If you’re a fleet manager, you know it’s critical to your business to stay in compliance with government regulations. Here is a checklist to help you stay on top of the most common compliance requirements.

Compliance checklist: 7 tasks for fleet managers

1. Comply with hours-of-service rules and documentation requirements

You’re no doubt familiar with the hours-of-service rules, which dictate how many hours drivers can drive without taking a break. It’s not enough to follow the rules, though—drivers also have to be able to prove they’ve followed them.

To stay in compliance, for every 24-hour period drivers are on duty, they should have documents that have the origin and destination of each trip (bills of lading, itineraries, schedules, trip records) and expense receipts related to any non-driving time. These Records of Duty Status (RODS) have to be retained for six months.

To make keeping track of all this information easier (and less prone to errors), Electronic Logging Devices (ELDs) have been created to help you keep up.

ELDs can help keep track of all this information with greater accuracy. These devices automatically record all driving time and location information. The ELD, however, must meet the FMCSA requirements for the drivers to remain compliant.

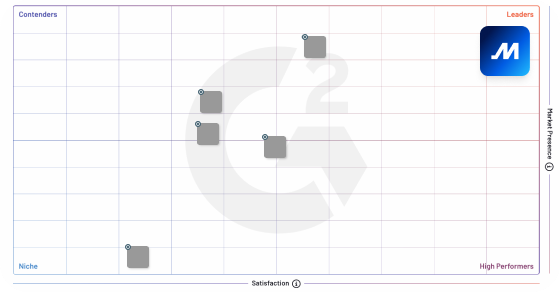

The Motive fleet management platform was built from the ground up to meet these ELD mandate requirements and ensure that fleets can stay compliant.

2. Comply with DVIR regulations

A DVIR is a pre-trip inspection of items such as brakes, lights, and tires to ensure a vehicle is fit for the road. Federal law requires a DVIR to be completed daily by commercial drivers.

To ensure compliance, at the start of a shift, drivers must review the last DVIR on the vehicle, and note and sign off on any defects. Defects have to be corrected before the vehicle can be used. At the end of the shift, they have to complete a new DVIR.

DVIRs need to be kept for a minimum of three months. The Motive App makes completing DVIRs fast and easy.

Discover DVIR best practices.

3. Comply with the International Fuel Tax Agreement (IFTA)

Because fuel taxes go toward road maintenance, states want to make sure they get their fair share, according to the miles driven in each state or province. Licensing your vehicle with the IFTA allows you to submit one fuel tax return every quarter (instead of one for every jurisdiction you drive through).

Similar to Hours-of-Service, IFTA requires keeping good records. Moreover, manually calculating miles traveled by each vehicle and each jurisdiction is an administrative burden that is also prone to errors and inconsistencies.

Motive automates complex calculations by automatically calculating the distance traveled in each jurisdiction. You can view trip reports in detail, or filter summaries by date or vehicle type.

Fuel purchases can be uploaded in bulk by uploading a CSV file from your fuel vendor. Drivers can also upload fuel receipts directly from the Motive App.

4. International Registration Plan (IRP) — record where your drivers drive

IRP is similar to IFTA, but it applies to license fees instead of fuel taxes. Whether or not this will save your fleet money depends on how many different jurisdictions your drivers drive through. If all or most of their trips are in one jurisdiction, it is most likely cheaper to apportion in that jurisdiction.

5. Drug and alcohol testing

To stay compliant, drivers need to register at a DOT Consortium. To learn more about drug and alcohol testing, see the DOT Employer Handbook.

According to the FMCSA:

“All CDL drivers operating commercial motor vehicles (CMVs) (greater than 26,000 GVWR, or transporting more than 16 passengers, including the driver, or placarded hazardous materials) on public roadways must be DOT drug and alcohol tested.

This applies to any driver required to possess a CDL, including those employed by Federal, State, and local government agencies, “owner-operators,” and equivalently licensed drivers from foreign countries. Part-time drivers must also be included in an employer’s drug and alcohol testing program.”

6. Maintain a Driver Qualification File (DQF)

The FMCSA requires that trucking companies must keep a driver qualification file for every driver. As a fleet manager, it would be your responsibility to do so.

The driver qualification file has to be maintained for the past three years. It has eight parts:

- Employee application (this must contain the mandatory information)

- Motor Vehicle Record (MVR) for every state a driver held a commercial license or permit

- MVR for the previous three years

- MVR Review — Every year, the driver should review the MVRs and note who did the review and the date, and identify any violations of the FMCSA regulations

- Record of violations — a list of any violations in the previous 12 months. You need this even if you have no violations. Parking tickets do not have to be included

- Copy of your drivers’ commercial drivers license (CDL)

- Medical Examiners Certificate (or copy), which is valid for up to 24 months

- You must also retain a record in the DQF verifying that the medical examiner used by the truck driver was authorized on the NRCME list.

Read: Best practices of successful fleet managers.

7. Update DQF with CDL endorsements

If a driver has endorsements on his/her CDL, additional information in the DQF will have to be maintained, such as background history check and extra insurance for things like hazardous cargo.

Simplify compliance with the right fleet management solution

Motive has the right tools and technology to help fleet managers with compliance.

Request a demo to see how the Motive fleet management platform can help with compliance, or call us at (844) 257-6396. Our 24/7 customer support team is always available to help you.