The trucking industry plays a critical role in keeping goods moving and supporting economic growth, but it’s not without its challenges. Over the past year, market dynamics have shifted, shaped by factors such as changing demand, economic uncertainty, and industry-specific pressures. Such changes have tested the resilience of carriers, shippers, and other stakeholders across the sector.

Now, the trucking market is showing signs of stabilization. Though obstacles like fluctuating freight volumes and rising costs persist, the industry continues to adapt. Understanding these trends and their potential impacts is key to navigating the road ahead and positioning your fleet for long-term success. Let’s dive into the State of Freight.

Trucking market outlook: Challenges persist, but signs of recovery emerge

The trucking market had a challenging year, but 2024 looks set to end on a more positive note. While we expected to see growth in the trucking sector by November 2024, stagnant freight prices and carrier exits have slowed the rebound slightly.

Expect moderate growth to return in the first quarter and long-term growth trends of 5.7%, year over year, to be restored by the end of 2025. As the oversupply of carriers eases, the market is returning to pre-2020 cyclical trends. However, global economic uncertainty is still an issue, along with fluctuating interest rates and diesel prices.

Carrier exits remain high, and new entries are slow

In September, for the third consecutive month, about 1,300 operators were shuttered. Low trucking rates continued to put pressure on small businesses, causing them to close. Financial strains have made it tough for operators to stay afloat, and new carrier entries have been lackluster. In fact, new carrier entries have declined by 5.1% since August, even with 7,800 of them entering the market. Still, even though new entries are down 10% year over year, they’re 38% higher than pre-pandemic levels.

By August, the average age of carriers leaving the market rose to 3 years, up from 1.5 years at the start of the freight recession. This trend suggests a gradual return to more typical business cycles as the recession eases. Nonetheless, companies older than 3 are struggling. In 2024, 50% of carrier exits involved these businesses, compared to 37% in 2023. For many, cash flow challenges and falling rates have been the primary drivers of closure.

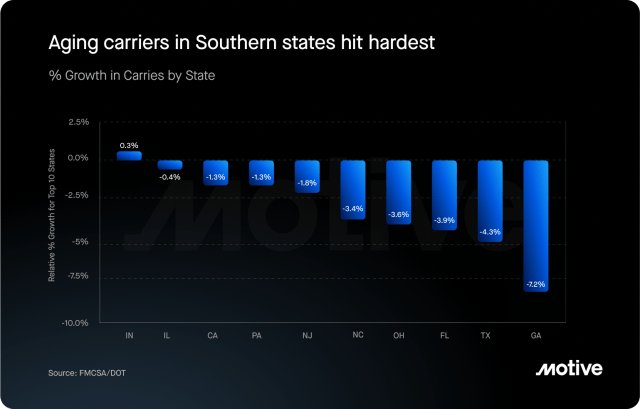

Regional impacts show diverging trends

Some states have been harder hit than others during this period of adjustment. Southern states, particularly Georgia and Texas, have seen substantial declines in operations, with Georgia down 7.2% and Texas seeing a 4.3% decrease. By contrast, Indiana stands out as one of the few top-10 trucking markets to experience growth, remaining relatively insulated from both the trucking boom and the subsequent freight recession.

The outlook for 2025: Stabilization on the horizon

As we look to 2025, expectations are cautiously optimistic. The strong consumer demand anticipated during the holiday season will drive short-term freight growth. Expect a slight dip in new carrier entries as many wait until the new year to begin operations.

Rising freight rates projected for next year are likely to stabilize the market, allowing older trucking companies with more established cash reserves to remain resilient. However, newer operators, especially in high-cost states like California and Texas, may face ongoing challenges. Increased operational costs and competition could lead to higher turnover for these younger companies, testing their ability to adapt in a stabilizing but competitive landscape.

Our take

The trucking industry is on the path to recovery, but the journey is likely to be gradual and marked by a period of adjustment. Strong consumer demand in the short term may help lift freight volumes through the holiday season, while rising freight rates in 2025 should bring some stability. Established operators are better positioned to weather this phase, but newer entrants in high-cost regions may need to adapt quickly to avoid the pitfalls that caused others to exit.