of vehicles expanded by 14%. This contrasts sharply with the U.S., where there has been a contraction of 6.6% in the number of trucking and transportation companies.

Why is this happening? In part because as more U.S. companies move away from direct Chinese imports, they are also investing more in supply chains through Mexico. One sector where this can be observed is electrical machinery, equipment, and parts, imports of which have seen a 33.9% increase from 2019 to 2023. These make up 18% of Mexico’s imports to the U.S., making it a key driver in the demand for Mexican carrier shipments.

Outlook for 2024 and Beyond

As Mexico integrates more deeply into global supply chains, the transportation and logistics sector is poised for ongoing growth. This burgeoning trade relationship with China, coupled with increased manufacturing and transportation capabilities, positions Mexico as a critical node in international trade, especially as businesses and governments look to diversify supply chains post-pandemic.

Mexico’s strategic position and growing economic ties with China are reshaping the North American trade landscape. As the world adapts to new economic realities, Mexico’s role is becoming increasingly significant, promising more opportunities and growth in the transportation and logistics sectors.