Efficiency is critical for any company, especially those that operate fleets. Every minute saved in administrative tasks translates to increased productivity and profitability. Companies rely on workforce management tools to enhance efficiency by streamlining critical Human Resources (HR) functions, such as timecards, tracking, and payroll.

But it’s not just simplifying manual processes that companies worry about regarding payroll. It’s accuracy. According to IRS estimates, one-third of organizations make at least one payroll error a year. The consequence isn’t just fixing mistakes (although you should do that, too). Payroll errors also lead to fines – $7 billion in 2023.

What if companies could automate employee time log submissions to their preferred payroll systems and ensure accuracy by eliminating human error?

Regardless of company size and industry, getting payroll right every time is critical. That means adhering to payroll best practices, such as developing a solid compensation plan, maintaining compliance, and paying people equitably.It sounds daunting, but Motive and our partners are here to help.

Below are five tips to know so you can plan and manage payroll confidently.

1. Build a payroll policy

To ensure organized and efficient processes, start by implementing a payroll policy. A payroll policy is a single truth source that operations or administration can follow. The policy provides preferred guidelines, so your team can accomplish payroll tasks accurately and efficiently.

- When building your payroll policy, assess the process, time, and resources needed to draft your plan and pay your people monthly. Consider including the following:

- An outline of the payroll process

- Employee classification specifications

- Determining factors for salaries and wages

- Reporting obligations for employees

- Instructions and procedures for resolving payroll mistakes

- Levels of earnable vacation time

- Guidelines on how to calculate wages and promotions

2. Set a budget for payroll

Payroll expenses shouldn’t be a surprise. Plan salaries, bonuses, and other payroll expenses so you have the financial runway needed to pay drivers.

Note: Employers are also legally responsible for certain employment taxes, like Social Security and Medicare. Employers must match the Social Security and Medicare deductions from an employee’s compensation, which amounts to 7.65% of gross pay and the employee’s salary or hourly wage. Payroll taxes vary by state, so it’s critical to consider this information when budgeting.

3. Educate Employees on Payroll Procedures

One of the most essential steps is educating employees on payroll procedures. Your operations team should understand responsibilities and deadlines thoroughly and provide continuous training on the latest regulations, software updates, and payroll best practices. So your employees know how to submit driver logs properly and how to punch in and out. To share this information, you could:

- Discuss payroll procedures in company meetings so everyone receives the same information and message. OR

- Upload the procedure to your company intranet or self-service portal for easy access anytime.

4. Maintain Proper Compliance

Payroll and compliance go hand in hand. Companies must adhere to relevant federal, state, and local laws regarding employee compensation. So, keeping the agencies that regulate payroll laws is critical—primarily the Internal Revenue Service (IRS) and the Department of Labor (DOL).

Some other payroll laws to consider are:

- Heavy and tractor-trailer Truck Driver

- Fair Labor Standards Act (FLSA)

- Federal Unemployment Tax Act (FUTA)

- Equal Pay Act (EPA)

- Workers’ Compensation

5. Leverage reliable software and tools

Rather than manually managing payroll, checking state and federal updates, chasing down missing information on time cards, and double-checking every data entry, invest in reliable payroll solutions that handle payroll complexities while seamlessly integrating with your Motive platform.

Using software that integrates with the Motive platform is critical to accurately automating, calculating, and distributing employee salaries, taxes, and scheduling. These benefits aren’t just helpful for your business but critical for employees. Because 58% of people live paycheck-to-paycheck, they can’t afford to wait for fixed payroll errors.

Motive and UKG built a tool that transforms how you manage timecards and payroll.

Thanks to Motive and UKG’s partnership, companies can now quickly and accurately manage their payroll and timekeeping from the Motive platform. Motive partnered with UKG to help customers simplify driver management and payroll tracking, eliminating the burden of manual payroll processes for operations.

“Through our partnership program at UKG, we strive to create greatness in every customer’s organization, with culture guidance and technology built for all. We are excited to partner with Motive, who will help us carry out this mission by combining UKG’s best-in-class HR and WFM software with Motive’s leading fleet management capabilities.”

— Mike May, Vice President of Technology Partnerships at UKG

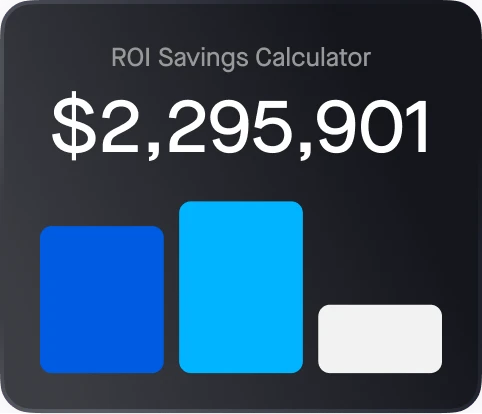

With the Motive for UKG integration, Motive customers can quickly and seamlessly manage their employee records. The integration offers several benefits, including synchronized employee records, automatic export of driver punch-in/punch-out times, scheduled synchronization for driver information and logs executed every 24 hours, and efficient data management that saves customers time and eliminates errors and redundancies.

This integration provides value to anyone involved in workforce management, including drivers, fleet administrators, managers, safety officers, and accountants. If you’re interested in experiencing the benefits of seamless integration, visit the App Marketplace and optimize your workforce management with Motive and UKG today!

More about UKG

For those who are not familiar, UKG provides payroll and HR software solutions to small, medium, and large companies. UKG automates administrative processes to reduce workload and manage hiring, onboarding, benefits administration, and performance more efficiently.