Welcome to the February edition of the Motive Monthly Economic Report. What follows is an analysis of the major trends in the supply chain and economy across the Motive platform during the past month. Keep reading for a front-seat view into key factors currently influencing the U.S. economy.

Big picture: Slower contraction and stable visits to retailer warehouses may indicate the trucking market is starting to improve

- Contraction in the trucking market slowed considerably in January, with 20% fewer carriers leaving the market and new carrier registrations rising 22% compared to December.

- Motive’s Big Box Retail Index saw a slight increase (2%) in visits to retailer warehouses, with those from grocery, superstore, and home improvement retailers seeing the biggest gains.

- February numbers will be a barometer of whether these trends hold further into 2024.

- Motive maintains its prediction that 2024 will see carrier numbers 10-20% above 2019 levels.

Be ready to take advantage of the market’s (potential) stabilization

With the first month of the year behind us, the trucking market appears to be moving in a positive direction after a challenging end to the year. While much of 2023 focused on adapting to a challenging environment, businesses now may begin to see the opportunity to adapt to more positive changes like retailers restocking more inventory. Ensure that your business plans maintain the flexibility to take advantage of these by utilizing a fully integrated operations system and streamlining data. These will help maximize visibility around fleet performance and efficiency, increasing the ability to potentially rise to these opportunities.

