Welcome to the August edition of the Motive Monthly Economic Report. What follows is an analysis of the major trends in the supply chain and economy across the Motive platform of 100,000 customers during the past month. Motive’s transportation and logistics data is a reflection of consumer demand and therefore, a leading indicator of overall economic stability and trends. Keep reading for a front-seat view into key factors currently influencing the U.S. economy.

Motive Predictions:

- 2024 will be a stronger holiday shopping season, with higher sales and earlier shopping than 2023.

- 2024 will be a record year for Mexican imports to the U.S. as Mexico establishes itself as the top importer until at least 2030.

- AI demand could fuel more imports from Mexico.

- The trucking market will hit net-positive growth by November, ending nearly 2 consecutive years of losses.

Top Findings:

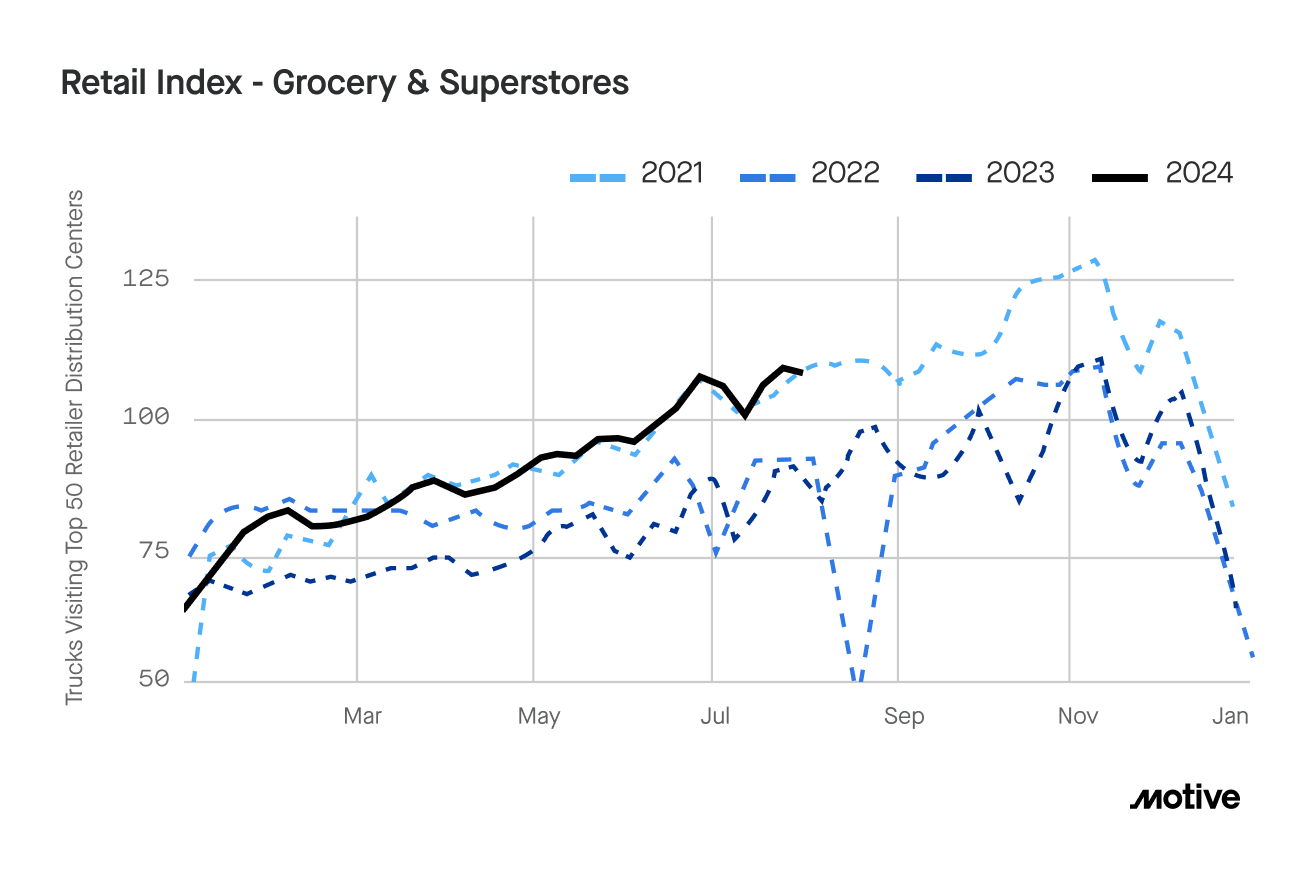

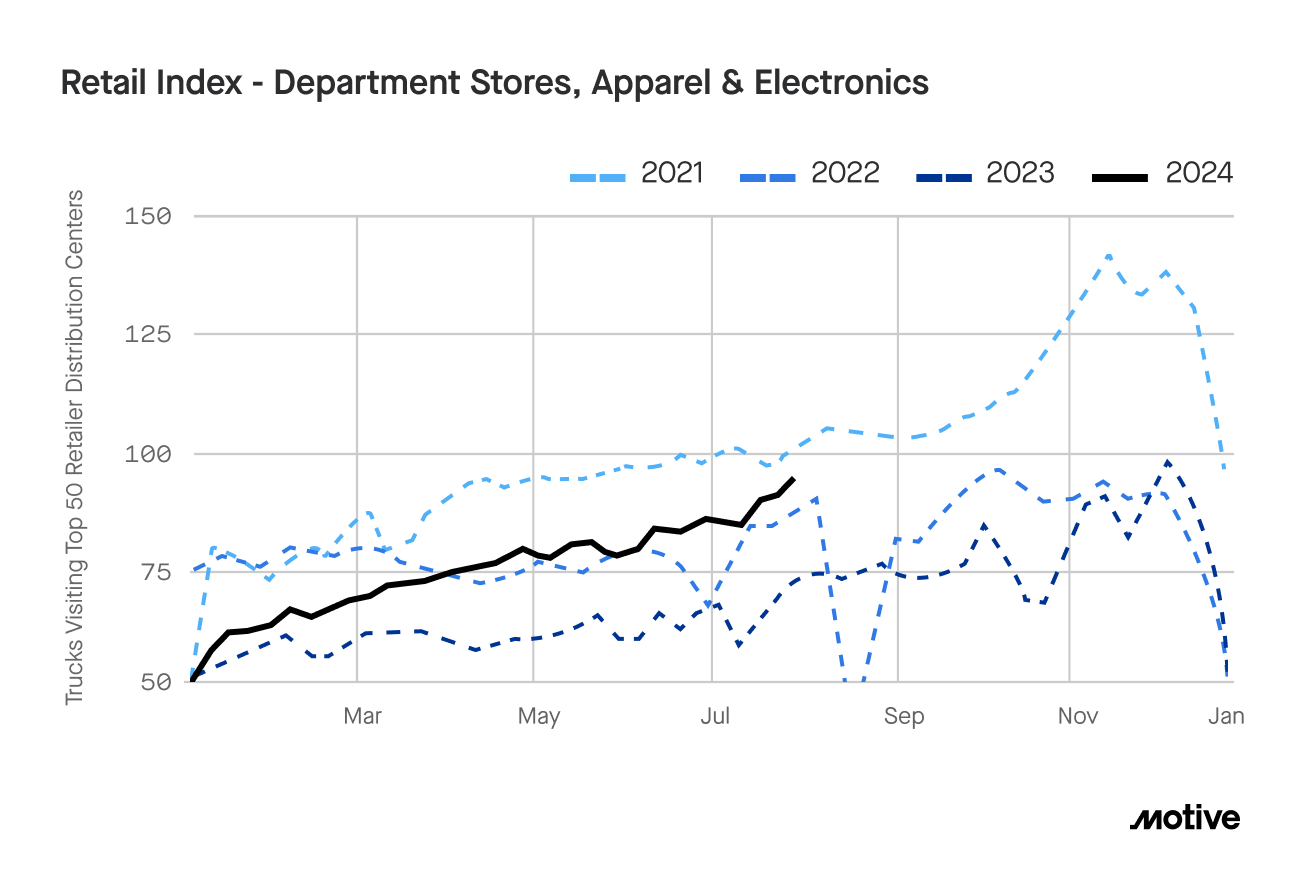

- Retailers are preparing for strong Q4 sales, with grocery and superstore warehouse visits surpassing 2021 levels, and department stores, apparel, and electronics jumping over 30% year-over-year.

