What Motive data says about the holiday surge and the shifts shaping the next year.

As we enter the busy holiday season and look ahead to 2026, businesses across the physical economy are facing significant challenges and opportunities. From the impact of tariffs to heightened safety risks on the road, the Motive Holiday Outlook Report provides critical insights into the State of Retail, Safety, Freight, Theft, and Fraud.

This report delivers data-driven insights, statistics, and predictions to help transportation leaders and business owners navigate the complexities of peak holiday demand and prepare for the evolving landscape of 2026. Let’s dive in.

The State of Safety: A concentrated risk window around Christmas

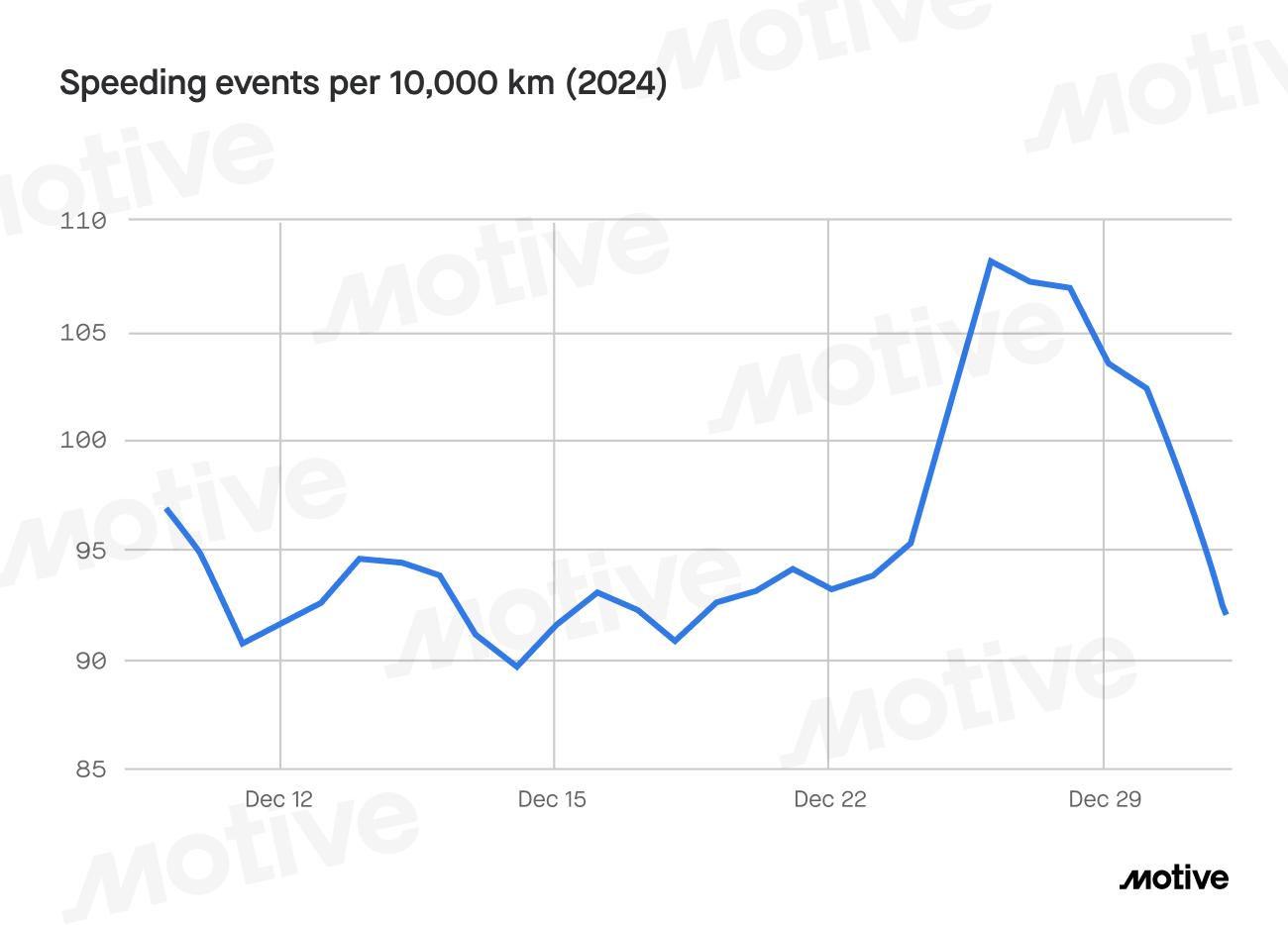

As the holidays arrive, the spirit of the season brings people together in celebration. For transportation, logistics, and food and beverage organizations keeping shelves stocked and orders moving, that stretch also brings a surge of urgency on the road. With last-minute shoppers out in force and delivery windows tightening, Motive data shows a 12% increase in speeding events the week before Christmas last year.

The spike likely reflects more revelers and last-minute shoppers on the road, as well as higher shipping activity and the push for time-sensitive loads to stay on schedule.

Christmas Day collisions spike due to winter weather

Holiday risk doesn’t stop once Christmas arrives. Drivers are still working tighter deadlines and longer hours, now layered with heavier traffic and slick winter conditions. Motive data gathered during last year’s holiday period shows that 66% of Christmas Day collisions occurred on wet, snowy, or icy roads.

