A healthier supply chain is driving down inflation, but we’re seeing soft retail demand

Welcome to the inaugural Motive Monthly Economic Report, where we break down the biggest supply chain and economic trends being observed across the Motive platform. Motive serves over 100,000 customers who operate in the physical economy, from small businesses to Fortune 500 enterprises. Our customers power the growth of the U.S. supply chain—in construction, oil and gas, transportation and logistics, agriculture, distribution, and beyond. They’re the people who grow our food, transport our materials, stock our stores, and pipe energy to our homes.

Motive technology is installed in more than 20% of all for-hire trucks in North America, giving us representative insight into the over-the-road supply chain. We’re excited to give you a front-seat view into the factors that are moving the U.S. economy.

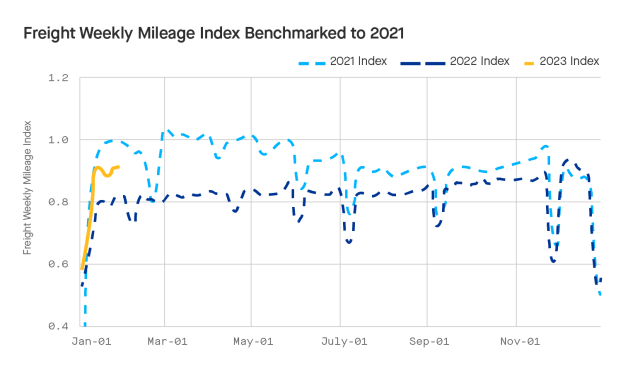

Stronger start to January for freight

What’s new: We’ve seen an 11% increase in truck utilization compared to January 2022. Since November, diesel fuel prices have declined by 15%. Backups at U.S. ports have cleared, trucking capacity has increased, and lead times and transportation costs have normalized to pre-COVID levels.

Why this matters: Inflation is cooling. The Consumer Price Index (CPI) is showing a decline in energy prices and food prices relative to the mid-2022 high inflationary period. A healthier supply chain and reduced transportation costs will continue to support this downward trend.

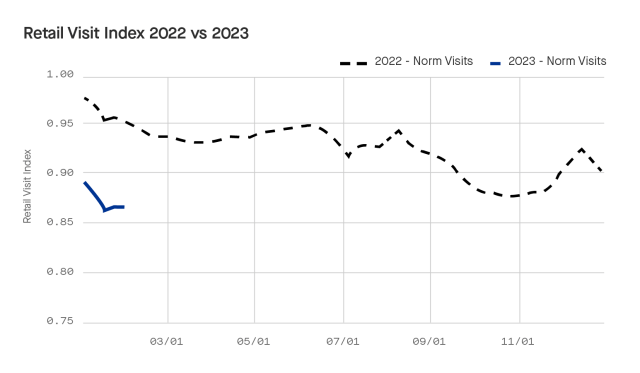

Still early days of retail recovery

What’s new: The supply chain is healthier and we’re seeing overall increases in freight activity. But we’re not seeing a corresponding rebound in the retail sector following the holidays. In fact, we’ve seen a 20% decline in retail activity year-over-year.

Our assessment: Several factors are driving the disconnect between supply chain health and retail recovery.

- In December, we saw a build up of holiday retail visits, which was delayed against 2021. The sales-to-inventory ratios are largely static. Businesses aren’t investing in inventory due to softness in consumer demand.

- Unemployment is the lowest it’s been since 1969, resulting in a tight labor market for the physical economy and challenges in hiring truck drivers, construction workers, and field service workers.

Why this matters: Retailers have been battling the impact of years-long supply chain impacts followed by weak consumer demand. Inflation is improving, but it’s still high and the economy is unsteady. Continued health in the supply chain should help stabilize some pockets of the economy, but top retailers are being cautious, which may be the new normal. With little confidence in the near-term outlook, retailers are hesitant to increase inventory. Buyers, meanwhile, are in “wait and see” mode knowing that there will be fewer supply chain risk than in years prior.

Data methodology

Motive data represents over 100,000 customers, half a million vehicles, and millions of drivers, from small businesses to enterprise fleets. Our customers work in every sector of the physical economy, including trucking and logistics, delivery, construction, food and beverage, oil and gas, and more. Motive’s technology is embedded into more than 20% of for-hire trucks in North America, giving Motive a representative view of the over-the-road supply chain.