The International Fuel Tax Agreement (IFTA) is a fuel tax collection mechanism that affects many interstate commercial carriers. In this article, we will explain:

- What IFTA is and why it exists

- What information carriers must collect

- How carriers report IFTA

- The role of states/jurisdictions in IFTA

- How to simplify IFTA reporting

What is IFTA and why is it necessary?

The International Fuel Tax Agreement, often referred to as IFTA, is a fuel tax collection and sharing agreement between the lower 48 U.S. states and ten Canadian provinces.

Before IFTA, carriers were required to obtain a fuel permit from every state or province they operated in and then report miles and fuel purchases to each jurisdiction. Many jurisdictions had differing filing periods, definitions, and reporting requirements that made compliance time-consuming and complex.

IFTA was created to simplify this process by:

- Establishing uniformity in reporting requirements across all member jurisdictions

- Requiring carriers to only apply for a permit and submit an IFTA report to their base state

Additionally, it’s important to note that IFTA is structured as a “pay now or pay later” system. Any fuel taxes paid when a commercial vehicle purchases fuel are credited to the carrier’s account that is created when they apply for an IFTA permit. At the end of each quarter, the IFTA report calculates the carrier’s net tax owed or refund due.

What information carriers must collect

Information that an interstate motor carrier needs to collect for each of its motor vehicles includes:

- Miles driven in each jurisdiction

- The odometer reading at each state line crossing

- Total gallons of fuel purchased in each jurisdiction

- The original fuel receipts or invoices

- Individual trip reports

You can find more in-depth information on IFTA recordkeeping requirements here.

How carriers report IFTA

Carriers must file quarterly IFTA reports by the following dates:

- First quarter: April 30

- Second quarter: July 31

- Third quarter: Oct. 31

- Fourth quarter: Jan. 31

To do this, carriers must aggregate the miles driven and fuel purchased for the quarter by jurisdiction. Once this information is consolidated, a carrier should start by calculating its overall fuel mileage. This can be done with a simple formula:

Total miles driven ÷ Total gallons = Overall fuel mileage

Next, a carrier will calculate how many gallons of fuel they consumed in each individual jurisdiction:

Total miles driven in state X ÷ Overall fuel mileage = Fuel consumed in jurisdiction X

Fuel consumed per jurisdiction is the key metric required to calculate the fuel tax owed in each jurisdiction. This metric is multiplied by the current rate for each jurisdiction, which can be found here. (Please note that the matrix will not be final until March 2020.)

Once this calculation is complete, you’ll input all of the data on your base jurisdiction’s (where you obtained your IFTA license) IFTA reporting form. This article walks through a more detailed step-by-step guide to filing IFTA.

The role of member jurisdictions in IFTA

Once you’ve submitted your IFTA report to your base jurisdiction, they handle the rest. If you owe tax to other jurisdictions, your base jurisdiction will transfer the correct portion of the funds automatically.

Additionally, if you’re owed a refund, your jurisdiction will collect the appropriate amount from each jurisdiction and send you a single refund check or apply the balance as a credit for future payments.

Each jurisdiction is required to annually audit 3 percent of the carriers licensed within it to verify that the correct tax is being paid.

The reason for audits is that IFTA relies on a lot of trust between each jurisdiction. If the agreement isn’t enforced correctly in any state, the other states may receive less tax money than they’re owed.

You can find more information about IFTA audits here.

How to simplify IFTA

Choosing the right fleet management solution can streamline much of the IFTA reporting process and prepare you to handle a potential audit. Here’s how:

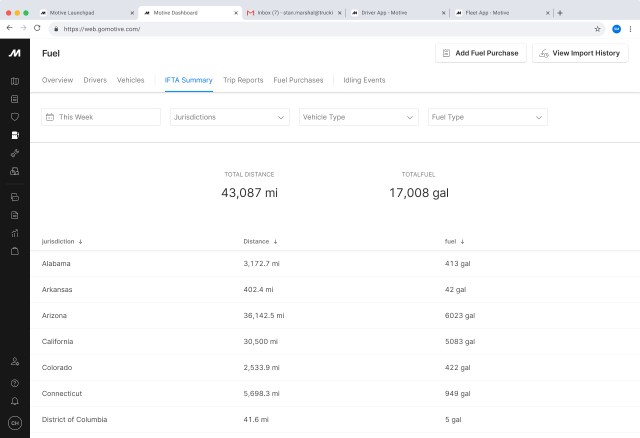

A fleet management solution will automatically track the miles driven and fuel purchased by jurisdiction for each vehicle. It will also save individual trip reports, including state line odometer readings.

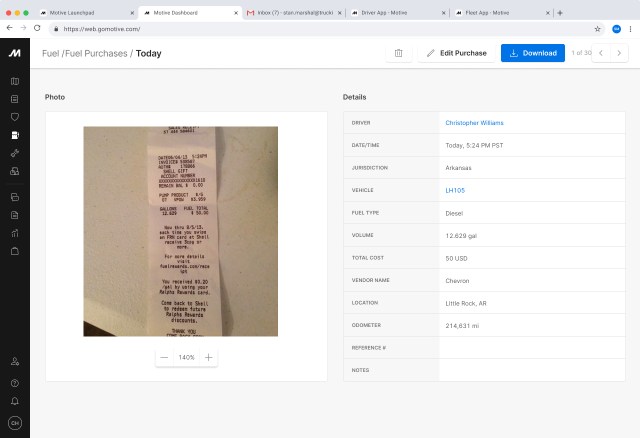

Leading fleet management solutions allow drivers to easily upload fuel receipts and append the odometer reading to automatically associate them with trips.

Also, you should be able to upload a CSV file list of fuel purchases from your fuel card provider to automatically associate them with trips in bulk at the end of the quarter if you prefer.

At the end of each quarter, you’ll be able to pull a simple report for each IFTA jurisdiction:

With this information, filling out quarterly IFTA reporting forms is a breeze.

How to learn more about IFTA

This was a high-level look at what IFTA is, how it works, and how carriers should comply. But, if you’re new to IFTA, you likely have more questions, such as:

- Who needs to comply with IFTA?

- How do I apply for an IFTA license?

- What IFTA decals do I need?

In this complete guide, we cover all of these questions and much more.