Welcome to a special edition of the Motive Monthly Economic Report, where we are taking a look at summer retail freight around Independence Day. Keep reading for a front-seat view into key factors currently influencing the U.S. economy.

Big Picture: Stronger than expected Independence Day surge in retail truck visits is the first bright spot for retail and freight demand, but we still expect a muted 2H

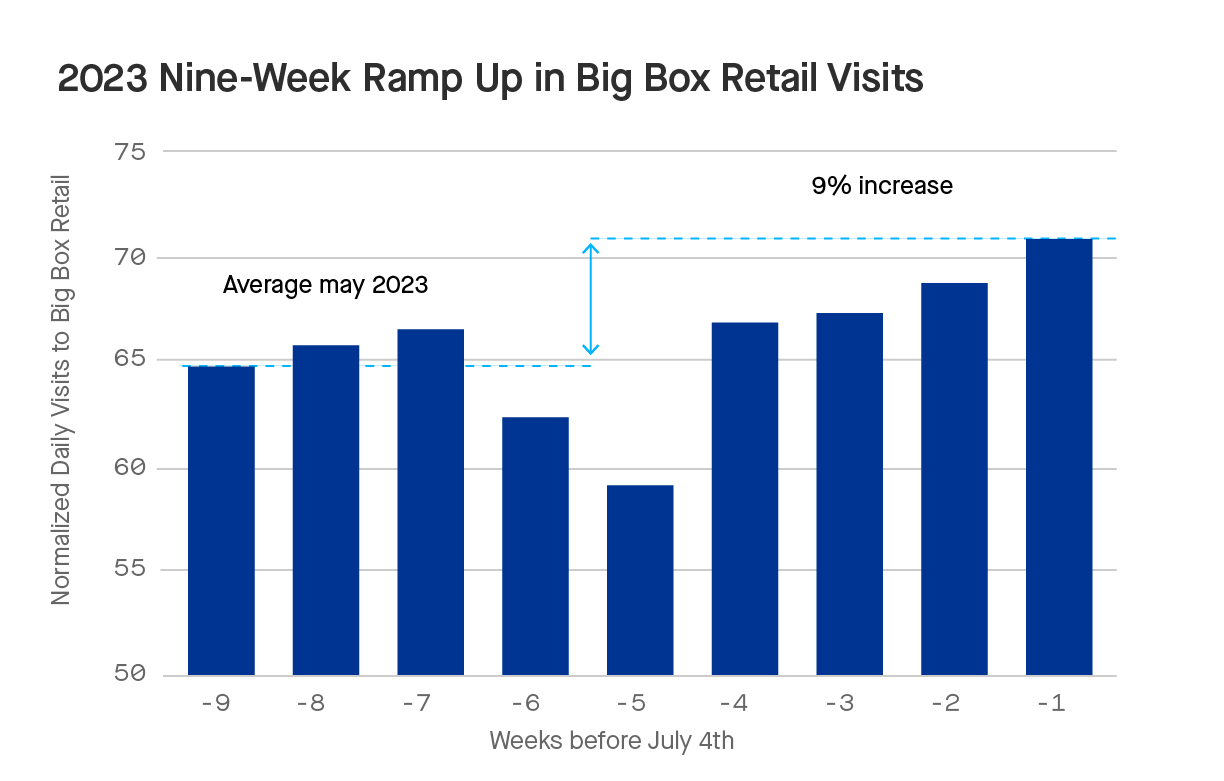

- Trucking visits to top 50 retailer warehouses jumped 3% in the week leading up to July 4th, marking a 9% jump since a slower-than-average Memorial Day Weekend.

