Managing fleet fuel costs is a relentless job. A fleet fuel card may be the answer. But before accepting it outright, consider all the details: The pros, the cons, and what to look for if you decide to move forward.

What does a fleet fuel card do?

A fleet fuel card is a dedicated, specialized payment method for fuel. It’s designed to help businesses effectively manage their fuel expenses.

The idea is simple. It’s an efficient way to track spending. Instead of tracking down scattered receipts or having drivers pay with cash, you get one online account where you can easily review all purchases, access details like miles-per-gallon (MPG) tracking, and even set controls to prevent unauthorized spending.

Tip: A fleet fuel card is different from a “fleet card.” While a fleet fuel card manages only fuel expenses, a fleet card can be used like a credit card for a variety of fleet expenses.

Pros: 4 reasons to use fleet fuel cards for your business

Fleet fuel cards have significant business advantages, from saving money on fuel to gaining better control over your operations.

1. Savings on fuel

Fuel costs are a massive part of a fleet’s operating budget. In 2024, fuel made up about 21.3% of all operational costs in the trucking industry, second only to driver wages.

Fleet fuel cards can reduce this significant expense in a couple of ways:

- Fuel discounts and rebates. Many fleet fuel card programs offer per-gallon discounts or rebates, often at participating fuel stations within a specific network.

- Spend controls. Many cards also let you set daily or per-purchase limits, and you can get reports showing which drivers are nearing or exceeding these limits. Some advanced cards even offer exception reporting, which alerts to unusual fuel purchases, helping you catch and stop wasteful spending quickly.

2. Better fuel efficiency

While there are practical ways for drivers to save fuel, fleet fuel cards help you take a comprehensive and data-based approach to increasing fuel efficiency. Fleet fuel cards can capture detailed information at most major fuel stations, including the price per gallon, the location of the purchase, and even odometer readings.

If you can access this rich data from the fleet fuel card you choose, you’ll be able to create a more accurate picture of fleet fuel purchases. You can analyze fuel spend thoroughly, identify areas where you might be less efficient, and make informed decisions to optimize fuel consumption across your fleet.

Using the Motive Card, we can track where and when our drivers stop for fuel and their actual mileage between fill-ups. Fuel is one of our most significant expenses, but we had to guesstimate these figures, missing critical data points in the past. . Instead of simply monitoring our fuel spend, we can implement active measures to control it

3. Fraud protection

Some fleet fuel cards come with enhanced security to help protect your business from fraud. These cards might require drivers to enter a unique ID for their transactions, making it harder for unauthorized users to use the card. Card providers may allow companies to set purchase limits and receive instant alerts if those limits are exceeded, which could indicate buying extra fuel for personal use.

When you’re looking for a fuel card, look for one that offers strong security features, such as spend controls and policies for reimbursement if cards are lost or stolen.

4. Streamlined spend operations

If the fleet fuel card you choose has customizable controls, you can determine how drivers use the cards to achieve precise expense management.

Here are some parameters companies can set with fleet fuel cards:

- Allowing only at-pump fuel purchases.

- Permitting both at-pump and in-store purchases (for snacks, drinks, etc.).

- Limiting purchases to only certain locations or specific gas station brands.

- Setting different purchasing profiles for various types of vehicles, based on their fuel capacity or specific needs. For example, you might want to restrict a light-duty van card to a lower fuel volume limit than you would for larger vehicles.

- Providing the ability to override purchase limits in emergencies, offering flexibility when unexpected situations arise.

5. Help with IFTA reporting

Unless your business is exempt, your operations involve International Fuel Tax Agreement (IFTA) reporting. The IFTA Agreement requires commercial fleets to keep precise records of all fuel purchases, mileage, and fuel taxes incurred in every state or province they travel through. You must also file a detailed fuel tax report four times a year. Fleet fuel cards provide detailed records that make compiling IFTA reports much simpler.

Cons: What are the disadvantages of fleet fuel cards?

While fleet fuel cards offer many advantages, they do have potential downsides.

1. A fleet fuel card may not be broad enough for your business

One of the main limitations of traditional fleet fuel cards is their narrow focus. While they’re great for managing fuel, they often don’t cover the full range of expenses a fleet incurs. Managing these expenses is where a more comprehensive fleet card comes in. The Motive Card, for example, is a fleet card that’s designed to support not only fuel savings, but a wide variety of other fleet expenses, including:

- Fleet maintenance and repairs.

- Lodging for drivers.

- Purchases inside gas station convenience stores.

- Any other legitimate business expenses.

A fleet card is both convenient and financially beneficial. Businesses using the Motive Card can see returns like these:

- Up to 2.5% from cashback and rebates.

- A potential 5% back from fraud reduction.

- Another 5% by capturing missed savings.

- Up to 7% in productivity gains.