- Mexico imports are at an all-time high; 675K trucks brought a total of $32.5B in goods from Mexico to the U.S. in May.

- Entrants and exits to the trucking market continue to move in a positive direction.

Retailers anticipate stronger and earlier-than-usual 2024 holiday shopping

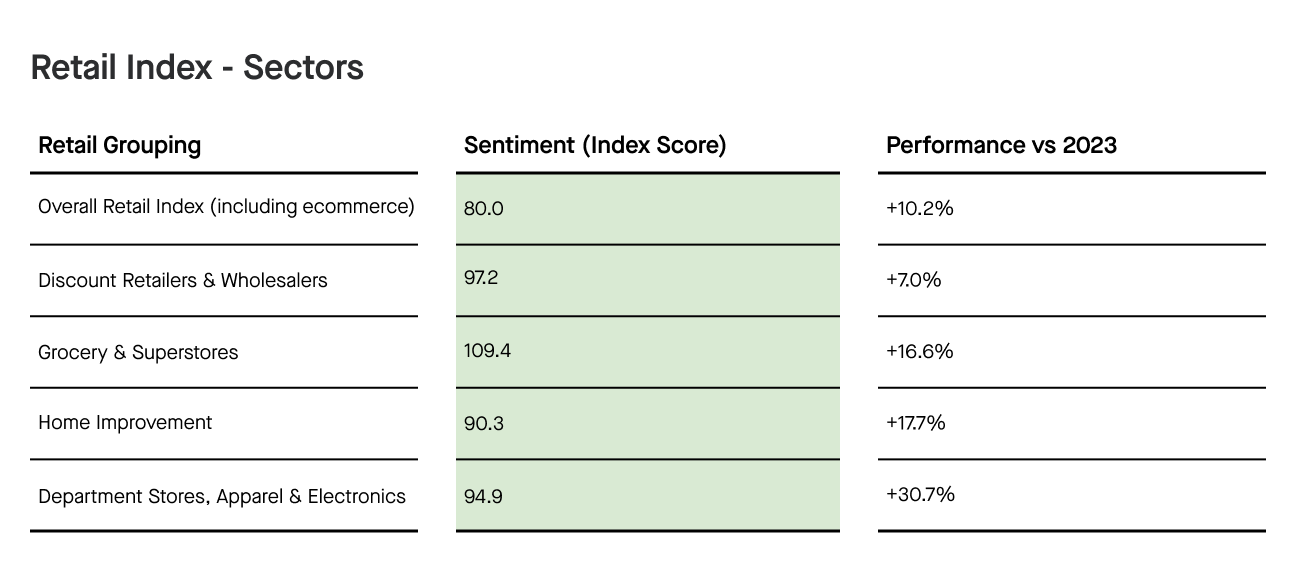

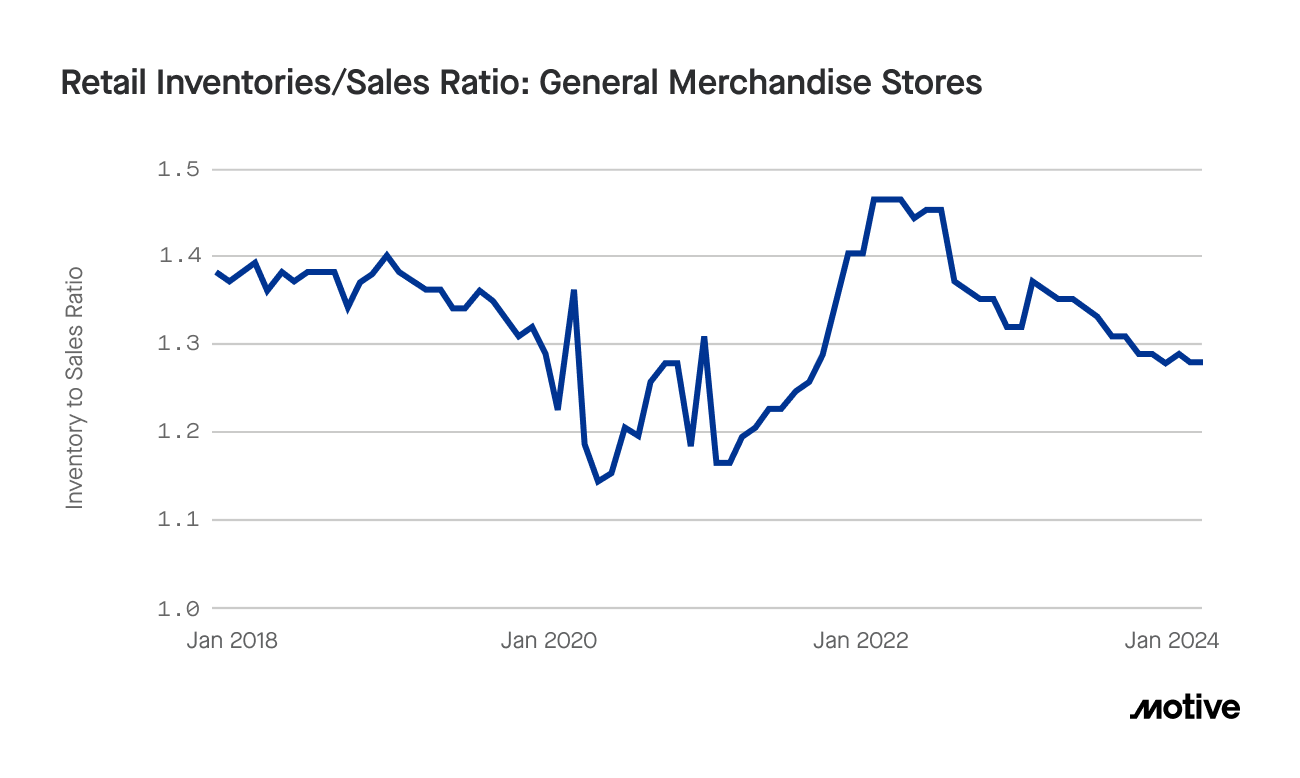

June saw one of the strongest month-over-month jumps to date for retailer restocking, according to Motive’s Big Box Retail Index. The metric, which tracks visits to warehouses of the top 50 U.S. retailers, jumped 10.8% since May, and 16% year-over-year. While these rates typically rise in summer months, this year’s surge indicates retailers are expecting bigger summer sales than last year and we predict they’ll see record sales for the month of July.

The 4th of July holiday, Amazon Prime Day, and other retailers’ competing promotions are what most likely drove the increase. One of the biggest retail moments of the year, Amazon Prime Day, drives many retailers to run competing discounts and promotions. This year, we’re seeing retailers bring in inventory at a markedly larger spike compared to 2023 as they gear up for higher demand and strong sales.

When it comes to performance across sectors, department stores, apparel & electronics (+32.9% YoY), and home improvement (+24.4% YoY) were top performers in June. Grocery & Superstores and Discount Retailers & Wholesalers also jumped 22.1% and 13% YoY respectively. We’re seeing particularly strong momentum in brick-and-mortar retail as these stores anticipate a very strong summer peak season. For example, department stores, electronics, and apparel retailers with brick-and-mortar locations saw a 13.8% jump heading into July, representing a 33% YoY climb.

Record truck border crossings and ground import volumes cement Mexico as #1 U.S. importer amid declining Chinese imports