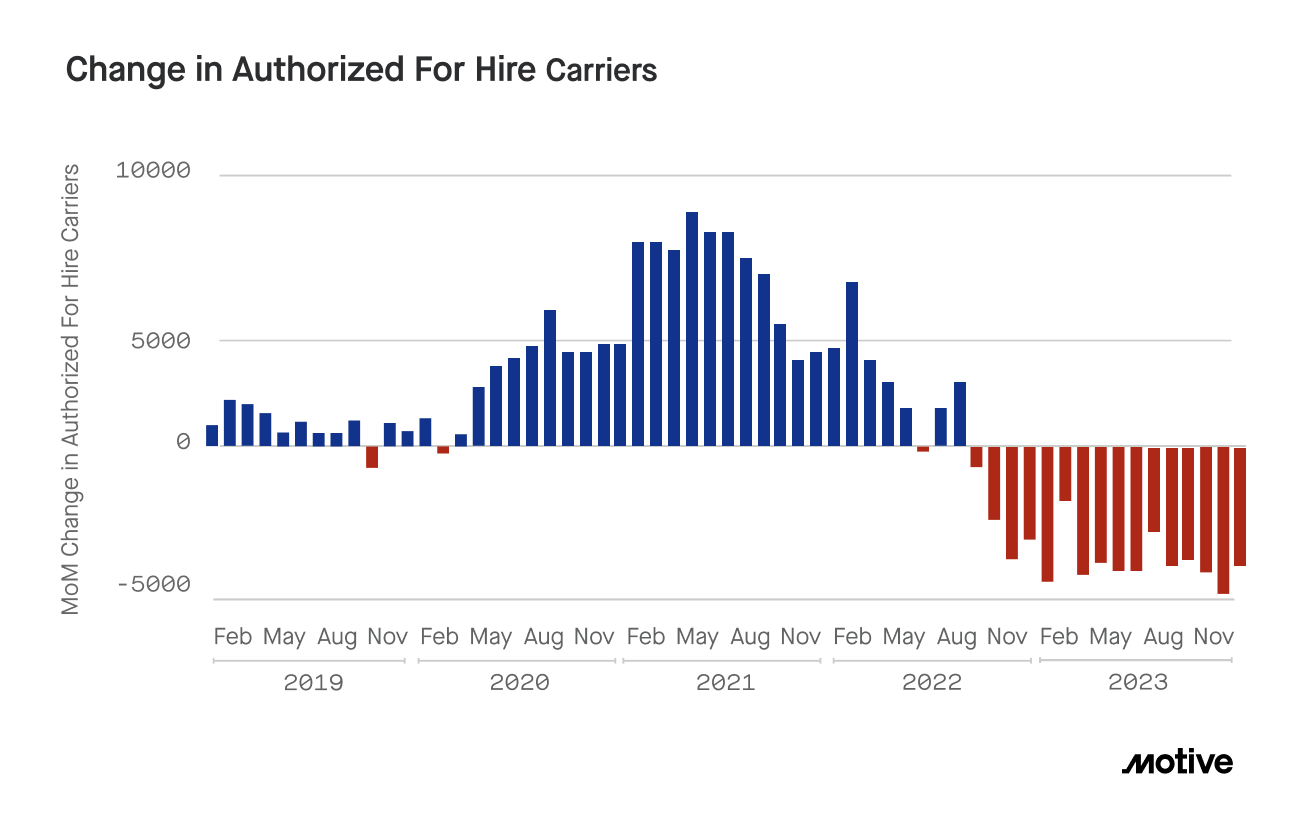

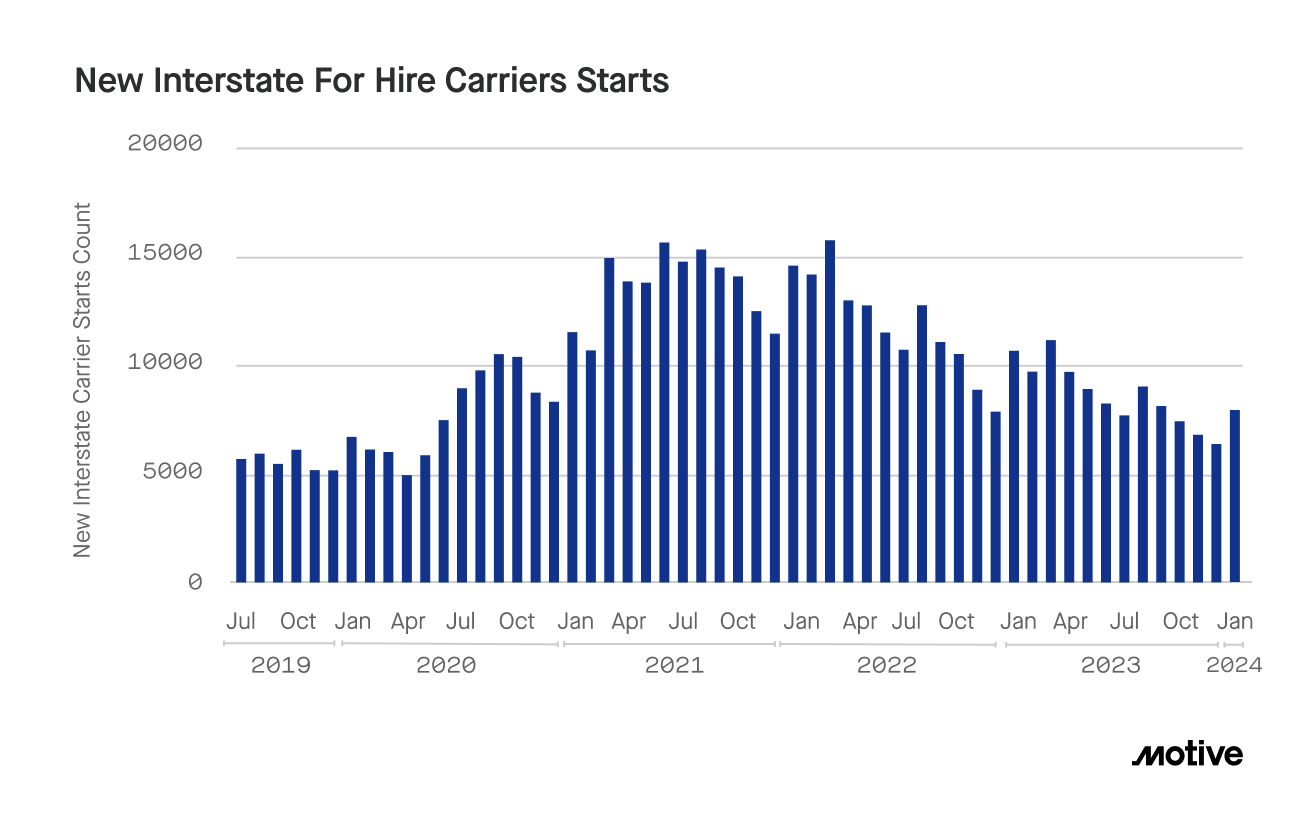

January brought lowest levels of contraction, most new registrations for trucking market since Fall 2023

The start of the year saw the trucking market’s contraction slow significantly. 3,707 carriers exited the market in January, representing a 20% decrease compared to December. New carrier registrations simultaneously posted their best month since September, rising 22% month-over-month to 7,938. It is worth noting, however, that this number is down 26% year-over-year from January 2023.

Seasonal trends are likely a factor in the improved January numbers, similar to how they drove elevated market contraction in December. Carriers that were waiting for the beginning of the year to jump into the market likely did so, while the uptick of those leaving ahead of 2024 predictably subsided once the year began. It will therefore be important to stay tuned for February numbers to see if the trend will hold.