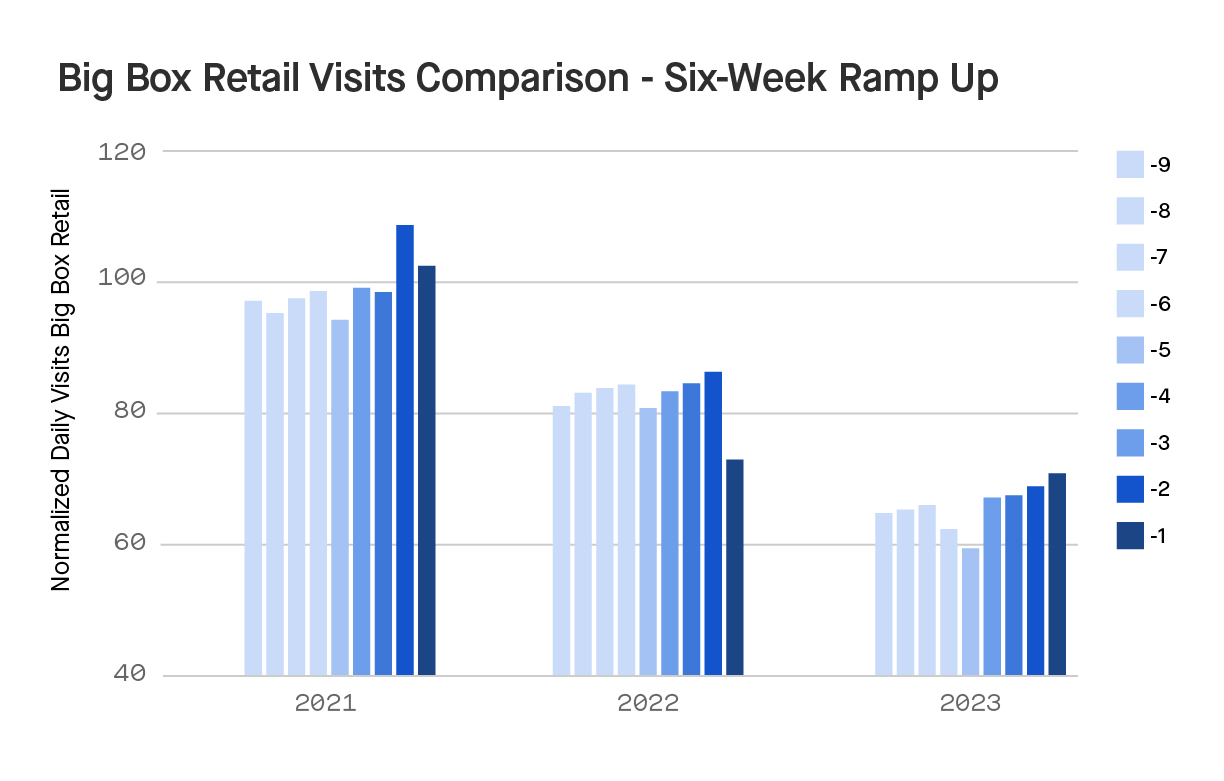

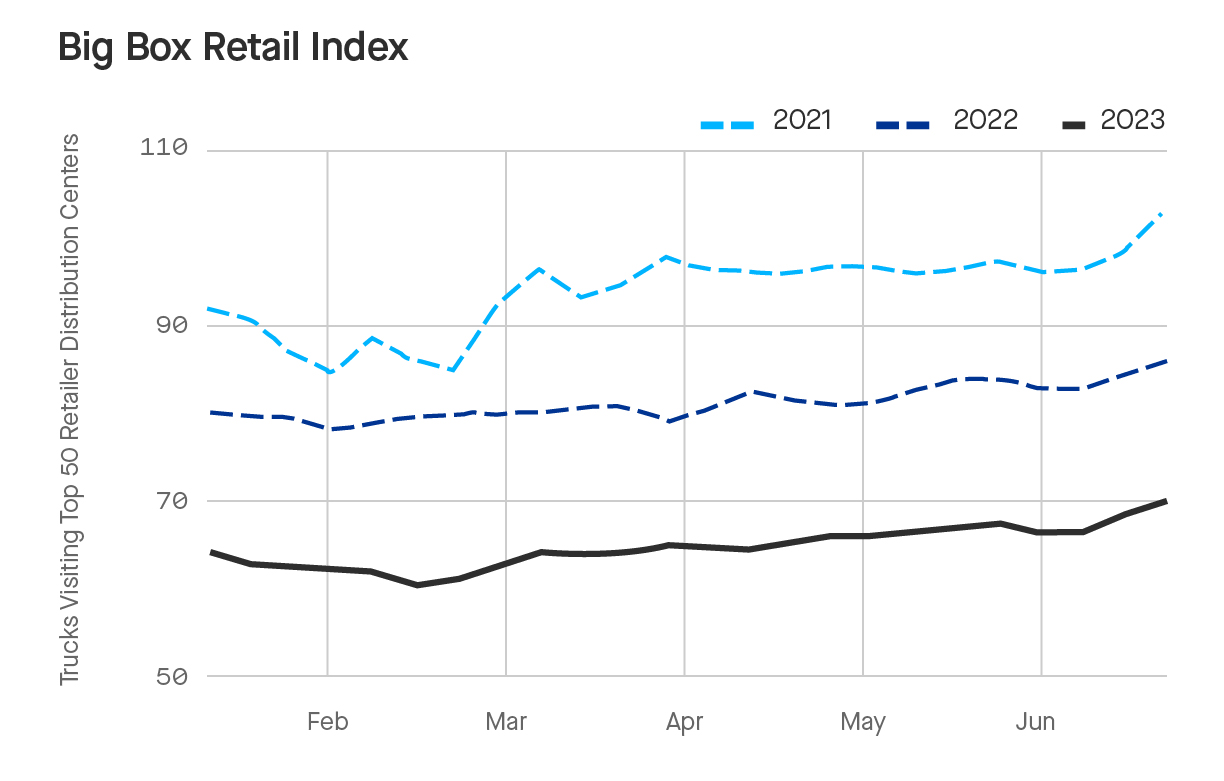

- Increase in retail freight traffic marks a 2023 peak for visits but is still well below the heights seen in previous years.

- Supply executives are bringing in inventory later, mirroring behavior seen during the 2022 holiday season.

- Retailers continue to adopt a “wait-and-see” approach in the current environment, suggesting a cautious outlook for consumer demand in the second half of the year.

- Despite the glimmer of hope with the July 4th surge, there is little optimism of demand surging back, and we expect a muted 2H.

July 4th brought an unexpected surge in trucking visits to retail warehouses – the first positive sign amid the freight recession

Though retail visits between Memorial Day and June 26 were largely muted, the final week leading into July 4th saw an unexpectedly strong week-over-week jump of 3%, as well as a 9% increase in traffic from the end of May. Thus far, retailers have been cautious and are adopting a “wait-and-see” approach when it comes to restocking due to uncertainties in predicting consumer demand, showing a reluctance to accumulate inventory levels similar to those observed last year. However, this late surge ahead of the start of peak season is one of the first positive signs we’ve seen amid the current freight recession.

Interestingly, the surge in retail trucking visits has typically happened in the second to last week before July 4 (“-2” in the graph above). This year, however, the surge came in the last week before the holiday (June 26-July 3, “-1” above). This means retailers are bringing in inventory much later than usual, which is consistent with the behavior we observed during the 2022 Christmas holiday season.

Shifting headwinds: inflation and supply chains