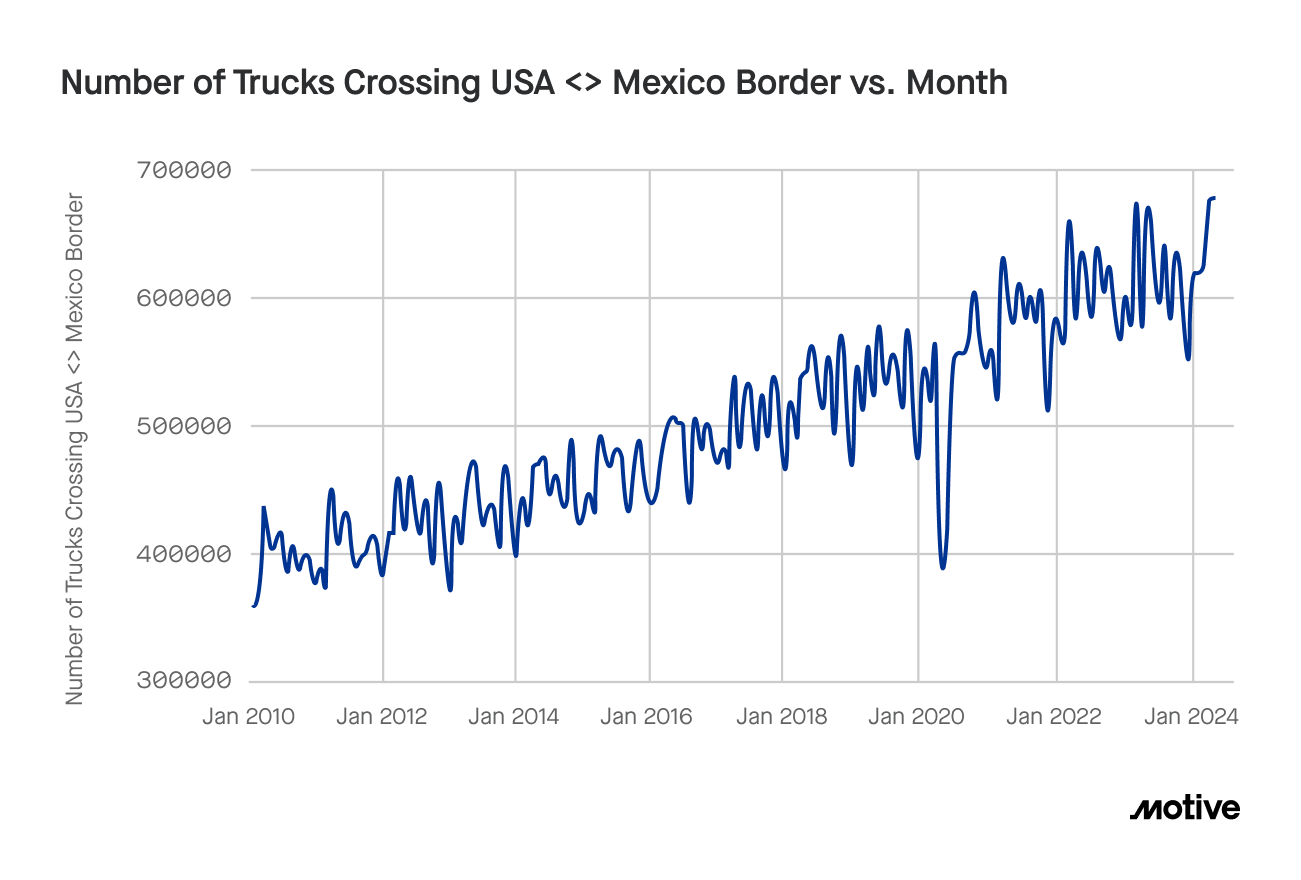

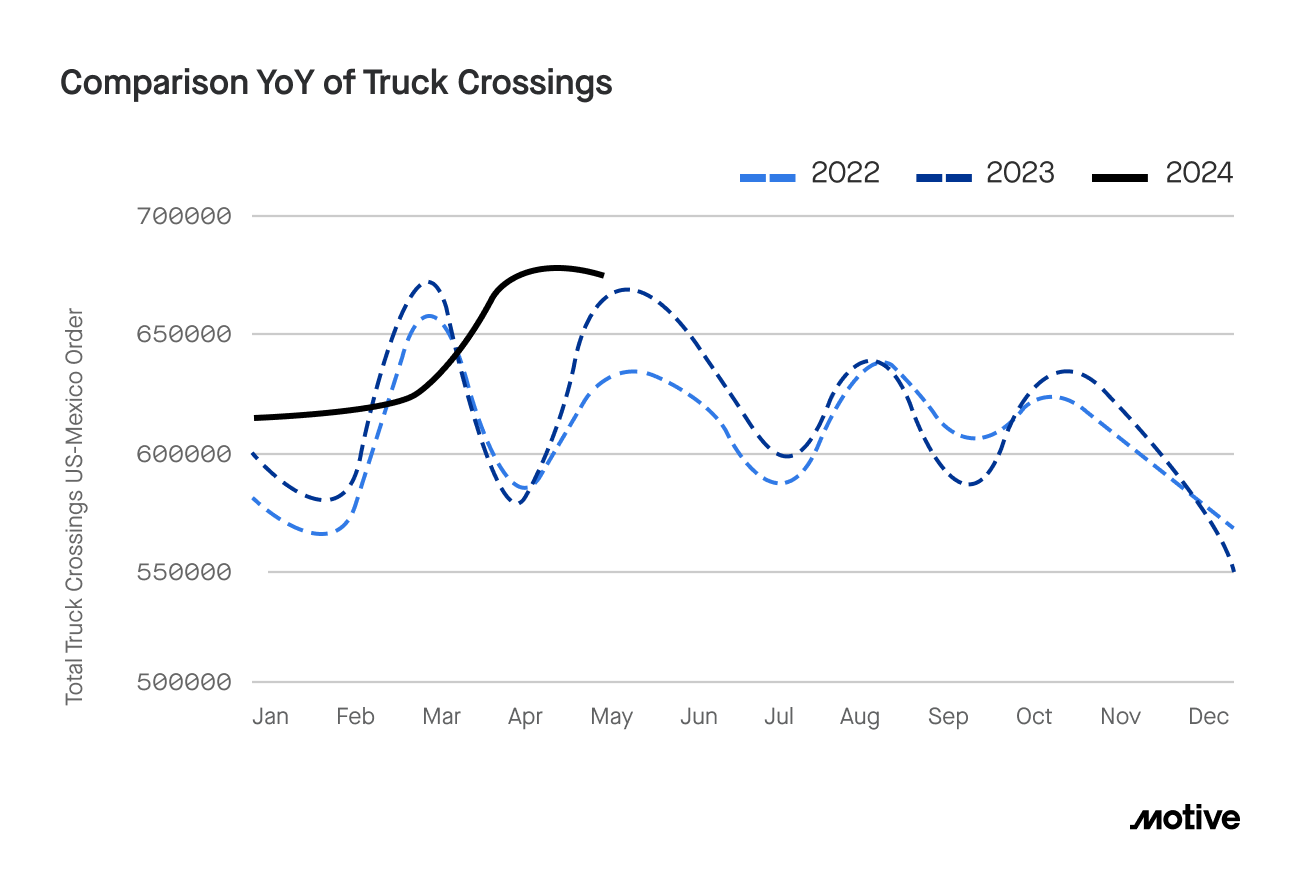

675K trucks crossed the U.S. Mexico border, bringing $32.5B in goods with it in May of this year, representing a 7.2% increase year-over-year despite the volatility of shipping during that period. These numbers represent all-time records for Mexico-to-U.S. imports and underscore the new normal for U.S. supply chains: Mexico is now firmly established as the country’s largest importer. The country has imported more goods than Canada by truck for the last 22 months consecutively. With Chinese imports down 19.9% year-over-year since May 2022, it’s clearer than ever that U.S. companies are adopting nearshoring from Mexico as a primary resourcing strategy.

Factors driving this trend include attempts by U.S. companies to diversify supply chains, more protectionist trade policies, and even the types of products being imported. The commodities that have seen the greatest year-over-year growth include computer-related machinery (up 20% year-over-year) and electrical machinery (up 8%). As U.S. companies continue to invest in building AI technology, demand for these materials will likely continue to grow, fueling higher Mexican imports in these areas in the next few years.

How will the upcoming election impact nearshoring? We think it is unlikely this trend will slow down regardless of the election outcome. While there is speculation that more protectionist trade policies may impact the USMCA, both parties seem likely to continue tariffs on Chinese imports and we predict nearshoring will gain more momentum going into 2025.

Motive predicts 2024 will be a record year for goods crossing the southern border, and, barring any major policy changes following the election, Mexico will remain the top U.S. importer until at least 2030.

