As the holiday season approaches, businesses operating within the physical economy face heightened risks of theft and fraud. The rise in cargo theft and credit card fraud presents a significant challenge for companies during the holidays, as financial exploitation and the threat of stolen goods — including equipment, vehicles, and cargo — rise.

Surge in cargo theft

Cargo theft surged by 49% in the first half of 2024, and the holiday season will likely aggravate it even more. Thieves often target unsecured or poorly monitored warehouses, as well as unattended vehicles during delivery. The holidays, with their higher circulation of consumer goods and valuable equipment, present a prime opportunity for crime. Businesses stretched thin on security resources are particularly vulnerable.

Watch the video: The power of AI in detecting cargo theft:

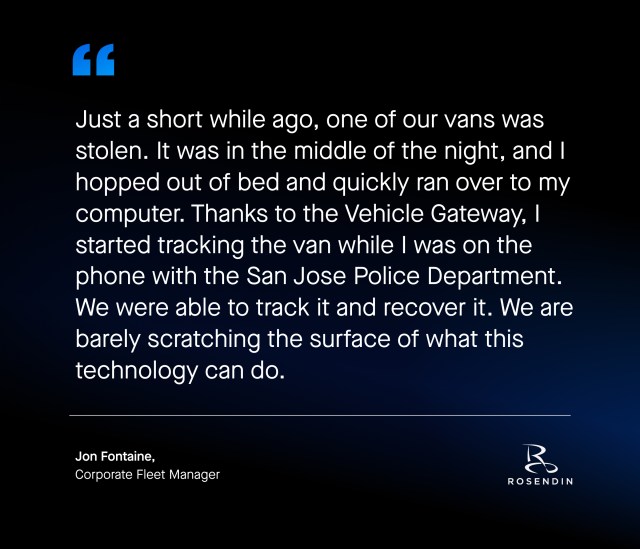

Over the past five years, holiday theft trends have shown an average loss of $121,473 per incident, making these crimes a significant financial burden for companies. As a result, businesses are increasingly relying on real-time tracking technology and AI-powered security systems. These tools alerts companies to irregular activity instantly, allowing them to track vehicles and cargo in real time and recover stolen items quickly.

Rise in credit card fraud for commercial vehicles

The holiday season also brings heightened financial risk, particularly in the form of credit card fraud and fuel card skimming. According to Motive’s Physical Economy Outlook, 44% of business leaders say fraud is having a big financial impact on their operations. Yet many don’t know how to detect or address it.

Fraud, especially in the form of fuel card theft, is a growing issue for companies operating fleets. Industry leaders estimate that 19% of current fleet spend is lost to fraud or theft. That figure rises to 22% in industries like construction. For businesses operating on thin margins due to fluctuating costs like fuel, maintenance, and insurance, these losses are especially painful.

To mitigate them, businesses must adopt a proactive and technology-driven approach to physical and financial security.

Our take

Businesses operating within the physical economy are becoming more aware of fraud, theft, and their impact on operations. However, a big gap remains in addressing these challenges. Amid the large transaction volumes generated by enterprise fleets, fraud often goes undetected. Insufficient monitoring of trailers, depots, and warehouses makes businesses all the more vulnerable. By adopting AI-powered technology and taking proactive measures, companies can safeguard their assets, stem financial losses, and stabilize their operations during peak season.