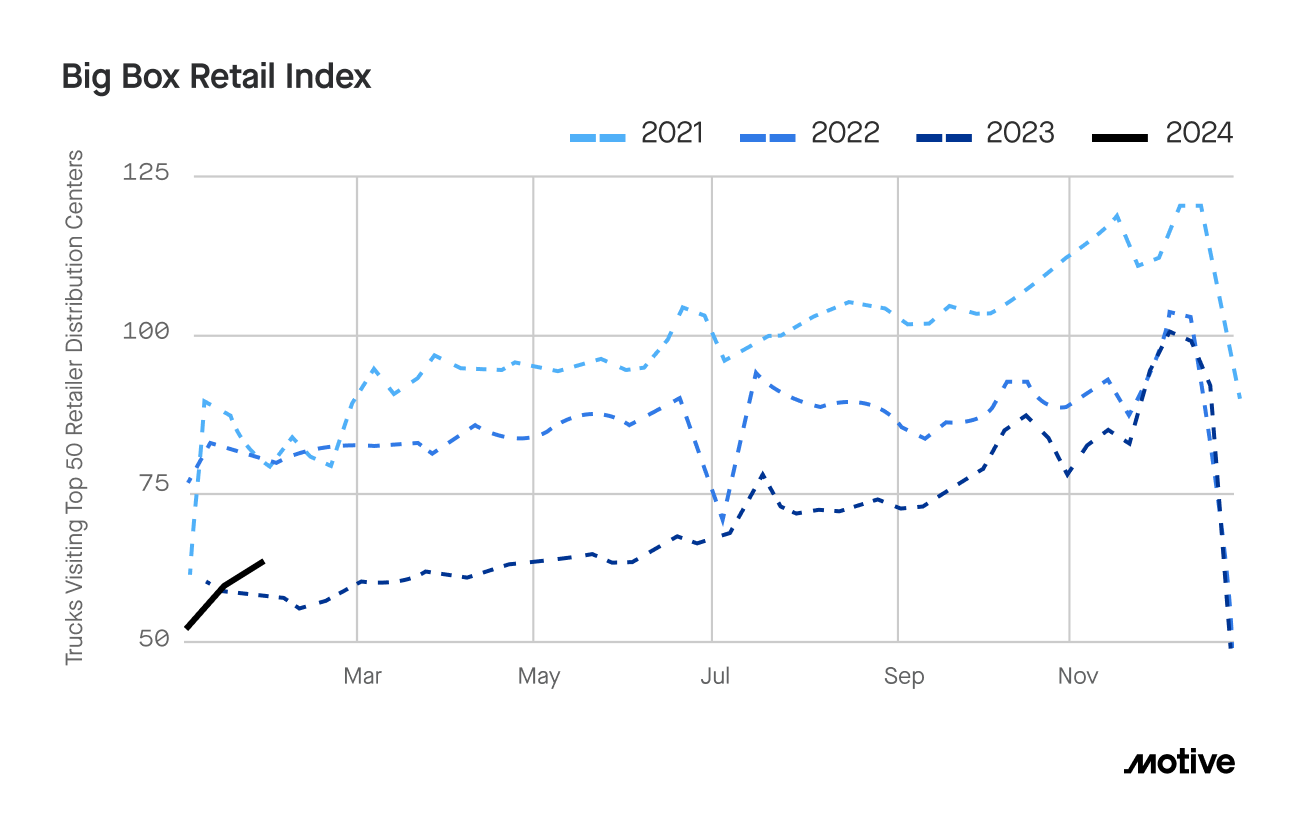

Retail warehouse visits hold steady post-holidays, with grocery, superstore, and home improvement seeing biggest gains