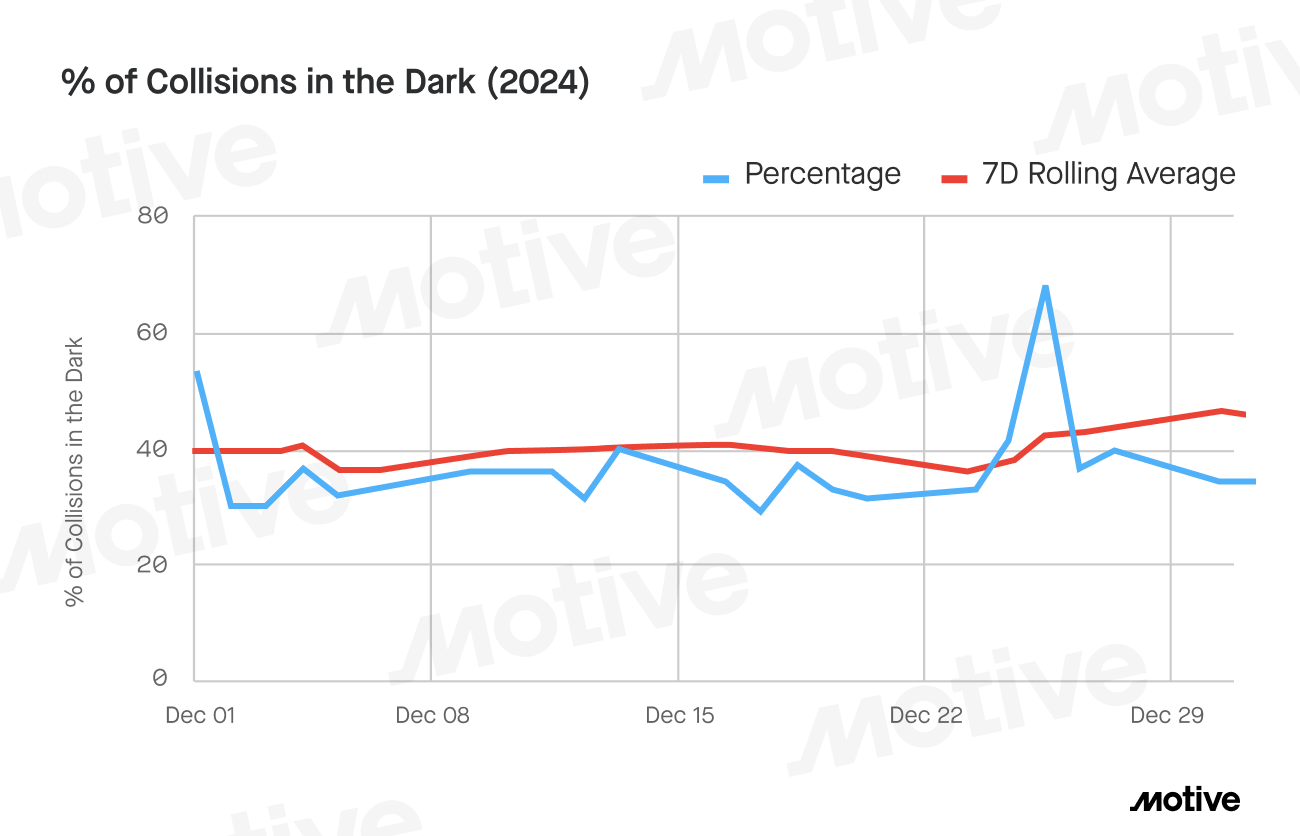

Time of day is a factor in safety outcomes as well. Overall, in December, only 38% of collisions occurred in dark conditions. However, on Christmas Day, collisions after dark are 1.7 times higher, likely tied to parties, drinking, and more people traveling later in the day. That combination heightens pressure for safety and logistics teams operating through peak season.

What fleet safety leaders can do to protect their drivers

When traffic and weather conditions can shift in an instant, organizations can leverage AI-powered safety technology that detects unsafe driving behaviors, delivers real-time visibility for drivers and managers, and provides immediate feedback via real-time dash cam alerts. And with a fully unified AI-powered Integrated Operations Platform that provides a comprehensive view of what’s happening on the road, teams can spot risk early, adjust plans quickly, and coach drivers automatically — before unsafe behavior turns into a collision.

- Tighten pre-Christmas speeding control through targeted coaching and real-time feedback using the Motive AI Dashcam.

- Operate with winter conditions in mind by using GPS tracking to help inform route or schedule adjustments when wet, snowy, or icy roads are in play.

- Plan for the Christmas evening surge with after-dark policies and monitoring using Motive AI Dashcams and AI Omnicams to improve visibility and protect workers in the field.