2. Unreliable fuel card providers

Another disadvantage is not so much about the fuel card itself, but fuel card companies. Some less reputable companies might have practices that subtly increase your costs or reduce the value you receive.

Common issues to watch out for include:

- Hidden fees.

- Complex fee structures.

- Unclear terms about discounts and rebates.

- Attractive initial rates that quickly change to less favorable terms.

- Unclear or inaccurate billing.

For example, Mike Meeker, fleet manager and environmental health and safety specialist for Architectural Surfaces, described his experience with inaccurate spend reporting from his former provider.

“I would go into the system to run a transaction report, and when the billing came, it was totally different,” he recalls. “That made for long days and nights trying to figure out the accuracy of our spend reporting. It created a lot of chaos for our IFTA reporting, and ended up costing us when it came time to file.”

Research potential fleet card providers, read customer reviews, and examine their terms and conditions before you sign up. Choosing a trustworthy provider is key to making sure you get the most from your fleet fuel card.

3. Fuel card fraud

Beyond the limitations of basic fuel cards, fuel card fraud can erode a business’s bottom line. It’s not easy to spot, and the challenge gets harder when spend management and fleet management software aren’t connected to each other.

According to a survey by FreightWaves and Motive, nearly 55% of participating fleet operators say they struggle to detect fraud.

According to the same survey, a substantial 49% of operators estimate that up to 5% of their fuel spend is fraudulent. To put the problem in perspective, for a fleet of 200 vehicles, 5% in fraudulent fuel spend could come out to be an estimated annual loss of more than $500,000. The loss includes various forms of fraud, with 45% of fleet operators believing third-party fraud (like skimming, scams, or phishing) impacts them the most.

With stats like these in mind, you’ll want a card that will protect you from these costs. Fleet cards like Motive’s provide robust fraud prevention tools.

For example, Jonathan Keyes, Director of Project Management at Hawx Pest Control explained how they’ve seen both fuel savings and fraud reduction by using the Motive Card. “We’ve saved about $21,000 in 2024, but the bigger, more unexpected impact has been fraud reduction,” he says.

How to choose the right card for your business

When choosing a fleet fuel card, don’t stop at rebates. The best fleet fuel cards for small, medium, and enterprise businesses alike will not only provide fuel savings, but they’ll also offer features that give you security and control and integrate smoothly with your existing business operations.

Look for these three card features:

Customizable spend controls

The right fleet card puts you in control with customizable spend controls, allowing you to decide exactly when, where, and how your cards can be used. You can even set specific allowed or blocked merchants. For example, you might set rules that a specific card can only be used to purchase fuel, or limit usage to weekdays during business hours. The right level of control helps ensure that cards are only used for approved business expenses from the start.

AI-powered fraud detection

Look for fleet cards that offer advanced security features, like AI-powered fraud detection. This technology works in the background to identify and even automatically decline suspicious transactions in real time. In 2024, Motive customers prevented more than 80,000 unauthorized transactions with our fraud detection capabilities, saving $55 million.

A card with AI-powered fraud detection is a crucial tool for protecting your business’s financial health.

Integrated into a fleet operations platform

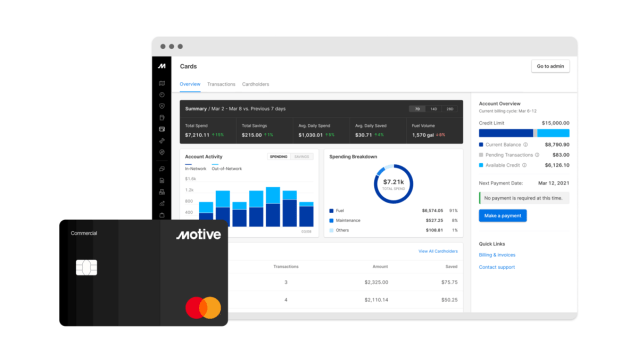

The administrative aspect of managing fleet spend can be enormous, especially if you’re working with disconnected systems. The Motive Card stands out because it’s part of a natively integrated platform combining fleet management and spend management. This means no more data silos.

It’s also easy to automate time-consuming manual tasks. For example, because fuel purchases are linked with mileage information, you can save time on IFTA reporting. Automated reporting and integrations reduce manual errors, meaning you can streamline core operations for significant productivity gains, sometimes up to 7%.

This kind of unified system provides a more complete picture of fleet spending and saves time across operations.

Smart spending for fleets: Choosing your path forward

If you want to improve profitability, looking into a fleet fuel card program is a good place to start. However, while basic fuel cards help you manage the fluctuating costs of diesel, consider the broader benefits of a comprehensive fleet card. Spend controls, advanced AI-powered fraud detection, and integration into an operations platform can save on fuel and improve your entire spend management process.