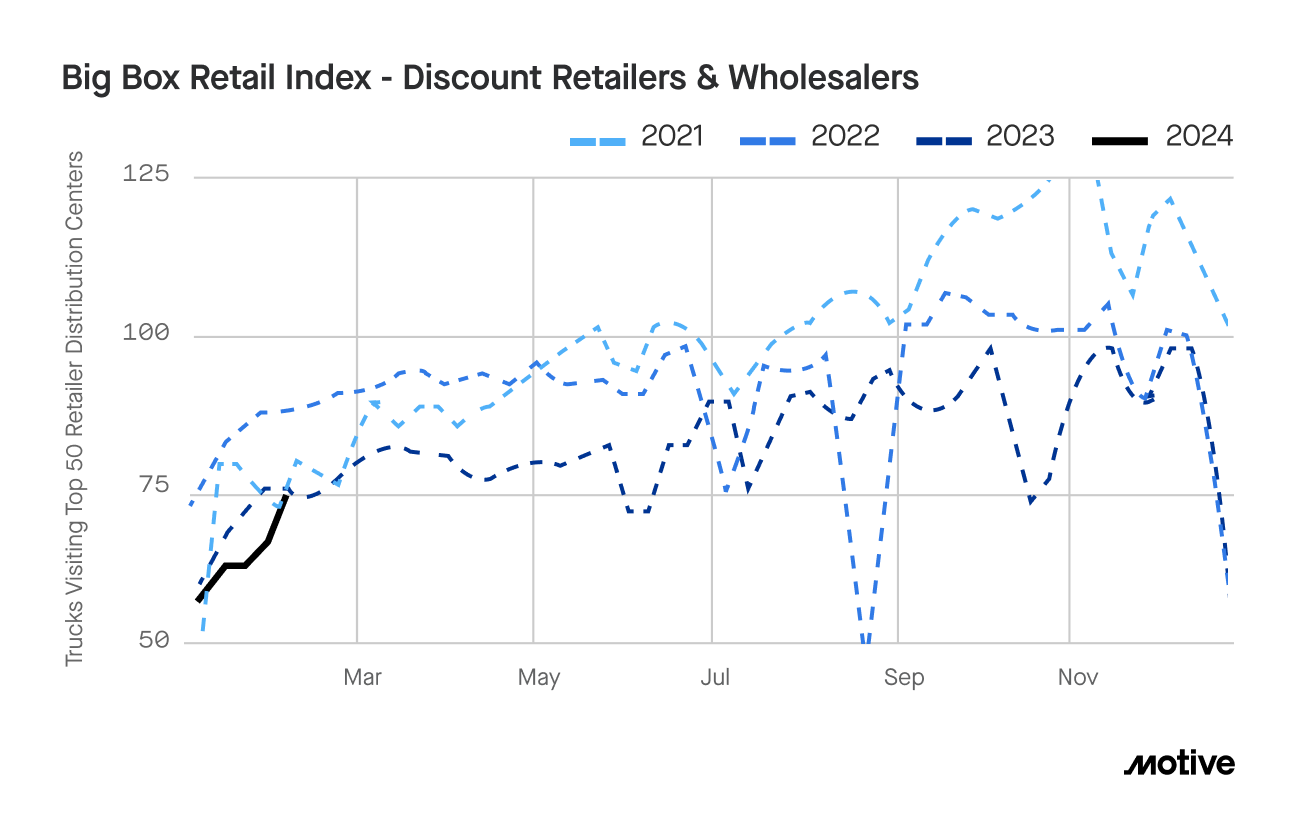

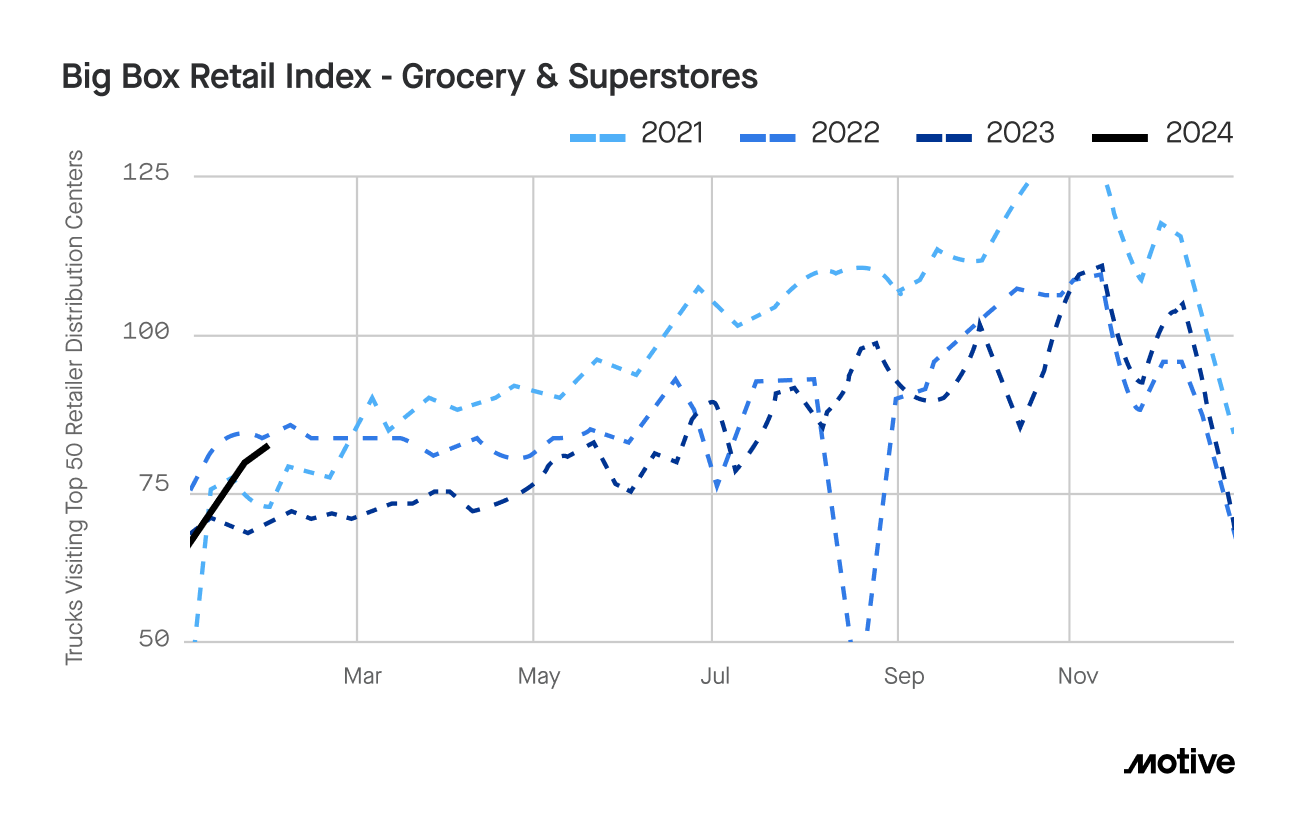

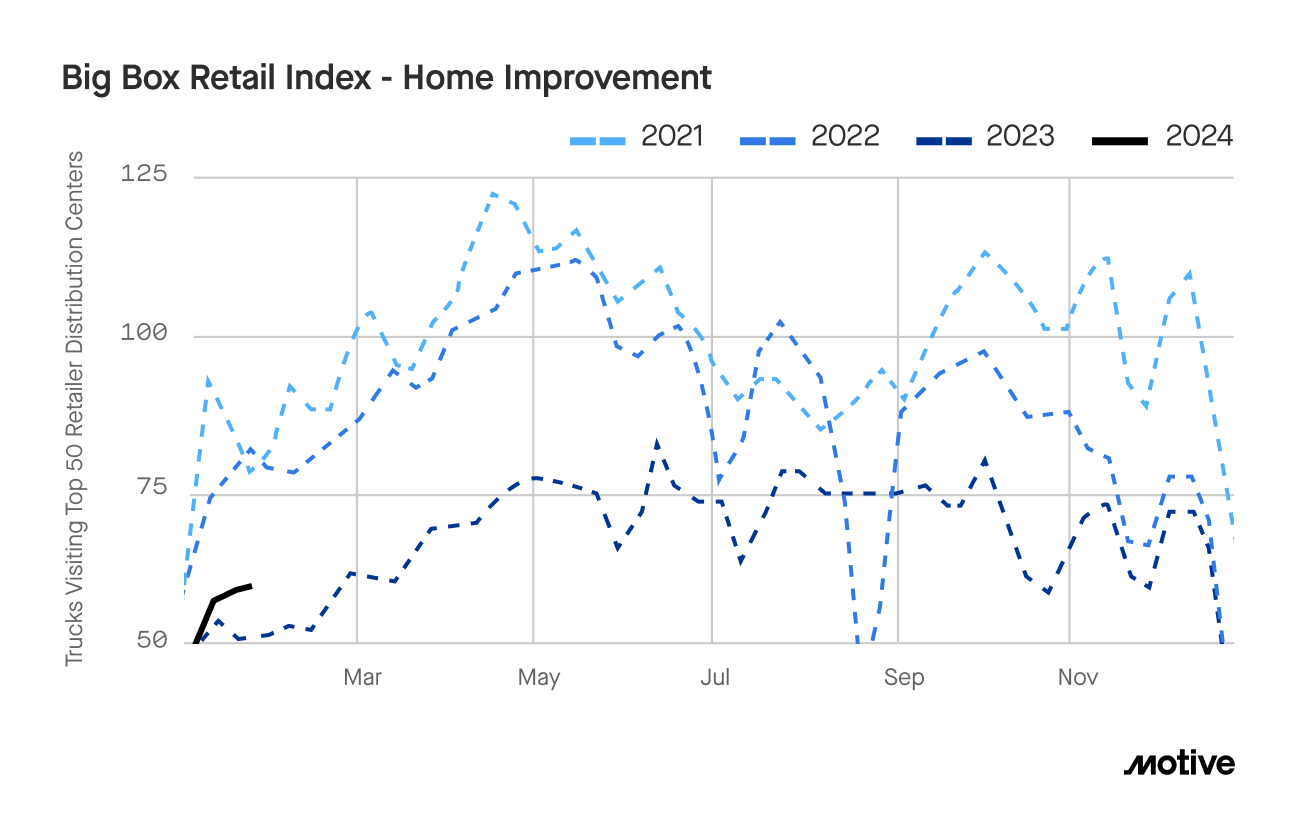

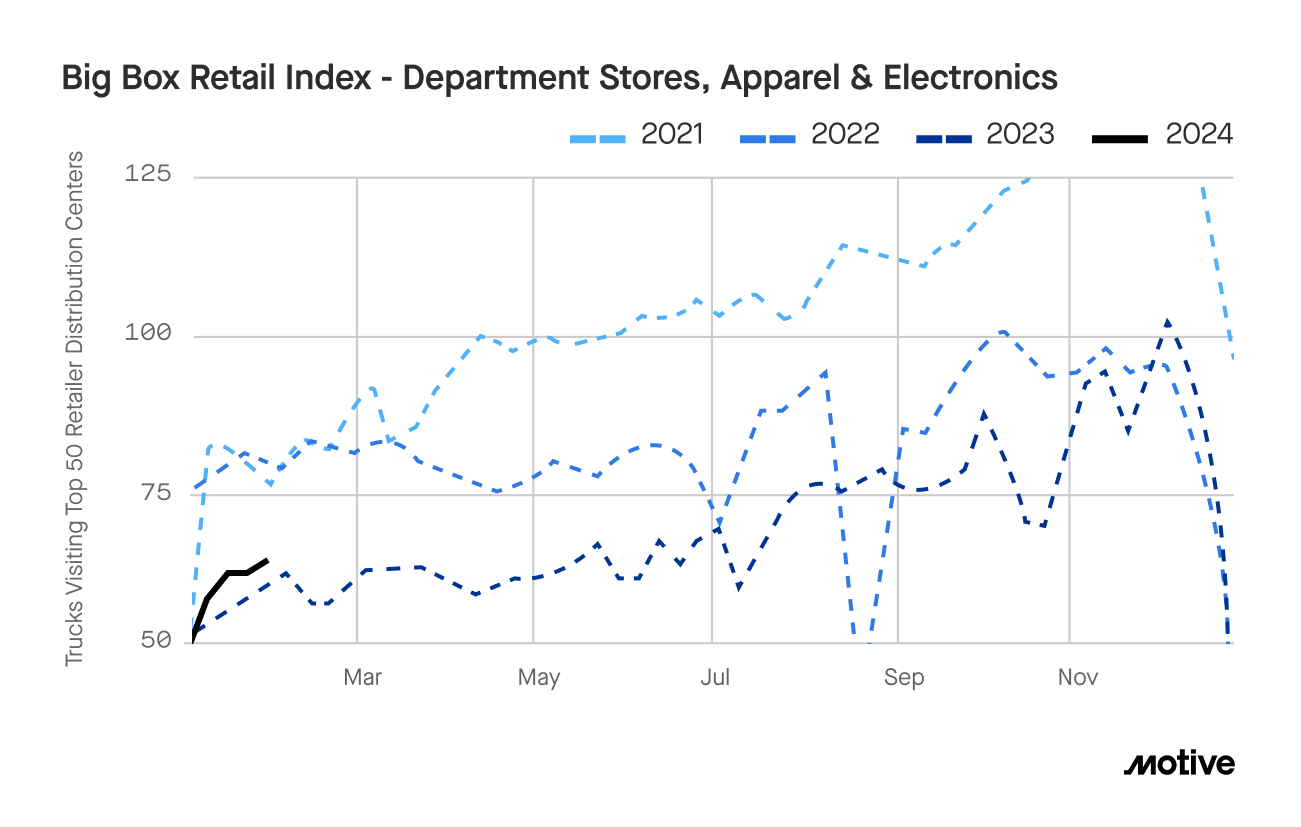

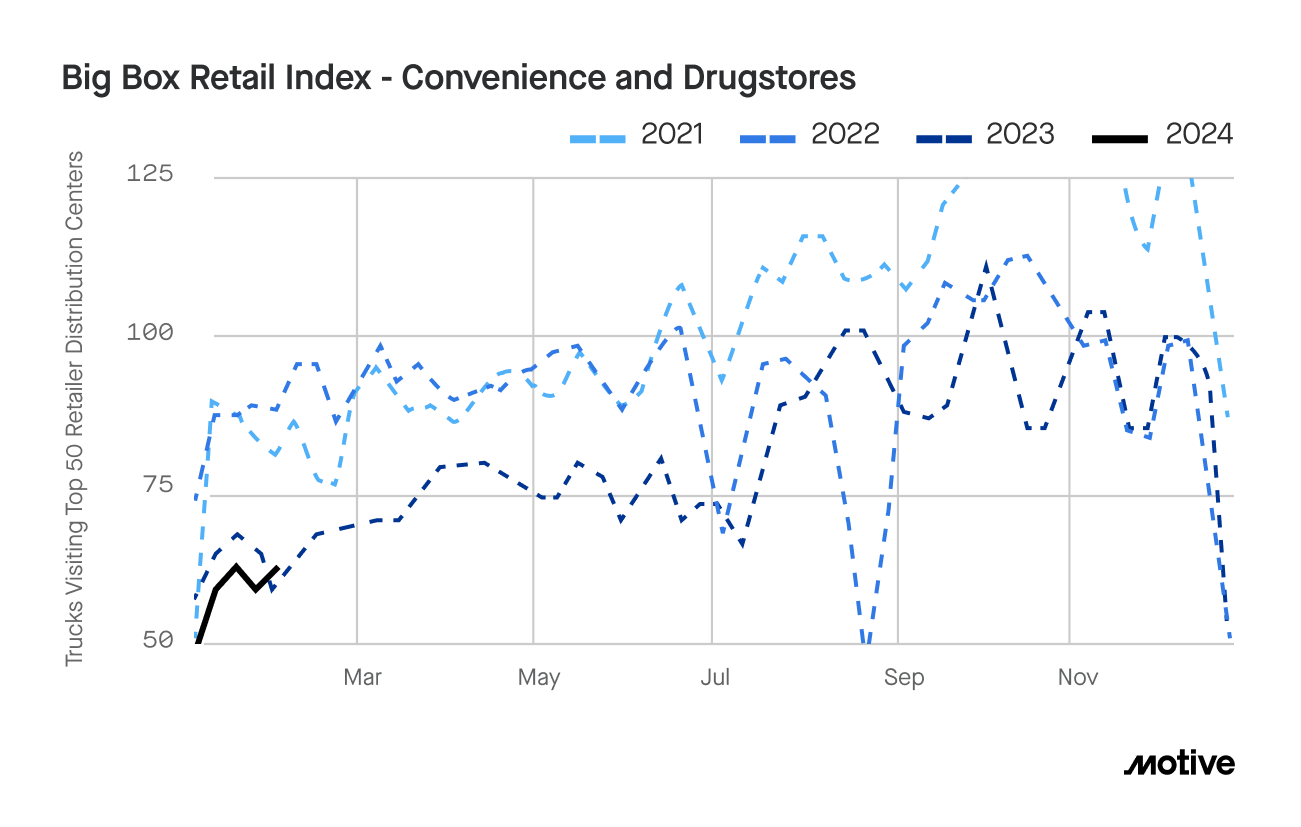

Motive’s Big Box Retail Index, which measures trucking visits to warehouses for the top 50 retailers in the US, ended January up 2% year-over-year, with a slower first two weeks giving way to a ramp-up later in January.

Closer analysis of the retail data shows that almost all sectors saw year-over-year improvement. Grocery and superstore retailers saw a 14.8% increase compared to 2023, home improvement saw a 14% year-over-year rise, and warehouses for department stores, apparel, and electronics saw a 5.9% jump. Discount retailers and wholesalers saw a modest decrease in visits, 1.8% fewer year-over-year.

Much of these increases can be attributed to the return of more steady re-stocking patterns compared to much of 2023. Retailers dealing with excessive inventory and uncertainty of consumer demand led to depressed visits last year. Through the first month of 2024, these issues seem to be at least somewhat abating.