The State of Retail: Tariffs are redirecting supply chains away from China

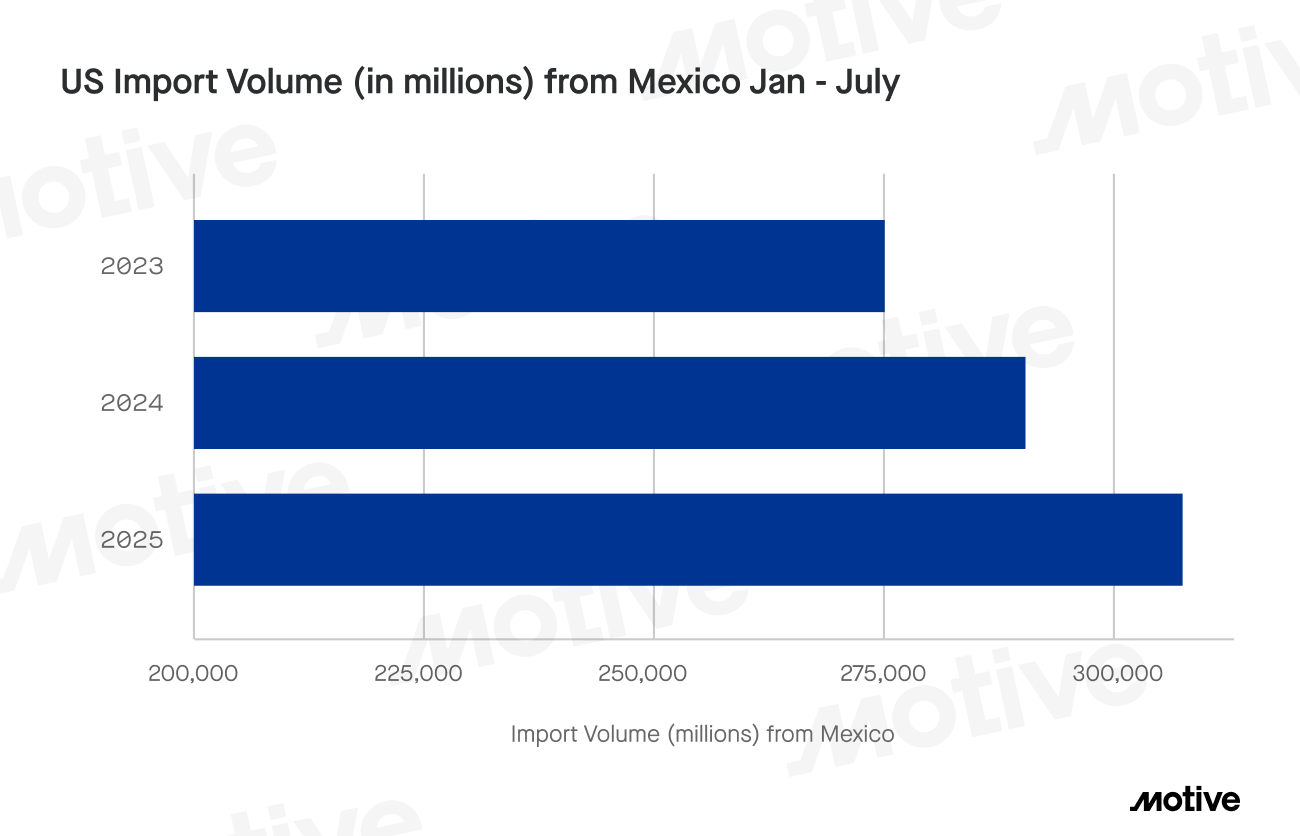

Mexico holds steady through tariff volatility

Tariffs are driving sharper month-to-month swings in import volumes, and the split between Mexico and China keeps widening. Mexico has held up well through the uncertainty that tariffs have caused, with import volumes from Mexico growing 6.5% year-over-year, compared to 5.95% growth between January and July 2024. This July came in stronger at an 8.2% year-over-year increase, with volumes ramping up after a slight decline in May.

“Imports from Mexico have shown a lot of resilience, even with all the tariff discussion going on,” notes Hamish Woodrow, head of strategic analytics and data engineering at Motive. ”The big narrative around Mexican imports is consistent year-over-year growth.”