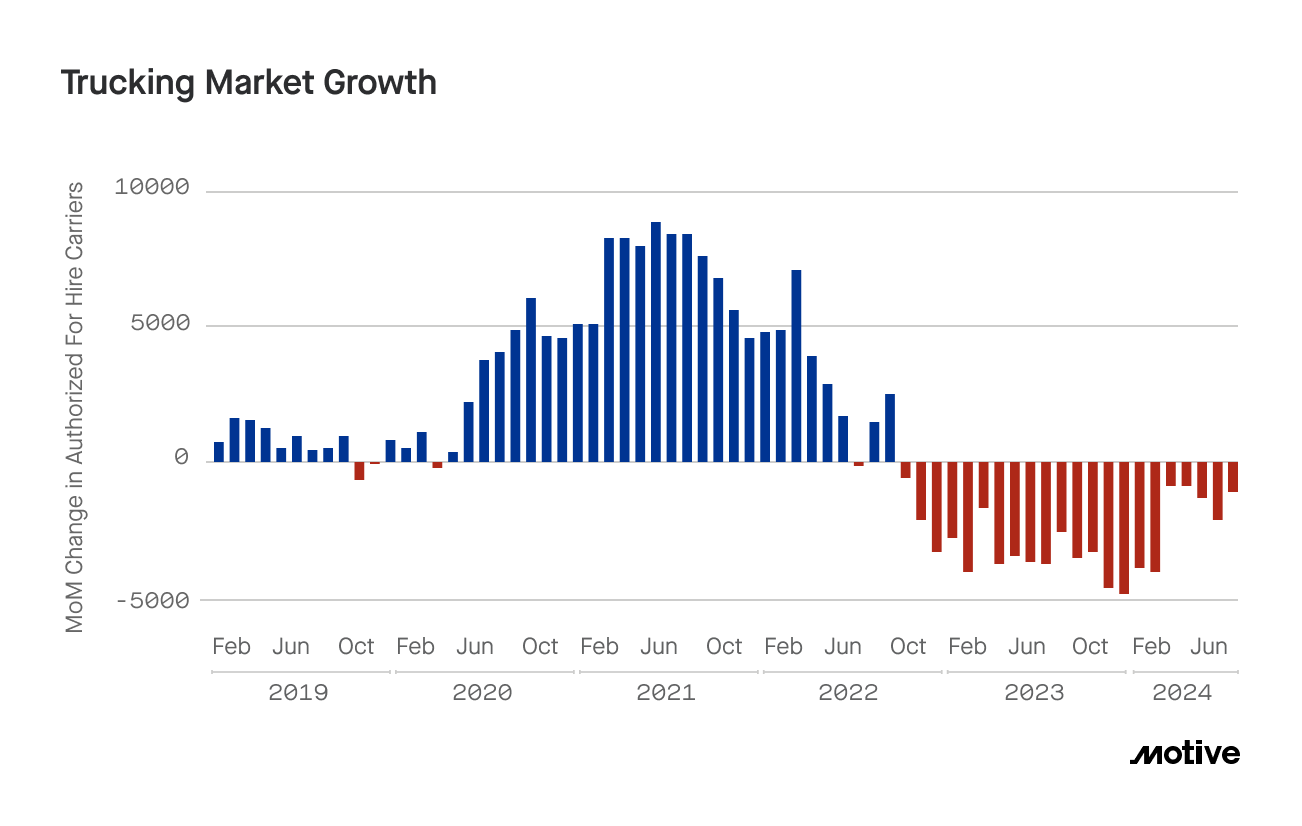

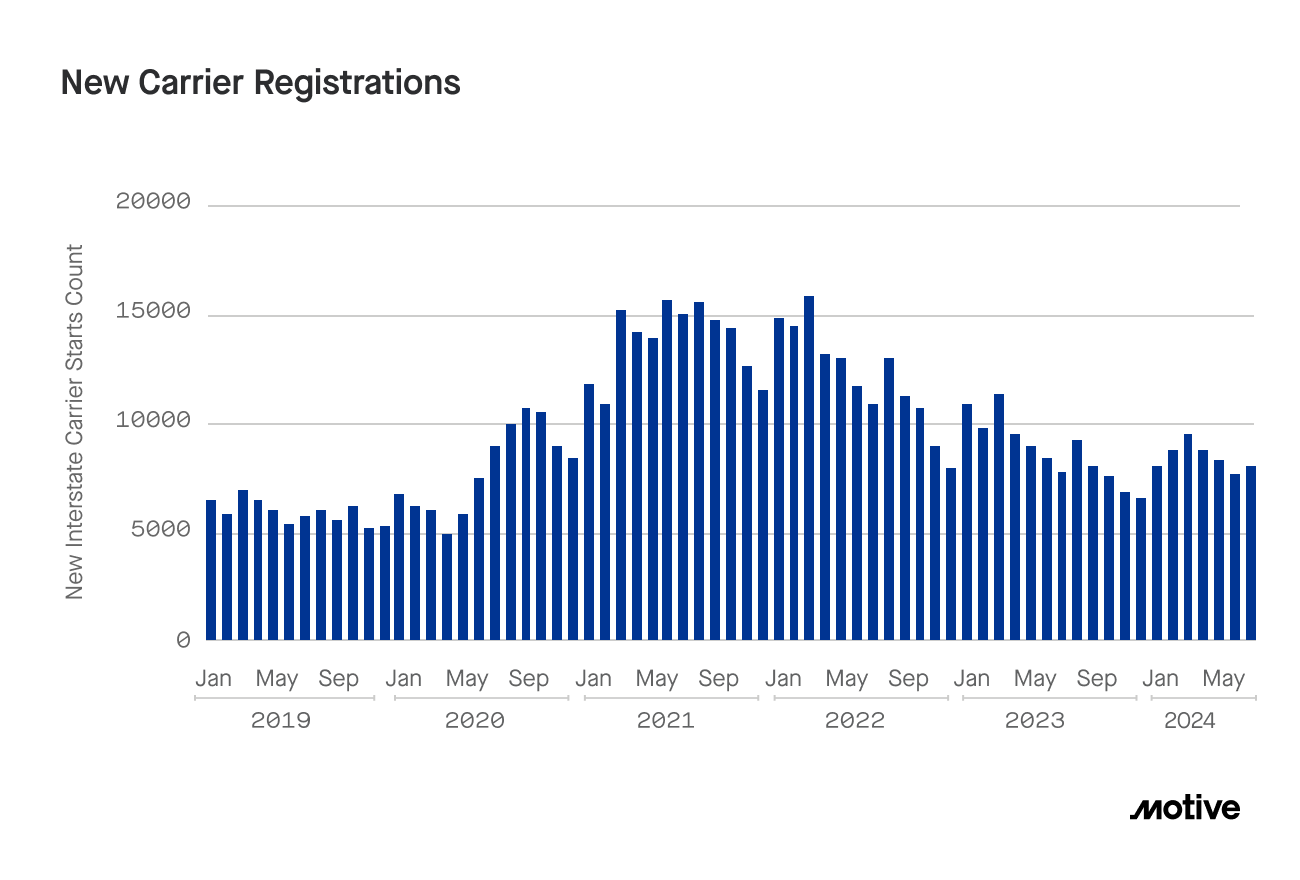

Trucking entrants and exits move toward equalization as the market begins to recover and we move closer to net positive growth

Following a small contraction in June, entrants and exits to the trucking market moved in a positive direction in July. Net exits plummeted to 915, a 53.6% drop from June and a 74% drop year-over-year that marks the lowest levels of contraction since the start of the freight recession in October 2022. New carrier registrations rose 4.5% since June and 3.6% year over year. Similar to last month, increased demand is moving the trucking market toward positive growth and we expect this momentum to continue through the end of 2024.

However, not every indicator in July was positive. Carriers continue to describe the current market as being in a trough and unemployment in trucking rose 0.2% compared to June and 1.9% year-over-year. Despite this, increasing freight demand amid strong consumer spending are continuing to move the trucking market in a positive direction.

We anticipate the trucking market will see positive growth for the first time in nearly two years by the end of November.

Summary

August paints an overall positive economic picture, with retailers anticipating strong holiday sales and earlier-than-usual consumer holiday shopping. We’re seeing significant changes in global supply chains as nearshoring transforms U.S. trade patterns and cements Mexico’s position as the top importer. Despite rises in unemployment and continued market challenges, the trucking market’s strong summer continues as its path toward positive growth becomes clearer.

Data Methodology

The Motive Monthly Economic Report uses aggregated and anonymized insights from the Motive network and publicly available government data from the Federal Motor Carrier Safety Administration, U.S. Census, and U.S. Department of Transportation.