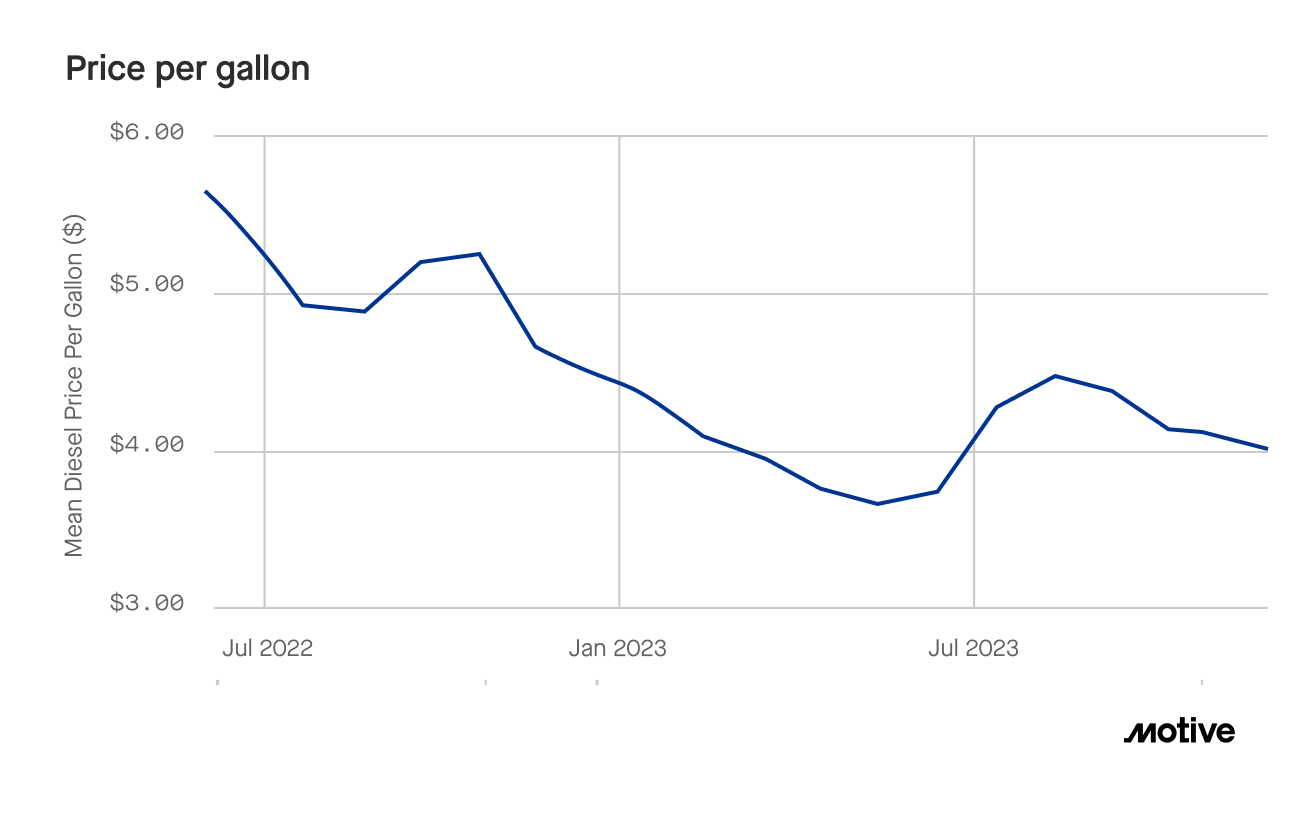

Meanwhile, diesel prices continued to fall in January, dropping 8 cents (~2%) to $4.06 per gallon. While experts have recently predicted less volatility in diesel prices this year, recent indicators of global stocks may point to a jump in prices in 2024.

Motive’s prediction: 2024 carrier registrations will outpace those of 2019 by 10-20% as market continues to stabilize

While January saw the trucking market’s overall contraction continue, the comparison to this time last year coupled with retailers continuing with more traditional restocking efforts indicates we may be reaching a level of stabilization for the market as a whole. This is particularly true of new carrier registrations, which are 18.6% above January 2020. Motive maintains its expectation that the rate of these new entries into the market will continue, with 2024 numbers eventually outpacing those of 2019 by at least 10%.

Data Methodology

The Motive Monthly Economic Report uses aggregated and anonymized insights from the Motive network, as well as publicly available government data from the Federal Motor Carrier Safety Administration, U.S. Census, and U.S. Department of Transportation.