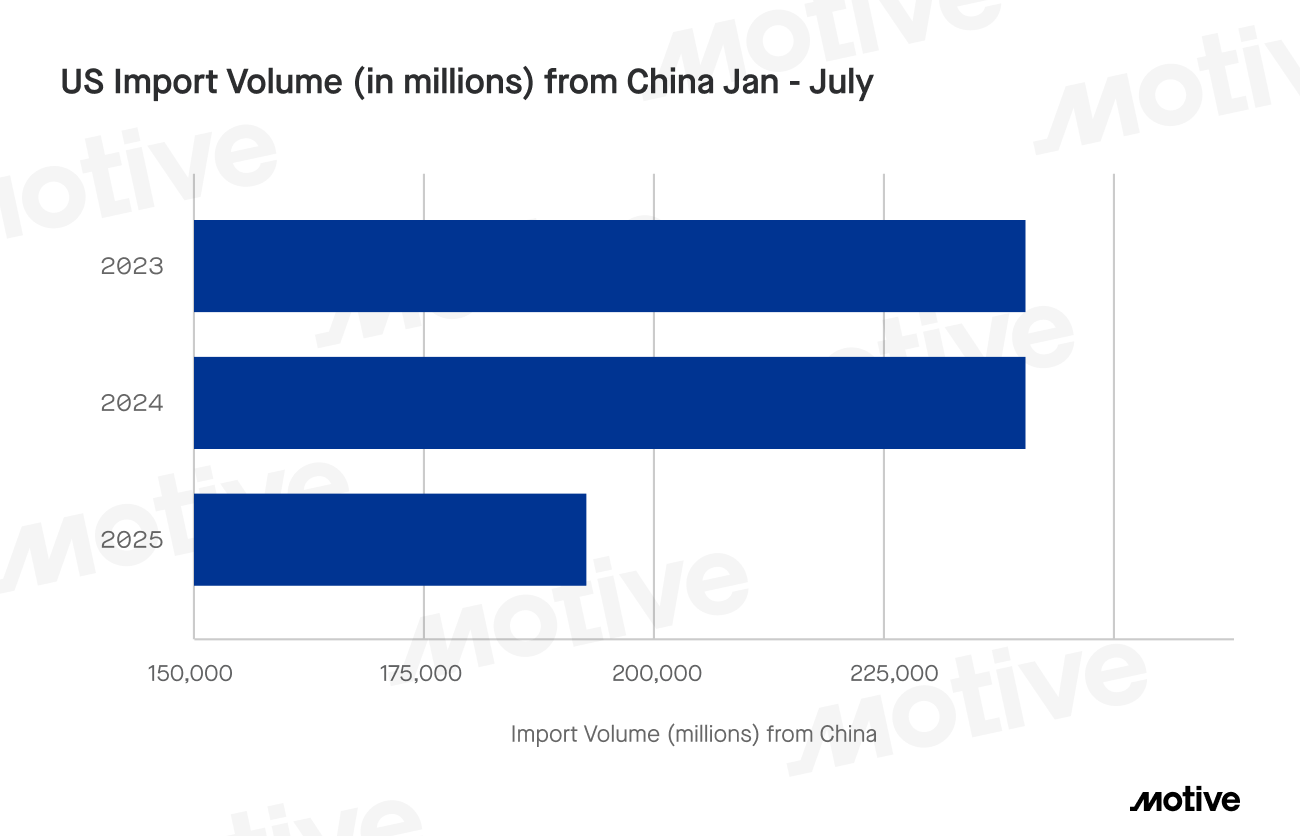

China falls to historic lows

China, meanwhile, is moving in the opposite direction. China import volumes were down 35% year-over-year in July, a month that is usually a strong period for Chinese imports. Year to date, 2025 Chinese imports are 18.9% lower than in 2024.

“You can really see the import volumes dropping off,” Woodrow said. “2023 and 2024 were relatively consistent, but 2025 has been really impacted by tariffs — especially these last tariff discussions with 100% tariffs going up. There’s just a lot of uncertainty, a lot of impacts to overall imports coming from China.”

Looking at the historical context underscores how deep the drop is. June imports totalled about $18.9 billion. “That’s lower than March 2020 when China shut down due to the COVID pandemic,” Woodrow said. With June and July typically peak months, he adds, “You’re going to have to go back in the books to find a July like this.”

Summer import rates were also lower, reflecting front-loading early in the year, when people rushed to import goods before tariffs went into effect.

The July to September Chinese import levels are substantially lower than anything seen in recent memory. The last time imports from China were so low, aside from the pandemic, was in February 2009, during the Great Recession. But even in that month, in the midst of the financial crisis, the U.S. was bringing in more from China than it did in June of this year. For Woodrow, that’s why tariffs have become the defining story of 2025.

“The fall-off since January has been out of the ordinary in terms of the percentage drop, and I’d say it’s a dominating theme for the year,” he said.

| The takeaway China import volumes may recover some traffic in the near term, but not to earlier levels or quickly. Diversification away from China is likely to hold for the next three to five years as manufacturers lock in supply chains in Southeast Asia, including Thailand, Indonesia, and Malaysia. Some categories may shift back faster than others, but the overall mix has reset. Even if tariffs normalize, China volumes are expected to remain well below the early-2020s baseline, with the open question being how much they rebound, not whether they return. |

