Preparing quarterly IFTA fuel tax reports is universally regarded as one of the most burdensome paperwork requirements in the trucking industry. Reviewing trip sheets to calculate distance traveled in each jurisdiction is time intensive and error prone for both drivers and fleet managers.

With Motive you never have to worry about calculating IFTA miles again. We are delighted to announce the launch of automated IFTA Fuel Tax Reporting. If you use the Motive ELD and subscribe to our ELD Pro subscription plan, you can now automatically calculate the distance your vehicle travels in each US and Canadian jurisdiction.

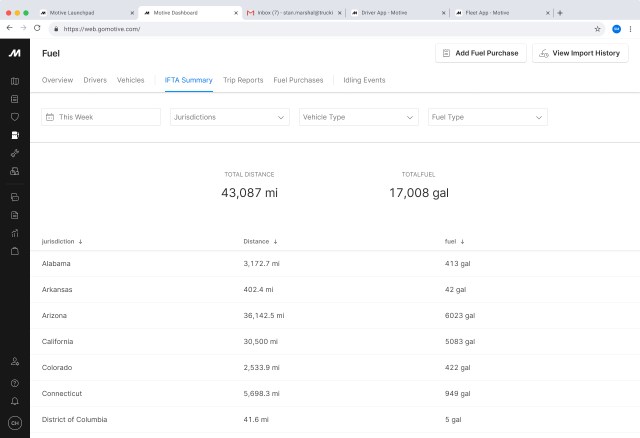

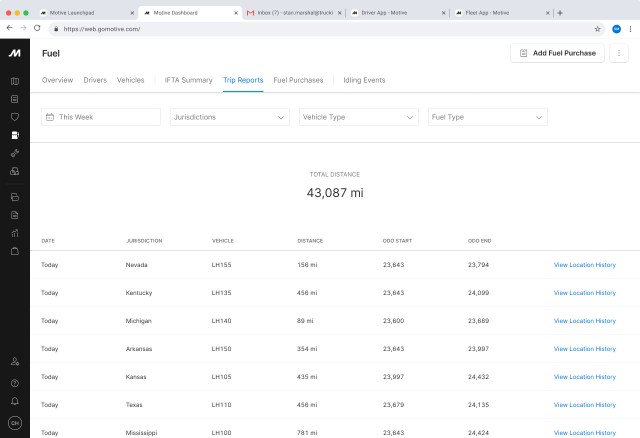

You can generate reports to calculate total distance traveled in each state or province for any date range.

Filter to see vehicle distance based on fuel type, or remove vehicles not subject to IFTA rules.

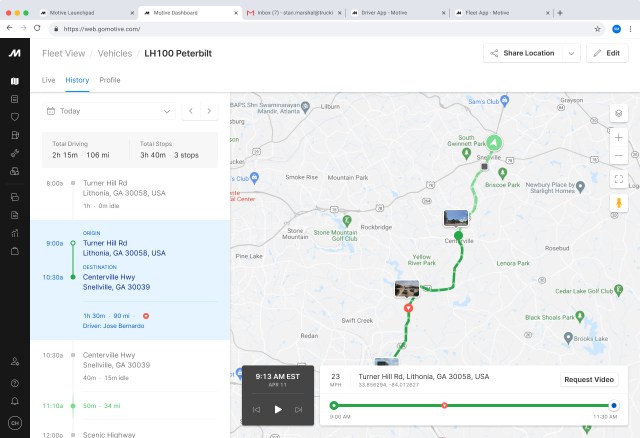

You also get a highly accurate GPS breadcrumb trail, which can be used in case of an audit.

Go to the Reports tab to export distance reports for easy IFTA fuel tax filing.

Any fleet using the Motive ELD can access the IFTA Fuel Tax Reporting feature via the Motive Dashboard. Contact us at 855-434-3564 or sales@gomotive.com to get started.