The better-than-expected surge in retail visits may have been caused by a combination of factors. One factor could be the signs of easing inflationary pressures, indicated by only a slight increase in consumer prices in June. Another factor could be the improvement in supply chains, allowing for leaner operations and bringing in supplies closer to the actual demand. This is similar to what was observed during the Christmas period in 2022, when there was a three-week delay in the increase in visits. It seems that customer demand, rather than supply chain challenges, remains the main bottleneck affecting retail visits in 2023.

Moving forward, the recent increase in traffic (reaching a peak of 71 on our Big Box Retail Index) is positive but falls short of previous years’ levels. It remains uncertain whether this late surge indicates a shift in demand or simply a change in the timing of retailers restocking in response to demand.

Key Takeaway: There’s a glimmer of hope amidst the changing landscape.

The potential upward trend in the market is encouraging, but it has significant implications for carrier planning as retailers adjust supply to match tighter demand windows. This highlights the importance of monitoring month-over-month and week-over-week trends in addition to year-over-year comparisons. A more capacity-focused supply chain with inventory management as the primary constraint means businesses will operate with leaner buying operations.

Data Methodology

This edition of the Motive Monthly Economic report looks specifically at retail traffic around the July 4th holiday. Each edition of the report uses aggregated and anonymized insights from the Motive network, as well as publicly available government data from the Federal Motor Carrier Safety Administration, U.S. Census, and U.S. Department of Transportation.