Big Box Retail Index signals modest growth, familiar seasonal swings

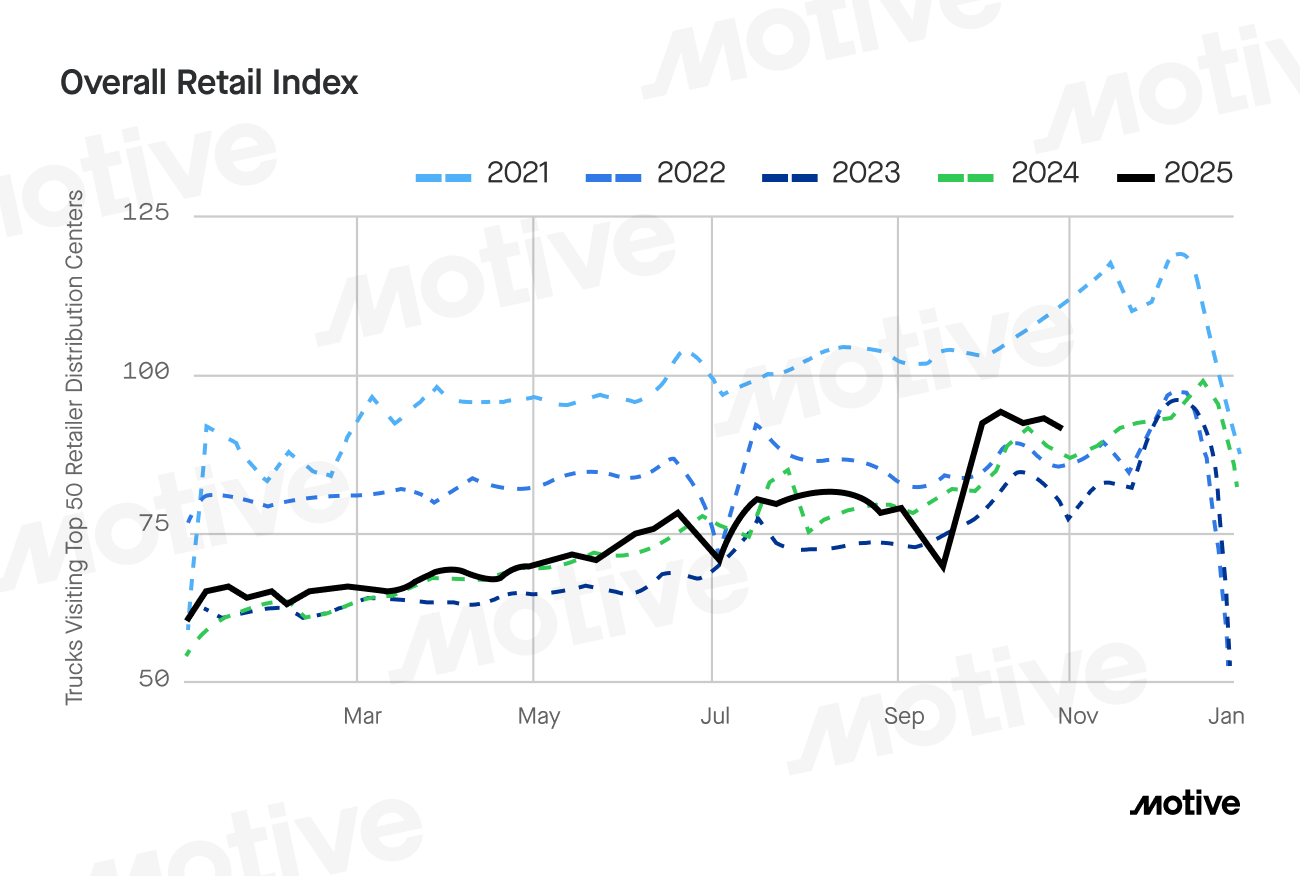

On the demand side, Motive’s Big Box Retail Index, which tracks exits and entries to distribution facilities at the Top 50 retailers, shows 2025 trending in line with 2024 volumes, with a large jump at the end of September and modest year-over-year growth of 3.5%.

“Broadly speaking, the economy is growing, yet not very quickly,” Woodrow said. “The retail sector is seeing moderate growth, in line with the rest of the United States.”

| The takeaway Across the retail sector, as we enter peak time periods at the end of the year, we expect to see a pattern of growth very similar to 2024, with volumes flattening out during the holiday season. Going into 2026, expect single-digit volume growth to continue, with a typical post-Christmas falloff, in line with the previous two years. |

The State of Freight: Trucking is on the path to recovery, albeit slower than expected

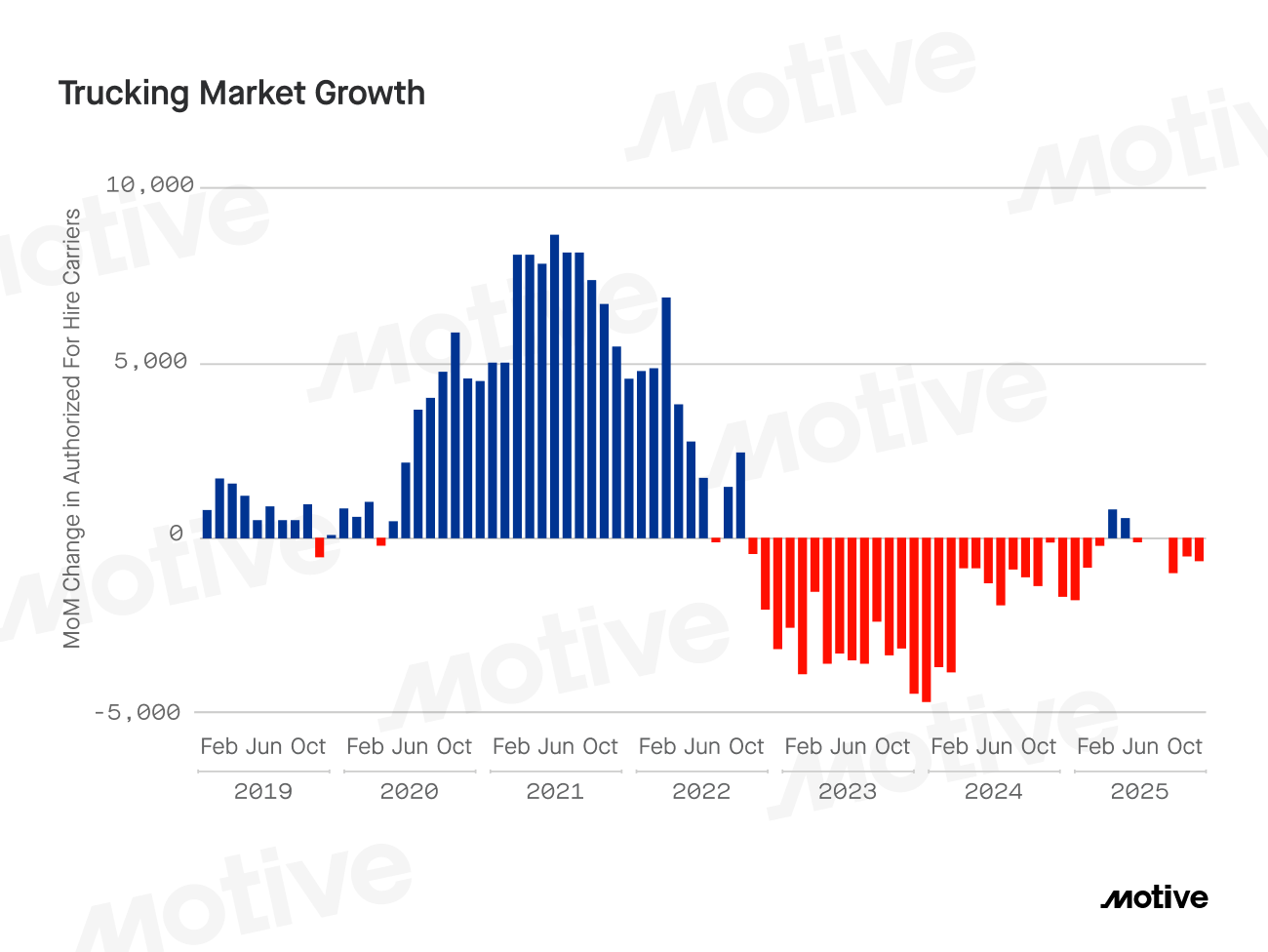

Carrier exits have slowed

After two years of steep contraction, the trucking market has settled into a flatter baseline. Through October 2025, there have been relatively few exits per month, with a total of 2,125 carriers leaving the market. That’s a meaningful shift in pace when you line it up against prior years. By October 2024, more than 15,000 carriers had exited. In 2023, the figure was closer to 30,800. So after two years of significant drops in the market, this year has been largely flat.

The takeaway in those comparisons is simple. Capacity is still shrinking, but the rate of reduction has dropped sharply. The market is no longer shedding carriers at the same intensity seen in 2023 and 2024, which is why 2025 reads as a period of stabilization rather than another downturn.

A balanced market, not a rebound

Woodrow frames 2025 as a year of pause after a hard reset. The market is “largely flat,” he says, with exits happening “at a much slower pace.” What stands out most is the balance. “For every carrier that exits, another one is entering,” he observed. That balance matters heading into peak season. It means fleets are operating in a market where capacity isn’t tightening quickly, but it’s not expanding either. Going into the holiday push, that’s a calmer capacity picture than fleets have been dealing with, without signaling a true rebound.

| The takeaway Looking ahead, expect low volume growth into 2026. But the bigger shift is structural. Capacity is no longer falling fast, yet it’s not expanding into a surge cycle either. Plan for a stable peak season, a familiar winter dip after Christmas, and modest growth on the other side. |

The State of Theft and Fraud: Spikes around the holidays

Cargo theft rises during peak season

During the peak season, high-value loads move faster and sit in more locations, widening the window for theft. Even celebrities aren’t exempt — thieves recently stole $1 million worth of Guy Fieri’s and Sammy Hagar’s tequila.

At the industry level, new research from the American Transportation Research Institute (ATRI) estimates that cargo theft costs the trucking industry $6.6 billion a year, or about $18 million a day. CargoNet reports theft was up 27% in 2024, with average losses exceeding $200,000 per theft incident, the highest average yet. Food and beverage loads are a top target, as thieves focus on high-demand, high-value loads such as alcohol and meat, along with easy-to-sell shipments like electronics and metals.

Fraud hits fleet spend

Holiday risk also shows up in payments. In Motive’s Physical Economy Outlook, surveyed leaders estimated that 19% of fleet spend overall is lost to fraud or theft, while 44% said that fraud has a significant financial impact on their operations. Fuel theft is a growing concern, and a recent survey shows that 96% of U.S. companies have faced at least one fraud attempt. Peak season increases transaction volume and velocity, which means any delay in detection and response may be costly.

To mitigate these risks, organizations must adopt a proactive and technology-driven approach to securing their operations.

What leaders can do now to prevent theft and fraud

- Monitor and secure high-demand cargo such as meat, alcohol, and electronics with GPS tracking, geofencing, and instant alerts.

- Rely on AI-powered fraud controls to prevent fraudulent spending and set limits for individuals or groups of cardholders.

- Tighten verification and monitoring at pickup, drop-off, and yard handoffs during peak, when high-value loads are moving faster, and theft windows widen.

| The takeaway Cargo theft and fraud are entering 2026 from a higher baseline than a year ago. With theft up 27% and average losses over $200,000 per theft incident, and fleets estimating 19% of spend lost to fraud or theft, these risks are no longer seasonal outliers — they are persistent and costly risks that peak season amplifies. Going into 2026, fleets should plan for continued pressure to increase cargo security and keep an eye on fleet spend for fraud, with tighter monitoring and faster intervention treated as core controls, not temporary holiday measures. |

Is your business ready for the holiday rush and beyond?

Understanding the macroeconomic landscape can help you prepare for the holiday rush and 2026 planning. Having a strategic partner and investing in the right technologies can take your business to the next level. Motive offers insights, strategies, and AI-powered products to help you address safety risks, freight trends, and rising costs head-on.

Data methodology

The Motive Holiday Outlook Report uses aggregated, anonymized insights from the 1.3 million drivers on the Motive platform, as well as publicly available government data from the Federal Motor Carrier Safety Administration, the U.S. Census, and the U.S. Department of Transportation.